Motilal Oswal Options Brokerage

Check All Brokerage Reviews

Options trading comes up with many benefits, and trading with one of the renowned brokers like Motilal Oswal opens a gateway to trade like a Pro. So, if you are thinking of starting options trading, then here is the complete information on Motilal Oswal options brokerage.

Motilal Oswal Options Brokerage Charges

Just like futures trading, options also come under the derivatives segment. You can trade options in equity, commodity, or currency trading segments with Motilal Oswal.

To trade in different segments, the Motilal Oswal brokerage charges differ too, the details of which are given in the segment.

The broker provides two different brokerage plans in which the brokerage various according to different factors. Those plans are:

- Motilal Oswal Standard Brokerage Plan

- Motilal Oswal Value Pack

Now, let’s check the brokerage by considering the plans individually.

So, let’s dive into the following segments!

Motilal Oswal Standard Brokerage Charges

As per the default plan, the brokerage varies according to the initial margin you deposit in your trading account at the time you opened the Motilal Oswal demat account.

The maximum fees the broker charges to trade in the options segment is ₹100 per lot, but if you maintain a margin in large amounts the charges decrease accordingly as shown in the table below:

| Motilal Oswal Standard Brokerage Charges | ||

| Initial Margin While A/c opening [Rs] | Options Broking (INR per lot) | |

| <25000 | 100 | |

| 25000 | 75 | |

| 50000 | 70 | |

| 100000 | 50 | |

| 300000 | 40 | |

| 500000 | 25 | |

| 600000+ | 25 | |

Apart from the Standard Plan, the broker provides another plan which is Value Pack. To know more about it, refer to the following segment.

Motilal Oswal Value Pack

In the Value Pack plan, Motilal Oswal offers various brokerage fees depending on the upfront fees that are deposited to activate the plan.

Here is the complete information of the options trading charges in Motilal Oswal traded in different segments.

| Motilal Oswal Options Brokerage | ||||||||

| Scheme Name | VP2KLT | VQ1KLT | VR1KLT | VS6KLT | ||||

| Upfront Fee (in ₹) | 2,000 | 3,000 | 5,000 | 10,000 | ||||

| 1st Leg and 2nd Leg (INR) - Equity & Commodity (Both Side) | ₹50 per lot | ₹45 per lot | ₹40 per lot | ₹30 per lot | ||||

| 1st Leg and 2nd Leg (INR) - Currency | ₹20 per lot | ₹18 per lot | ₹15 per lot | ₹12 per lot | ||||

| Motilal Oswal Options Brokerage | ||||||||||

| Scheme Name | VT26KLT | VU46KLT | VV1LACT | VW1LACT | VX1LACT | |||||

| Upfront Fee (in ₹) | 30,000 | 50,000 | 1,00,000 | 2,00,000 | 3,00,000 | |||||

| 1st Leg and 2nd Leg (INR) - Equity & Commodity (Both Side) | ₹25 per lot | ₹ 25 per lot | ₹20 per lot | ₹18 per lot | ₹15 per lot | |||||

| 1st Leg and 2nd Leg (INR) - Currency | ₹11 per lot | ₹10 per lot | ₹8 per lot | ₹8 per lot | ₹6 per lot | |||||

Let’s understand the brokerage plan with an example.

Being an options trader, Darshan had opened the Demat account with Motilal Oswal and was trading for 2 years with the Standard plan as he was not at all active in trading.

As time passed, he started trading actively by executing the trade. So to reduce the burden of hefty brokerage, he switched to the Value Pack Plan.

Now, let’s see how this decision affects the options brokerage as part of the Motilal Oswal Trading charges.

SITUATION 1: Darshan, with the Standard Plan, decided to trade in an equity option where the brokerage is ₹100 per lot. He bought 200 lots and thus paid ₹20,000 (200*100) as the brokerage.

SITUATION 2: After two years he opted for the Value Pack plan VP10KLT by paying the upfront fee of ₹ 10,000, and Darshan has been provided the brokerage of ₹30 in equity options. Here, on buying 200 lots, he paid the brokerage of ₹6000 (30*200).

Thus, with the Motilal Oswal Value Pack, the brokerage is comparatively less which helps you to increase your profit margin. Also, if you are seeking an answer is Motilal Oswal a discount broker, then seeing the above brokerage charges might have cleared this.

Motilal Oswal Brokerage Calculator

Now, what do you think about brokerage? Are those the only fees that are to be paid as a brokerage by Darshan?

