Auto Square Off Charges

Are you a beginner trader and is unaware of the penalties and fees charged by the broker? If that is the case with you then here is the complete information of auto square off charges charged by different brokers.

Wondering what are these charges?

For that, it is important to dive into the detail and learn about how much auto-square charges are charged by each broker.

What is Auto Square Off Charges?

Intraday trading involves buying and selling stocks within a day.

But does it mean you can square off your position by 3:30 PM (the time at which the market closes)?

And what if you forget to square off the trade before time?

Let’s answer all these questions one by one.

First, you have to square off your position on or before the square-off time, the time provided by your broker to close all your open position in day trade.

Second, in case you forget to square off the position, you will be charged with the extra fees called auto-square off charges, because in that case, the broker square off the trade on your behalf and therefore imposes the penalty fees.

Now how it will impact profit in trade?

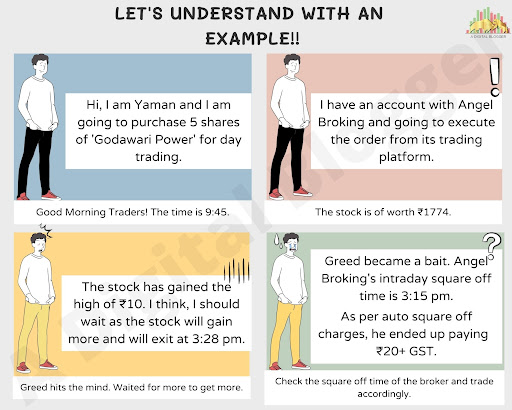

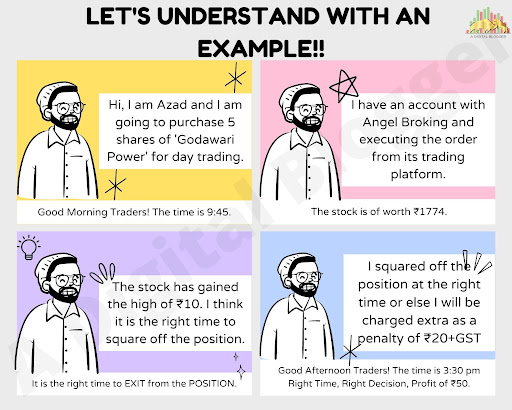

For this let’s take an example.

Suppose you are a beginner and did a small intraday trade with an expectation of earning a profit of at least ₹1000.

The brokerage charged by your broker is ₹20 on each side thus the net profit would be around ₹960.

But somehow, unaware of the square-off time, you forget to close your position and thus charged a penalty or auto-square off charges equal to ₹20.

Although the amount seems to be small but as a beginner this affects your overall profit percentage.

On the other side, if your analysis goes wrong and instead of profit, you suffered a loss of let say ₹500 than along with the brokerage you would end up paying an additional fee of ₹20 thus increasing the overall loss.

Thus, it is important for you to know the square off time and charges to avoid any kind of losses in your trade.

Auto Square Off Charges in Zerodha

It is time to discuss Zerodha, the best discount broker in India, that allows traders to trade efficiently in various segments and with different stock exchanges.

The square off time of Zerodha is 3:20 pm in the equity cash, 3:25 pm in equity derivatives, 4:45 pm in currency derivatives, and 25 minutes before the market closes in commodities.

To know more about the auto square off charges in detail of Zerodha, then refer to the following table.

| Zerodha Auto Square Off Charges | |

| Auto Square Off Charges | ₹50 per order |

If Zerodha itself squares off the trade, the trader is required to pay the amount of ₹50 along with 18% GST.

Auto Square Off Charges in Groww

Here comes the newbie in the share market. Groww recently came into the game of the share market and joined the competition against many stockbrokers.

The beginners refer to the Groww to start trading and gain some experience over the same. Hence, for auto squaring off the trades, gather the information of the fee that is to be paid to the broker as a penalty.

| Groww Auto Square Off Charges | |

| Auto Square Off (call & trade) | ₹50 per order |

For auto square off the trades with call and trade facility, Groww penalty charges will be ₹50 per position.

Kotak Securities Auto Square Off Charges

Let’s check the information over the bank-based stockbroker if you have decided to trade with it. A trader can easily trade in both the stock exchanges, be it NSE or BSE. Also, one can go with various segments according to suitable preferences.

Now, let’s dive into the following table to know more about the square-off charges of Kotak Securities.

| Kotak Securities Auto Square Off Charges | |

| Auto Square Off (call & trade) | ₹20 per order |

For auto squaring off the trade with the call and trade facility, a trader will have to pay ₹20 per order if Trade Free plan is selected by the trader at the time of opening a demat account.

Auto Square Off Charges in Angel Broking

From the above examples, it might be get cleared that the broker charges the auto square off charges on the facility of call and trade.

From being a full-service stockbroker, Angel Broking has become the first stockbroker under the hybrid broker’s category.

Apart from this, the broker allows the traders to trade with various stock exchanges including NSE and BSE. Furthermore, it allows the traders to tarde undr various segments.

To know more about the auto square off charges in Angel Broking, for that, dive into the following table.

| Angel Broking Auto Square Off Charges | |

| Auto Square Off (call & trade) | ₹20 per order |

For auto squaring off the trades, a trader has to pay ₹20 pus GST. It is also important to note that the intraday square off time of Angel Broking is 3:15 pm.

Auto Square Off Charges in Upstox

Like Zerodha, Upstox is also a discount broker that allows the traders to trade in various stock exchanges and segments. To know how much the broker will charge of auto square off the trades, for that dive into the following table.

Moreover, the trader will have to exit the position at 3:15 pm, and after that, the broker will charge extra as an auto square off fee.

| Upstox Auto Square Off Charges | |

| Auto Square Off (call & trade) | ₹20 per order |

The trader will have to pay ₹20 excluding GST if the auto square off is done with the call and trade facility of the broker.

5paisa Auto Square Off Charges

Following Zerodha and Upstox, here comes another stockbroker, i.e. 5paisa. 5paisa also allows the traders to trade with various stock exchanges like NSE, BSE, and MCX, and along with that, the broker can trade under different segments offered by the broker.

If the broker does not square off the position till 3:20 pm, the broker will automatically square off the trade and will charge extra for that as listed in the following table.

| 5paisa Auto Square Off Charges | |

| Auto Square Off (call & trade) | ₹20+18% GST |

For the auto square off trades, the traders will have to pay ₹20 per order f the trade is not exited till 3:20 pm.

How to Avoid Auto Square Off Charges?

Auto square off charges, as discussed is an additional fees that might increase your loss or minimize the profit percentage. It is therefore important to keep an eye on the clock to avoid this fees.

The fees is discussed above, and as you can see that every broker comes up with its own charges. So what is the best way to avoid paying this fees?

Well! checking with the time of the intraday square off time of the broker with which you have a demat account.

The timing detail of the intraday square off time is provided in the section below.

Intraday Square Off Time

Keep the pen ready, and a paper of the notepad opened. Now, it is important to note down the intraday square off time of various stockbrokers.

Gather the information and record the timings in mind to trade accordingly. For that, dive into the following table.

| Intraday Trading Square Off Time | |

| Zerodha Square off Time | 3:20 P.M. |

| Motilal Oswal Square off Time | 3 P.M. |

| Upstox Square off Time | 3:15 P.M. |

| Angel Broking Square off Time | 3:15 P.M. |

| Stoxkart Square off Time | 3:20 P.M. |

Conclusion

In all the intraday square off charges varies according to the broker but at the same time

Get an assistance in choosing the broker with the minimum brokerage and other fees and open a demat account online for FREE!

More on Intraday Trading