Call and Trade Charges in Zerodha

Charges

Have you faced a situation where you want to take a certain position or exit the one but the Zerodha app not working or your internet connection is poor? If yes, then you can use the call and trade facility. But to use that service it is essential to know Call and Trade charges in Zerodha.

So, let’s dive in to understand the charges for call and trade.

What is Call and Trade Charges in Zerodha?

If you are not able to use the Zerodha Kite due to some technical issue or want to modify your order after placement then you can simply reap the benefit of the call and trade facility by calling at 080 4718 1888 from your registered mobile number.

Now, using this facility you can trade and place multiple orders but here you need to pay some additional charges as well. Also, these charges are applicable when you do not square off your position and Zerodha auto square off your MIS position.

Call and trade charges in Zerodha are ₹50 plus GST per order.

Now to understand these charges in detail let’s take an example.

Let’s suppose you want to place the following trades using the call and trade facility:

- Buy 1000 shares of ABC company at ₹50 each

- Buy 10 lots of XYZ company for an options trade.

Here,

No. of Trades= 2

No. of Order= 1

Here total call and trade charges are charged per order and hence you pay ₹50 plus GST (₹59) for this order. Apart from this, you need to pay the respective Zerodha brokerage for placing intraday and options trading on trade execution.

Calculating these charges;

Turnover of Intraday trade= 100*50

=₹5000

Zerodha intraday charges= 0.03%*50000

= ₹15

Total Brokerage Charges= ₹(59+15+20)

=₹94

Why Call and Trade Charges in Zerodha?

Since on availing of this service, the broker is taking the responsibility to square off the position or to place multiple trades mentioned in the order on your behalf, for which the trader has to pay the fees.

You can place multiple trades in a single order and place multiple orders in a single day using this facility.

But yes, for every new order you need to pay additional charges as discussed above.

How to Avoid Call and Trade Charges in Zerodha?

Now if you do not want to spend extra money on your trade, then you can use the Zerodha Kite app and web platform. In case, your app is not working, then try switching your internet connection.

In case you have placed an intraday trade position using the app, then check the Zerodha square off time and make sure to close all the open intraday positions on time to avoid these charges.

Zerodha Call and Trade Charges Calculator

As discussed in the example above, call and trade charges are charged in addition to the brokerage charges. So, here to get a better idea of the exact Zerodha charges for your order, it is important to calculate the commission and other taxes and add call and trade fees to it.

So, apart from the brokerage, there are STT charges in Zerodha, GST, and stamp duty that one must consider. To get a clear understanding of this, you can use the Zerodha brokerage calculator.

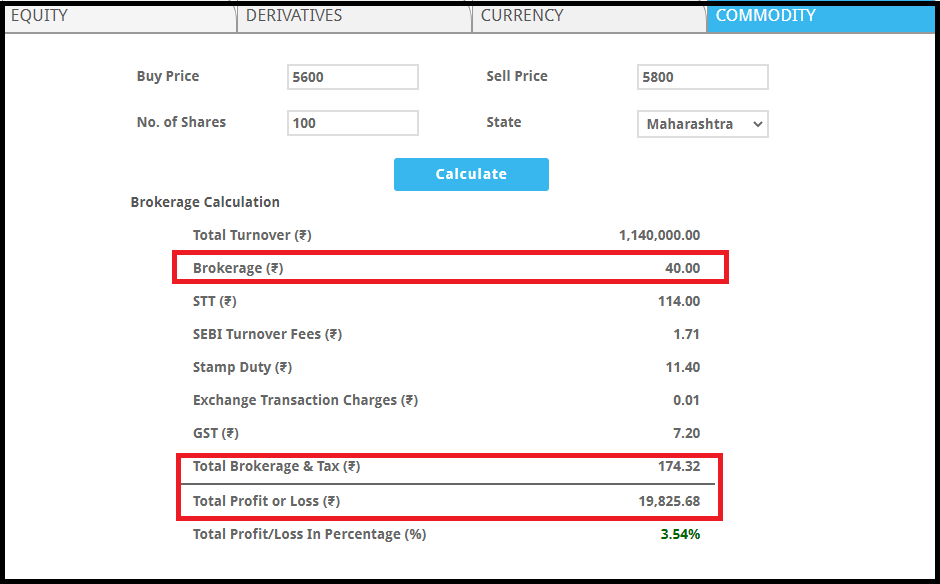

To use it, you need to fill buy price, sell price, quantity, and state and click on Calculate.

The calculator calculates the brokerage and profit or loss percentage as well.

Conclusion

Along with many other trading and brokerage services, the broker offers call and trade facilities as well. However, like any other service, there is additional call and trade charges in Zerodha, which is quite high in comparison to other stock brokers in the industry.

In case, you are looking for a renowned stock broker to begin your investment journey then fill in the details in the form below and we will assist you in choosing the right broker and in opening a demat account online for FREE!

More on Zerodha