HDFC Securities Option Brokerage

Check All Brokerage Reviews

When it comes to hedging the risk, trading in derivatives proves to be useful. So, if you want to open HDFC Demat Account, then here are the details of the HDFC Securities option brokerage.

Now, as we all know, that options are being traded in lots. So how much the broker charges? Well! for this here is the detailed review of the HDFC Securities charges imposed to trade in equity, commodity, and currency option segment.

HDFC Securities Option Brokerage Charges

HDFC Securities is a bank-based stockbroker offering full-service broker services for over the decades. The broker has earned a great name and fame in the industry. Offering multiple trading segments to its clients, the brokerage charged by the broker is comparatively higher than others.

Here is the complete detail HDFC Securities option brokerage charges.

| HDFC Securities Option Charges | |

| Equity Option Charges | 1% on Premium or ₹100 per lot |

| Commodity Options Charges | ₹100 per lot |

| Currency Option Charges | Square Off Trade: ₹10 on each side |

| Non-Square Off Trade: ₹20 per contract | |

| Transaction Charges | ₹5000 per crore |

| STT Charges | 0.05% on Premium |

| SEBI Charges | 0.00015% on Turnover |

| Stamp Duty Charges | 0.002% on Turnover |

| GST | 18% of Brokerage and Transaction |

Sanchet traded in equity options has purchased 10 lots of XYZ company, of which 1 lot carries 100 shares. So, he will have to pay the brokerage of ₹1000 (10*100).

On the other hand, trading in currency option, the brokerage depends upon the type of trade one opts for. Here for the square-off trade, the HDFC Securities option brokerage is ₹10 on both buy and sell each. While for the non-square-off trade, you ended up paying the brokerage of ₹20 per contract.

Similarly, one can trade in commodities and currencies by checking the HDFC commodity trading charges.

HDFC Securities Brokerage Plans

Apart from the standard brokerage plan, HDFC Securities allows the traders or investors to lessen their brokerage with the Value Plan.

This brokerage plan benefits the active options trader by imposing the lowest fees to trade. The Value Plan is activated by paying certain upfront charges that range in between ₹4000 to ₹60000. The HDFC Securities option brokerage plan information is tabulated below:

| HDFC Securities F&O Value Pack | |||||

| Scheme | VPD 30 | VPD 25 | VPD 20 | VPD 15 | VPD 10 |

| Upfront Fees | ₹4000 | ₹8000 | ₹12000 | ₹30000 | ₹60000 |

| Free Equity Delivery Volume | 175 | 500 | 1000 | 3000 | 10000 |

| Effective Price Per Option Lot | ₹19 | ₹14 | ₹10 | ₹8 | ₹5 |

| Option Price Post Validity | ₹30 | ₹25 | ₹20 | ₹15 | ₹10 |

| Futures Brokerage | 0.025% | 0.020% | 0.015% | 0.010% | 0.005% |

To understand the table, let’s assume the same example of Sanchet.

With the Value Plan of VPD 15 (upfront fee of ₹30,000), Sanchet will have to pay ₹8 per lot. So, here if he bought 10 lots of XYZ company consisting 100 shares in a lot, at that point, he will have to pay ₹80 as a brokerage.

It can be easily derived that with the Value Plan, Sanchet will get the opportunity to pay lesser brokerage as compared to the standard plan.

HDFC Securities Brokerage Calculator

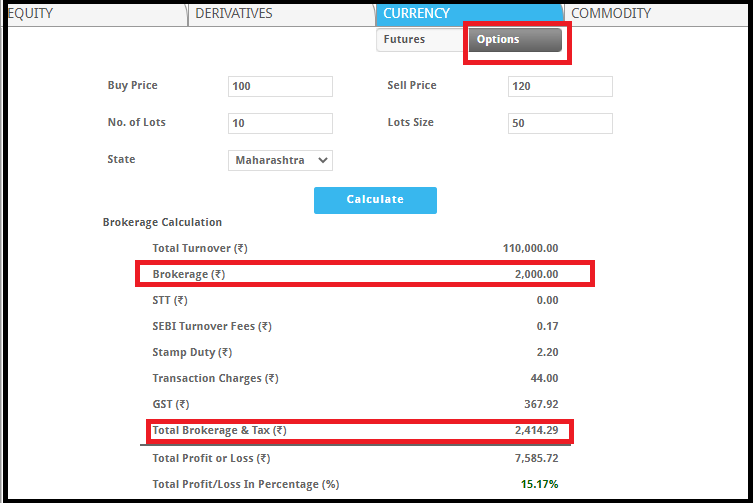

As in the beginning, there are many other charges apart from the standard HDFC Securities option brokerage that one has to pay while executing the trade. Now it often becomes challenging for traders to calculate the exact fees. To make it easy one can conduct the calculation with the brokerage calculator.

So, if you are looking forward to know the process of how to calculate brokerage in HDFC Securities, then here is the seamless way for you.

Just fill in the details and click on ‘Calculate’ to gather the transparent fees that are to be paid to the broker, as shown below.

The HDFC Securities brokerage calculator displays the Total Turnover, brokerage (excluding taxes), various types of taxes to be paid, and Total Brokerage & Tax (including brokerage).

Conclusion

The HDFC Securities option brokerage is however more but it allows its customers to pay the brokerage by selecting the brokerage plan according to their preferences.

Rather than the brokerage charges mentioned above, there are some additional charges too that are to be paid by the customers as taxes. Check the complete charges information above and open a Demat account with HDFC Securities without delay.

If you are looking for assistance to open a Demat account, then get in touch with us!

More on HDFC Securities