Motilal Oswal Value Pack

Check All Brokerage Reviews

Are you willing to trade with Motilal Oswal but the high brokerage fee is the major resistance for you? If yes, then here is the plan, Motilal Oswal Value Pack that allows traders to trade more at minimal fees.

In this article, you will be able to know the different schemes, plans activation process, brokerage charges under different segments, and a lot more.

So, let’s get started.

Motilal Oswal Value Pack Scheme

As already discussed, Motilal Oswal Value Pack is the brokerage plan that helps traders to trade more at the minimum cost.

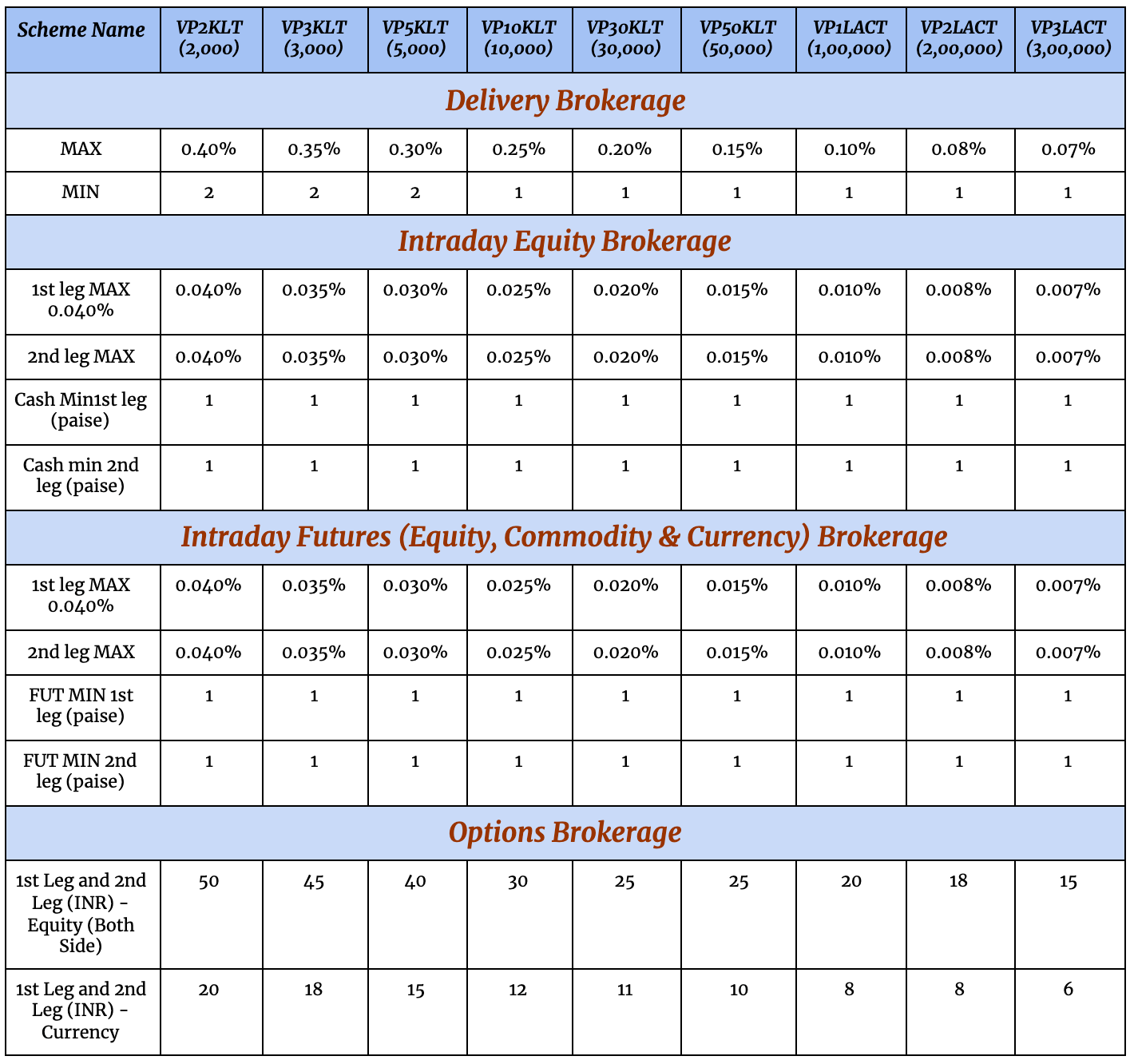

The detail of the Value Pack scheme is tabulated below:

In short, the Motilal Oswal Value Pack allows multiple subscriptions to choose from as per the preferences.