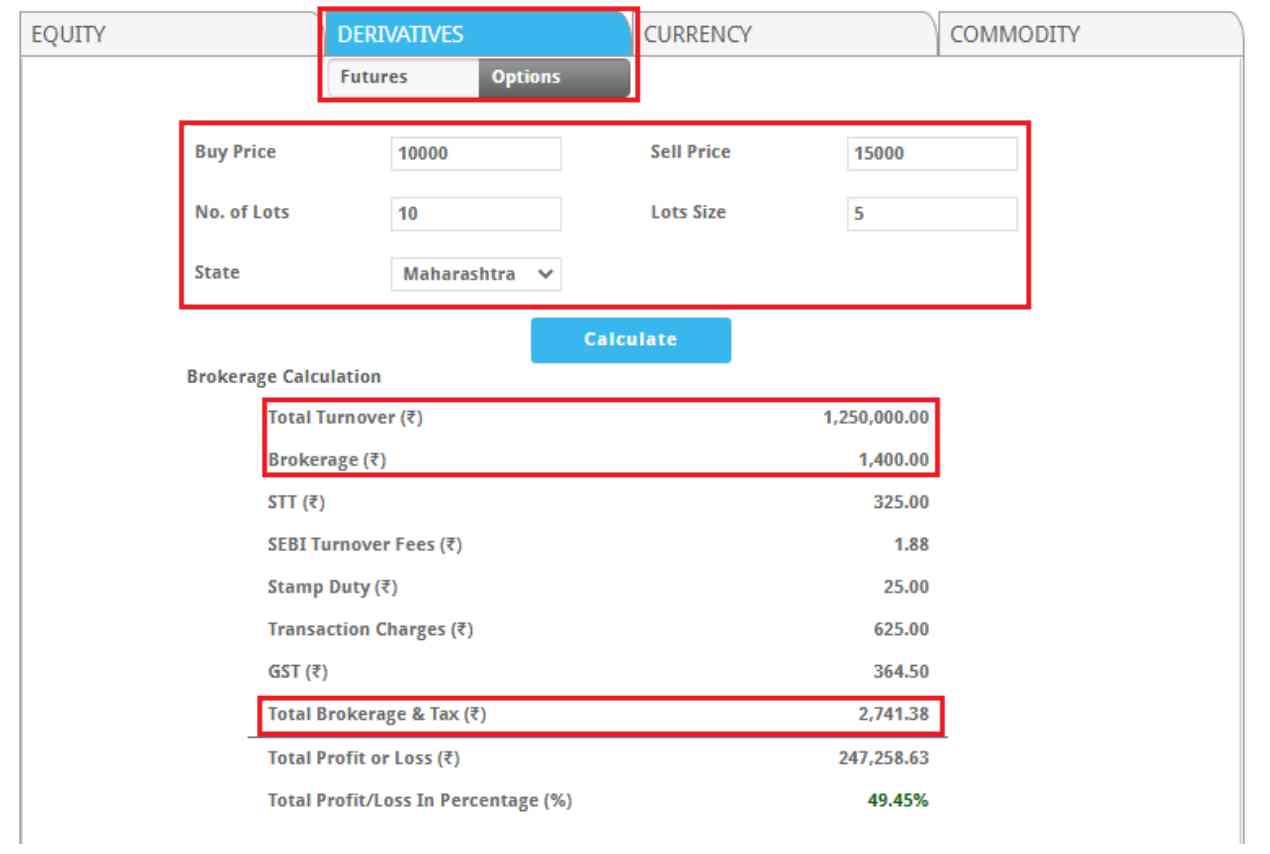

No, these are not the actual brokerage that is to be paid, because the ‘Total Brokerage’ includes various taxes like Sebi turnover fees, STT, stamp duty, GST, and Motilal Oswal transaction charges.

Let’s understand the calculation of options brokerage with the help of a calculator.

Along with the brokerage, Darshan is able to calculate actual profit or loss percentage to execute the trade with the brokerage calculator.

Conclusion

The option brokerage charges are charged in the lot. Above mentioned information was all based on Motilal Oswal options brokerage.

As discussed, the broker offers the two plans to the traders for the Motilal Oswal Options Brokerage.

In case the calculation confuses the trader, it is better to go with the brokerage calculator and get the transparent values.

Here comes the time to compare, calculate and trade!

In case you need any assistance to learn more about Motilal Oswal Options Brokerage, just fill in the basic details below and we will arrange a callback for you: