JM Financial Delivery Charges

Charges

For every beginner, delivery trading is something that helps them to understand the market in creating wealth in long term. JM Financial offers the Blink trading app to trade. So, before you get into the trade let’s have a quick look at the JM Financial delivery charges.

JM Financial Delivery Trading Charges

Like any other full-service broker JM Financial charges a brokerage on delivery trading. Before proceeding ahead it would be wise to tell you that there are certain other charges like SEBI charges, GST (Goods and Service Tax), transaction tax, and STT charges which you have to pay along with brokerage.

They are sometimes termed hidden charges and appear in the final receipt of trade settlement. We will discuss them separately.

Delivery trading essentially implies that you have to take delivery of the trades and these trades could be related to stocks thus giving you the flexibility to plan a long-term investment in stocks.

JM Financial Brokerage is calculated on a turnover value and is equal to 0.15% on every trade executed. That means you have to pay 0.15% of the total trade turnover.

| JM Financial Delivery Brokerage | |

| Delivery Brokerage Charges | 0.15% of the turnover value |

Let’s understand these charges with a simple calculation. Suppose you bought 50 shares of ₹5000 and sold them for ₹8000 total trade turnover is ₹13000.

- The delivery brokerage charge on the buy side= is 0.15% of ₹5000= ₹7.5

- The delivery brokerage charge on the sell side= is 0.15% of ₹8000=₹4.5

So the total brokerage is ₹12

In this way, you can calculate the delivery brokerage charged by the broker on every trade you execute. Apart from this, there are JM Financial DP Charges which is levied on sell side.

JM Finacial Delivery Brokerage Calculator

Now, apart from this, there are some hidden charges as mentioned above. These hidden charges make it difficult for any investor or trader to understand the total cost of the trade and further evaluate the profit or loss percentage.

Hidden charges make a big component of returns in stock market trading. Yet they are ignored by traders as they just account for brokerage deductions on trade settlements.

Here is the detail of these charges for equity delivery trades:

- SEBI Charges: 0.00015% of the turnover value

- Transaction Charges: 0.00345% of the turnover value

- Stamp Duty Charges: 0.015%

- STT Charges: 0.25% of the turnover value

- GST: 18% (brokerage+transaction)

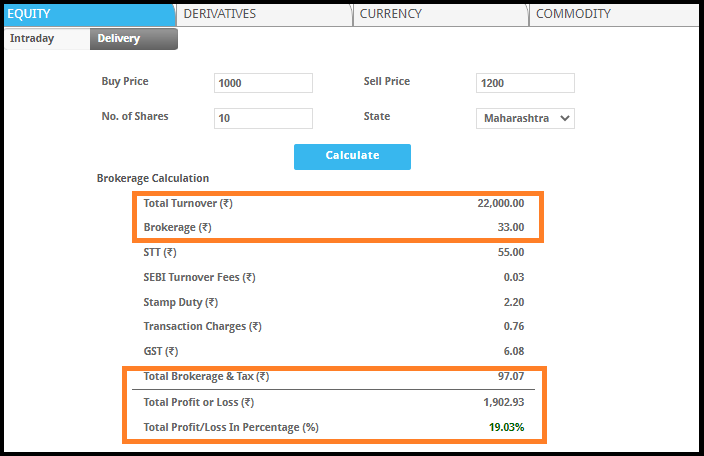

To make it easier to understand these charges you can use the brokerage calculator and find the detail of brokerage, fees, and total profit or loss percentage.

Conclusion

Delivery trading is associated with buying a stock one day and selling it another day. This type of trading is preferred by those individuals who invest their money for either the long term or for a few days, weeks, or months.

JM Financial facilitates delivery trading at a very affordable and reasonable brokerage of 0.15% of total trade turnover and gives enough space to save on brokerage costs.

Hope after reading this blog you will consider opening a Demat account (+Trading account) with JM Financial for delivery trading.

Begin your investment journey now with a renowned stockbroker. Get in touch with us and we will assist you in opening a demat account online for FREE!