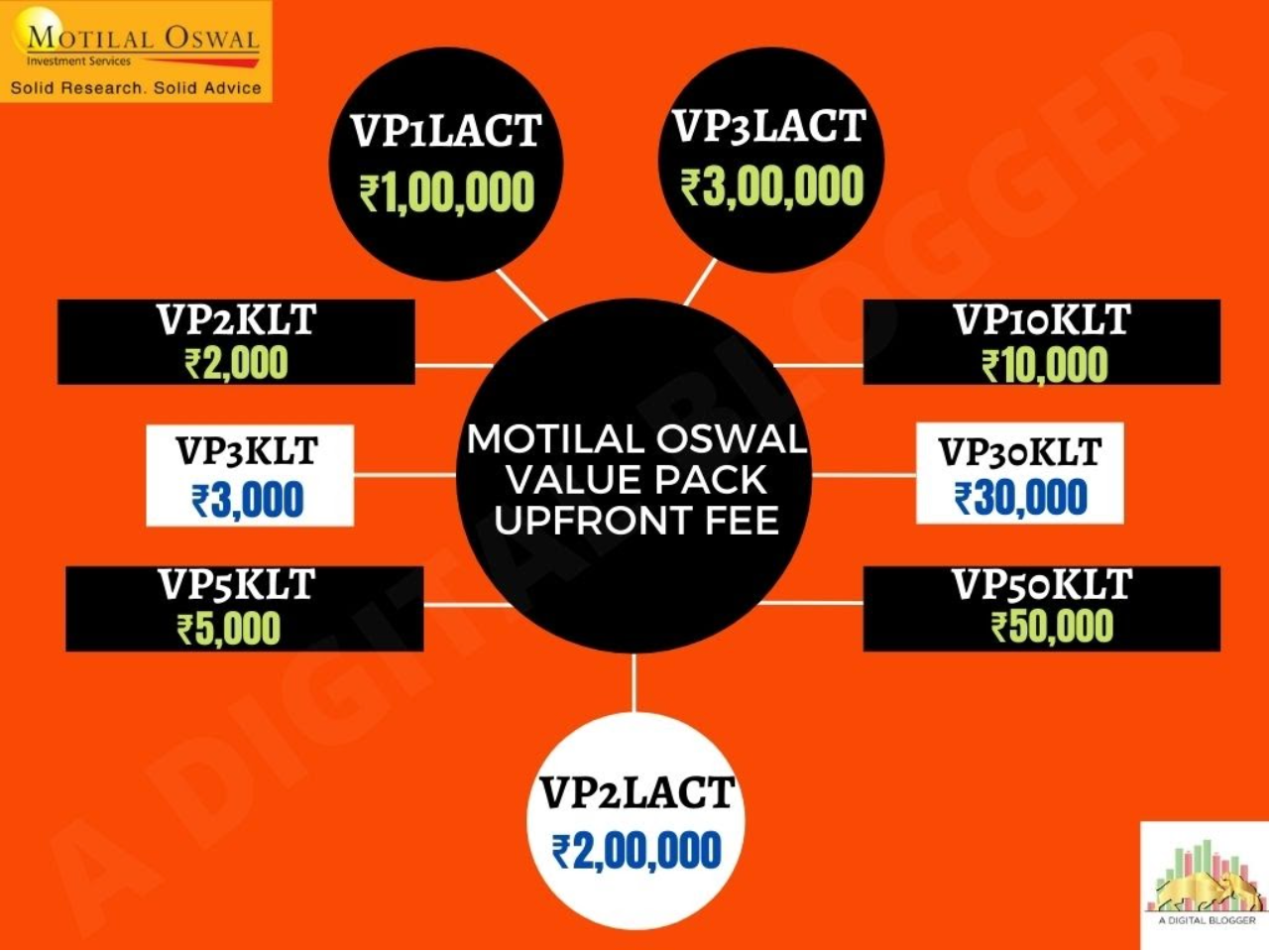

For opting for any scheme, there is an upfront fee that is to be paid to the broker at the time of opening a Motilal Oswal demat account or scheme activation. The upfront fee is given below:

*After the payment is made, the scheme will commence.

