Kotak Securities Delivery Brokerage Charges

Check All Brokerage Reviews

Kotak Securities is a full-service stockbroker and has been delivering great services constantly to make a mark in the market. If you have a Kotak Demat Account, then you should be acquainted with the Kotak Securities Delivery brokerage Charges.

Now, Kotak Securities actively has 2 brokerage plans, namely

- Standard brokerage plan

- Trade Free Plan

Let us check the Kotak Securities delivery brokerage charges under different plans in detail.

Kotak Securities Delivery Brokerage Plan

Being a full-service stockbroker, Kotak Securities charges brokerage on the basis of the percentage of the trade.

In comparison to other brokers in the list, Kotak Securities offers much relaxation to its customers by charging minimum brokerage fees.

The charges detailed for delivery trading in different segments is provided in the table below:

| Kotak Securities Delivery Brokerage Charges | |

| Segment | Brokerage |

| Equity Delivery | 0.25% |

| Equity Futures Delivery | ₹20 per order |

| Equity Options Delivery | ₹20 per order |

| Currency F&O Delivery | ₹20 per order |

| Commodity F&O Delivery | 0.25% |

Let’s understand these charges with an example.

Suppose Mr. Gupta has his account in Kotak Securities.

Mr. Gupta is inclined towards delivery trading and also intraday trading, so he opted for the ‘trade free’ plan.

Now suppose, both the investors make an investment with the turnover of ₹1,00,000, then the brokerage for both the cases is as follows,

- Mr. Gupta has the “trade free” plan, so the brokerage will be: 0.25% of 1,00,000= ₹250

Here one can reap the benefit of free delivery trading with Kotak Securities, as well. Wondering how! with the exclusive Kotak Securities Brokerage plans.

Simply by subscribing to the Kotak Securities zero brokerage plan. Now this plan is exclusively created for traders less than 30 years of age. To activate this plan one has to pay one-time subscription charges of Rs 499.

Also, the broker offers free access to the stock market course offered by Elearnmarkets and Stockedge. So, if you are eligible for the plan, subscribe now and trade more without worrying much about the brokerage charges.

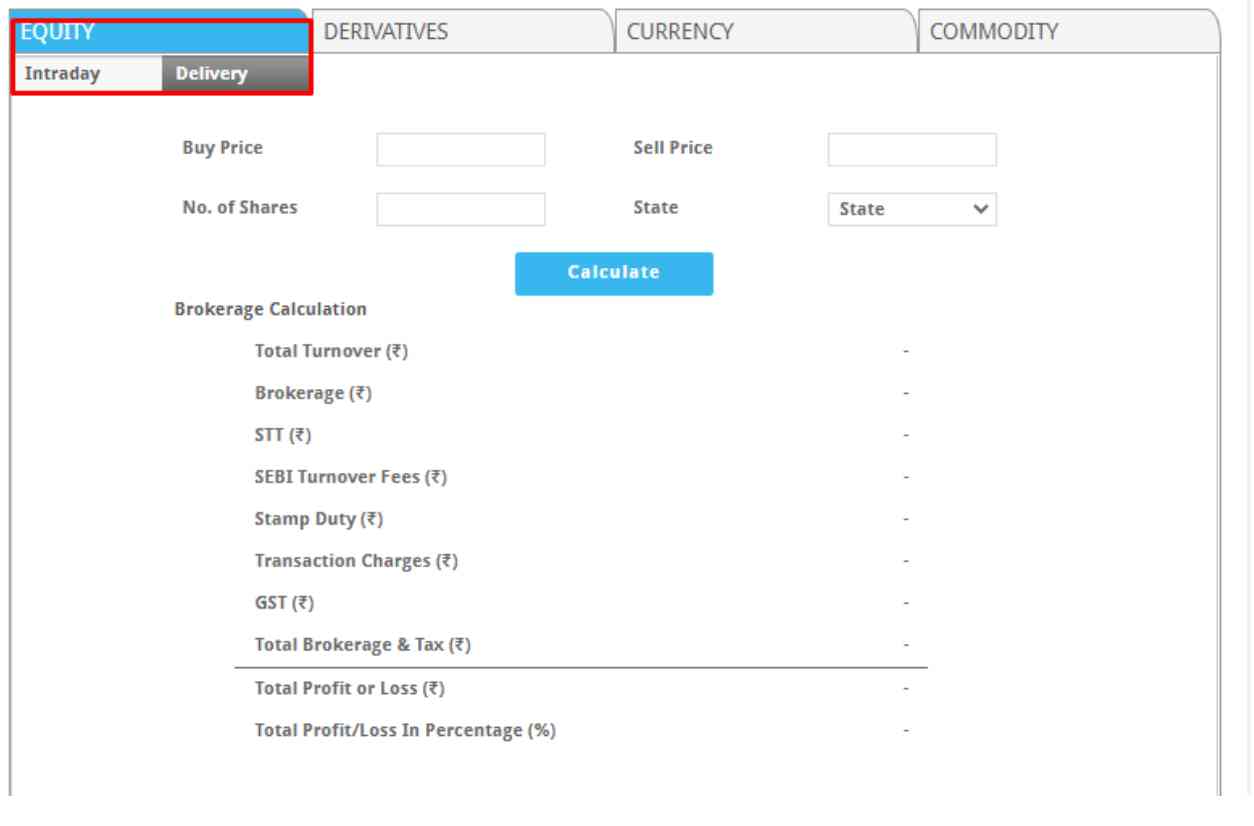

Kotak Securities Delivery Brokerage Calculator

Apart from delivery brokerage, there are some additional charges as well like transaction fees, stamp duty, STT charges, etc.

The total brokerage payable at the end is calculated by considering all the charges.

So, if you are having difficulty in evaluating the exact brokerage charges that will be levied by your broker, you can use the calculator that helps you in understanding how does Kotak Securities charges brokerage?

All you have to do is enter the buy price, sell price, number of shares, and the state. You will get the necessary details.

Remember, there are Kotak Securities DP charges and not to forget the STT charges in Kotak Securities as well that need to be paid as part of your trading charges for the delivery segment along with brokerage.

Conclusion

Kotak Securities has earned a good name among the bank-based stockbrokers.

The broker comes up with different plans for investors that help them to trade in the equity delivery segment accordingly. So, open a demat account now and get into trade now with the renowned broker.