Upstox Charges

Check All Brokerage Reviews

Upstox is one of the best discount brokers in India and this article will talk about all the possible Upstox charges for various things like account opening, brokerages etc.

Apart from that, there are a lot of other types of charges as well including API charges, withdrawal charges, fund transfer charges, NRI Trading charges etc. This detailed review on Upstox charges is going to explain everything to you!

Let us go through the Upstox charges one by one in detail.

Upstox Demat Account Charges

The Demat account charges include the account opening fees and the Account maintenance fees that need to be paid every month.

Being one of the oldest discount brokers, Upstox comes up with different offers and benefits for its customers. Also, it comes up with different options for different categories of clients thus bringing flexibility in its account opening mode.

So, let’s dive in to understand the charges details.

Upstox Demat Account Opening Charges

The Upstox account opening charges are to be paid upfront and are generally, the first kind of payment you need to make to the broker before moving ahead with the process.

Upstox offers demat and trading accounts in 3 different categories.

Let us discuss these charges for those three categories:

- For Individuals

- For HUF

- For LLP

Let’s discuss the account opening fees of all the categories one by one.

1. Upstox Charges for Individual Account Opening

Demat account charges – The demat account is opened for free.

Trading account charges – In order to trade in different segments, the Upstox trading account needs to be opened, the charges of which are ₹200 including taxes.

Annual Maintenance Charges (AMC) – There are no account maintenance charges for the trading account. However, for the demat account, the Upstox AMC Charges for the first year is ₹100 which includes taxes.

After the completion of the first year of account opening, AMC for the trading accounts will be ₹150 + ₹27 (GST charges) = ₹177 in total.

The above-mentioned charges get deducted from the trading account itself.

2. Upstox Charges for Hindu Undivided Family (HUF)

The charges for a trading account and annual maintenance charges for demat account remain the same for HUF – ₹177 in total (including ₹150 fees and GST of ₹27)

3. Upstox Charges for LLP

The combined charges for demat and trading account are ₹500 + ₹1000 = ₹1500

GST charges for the accounts = ₹270

Therefore, total charges for trading and upstox demat account = ₹1770

The annual maintenance charges for the demat accounts from the second year of opening will be ₹1180 per year including a fee of ₹1000 and GST charges of ₹180.

Notes:

- All the account opening and maintenance charges are non-refundable in nature.

- The payment of these charges can be either done online or a cheque can be sent in favour of “RKSV Securities India Pvt Ltd”.

- An extra ₹100 would be charged in case of physical account opening. These charges are generally levied for handling and delivery of the form.

Know about the Upstox 3 in 1 account charges and the benefit of opening this account.

Upstox Brokerage Plans

There are 2 kinds of brokerage plans which are being offered to the clients of Upstox.

Upstox Basic Plan Charges

Let us discuss all the Upstox charges related to this kind of plan.

- Upstox Equity Delivery charges and Buy Today Sell Tomorrow (BTST) Trading = ₹0. This would remain a fee of ₹0 for the entire lifetime of the account.

- ₹20 or 0.01% for every order executed in Intraday Equity Trades, Equity Futures, Currency Futures and Commodity Futures segments. That amount is charged whichever is lower in number.

Get the complete information of the upstox intraday margin and invest in a smarter way.

- ₹20 flat for every order executed in Options, Currency Options and Commodity Options Segment

The leverage on cash segment under the basic plan is up to 20x. Keep a close eye on this metric as this is the differentiating factor between the two plans.

Upstox Priority Pack Charges

The details of the Upstox Charges for the priority plan have been listed below.

- Equity Delivery and Buy Today Sell Tomorrow (BTST) Trading = ₹0. This would remain a fee of ₹0 for the entire lifetime of the account.

- ₹30 or 0.05% for every order executed in Intraday Equity Trades, Equity Futures, Currency Futures and Commodity Futures segments. That amount is charged whichever is lower in number.

- ₹30 flat for every order executed in Options, Currency Options and Commodity Options Segment

The leverage on cash segment under the basic plan is up to 25x.

Let us now discuss the leverage Upstox gives to both the basic and priority plan for different segments:

Upstox Charges Related to Brokerages for Non-Individuals.

- The lower of the two – ₹20 or 0.1% for every order executed in Equity Delivery and Buy Today Sell Tomorrow (BTST) Trading

- The lower of the two – ₹20 or 0.01% for every order executed in Intraday Equity Trades, Equity Futures, Currency Futures and Commodity Futures segments

- ₹20 flat for every order executed in Options, Currency Options and Commodity Options Segment

Upstox Transaction Charges

One needs to understand the charges discussed below are not Upstox Charges but the standard charges that are levied by the SEBI and government of India.

For other details you can refer to Upstox DP details.

Upstox Charges for Equity

There are some common charges for both equity intraday and delivery segments that have been mentioned below:

- The transaction charges on BSE for stocks that come under Group A, B, E, F, FC, G, GC, I, W & T are ₹3 per lakh.

- The transaction charges on BSE for stocks that come under the Group SS ad ST are ₹1000 per lakh.

- The transaction charges on BSE for stocks that come under the Group XC, XT, XD, Z, P and ZP and M, MT are ₹100 per lakh.

- Under BSE, the transaction charges for an offer to buy and offer to sell segments are ₹3 per lakh.

Upstox Charges for Currency

No STT / CTT charges are applicable for currency futures or options trading.