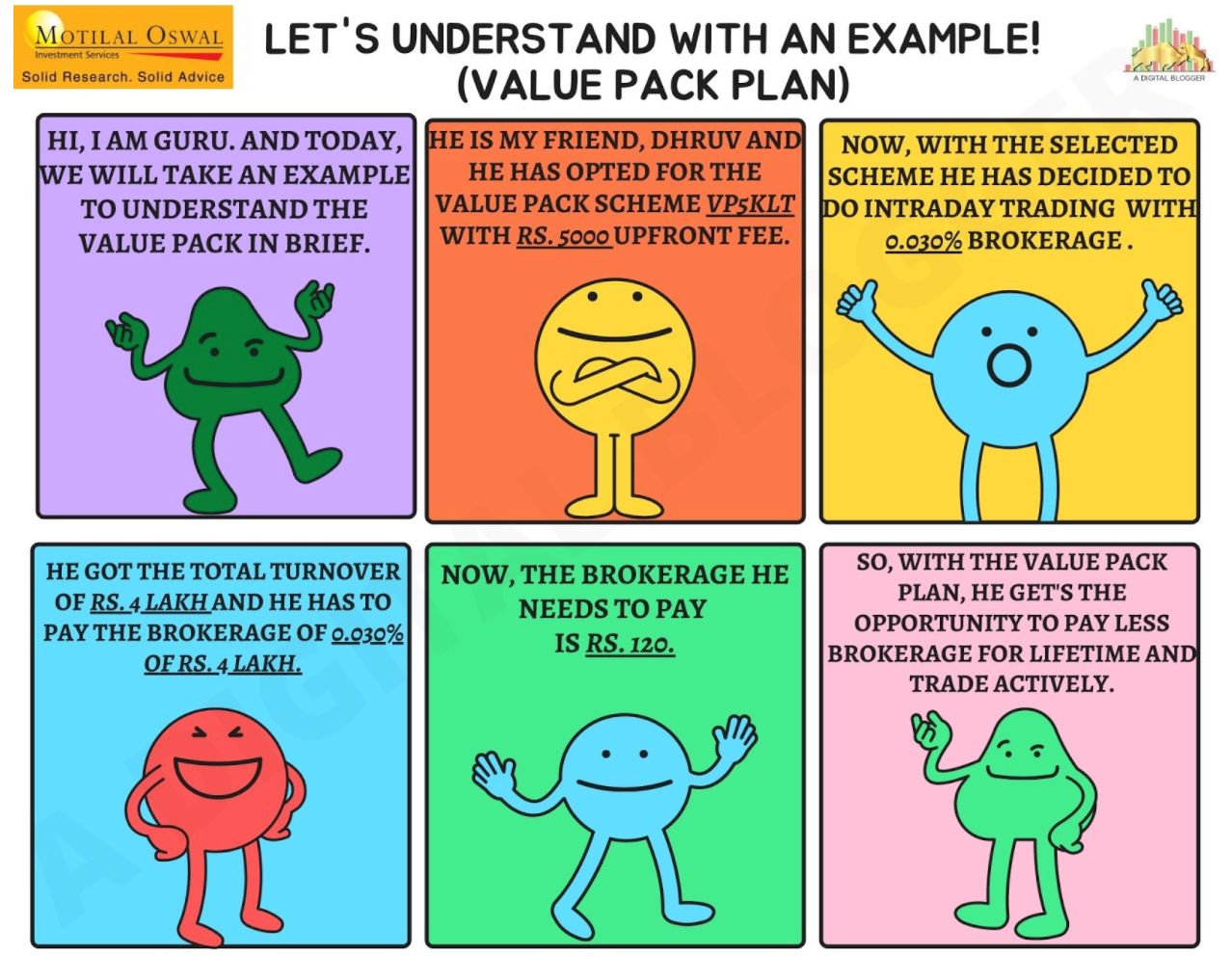

Now, to understand the concept in a more precise way, let’s assume an example.

Dhruv opted for the Value Pack VP5KLT scheme by paying the upfront fee of Rs. 5,000. He is an intraday trader, and if he gets a total turnover of Rs. 4 lakh, in that situation, he needs to pay 0.030% of Rs. 4 lakh, i.e., Rs. 120 as a brokerage.

After understanding the Value Pack plan, now let’s compare it with the example of the Standard Brokerage Plan.

