Zerodha Intraday Charges

More on Zerodha

Zerodha, India’s topmost discount broker is among the safest and most reliable brokers for intraday trading. So, if you are willing to trade using the Kite platform then let’s have a quick look at Zerodha intraday charges.

In this review, we will be discussing:

- Intraday brokerage charges for various segments.

- Square Off Charges

- Auto Square Off Charges

- DP Charges

- STT Charges

And will understand how you can calculate brokerage fees seamlessly.

Zerodha Intraday Brokerage Charges

Intraday trading involves buying and selling shares in a single trading session. Now, it involves placing a single trade or multiple trades to maximize profit.

But does the brokerage you are paying allow you to increase the profit percentage.

Well for this let’s have quick look at the brokerage fees charged by a broker for different trading segments.

| Zerodha Intraday Brokerage Charges | ||

| Segment | Brokerage Fee | |

| Equity Intraday Charges | 0.03% or ₹20 (whichever is lower) | |

| Equity Futures Intraday Charges | 0.03% or ₹20 (whichever is lower) | |

| Equity Options Intraday Charges | 0.03% or ₹20 (whichever is lower) | |

| Commodity Intraday Charges | 0.03% or ₹20 (whichever is lower) | |

| Currency Intraday Charges | 0.03% or ₹20 (whichever is lower) | |

Now, let’s understand these charges separately.

Zerodha Intraday Equity Charges

Equity trading involves buying and selling of shares listed in the stock market. Here you can trade in a single share or multiple shares. without worrying about the brokerage fees as the broker charges the maximum fee of ₹20 per executed order.

However, apart from Zerodha equity charges, there are some additional taxes and brokerage fees imposed on a trade, the detail of which is given in the table below:

| Zerodha Equity Intraday Brokerage | ||

| Charges | Detail | |

| Equity Intraday Brokerage | 0.03% or Rs. 20/executed order whichever is lower | |

| STT Charges | 0.025% on the sell side | |

| Transaction Charges | NSE: 0.00345% | |

| BSE: 0.00345% | ||

| SEBI Charges | 0.003% or ₹300 / crore on buy side | |

| Stamp Duty Charges | ₹10 / crore | |

| GST | 18% on (brokerage + SEBI charges + transaction charges) | |

Zerodha brokerage charges on penny stocks for intraday trading are also the same as discussed above.

Zerodha Intraday Charges for Options

Next comes the option segments, where you buy or sell in lots. Here to place, intraday options trade the brokerage charges remain the same however there is a difference in taxes across the segments, the detail of which is given in the table below:

| Zerodha Options Intraday Charges | ||||||

| Charges | Equity | Commodity | Currency | |||

| Options Intraday Charges | ₹20 per trade | 0.03% or ₹20 (whichever is lower) | 0.03% or ₹20 (whichever is lower) | |||

| STT Charges | 0.05% on sell side (on premium) | 0.05% on sell side | No STT | |||

| Transaction Charges | 0.053% (on premium) | 0.05% | 0.035% | |||

| SEBI Charges | ₹10 / crore + GST | ₹10 / crore | ₹10 / crore | |||

| Stamp Duty Charges | 0.003% or ₹300 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.0001% or ₹10 / crore on buy side | |||

| GST | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) | |||

Zerodha Intraday Charges for Futures

Similar to options, futures are traded in lots. To calculate the brokerage fees it is important to multiply the buy and sell price by the lot size.

On the basis of the turnover value, the Zerodha futures charges for intraday is 0.03% or ₹20 per trade. Since you are doing intraday trade, hence the maximum fee you end up paying would be ₹40.

However, if your current balance in the Zerodha trading account is negative then the brokerage charged would be double.

| Zerodha Futures Intraday Charges | ||||||

| Charges | Equity | Commodity | Currency | |||

| Futures Intraday Charges | 0.03% or ₹20 (whichever is lower) | |||||

| STT Charges | 0.01% on sell side | 0.01% on sell side | No STT | |||

| Transaction Charges | 0.002% | 0.0026% | 0.0009% | |||

| SEBI Charges | ₹10 / crore + GST | ₹1- ₹10 / crore | ₹10 / crore | |||

| Stamp Duty Charges | 0.002% or ₹200 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.0001% or ₹10 / crore on buy side | |||

| GST | 18% on (brokerage + SEBI charges + transaction charges) | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) | |||

Zerodha MIS Charges

Intraday trading involves buying or selling and then reversing the position (square-off position) by the end of the trading session. Here to reap the leverage benefit you can choose the MIS option while placing the trade.

As per this order type, all your intraday open positions get squared off automatically at the end of the day, if you fail to close it yourself. So, if you have opened a buy position at the beginning of the day, then you have to sell them before the closing hour. But what is Zerodha sell charges that you need to pay to square off your position?

Well, as discussed above, Zerodha intraday charges are on the basis of per trade. Here opening a position will calculate the brokerage on the basis of the total trade value (0.03% of trade value) and similarly squaring off charges are calculated.

