Motilal Oswal Brokerage

Check All Brokerage Reviews

Motilal Oswal, one of the best stockbrokers in India, offering the best services and many more trading benefits to its traders. You can start trade with the broker by opening a Demat account online. But is Motilal Oswal a discount broker? For this let’s have a quick look at the defining parameter Motilal Oswal brokerage.

Brokerage charges are one of the few parameters one must consider while opening an account with the broker.

In this article, we will give you complete information on the brokerage charges of Motilal Oswal.

Motilal Oswal Brokerage Charges

When an individual looks for a suitable stockbroker, they go through various aspects. Brokerage is undoubtedly one of them. So, if you are thinking of opening an account with Motilal Oswal, then let’s make it a bit easier for you.

Motilal Oswal trading charges are comparatively higher charges and fees, but there are many services and offers brought to you by the broker, that make it extremely easy for you to trade across different segments.

It also offers the Motilal Oswal Call and Trade facility that allows you to trade without the trading apps, however, charges still do apply.

Here to offer relaxation to its customer, the broker offers different plans. The standard plan is activated as soon as you open a Demat account with Motilal Oswal. It offers a minimum brokerage rate that depends upon the margin you deposit in your trading account.

On the other hand, there is a Value Pack, that further reduces the brokerage on the basis of upfront fees you pay to the broker.

Let’s discuss all these charges and plans in detail.

Motilal Oswal Trading Charges

Here is the list of brokerage charges we are going to discuss. So, now trade in any of the segments by grabbing full information on the rates and plans.

- Motilal Oswal Intraday Charges

- Motilal Oswal Delivery Brokerage

- Motilal Oswal Commodity Brokerage

- Currency brokerage in Motilal Oswal

- Motilal Oswal Futures Brokerage

- Motilal Oswal Options Brokerage

So, let’s dive in and learn about the different fees and brokerage charges of Motilal Oswal.

Motilal Oswal Intraday Charges

Intraday trading comes up with too many risks. You just to focus on how you can earn more profit. For this, look for the brokerage charges or plans that can help you to trade at the minimum cost.

The minimum brokerage to trade in intraday is ₹12 but along with this Motilal Oswal comes up with multiple options for its traders. Now you pick the right plan according to the trade volume and end up paying the minimum fees.

Here is the complete detail of the Motilal Oswal brokerage charges.

| Motilal Oswal Intraday Brokerage Charges | ||

| Plan | Margin/Upfront Fees (in ₹) | Brokerage |

| Standard Brokerage Plan | <25,000-6,00,000+ | 0.05%-0.01 |

| Value Pack | 2,000-3,00,000 | 0.040%-0.007% |

Motilal Oswal Delivery Brokerage

The investor needs to pay comparatively more to trade in the delivery segment. Motilal Oswal charges a minimum fee of ₹25 to trade in equity delivery. Further, it comes up with different plans that help you to trade by paying the least fees.

Here is the range of charges depending upon the initial margin or upfront fees.

| Motilal Oswal Delivery Brokerage Charges | ||

| Plans | Margin/Upfront Fees (in ₹) | Brokerage |

| Standard Brokerage Plan | <25,000-6,00,000+ | 0.05%-0.01 |

| Value Pack | 2,000-3,00,000 | 0.040%-0.007% |

Motilal Oswal Commodity Brokerage

As already discussed, the broker is registered with MCX and so you can trade in different commodities using the Motilal Oswal app.

You can trade in commodities by paying the least brokerage of 0.01% per trade. Grab complete information and range of commodity brokerage in the table below:

| Motilal Oswal Brokerage Charges | |||

| Plans | Trading Segment | Margin/Upfront Fees (in ₹) | Brokerage |

| Standard Brokerage Plan | Futures | <25,000-6,00,000+ | 0.04% -0.01% |

| Options | ₹100-₹25 per lot | ||

| Value Pack | Futures | 2,000-3,00,000 | 0.040%-0.007% |

| Options | ₹50-₹15 per lot |

Currency Brokerage in Motilal Oswal

Motilal Oswal facilitates you to trade in the currency futures and options by charging you the minimum brokerage fees.

Here is how much brokerage is charged by Motilal Oswal for Currency trade.

| Motilal Oswal Currency Brokerage Charges | |||

| Plans | Trading Segment | Margin/Upfront Fees (in ₹) | Brokerage |

| Standard Brokerage Plan | Currency Futures | <25,000-6,00,000+ | 0.05%-0.01% |

| Currency Options | ₹100-₹25 per lot | ||

| Value Pack | Currency Futures | 2,000-3,00,000 | 0.04%-0.008% |

| Currency Options | ₹20-₹6 per lot |

Motilal Oswal F&O Brokerage Charges

The F&O segment comes under the derivatives, is a set of tools that help the trader reduce the risk involved, and are considered far more tricky than the rest of the financial segments.

The Motilal Oswal Futures Brokerage can be up to 0.05% to 0.01% depending upon the margin you deposit in your trading account.

Other than this the option charges also vary and you can end up trading by paying the ₹100-₹20 per lot.

You can find the complete summary of F&O charges in the table below:

| Motilal Oswal F&O Brokerage Charges | |||

| Plans | Segment | Margin/Upfront Fees (in ₹) | Brokerage |

| Standard Brokerage Plan | Futures | <25,000-6,00,000+ | 0.05%-0.01% |

| Options | ₹100-₹25 per lot | ||

| Value Pack | Futures | 2,000-3,00,000 | 0.04%-0.008% |

| Options | ₹50-₹15 per lot |

Motilal Oswal Brokerage Plans

Every full-service or discount broker comes up with different offers for its customers. This not only attracts more traders towards their services but also helps them to pay the hefty fees thus increasing their profit margin.