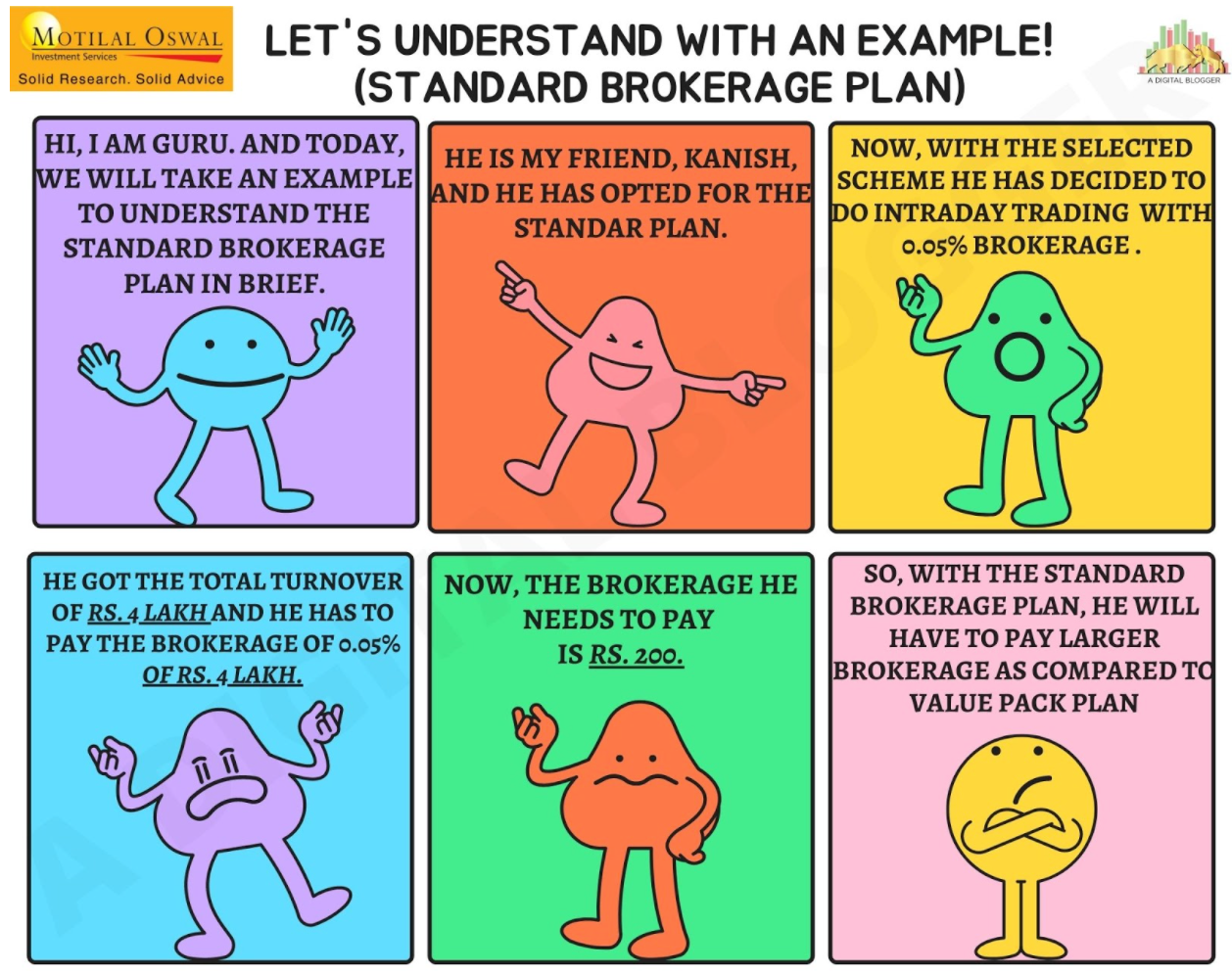

Kanish is also an intraday trader who didn’t opt for the Value Pack Plan and pays the brokerage according to the Standard Motilal Oswal Brokerage plan.

So with the total turnover of Rs. 4 lakh he has to pay 0.05% i.e Rs. 200 as a brokerage.

From the above-mentioned situations, it can be derived that Dhruv paid less brokerage with the Value Pack plan as compared to Kanish (with Standard plan) after being an active trader.

Thus, as an active trader like Dhruv you too can save money by paying fewer brokerage fees.

Motilal Oswal Value Pack Terms and Conditions

Before moving ahead, let’s smash the confusion over the Terms & Conditions of the Motilal Oswal Value Pack. Check the following information on the same.

- On a cumulative basis, the daily brokerage up to the range of the scheme amount is automatically refunded to the client’s ledger, which is generated by the trader over the segments.

- From the date of the activation of Pack, once the cumulative brokerage comes equal to or expands the scheme amount, the Value Pack will be deemed expired.

Note: After expiration, the pack will automatically get renewed with the auto-debit, which will be charged to a ledger.

- If the trader or investor wants to discontinue or cancel the Value Pack Scheme before the expiry, in that situation, the brokerage produced from the date of scheme activation up to the date of cancellation will be measured according to the Default plan. The leftover amount will be refunded in this situation.

Note: In the above case, the penalty of ₹500 will be charged, whereas if the trader or investor wants to discontinue the present scheme to upgrade the scheme with a higher amount, no penalty will be charged if the new scheme is within 15 working days.

- Apart from the brokerage charges, you are provided relaxation in AMC charges as well. In general, the broker charges the AMC fees equal to ₹999, but with the activation of the Value Pack, the AMC is reduced to ₹299 only. Thus you can reduce the Motilal Oswal demat account charges by choosing the Value Pack of ₹3000 or more.

Note: Motilal Oswal AMC Charges will change according to the other schemes that are selected at the time of opening a Demat account. And in case a trader or investor wants to change the scheme to a higher amount, in that case too, the AMC will vary.