However, the maximum fees remain the same i.e. ₹20 per trade.

Here, if the system square of your position, then additional auto square off charges are imposed on your position which is equal to ₹50 per trade plus GST.

So, let’s say if the total intraday brokerage is ₹30 then you need to pay ₹50 additional fees which eventually decrease the profit percentage or increase the loss.

Zerodha Intraday DP Charges

DP charges in Zerodha or debit transaction charges are charged whenever the shares are debited from the demat account. In intraday trade, there is no actual buying or selling of shares.

Here the traders trade and tend to earn profit with the change in the value of shares.

Since there is no credit or debit of shares in intraday trade, hence there are no DP charges.

Zerodha Intraday Charges Example

The charges mentioned above on Zerodha intraday trading are an overall idea of the brokerage charged by the firm on day trades.

However, while trading (be it intraday or any other form of it), a trader has to be very particular about the exact brokerage levied on various segments to make accurate trading decisions and thereby earn profits.

So, let’s consider the different situations to understand Zerodha intraday charges.

Case 1: Suppose Mr. A is an intraday trader. One particular day he executed a trade in XYZ shares and bought 100 shares at ₹200 each and later sold it at ₹210 each.

Let’s calculate the buy and sell trade values:

Buying Value= 100*200

=₹20000

Brokerage= 0.03*20000

=₹6

Selling Value= 100*210

=₹21000

Square off Charges= 0.03*20000

=₹6.2

Total Brokerage= ₹(6+6.2)

=₹12.20.

Case 2: Mr. B traded in the PQR share trading at ₹500. He bought 200 shares and later sold it at ₹550. Let’s calculate the turnover and brokerage fees.

Buying Value= 200*500

=₹100000

Brokerage= 0.03%*100000

=₹30.

Here the maximum brokerage ₹20 will be charged.

Selling Value= 200*550

=₹110000

Square off Charges= 0.03%*110000

=₹33

Again the maximum brokerage ₹20 will be imposed.

Total Brokerage= ₹20+20

=₹40.

In the second case, let’s assume that Mr. B forgot to square off his position on time, hence the broker will charge auto square-off charges i.e. ₹50.

Hence the total charges for the intraday trade would be ₹(40+50) equal to ₹90.

Zerodha Iceberg Order Charges

Now there is an option to trade intraday at the reduced impact cost with Zerodha iceberg order.

This order type breaks your order into multiple legs and reduces the impact cost. Also, there are no additional charges however you need to pay separate brokerage for each leg. So, for example, you place a trade choosing 5-legged iceberg order with the trade value of ₹10000, ₹20000, ₹30000, ₹350000, ₹38000 then the total brokerage would be:

- 0.03%*10000=₹3

- 0.03%*20000=₹6

- 0.03%*30000=₹9

- 0.03%*35000=₹10.50

- 0.03%*38000=₹11.40

Here the Zerodha Brokerage on the basis of the number of legs would be ₹39.90

Still confused, you can check brokerage charges in Zerodha by checking the statement of fees under the Funds Section in the Console.

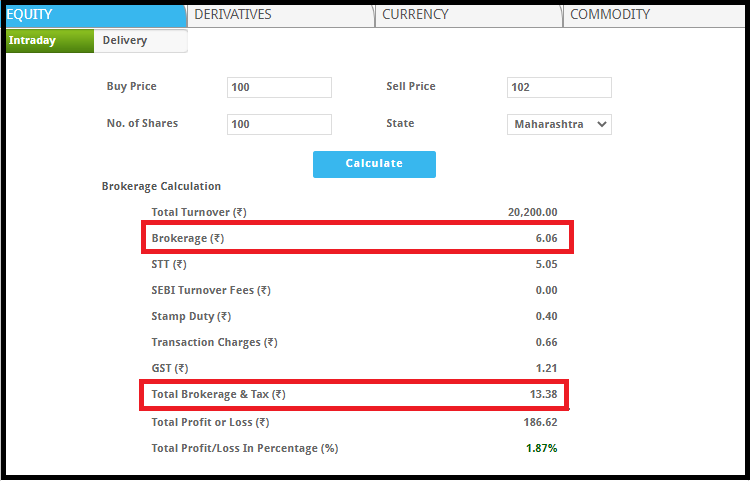

Brokerage Calculator Zerodha Intraday

As discussed above, apart from brokerage there are some taxes and other fees like stt charges in Zerodha are imposed on the overall trade value. This increases the overall commission thus reducing the profit.

No doubt, remembering and calculating each one of the commission percentages is a bit difficult and thus here we are with the seamless solution for you, the Zerodha brokerage calculator.

Here you just need to enter the buy/sell price, quantity, and state to calculate the exact brokerage.

Conclusion

Grabbing awareness of the charges helps you in making the right decision regarding trade.

Hope this detailed article on Zerodha intraday charges helped you. For better decisions check the details of fees and other charges charged by other brokers.

So, research, compare, and make a decision to earn more.

Happy trading!

Willing to open the demat account?

More on Zerodha