Zerodha Charges

Charges

Zerodha is the first broker who introduced the discount brokerage model in the stock market industry. The broker not only provides relaxation in brokerage fees but also in other fees charged for additional services. Here is the complete detail of Zerodha charges for different products and services.

Zerodha Demat Account Charges

To begin trading services using the Zerodha Kite platform, one needs to open a demat account with the broker.

Now there are different charges associated with the demat account. Some of these charges are charged one time while others are charged only when you avail of specific services.

Here we have discussed two charges in detail:

Zerodha Account Opening Charges

As the name suggests, it is the fees charged for opening or activating the demat account charges.

Now there are many stockbrokers that open a demat account for free, but when it comes to Zerodha, it charges ₹200 for opening an equity account and an additional ₹100 for a commodity account.

Here is the detail of the demat account opening charges in Zerodha.

Zerodha AMC Charges

Other than account opening charges there are the maintenance fees that are charged to ensure the security of holdings in the demat account. Here the broker charges it quarterly or yearly the detail of which is given in the table below:

Zerodha Brokerage Charges

Once you open a demat account, you can use it to trade across different segments. For every executed trade, the broker charges a maximum fee of ₹20. So, unlike full-service stock brokers where a commission is charged on the basis of the trade value, here flat fees are charged.

Further, if place CNC order then no brokerage is imposed on the trade.

Here is the detail and explanation of brokerage fees for the different segments and product types.

Zerodha Delivery Charges

Zerodha equity charges for delivery trading are Zero which allows you to trade freely in any equity share that you want to hold for more than one day. This is the feature that makes this broker different from the rest in the beginning.

Zerodha Intraday Charges

Now every intraday trader wants to earn maximum profit by taking multiple trade positions but when it comes to brokerage it reduces their profit percentage. But with Zerodha, you can now focus on making a maximum profit as the broker charges minimum brokerage fees.

Here is the detail.

To understand this, let’s take an example.

Suppose you bought 500 shares of ABC company at ₹100 each for intraday trade and later sold it at ₹110 each. Here let’s check the buying and selling value to calculate the brokerage fees.

Buy Value= 500*100

=₹50000

Brokerage=0.03%*50000

=₹15

Sell Value= 500*110

=₹55000

Brokerage= 0.03%*55000

=₹16.50

Here the brokerage calculated on the basis of turnover value is less than ₹20 hence the trader needs to pay the fees as per the calculation. However, if the brokerage on the trade value is more than 20 then the maximum ₹20 is charged for intraday.

Zerodha Options Charges

You can buy and sell equity shares in the derivatives market as well. Here you need to activate the segment using Kite app. Post that you can trade in as many lots as you want to at the flat brokerage fees of ₹20 per trade.

Zerodha Futures Charges

Similar to options you can also trade in the futures market. Here the brokerage charge is similar to that of intraday. So, if you trade in less volume than Zerodha charges you the brokerage less than ₹20.

Zerodha Commodity Brokerage

If you open a Zerodha commodity account, then you are allowed to trade in different commodities as well. Commodities are only traded in the futures and options market and hence the brokerage is charged accordingly.

For either of the product, Zerodha charges you 0.03% or ₹20 per trade.

Zerodha Currency Brokerage

Also, you can trade in four different global currencies using the Zerodha Kite app. Similarly to commodity, the trade is done in the derivatives market and the commission charged per trade is as follow:

BTST Charges in Zerodha

BTST, Buy Today Sell Tomorrow, allows you to hold your position overnight but does not involve the delivery of shares in the demat account. But still, the brokerage is charged as per the delivery brokerage charges in Zerodha.

This means you do not have to pay any brokerage for BTST trade using Zerodha Kite.

STT Charges in Zerodha

Apart from all the charges and brokerage fees discussed above, there are a few taxes and transaction charges charged by the broker. One such tax is Security Transaction Tax which is charged on equity and commodity segment.

Also, unlike brokerage, these charges are charged on the turnover value.

The detail of these charges for different segments is given in the table below.

