Zerodha GTT Charges

Charges

Zerodha GTT or Good Till Triggered is the order type that allows you to trade at the price entered by you. Such types of orders come with a validity of one year. But what are Zerodha GTT charges?

Does the broker charge you additional money to place a trade using a GTT order?

Let’s have a quick understanding of Zerodha GTT charges in detail.

Zerodha GTT Order Charges

You can easily trade using the GTT order type using the Zerodha Kite app. Now all the traders who want to buy or sell a particular share at the desired price can be placed easily.

Above all the features and benefits, the best part is that there are no additional Zerodha GTT charges.

However, you need to pay the corresponding brokerage charges as per the trading segment and product you choose, when the order gets executed. So, to get the right understanding of how much Zerodha charges for each trade type, here is the detail of brokerage charges.

Zerodha Brokerage

Zerodha charges flat brokerage fees on the basis of trade rather than on the turnover value. Here Zerodha delivery charges for GTT order is 0 and for intraday, the maximum brokerage is ₹20 per trade.

All other charges for different segments is summarized in the table below.

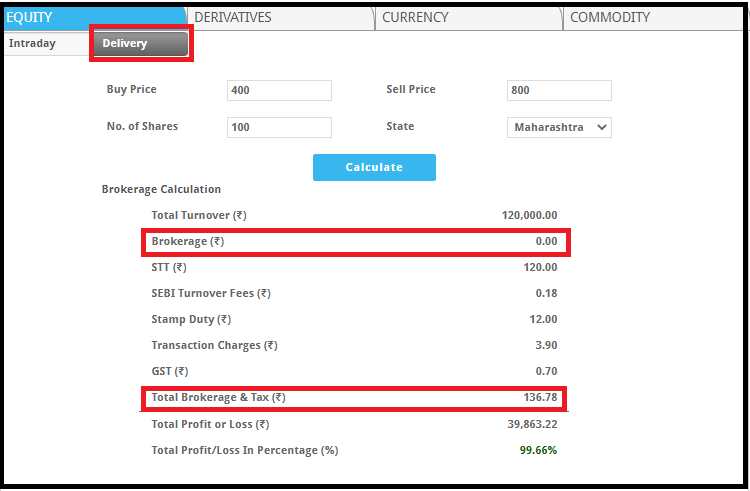

Zerodha Brokerage Calculator

Apart from the brokerage charges, there are other additional fees and taxes associated with the trade like STT charges in Zerodha, GST, turnover fees in SEBI, etc.

All these charges are calculated on the basis of turnover value except GST which is calculated on the basis of brokerage and transaction fees. Now to get an idea of these fees while placing a Zerodha GTT order you can use the brokerage calculator.

The calculator helps you in finding the right brokerage and profit or loss percentage along.

Conclusion

Zerodha GTT charges are NIL. So all you have to consider is the brokerage fees and other taxes to define the volume of trade. Also, these charges will only be applicable when the order gets executed.

In case you are looking for the right stockbroker that suits best for your trading needs, then fill in the details below and we will assist you in choosing the right stockbroker and in opening a demat account online for FREE!

More on Zerodha