Upstox Charges for Commodity

Following are some of the charges that are common applying to all the different segments where trading occurs:

- GST charges – They are calculated by doing 18% on the sum of brokerage and transaction charges.

- SEBI charges – These are charged as per ₹15 for every crore.

- Stamp duty charges – These charges vary from state to state.

Other than all the charges described above, there are DP charges as well.

These are depository participant charges that need to be paid every time there has been a sale of shares and they have been credited from a trader’s demat account.

Upstox DP Charges are calculated by adding GST to₹18.50.

The GST is charged as per 18%. So, basically, the total depository charges become ₹21.83 for every stock.

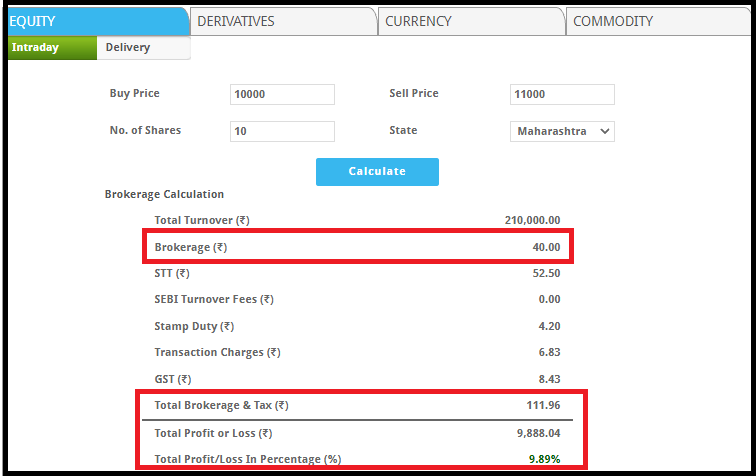

Upstox Charges Calculator

Now for any trader, it is a bit confusing and difficult to calculate the brokerage fees along with other taxes. To make it simple and easier one can use Upstox brokerage calculator.

This calculator not only calculates the total brokerage but also the taxes and profit or loss percentage.

To use it simply enter the buy price, sell price, and quantity. Then click on Calculate, and you will get the complete detail of your trading charges on screen.

Upstox Margin Trading Charges

Upstox provides the facility of margin trading. One can get 50% of his / her trade value up to a maximum amount of ₹5 lakh.

There is a facility available on Upstox called margin against shares. To avail this facility of obtaining extra margin for one’s trades, a trader can pledge of shares from his/her demat account.

There are some charges that the brokers charge for letting someone use this facility. In the case of Upstox, it is at ₹50 for every scrip.

For more information, you can also check out this detailed review on Upstox Margin Calculator.

Upstox Auto Square Off Charges

If a trader does not square off his / her intraday trades or Cover or bracket orders before the Upstox square off timings, the trades would be automatically squared off by the system and a charge of ₹20 + 18% GST would be deducted from the trading account.

Upstox Charges for Call and Trade

One can place his / her orders by calling the designated phone number in order to trade at the rate of ₹20 + GST for every order that has been placed.

One has to pay a flat fee of ₹50 for every offer for share or buyback offer one wants to be a part of.

Upstox NRI Charges

Upstox brokerage charges hit the roof at ₹200 per trade. In other words, an Indian resident client pays a maximum ₹20 per trade which is 10 times cheaper than what an NRI trader is going to pay.

These brokerage charges are going to be consistently applied across other trading segments.

Apart from that, other charges are going to stay the same. For more information, you can check this detailed review on Upstox NRI Trading Account.

Upstox API Charges

There are two types of APIs provided by Upstox to its clients and the charges of both the types of different based on the value provided.

Here are the details:

- Interactive API: This API provides updates on orders, positions and holdings on a real-time basis.

- Historical API: This API provides information on Open, High, Low, Close prices for different time intervals including 1 minute, 5 minutes, 10 minutes, 30 minutes, 60 minutes, 1 day, 1 week, 1 month.

As far as the pricing goes, the broker has monthly subscription charges for API usage. Here are the details:

Upstox Algo Trading Charges

There are no separate charges for using the algo trading facility at Upstox.

Upstox Withdrawal Charges

There is a specific fee set by RBI for any withdrawals done. The fee depends on the transfer mode used.

Here are the details:

Upstox Fund Transfer Charges

When it comes to Upstox Fund transfer charges, the broker does not levy any amount on the discount broker.

However, you have to take care of that fact the margin cheque does not get dishonoured. Because, if that happens you will need to pay a penalty of ₹250 + GST.

These charges are non-negotiable and are mandatory to be paid.

Conclusion

Upstox is one the best discount brokers in India in terms of its account opening charges, annual maintenance fee, brokerages charged and leverages given.

As soon as a transaction is completed in a trading account, one needs to pay some charges to a broker through which the transaction is being made and some charges to the government.

One has to pay these charges irrespective of the segment one is trading in. They are applicable in equity, currency, commodity or derivatives market.

One should use brokerage available on the Upstox website in order to get complete details about different kinds of charges applicable to each transaction. Does all the charges associated with trading confuse you? Looking for how to calculate brokerage in Upstox. Well now you can make it simpler with Upstox brokerage calculator.

The details of all the charges have been covered in this article. One can refer to this article before making any transactions in any segment.

In case you are looking to get started with stock market investments, let us assist you in taking the next steps ahead.

Just fill in a few basic details to get started:

More on Upstox

If you wish to learn more about this discount broker, here are a few references for you: