JM Financial Brokerage

Charges

In this competitive stock market industry, every stockbroker comes with attractive brokerage fees and other services so when it comes to brokers like JM Financial what fees and charges it levies on their clients. In this article, we will cover a detailed review of JM Financial Brokerage.

Being registered with stock and commodity exchanges the broker provides the benefit of trading in equity, currency, and commodities.

Let’s now have a quick overview of how much charges are imposed for trading in all these segments.

JM Financial Brokerage Charges

Like any other full-service broker, JM Financial also charges brokerage on the basis of turnover value. But before gaining an access to its service, it is important to open a JM Financial Demat account.

Here is the comprehensive list of JM Financial Brokerage Charges.

- Equity Brokerage Charges

- Commodity Brokerage Charges

- Currency Brokerage Charges

JM Financial Equity Brokerage

You can trade in equity using different options like delivery, intraday, futures, and options and there are different brokerage charges for trading in all the mentioned products.

In delivery, intraday, and futures trade, the charges are calculated on the basis of turnover value while the options brokerage is evaluated on the basis of lot size.

Here is the detail of charges in each of these segments.

JM Financial Intraday Charges

The craze for intraday trading is growing day by day in the Indian stock market. Even most newbie traders start trading intraday to check their trading skills.

What makes it more popular is one can trade with small amounts which is not always possible with other trading segments.

JM Financial charges 0.02% of the turnover value for intraday trading.

JM Financial Delivery Charges

Any trade in which stocks are delivered to the Demat account is called delivery trading. In short, if you are planning to hold shares for more than one day, then the broker charges delivery trading brokerage.

JM Financial charges for trading in a delivery segment is equal to 0.15% of the turnover value.

So how can you calculate delivery brokerage? Let’s understand with an example how delivery charges are calculated. Suppose you have decided to trade in delivery and according to this plan you have to pay 0.15% brokerage on total trade.

Suppose you have done a total trade of ₹10000

So 0.15% of ₹10000 is = ₹15

JM Financial Futures Brokerage

Futures trade involves buying shares in the future at the price fixed today and thus one can evaluate the lumpsum profit and loss per trade which helps in calculating the turnover value and hence brokerage.

JM Financial charges 0.02% brokerage on the turnover value. Here is the detail of charges on equity future and currency by JM Financial.

Option Trading Charges in JM Financial

Next to futures, there is an options trading charges that is calculated on the basis of lot size. The broker charges ₹25 per lot for trading in options.

JM Financial Currency Brokerage

You can trade future and option contracts of four different currencies in the Indian stock market. Here is the detail of the brokerage imposed for the currency trade in JM Financial.

JM Financial Commodity Brokerage

You can also do trades in commodities with JM financial. Here are the charges you have to pay for commodities trading with JM Financial.

JM Financial Hidden Charges

These were the charges you have to pay to JM Financial for using their trading platform.

Now there are some other hidden charges which are usually ignored by traders. There are STT (Security Transaction Tax) taken by BSE and NSE, GST by central govt, STAMP duty by state govt etc.

Other than these, there are JM Financial DP Charges that are imposed on the selling of shares held in the demat account.

Let’s summarize all these charges in a table for ease of understanding.

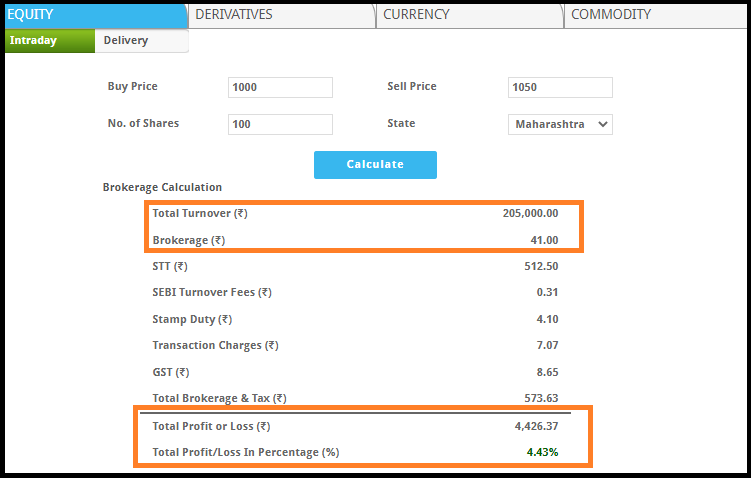

JM Financial Brokerage Calculator

When trading in a particular segment, it becomes important for a trader to know about the brokerage fees along with other taxes imposed by different market participants.

Now for a beginner or for any other trader, it often becomes difficult to calculate these charges or to evaluate the profit or loss percentage.

Conclusion

Brokerage Charges seem too small but still, they form a significant part of returns on the money you invested in the stock market.

So you should choose a broker who provides brokerage at minimum charges.

You now have all the information about JM Financial’s brokerage charges so you can now open a Demat account with JM financial and start trading.

Start investing in the stock market with a renowned stockbroker. Get in touch with us and we will assist you in opening a Demat account online for FREE!