JM Financial Charges

Charges

JM Financial, a full-service broker present in the Indian stock market since 1973, is serving traders and investors with utmost dedication. The client base of JM Financial is increasing day by day and if you too want to open a Demat account with this stockbroker then here is the detailed information about JM Financial Charges.

JM Financial Charges List

Now once you register yourself with the stockbroker, you can easily begin your trading and investment journey. Here on opening a demat account, the broker provides you the trading app from which you can buy and sell shares you like.

Apart from this, the broker provides you the service of pledging shares that allows you to trade more even with the limited funds in your account. In all there are multiple services offered by the stockbroker. For all these services the broker charges a fee in the form of account opening, account maintenance, brokerage, transaction, etc.

Here is the list of charges charged by JM Financial.

- Demat Account Opening Charges

- AMC for demat account

- Brokerage Charges

- Transaction Charges

- Hidden Charges

Let’s know about them one by one.

JM Financial Demat Account Charges

You can open a Demat account with JM Financial online and for that, you have to follow simple steps. But does demat account have charges?

Well! There are a few charges associated with the demat account services like:

- Account Opening Charges

- AMC Charges

JM Financial Demat Account Opening Charges

Now the demat account opens a gateway for investing and trading in the stock market. To make it simple and easily accessible to its clients, JM Financial does not charge any fees.

But there are additional charges like dematerialization and dematerialization charges, pledge charges which you have to pay which you have to pay post opening a demat account and only if you avail any of those services.

JM Financial AMC Charges

AMC charges or account maintenance charges are levied on services provided by a stockbroker and you have to pay irrespective of whether you do trade actively or not.

But here is the catch. For the first year, you have to pay nothing as AMC while opening an account with JM Financial. However, you have to pay ₹650 from the second year onwards as AMC charges.

JM Financial Brokerage

Once you start trading and investing with JM Finacial you have to pay a certain fee to do trading or investing in various segments like equity, commodity, and currency. This fee is called brokerage.

Below is a detailed review of brokerage charges in different stock trading segments.

JM Financial Equity Charges

With JM Financial you can do equity trading in various segments like intraday, delivery, futures and options for which you have to pay the following brokerage charges.

JM Financial Commodity Charges

JM Financial allows you to do commodity trading in futures as well as in option for which brokerage charges are listed in the following table.

JM Financial Currency Charges

Along with commodity, you can trade in four different currencies as well. Here is the brokerage fees associated with the currency trade.

JM Financial Transaction Charges

Transaction charges are levied by a stock exchange on a stockbroker on both sides of order i.e while buying and selling stock and stockbrokers pass this charge on their clients.

The transaction tax includes a fee charged as STT( Security Transaction Tax) by stock exchanges (NSE/BSE) and the debt transaction cost on debt of shares from the Demat account, also known as DP charges.

Here is the list of JM Financial transaction charges.

JM Financial DP Charges

Along with the exchange transaction charges, there are debit transaction charges that are imposed by depositories on the sell transaction.

In simple terms, this fee is charged every time you sell shares held in your demat account. These charges are not disclosed in the contract note which is why many investor remain unaware of this fee. These charges are imposed per scrip whenever shares are debited from your Demat account.

JM Financial Brokerage Calculator

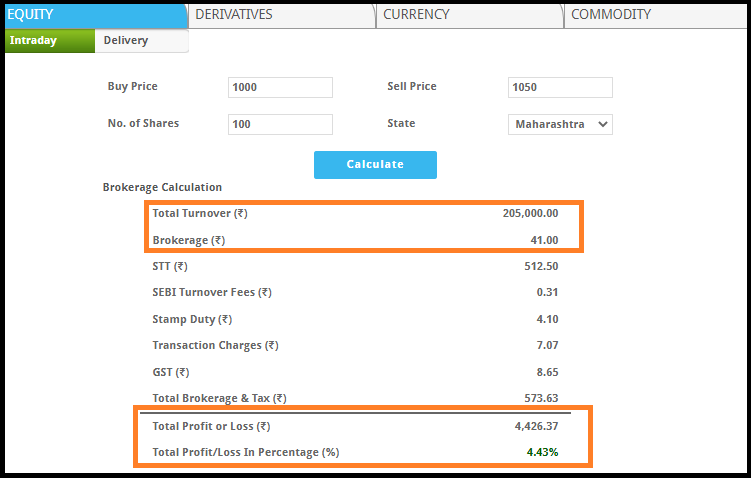

Now apart from the JM Financial charges discussed above, there are some additional fees and taxes that need to be paid every time you trade.

Every trader or investor must be aware of these charges as they are charged on the basis of turnover value and impact the profit or loss percentage of the trader.

These charges include STT (Security Transaction tax) which goes to the coffers of the central government, SEBI charges, Stamp charges etc. These are summed up in the below table for your ease of understanding.

To make the calculation of these charges simple and easy, here is the digital brokerage calculator that gives you clear information about the brokerage as well as the profit or loss percentage in the trade.

Conclusion

While executing a trade most traders and investors just consider brokerage charges in their calculation but there are some taxes and other hidden fees associated with the trade.

While opening a Demat account, JM Financial provides much-needed relief by forgoing the account opening fees and AMC charges for the first year.

We have given you a list of complete charges of JM Finacial and after going through this you can take a final decision whether to choose this broker or any other whose charges you consider are on the lower side.

Willing to invest in the stock market? Begin now! Get in touch with us and we will assist you in choosing the right stockbroker and in opening a demat account online for FREE