Sharekhan Option Trading Charges

Charges

Sharekhan is a well-known full-service stock broker and hence most traders get attracted to it for options trading. But are you aware of the Sharekhan option trading charges?

Let’s dive in to know the option trading charges.

Sharekhan Brokerage Charges for Options

Options trading comes under derivative trading. You can trade options in equity, currency, and commodities. Irrespective of the trading segment, options are always bought and sold in lots.

Lot size depends upon the underlying asset and one can buy or sell these lots depending upon the trading capital they have.

Here being a full-service stock broker, the brokerage charges in Sharekhan in options are charged on the basis of lot bought and sold.

Sharekhan Equity Options Trading Charges

Sharekhan charges for option trading in equity is ₹20 per lot. This includes trading in Nifty, Bank Nifty, and other indices. Along with this, these charges are applicable for buying and selling option contracts of the companies in the derivatives market.

Apart from the brokerage, there are some taxes imposed by different market participants, the detail of which is given in the table below:

| Sharekhan Equity Option Brokerage Charges | ||

| Brokerage | ₹20 per lot | |

| STT | 0.125% of the intrinsic value on options that are bought and exercised | |

| 0.0625% on sell side (on premium) | ||

| Transaction / Turnover Charges | NSE: 0.05% (on premium) | |

| BSE: 0.005% (on premium) | ||

| SEBI Charges | ₹10 / crore | |

| GST | 18% on (brokerage + transaction charges) | |

| Stamp Charges* | 0.003% (buy side) | |

Sharekhan Commodity Options Brokerage Charges

Sharekhan is registered with both MCX and NCDEX, hence you can trade in both agri and non-agri commodities using Sharekhan trading app.

The charges for commodity options are the same as for equity options, i.e. ₹20 per lot.

Along with this, there are taxes that need to be paid. The details of all these charges are given in the table below:

| Sharekhan Commodity Option Charges | ||

| Brokerage | ₹20 per lot | |

| STT | 0.05% (on sell side) | |

| Transaction / Turnover Charges | 0.05% of turnover value | |

| SEBI Charges | ₹10/Crore | |

| GST | 18% of Brokerage + Transaction charges | |

| Stamp Charges* | ₹300/crore (buy side) | |

Sharekhan Currency Option Trading Charges

Currency or forex trading can be done in four different currencies, USD, GBP, EUR, and JPY. Here again, you need to buy and sell option contracts in lots.

However, in comparison to equity and commodity options, the charges for currency option trading is quite less. Here are the details:

| Sharekhan Currency Option Brokerage | ||

| Brokerage | ₹5 per lot | |

| STT | No STT | |

| Transaction / Turnover Charges | NSE ₹4220 | MCX ₹3220 | |

| SEBI Charges | ₹10/Crore | |

| GST | 18% of Brokerage + Transaction charges | |

| Stamp Charges* | ₹10/crore on buy side | |

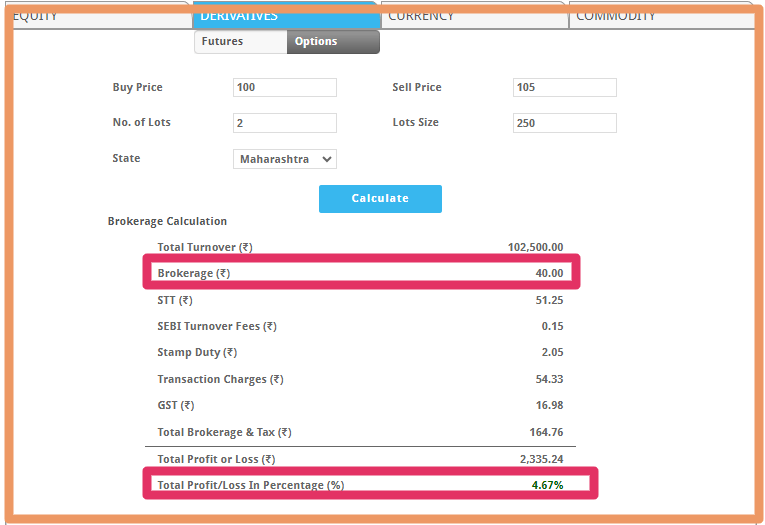

Sharekhan Brokerage Calculator

For a beginner, it is confusing and difficult to calculate the exact fees charged per trade. To make it simpler, you can rely on the Sharekhan brokerage calculator which simplifies your calculation and helps you in knowing the brokerage and profit/loss made in a trade.

To calculate the fees you need to enter the buy and sell value along with the quantity (no. of lots) and state.

Conclusion

Sharekhan offers research tips and advisory services that help an option trader place the right option trade. However, in comparison to discount brokers, the brokerage is quite high which decreases the profit margin of the trader.

Determine your trading need open Sharekhan demat account to trade in different segments.

Want to enter the stock market world? It all starts with opening a demat account. Fill in your details below and our team will call you to recommend the right stock broker and in opening a demat account online for FREE!