As soon as you open Motilal Oswal demat account, the broker offers you a default plan or Standard brokerage plan. Other than this, there is another plan for active traders, called Value Pack.

Let’s delve into more details to grab full information on the fees and charges.

Motilal Oswal Standard Brokerage Plan

Motilal Oswal provides flexibility to its customers by offering the standard brokerage plan. Here, the total brokerage fees vary on the basis of the margin you keep in your trading account.

So, if you are an active trader, you can pay the least amount by keeping the upfront margin. Here is the detail of the margin and the corresponding brokerage that the broker charges.

| Motilal Oswal Standard Brokerage Plan | |||||

| Initial Margin (in ₹) | Intraday | Delivery | Futures | Options | Commodity |

| <25000 | 0.05% | 0.5% | 0.05% | ₹100 per lot | 0.04% |

| 25000 | 0.04% | 0.4% | 0.04% | ₹75 per lot | 0.03% |

| 50000 | 0.03% | 0.3% | 0.03% | ₹70 per lot | 0.02% |

| 100000 | 0.025% | 0.25% | 0.025% | ₹50 per lot | 0.01% |

| 300000 | 0.02% | 0.20% | 0.02% | ₹40 per lot | 0.01% |

| 500000 | 0.0150% | 0.15% | 0.0150% | ₹25 per lot | 0.01% |

| 600000+ | 0.01% | 0.1% | 0.01% | ₹25 per lot | 0.01% |

Motilal Oswal Value Pack

Being a full-service stockbroker, Motilal Oswal cares for its customers and so comes up with the minimum brokerage plan. As the name goes, it offers value to trade by charging you the minimum fees.

You can activate or deactivate this pack anytime by getting in touch with Motilal Oswal customer support.

The details of the Value Pack are tabulated below.

| Motilal Oswal Value Pack | ||||||

| Subscription Amount (₹) | Intraday | Delivery | Futures | Options (₹ per lot) | Commodity | |

| Equity/ Commodity | Currency | |||||

| 2,000 | 0.04% | 0.40% | 0.04% | ₹50 | ₹20 | 0.04% |

| 3,000 | 0.035% | 0.35% | 0.035% | ₹45 | ₹18 | 0.035% |

| 5,000 | 0.030% | 0.30% | 0.030% | ₹40 | ₹15 | 0.03% |

| 10,000 | 0.025% | 0.25% | 0.025% | ₹30 | ₹12 | 0.025% |

| 30,000 | 0.020% | 0.20% | 0.020% | ₹25 | ₹11 | 0.02% |

| 50,000 | 0.015% | 0.15% | 0.015% | ₹25 | ₹10 | 0.015% |

| 1,00,000 | 0.010% | 0.10% | 0.010% | ₹20 | ₹8 | 0.01% |

| 2,00,000 | 0.008% | 0.08% | 0.008% | ₹18 | ₹8 | 0.009% |

| 3,00,000 | 0.007% | 0.07% | 0.007% | ₹15 | ₹6 | 0.008% |

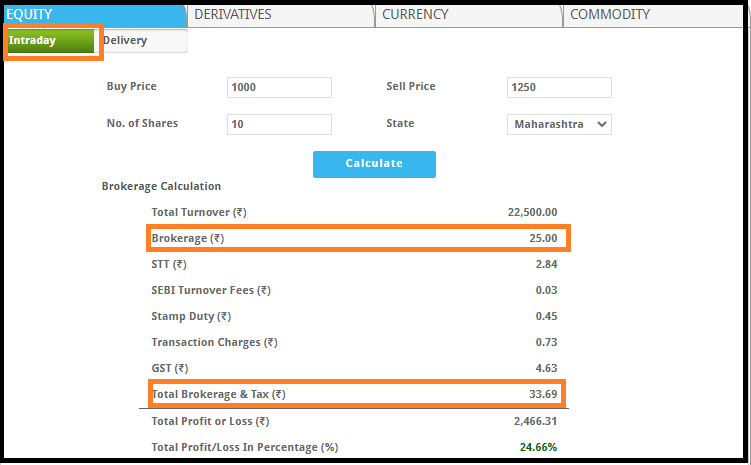

Motilal Oswal Brokerage Calculator

So hope you might now be able to calculate the brokerage for a particular segment. But do you know that the exact fees you pay to the broker differ from the brokerage in the particular segment?

Wondering why the broker ask for additional fees?

Well! this is because of some hidden fees and taxes. Along with brokerage, the trader has to pay other charges as well like STT, SEBI charges, GST, transaction fees. This adds on the brokerage fees and thus the exact charges are generally higher than what you calculate using the above data.

So, if you are involved in trading in any of the segments then here is the calculator for you. You can easily find out the brokerage charges and also the profit or loss you can make by getting into a particular trade.

Conclusion

The new entrants in the share market – traders and investors, tend to look at every aspect very cautiously and in-depth. Brokerage charges are such an aspect that helps them choose the broker that suits them the best.

Motilal Oswal opens a gateway for potential traders to trade in different segments including equity, commodity, currency, and derivatives. Thus, there is a benefit of Motilal Oswal demat account wherein you get the chance to trade in all these segments by paying the brokerage of your choice.

No doubt! the broker provides impeccable services, different brokerage plans, and multiple offers and benefits to its traders. So why wait for more, get into trade now, and start reaping maximum benefits.

Wish to open a Demat Account? Refer to the form below

Know more about Motilal Oswal