Zerodha Brokerage on Penny Stocks

Charges

Are you looking for the right broker to invest in penny stocks? Well, most brokers do not offer penny trading. But Zerodha offers trading in penny shares at unmatchable rates. Wondering what is the Zerodha Brokerage on Penny Stocks? Let’s find out.

Zerodha Brokerage Charges for Penny Stocks

Being a discount broker, Zerodha charges a minimum fee for trading in any segment. Here when it comes to trade in penny stocks, you can trade them only in the equity market.

Further in the equity market, one can either hold it overnight for BTST or delivery trades or do intraday trading.

On the basis of trading products, the brokerage is charged, the details of which are given below.

Zerodha Delivery Charges

Zerodha brokerage for the delivery segment is zero. Hence whatever the trade value is you do not have to pay any fees. However, there are few taxes, here is the detail in the table below:

DP Charges in Zerodha

Now when you place sell-delivered penny shares, then you need to pay Zerodha sell charges in form of DP charges also known as a debit transaction fee. It is charged per scrip per day.

Zerodha Intraday Charges

The maximum intraday trading charges charged by Zerodha is ₹20. These charges are imposed when the trade value for penny stocks is around ₹66000 or more.

For lesser trade value the broker charges the brokerage equals 0.03% of the turnover. So, if the turnover value is ₹50000 then the charges would be equal to ₹15.

Here is the complete detail of charges with taxes for intraday trade in penny stocks.

Charges for BTST in Zerodha

BTST trade where you hold your position overnight but does not take delivery of shares. Here again, the charges are charged similarly to the delivery trade i.e. zero.

Also, the charges and other fees are calculated as per the equity delivery trade.

Call and Trade Charges in Zerodha

Apart from the mobile trading facility, the broker provides you the provision to place, modify, and exit from trade on call through the ‘Call and Trade’ Facility. However, to use this facility one has to pay an additional ₹50 per order is charged.

Unlike trade charges, these charges are imposed per order. Hence you can place multiple trade requests in a single call. Also, these charges are imposed when you do not square off the intraday position on time for penny stocks.

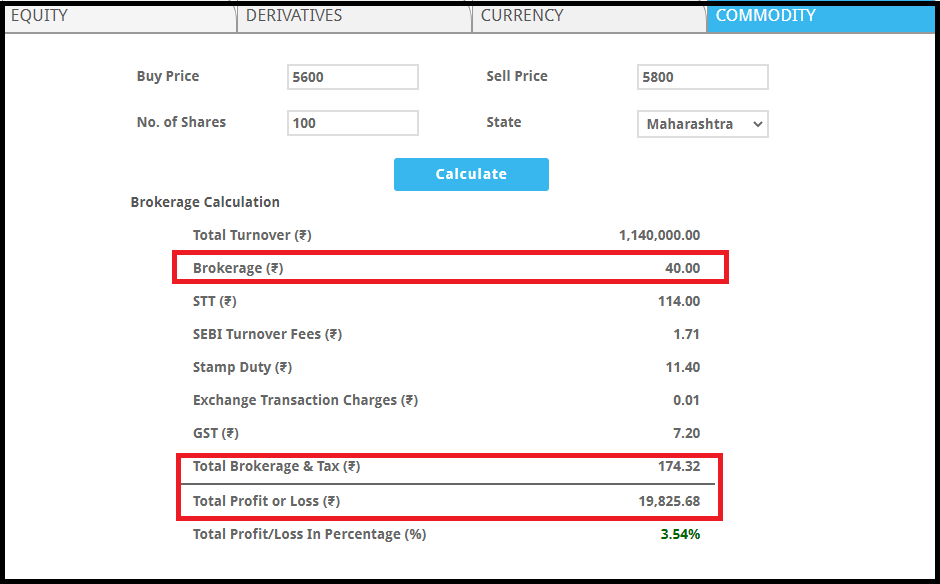

Zerodha Brokerage Calculator

No doubt, Zerodha equity charges are straight and easy to evaluate but when it comes to taxes like STT charges in Zerodha, it becomes a little difficult for the trader to find the exact brokerage fees.

To simplify this, you can rely on the brokerage calculator where you just need to enter the trade value and quantity, and Zerodha brokerage for penny stocks along with the PnL percentage will display on the screen.

Conclusion

Penny stocks are low-cost shares having a value of ₹10 or less. They are traded in quantity and depending upon the trading segments Zerodha charges the minimum and maximum fees.

However, there are no futures and options contracts for penny stocks hence one can only trade them in the equity market.

Want to invest in the share market? Get in touch with us and we will assist you to choose the right stockbroker and opening a demat account online for FREE!

More Zerodha