Motilal Oswal Value Pack Calculator

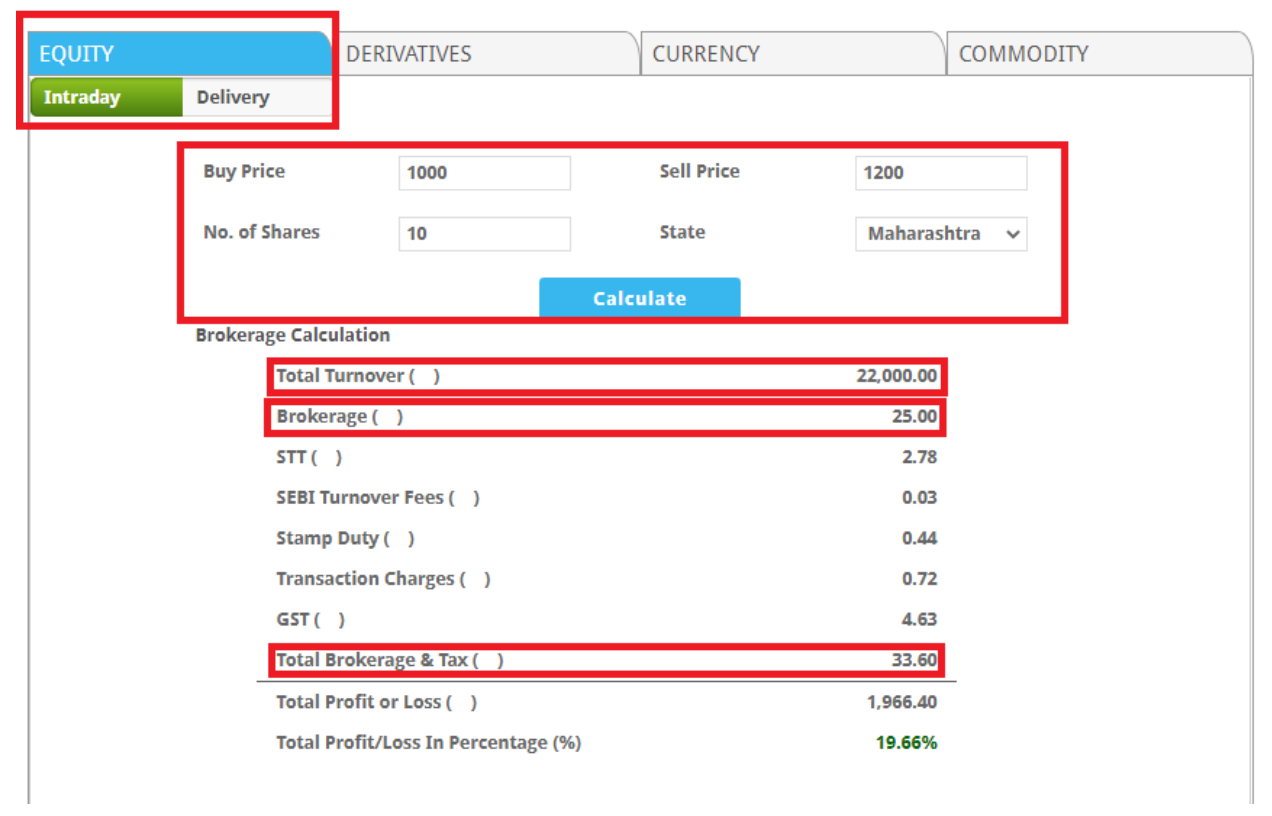

Sometimes, the calculation of the brokerage became complicated. So to make the calculation more manageable, the broker provides the brokerage calculator to get transparent data over the Motilal Oswal charges. To understand in a more detailed way, refer to the following calculator example.

After opening the calculator, fill in the necessary data, and calculate the brokerage of any segment.

By the way, you can also use the Motilal Oswal Call and Trade facility, however, the call charges could be a bit higher in this case. Make sure you are aware of those.

Conclusion

Being a full-service stockbroker, to reduce the hefty brokerage charges, the broker provides the Value Pack Plan that minimizes the Motilal Oswal brokerage, which further gets differentiated according to the Value Pack scheme selected by the traders or investors at the time of opening the account.

No doubt, the Value Pack brings an opportunity for traders to trade more at a low cost.

So here comes the time to think, plan and conduct the move!

In case you wish to learn more about this value pack or anything related to it, just let us know your contact details in the form below and we will call you back, right away: