BTST Charges In Zerodha

Charges

BTST trade in Zerodha gives traders an opportunity to hold the stock overnight without taking actual delivery of shares. Simply learn how to do BTST in Zerodha Kite and reap the benefit of short-term trade. But wait what are BTST charges in Zerodha?

Before going ahead let’s tell you more about the BTST trade. BTST stands for Buy Today Sell Tomorrow and is a form of trade in which investors can sell the shares even before they are credited in their Demat account.

Let’s know how much Zerodha charges on BTST trades.

What is BTST Charges in Zerodha?

Here let’s recall the Zerodha brokerage. The broker charges a flat ₹20 per trade for intraday trading while Zerodha delivery charges are zero. But what are the BTST charges, as you are neither doing an intraday nor taking delivery of shares?

Well! in this case too, the broker does not impose any fees on the trader thus allowing them to trade for FREE!

Here is the detail of Zerodha charges for BTST:

When executing the sell order in BTST trade, Zerodha sell charges remain zero.

However, one must consider the shortfall of delivery in the BTST trade. If that arises, then to complete the trade, the exchange auction of shares for which you have to pay Zerodha penalty charges which are around 20% of the sell value.

Zerodha Brokerage Calculator BTST

Although, the broker does not impose any fees for trading but there are other charges which remain hidden until you have a look at the final trade settlement receipt.

These charges include Stamp charges levied by states, GST charges of course go to the Government of India, Transaction charges to NSE/BSE, and STT charges in Zerodha also to the government of India. You can check brokerage charges in Zerodha along with these taxes in Console.

Also, you can gain an understanding of the fees and taxes in the table below:

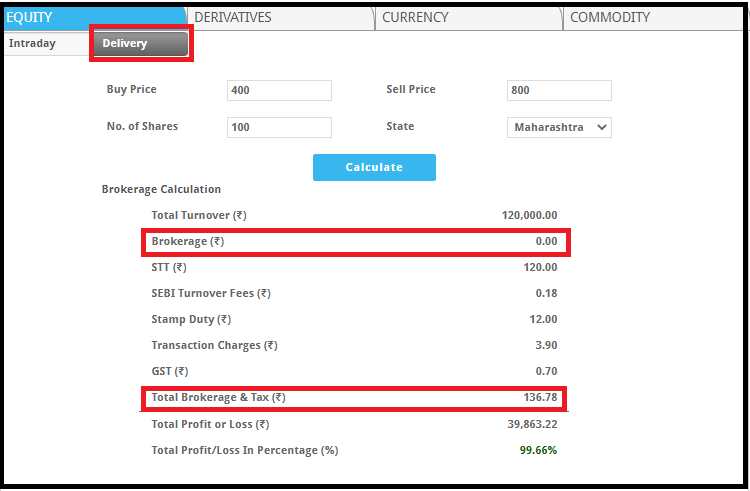

Calculating these charges manually is not easy so you can use the online calculator to calculate brokerage and other charges on BTST trade.

You have to basic values like buying and selling price, and quantity of shares and you will get total profit or loss at the bottom of the calculator as is shown in the below screenshot.

Conclusion

Zerodha is one of a few discount brokers who facilitate BTST trading with no brokerage at all. If you opt to make a BTST trade with Zerodha you should have a complete list of charges you need to pay using its trading platform.

Also, if you use call and trade facility to place BTST facility then you need to pay additional call and trade charges in Zerodha equal to ₹50 per order.

Here it is important to go for the BTST order only if you are sure about the position as there is a BTST penalty in Zerodha for not squaring off your position at the right time.

Willing to begin your investment journey in the stock market. Get in touch with us now and we will assist you in choosing a right stockbroker and in opening a demat account online for FREE!