Zerodha Sell Charges

Charges

Every stockbroker including Zerodha imposes trading fees on the successful execution of the trade. The trader trading using the Kite app is aware of the brokerage imposed on buying a share. But does Zerodha sell charges also the same as buying trading fees?

In this article, we will be discussing the trading fees levied on different trading segment

How Much Zerodha Charges for Selling Shares?

The trader place sells order in Zerodha to;

- Close the intraday or delivery trading position.

- Short-sell equity shares for intraday trades.

- Selling option contract to open a new position or close an existing position.

- Selling future contracts to open or close a position.

This means that for selling shares, the trader has to pay Zerodha brokerage on the basis of type of trade executed in a particular segment.

Thus, in order to gain an idea of Zerodha sell charges, let’s discuss the fees in detail. Let’s start with the Zerodha equity charges for different trading products.

Zerodha Delivery Charges

First comes the delivery trade. Now in this, the shares are sold after holding for an overnight position for a few days, months, or years. Here like placing CNC trade there is no brokerage on buying similarly no Zerodha sell charges are imposed on delivery trades.

| Zerodha Delivery Trading Charges | ||

| Delivery Trading Charges | Zero | |

DP Charges in Zerodha

Although, there are no delivery sell brokerage charges one has to pay debit transaction fees imposed on the basis of the number of scrip sold on a particular day.

These charges are called DP charges ₹13.5 per scrip per day.

| DP Charges in Zerodha | Charges | |

| DP Charges | ₹13.5 per scrip+18% GST | |

Zerodha Intraday Charges

Whether you have placed MIS sell order or sold a CNC order on the same day, Zerodha charges are imposed as per the intraday trading charges which is 0.03% or ₹20 whichever is lower.

Here is the detail of Zerodha sell charges for intraday trades:

| Zerodha Intraday Charges | ||

| Intraday Brokerage Charges | 0.03% or ₹20/Trade whichever is lower | |

Hre along with the brokerage charges, you need to maintain a margin in your trading account to short-sell in intraday trade. Failing to meet the margin requirement makes you liable to pay Zerodha penalty charges which are in the range of 0.5% to 1% of the shortfall amount.

Zerodha Options Charges

Option Selling is where you place a sell order to earn a premium. Other than this, to close the buy position in Options, a trader place a sell order in Zerodha Kite.

Whatever the case is the broker charges a maximum ₹20 brokerages. However, the minimum Zerodha sell charges vary for different segments the detail of which is given in the table below:

| Zerodha Options Trading Charges | ||

| Equity Options Charges | ₹20 per trade | |

| Commodity Options Charges | 0.03% or ₹20 per executed order, whichever is lower | |

| Currency Option Charges | 0.03% or ₹20 per executed order, whichever is lower | |

Zerodha Future Charges

Like options, futures are also traded in the equity, currency, and commodity segment. The sell order is placed either to create a new position in the market or to close the existing buy position.

Irrespective of the trading style and segment the brokerage charges for future trading in Zerodha is 0.03% or ₹20 whichever is lower.

| Zerodha Futures Trading Charges | ||

| Equity Futures Charges | 0.03% or ₹20 per executed order, whichever is lower | |

| Commodity Futures Charges | ||

| Currency Futures Charges | ||

BTST Charges in Zerodha

BTST, Buy Today Sell Tomorrow is where the trader buys shares and sells them on the next trading day. Since the CNC order hence no brokerage is imposed.

However, the debit transaction fees i.e. DP charges are deducted which is equal to ₹13.5 per scrip.

Zerodha sell charges for BTST trade are summarized in the table below:

| Zerodha BTST Charges | ||

| BTST Brokerage Charges | Zero | |

| BTST DP Charges | ₹13.5 per scrip | |

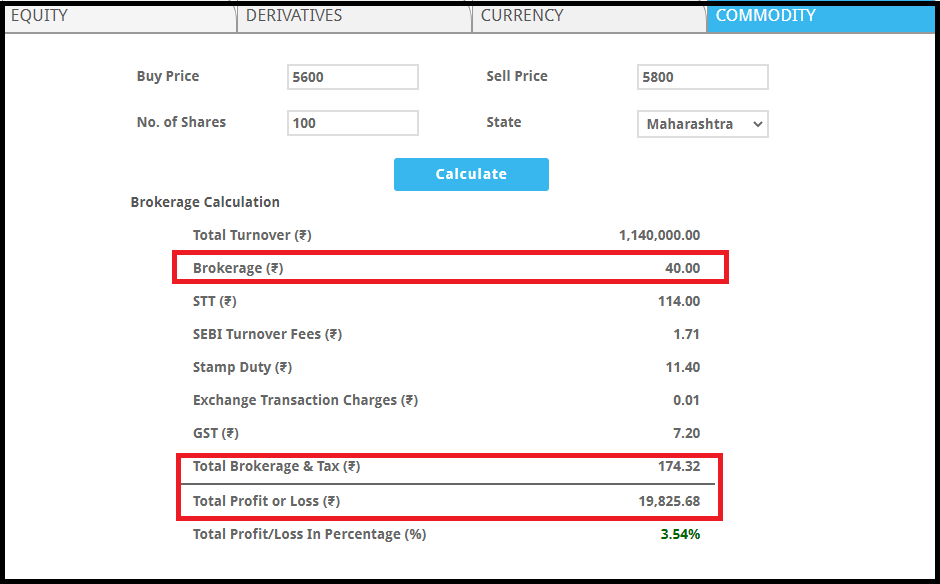

Zerodha Brokerage Calculator

Now, apart from the brokerage, there are few taxes, like STT charges in Zerodha, and other taxes imposed on every trade. However, no stamp duty charges are levied on sell orders. But still, with so many additional fees it is a little complicated for a trader to calculate the exact fees needed to pay.

To make it easier, you can use the brokerage calculator that tells the Zerodha sell charges including all taxes and profit or loss you can make in a particular trade.

Conclusion

Zerodha sell charges are same as buying however, there are few taxes like stamp duty that is not imposed on sell orders. Along with this Zerodha brokerage on penny stocks is also the same as discussed above.

Use the above information and calculator to determine actual trading fees in Zerodha.

Willing to invest in the share market? Get in touch with us and we will assist you in finding the right broker and in opening a demat account online for FREE!

More on Zerodha