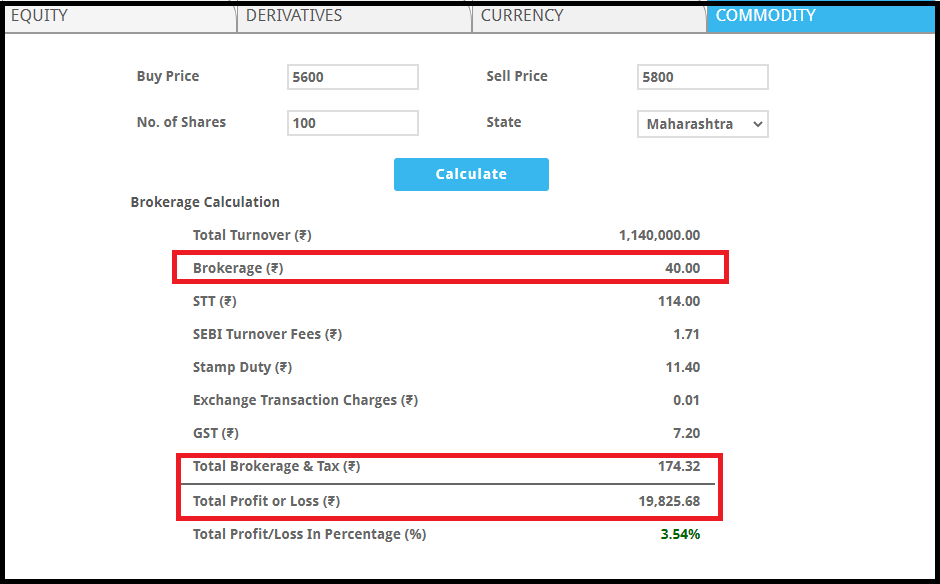

Zerodha Brokerage Calculator

We discussed different trading fees in Zerodha. Here when it comes to paying the brokerage then apart from the commission, there is STT as discussed above, and another hidden cost like:

- Transaction Charges

- SEBI Turnover charges

- Stamp Duty charges, and

- GST

To know the complete cost of trade, you can use a brokerage calculator that not only helps you in calculating the brokerage fees but also the profit or loss percentage.

Zerodha Call and Trade Charges

If you are not comfortable or not much aware of using the trading app, then you can reap the benefit of the Zerodha call and trade facility. Here you just need to call and provide detail of the share or trade you want to place along with the quantity.

Once executed you need to pay call and trade charges in addition to the brokerage fees.

Zerodha call and trade charges are as follows:

Zerodha Iceberg Order Charges

Now, whenever you place an order it is sometimes executed at a price that is a little different from the value you entered. For example, you placed an order to buy 1000 shares at ₹500 each, but it gets executed at ₹500.10.

₹0.10 seems to be small but calculating it for 1000 shares would be quite high (1000*0.10) and is equal to ₹100.

This additional cost is called impact cost. To reduce this, you can choose the Zerodha iceberg order where you can break your order into multiple legs and execute at the right value. Here the next order will be executed once the last order is executed.

Here the brokerage is charged as per the trading product. For example, if you have chosen to trade intraday in equity shares, and break the order in 4 legs then the brokerage will be charged 4 times.

Check the table below to understand these charges:

Zerodha Charges for Cancelled Order

Sometimes, we place the trade but the order gets canceled or only partial order gets executed. This could be due to many reasons, like

- There is no seller in the market selling shares at the price we want to buy.

- Low margin in the trading account.

- The validity of the trade gets expired.

Now in any of the above cases, Zerodha does not charge any fees. It means you only need to pay brokerage when the order gets executed.

DP Charges in Zerodha

Now in delivery trading, there are no brokerage fees charged on the trade, but whenever you sell shares held in your demat account, you need to pay debit transaction charges also called DP charges.

Zerodha DP charges are ₹13.50 per scrip per day. If we carry out the Angel One vs Zerodha comparison on this parameter, then Zerodha wins here as it charges less than the former.

Zerodha Penalty Charges

There are certain instances where not following the right rule of trade makes you liable to pay the penalty charges. These charges are generally charged when the margin required for a trade is less.

Here is the detail of the penalty charges on the margin shortfall in Zerodha.

Zerodha Auto Square Off Charges

When doing intraday trading it is mandatory to close all your open position before the square-off time to avoid any penalty. In case, you forget, then Zerodha square off your position and charges you the additional auto square-off fees equal to ₹50 per order plus GST.

Other than this, if there is a margin shortfall Zerodha square off your position and charges the penalty cost.

Zerodha GTT Charges

Good Till Triggered Price is the advanced order type in Zerodha that allows you to buy or sell at your desired price. This order comes with a validity of one year and you can easily place it using the Kite app.

Here the best part is there are no additional charges for using this order type and the brokerage is charged only when the trade is executed.

Zerodha Withdrawal Charges

Now to trade in Zerodha you need to transfer funds to your trading account and later you can transfer your profit to a bank account. Zerodha uses a payment gateway for adding funds for which it charges fees.

But when it comes to withdrawal there are no charges imposed on a trader and one can withdraw up to ₹5 crores.

Zerodha API Charges

Many traders want to build their own smart and algo strategies to execute multiple trades and earn good profits. For this, the broker offers the API Zerodha Kite connect.

Here to subscribe and use the platform for building algo strategies one has to pay ₹2000 per month. Check the detail of charges in the table below.

Conclusion

Even though there is a commission on every trade and other charges associated with its product and services but when compared with other stock brokers, Zerodha services are fees is lowest among all.

Above all, it is known for its quality services as well which makes it one of the best stock brokers in India.

Still confused, about which stock broker you must open an account with? Just fill in the detail below and we will assist you in choosing the right one and in opening a demat account online for FREE!

More on Zerodha