How to do Scalping in Forex?

More On Currency Trading

Forex is a financial market where you can buy, sell or exchange currency pairs like EUR/USD. And scalping in forex involves buying and selling the currencies and holding the position for a very short time – usually for 2 minutes, 5 minutes, 15 minutes, or even 20 seconds. That is why today we are doing to discuss about How to do Scalping in Forex?

In scalping, you make small profits from the short-term price fluctuations of a currency pair. That is why much concentration in scalping is needed rather than swing and day trading.

How to do Scalping Trading in Forex?

In scalping, you take very quick ins and outs of positions multiple times in a single day and make small profits. Like when you are into currency trading and you buy any currency you take the entry and when you sell it you exit your position or trade.

Most scalpers close their positions after 1 to 15 PIPS.

You can place many trades throughout the trading day using technical analysis tools and strategies. Using these strategies, a trader develops a set of scalping rules that help to take advantage of forex trading.

You can try the leading strategies that work and what have been proven successful by many traders.

As we know there are a lot of trading strategies in the forex market and it is crucial to identify the best one. To get a better idea of how to make money scalping forex, more precisely, let us go through them one by one.

Currency Pairs With Low Spreads

Scalpers earn small profits on every small change in the price of currency pairs. Such price changes refer to as PIPs, Percentage in point, or price interest point.

Scalping in forex runs on the PIPs concept. It does not offer you massive returns but operates on small 5 to 15 PIP gains.

Therefore, you should try to invest in currency pairs with the lowest price spreads (currency pairs with the small difference between bid and ask price), like EUR/USD. Also, volatility is low and liquidity will be high.

If you invest in large spread currency pairs, it will benefit the brokers to get more margins and to have a significant portion of your payout.

For a practical example let us take a look at the table below.

In the above table, a trader Mr. Y buys EUR/USD by selling US Dollars with normal spreads. Suppose, he or she would buy Euro at 1.2448 and sell it at 1.2460. He or she would make profits of 2 pips in euro.

Investing in currencies with normal/lower spreads provides you fewer profits and therefore fewer risks. So if you want to face fewer losses, invest in currency pairs with low spreads.

However, Mr. Y would make a profit of 20 pips by selling US Dollars with wide spreads. Suppose, he or she would buy euro at 1.2458 and sell it at 1.2468.

He would make profits of 20 pips in euro. The currencies pairs with wide spreads offer more profits and have higher risks.

Now let us consider a trader Mr. Z who wishes to invest in USD/JPY pairs with normal spreads. He or she buys Japanese yen by selling USD/JPY.

He faces a loss of 3 pips in JPY by buying yen at 112.09 and selling it at 112.06. On the other hand, if a trader faces the loss of 9 pips if he or she would buy it at 112.15 and sell it at 112.06.

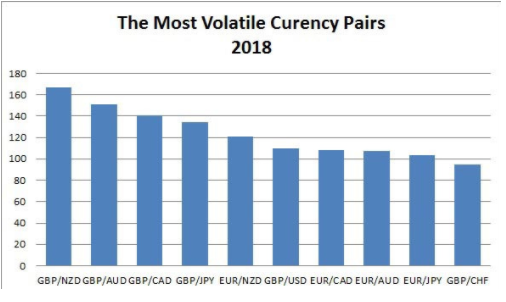

Most Volatile Currency Pairs

Spreads are not the only significant factor to consider for those looking for how to do scalping in forex. There is also another quite effective factor that is volatility.

The volatility of a currency pair represents price movements during a specific period.

The higher the volatility higher the changes in the prices. Lower volatility shows lower changes in the currency pairs’ prices.

Lower volatile currency pairs are not that useful as you have to wait for prices to change.

And, in scalping in currency pairs, you usually trade for 5 or 15-minute, but in the case of low volatile pairs, you might have to wait for an hour or more for the pair to reach your desired price level.

Therefore, you should choose such currency pairs to trade that have high volatility. Some of the currency pairs with high volatility are GBP/NZD, GBP/CAD, and GBP/JPY. You can invest your capital in these pairs.

Dealing Desk Broker

When it comes to trading, a selection of a broker with a good reputation and high level of security is important. However, if anyone is planning to use the scalping technique in forex trading, it becomes even more crucial.

Why? Because, the forex market is most volatile, here the value of currencies keeps on fluctuating every second. A very short miss can result in huge losses.

So here in forex trading, you need to avoid Dealing desk forex brokers, as they aim to earn profits by selling currency pairs at lower prices and selling them at higher prices.

Suppose, you open positions and achieve 10 to 15 pip gains but you cannot close your positions because of Dealing desk forex brokers as they reject to execute your orders. This can be harmful to your trade as you can lose a significant amount of money.

Luckily, there are numerous forex brokers with no dealing desk who provide the investors competitive spreads on currency pairs. You can choose any of them for happy currency trading exchange.

Moving Average

Now moving on to a very useful technical tool i.e. Moving Average while using scalping strategy in currency trading.

Basically, there are two types of moving average; Simple moving average, and Exponential moving average. Some traders find Simple moving average (SMA) effective while for other traders Simple moving average can be a very helpful tool.

Here we have explained the Simple moving average.

Traders look in the direction of moving averages and open positions according to them. Long term trades (1 minute to 15 minutes) might require much more analysis but it will show you some results.

Now let us talk about what this Moving Average is.

Moving Average – The most simple way to use moving average is to determine the trend. Plot a single moving average on the chart. Only then you will understand it.

See !! If the value of currency pairs stay above the moving average, it denotes that the value is in an uptrend. On the other hand, if it goes down the moving average, it shows the price of currency pairs is in a downtrend.

Let us say the value of currency pairs i.e. USD/JPY has been in a downtrend but now it (value) is showing a higher surge. That means the price is now above the moving average.

So what can you do now? It is a quick and appropriate time to buy. You buy a billion units as now you feel confident that USD/JPY will go up. Here below a large green candlestick is showing an uptrend.

Now, what happened? The trend turns out and due to some news traders reacted and prices keep lowering. Now the thing we suggest you do is that you should plot a couple of moving averages on the charts instead of just one.

For example, let us say we have two MAs: the 10-period MA, and the 20-period MA. On your chart, it would look like this.

In the above chart of USD/JPY, the 10 simple moving average is above the 20 SMA throughout the uptrend. It shows it is the right time, where you can open your position and can buy a currency pair.

Hence, with the best EMA for intraday, you can decide whether you should invest in this currency pair or not.

To sum up

Finding brokers and currency pairs with small spreads and choosing the currency pairs with the highest volatility will give you a wide exposure to more trading opportunities while using a scalping strategy in currency trading.

Besides, appropriate usage of simple and exponential moving averages will help you to find suitable entry points for opening and closing positions in the forex market.

Wish to start trading in Stock Market? Refer to the form below