Zerodha Currency Trading

More On Currency Trading

Zerodha Currency Trading is one of the many types of trading the discount broker allows to its clients. For instance, you can perform Zerodha Options Trading, Zerodha Futures Trading, Zerodha Intraday Trading and for that matter, even Zerodha Virtual trading.

Currency markets or forex markets are the largest investment markets in the world with a total turnover of around $2 trillion. Currently, the Indian forex market is the 16th largest in the world with a staggering turnover of $58 billion.

Having a Zerodha Free Demat Account offers you to trade in products like currency, derivatives, mutual funds, and many more.

The currency market is highly regulated in India and one can perform currency trading through a broker that has been registered with the Securities Exchange Board of India (SEBI). Zerodha is one such broker. In this article, let us discuss some of the basics of Zerodha currency trading.

Zerodha Currency Trading Pairs

Currency trading exchange is always done in lots. Zerodha allows trading in 4 currency pairs which are –

- USD – INR

- EUR – INR

- GBP – INR

- JPY – INR

Here are some of the other related details you must be aware of when it comes to Zerodha Currency trading:

- Trading Hours of Currency Market in India – Monday to Friday – 9:00 am to 5:00 pm

- Contract trading cycle – 1-year cycle

- Last Trading Day – Two working days prior to the last working day of the expiry month at 12:15 pm

- Final settlement day – Last working day of the expiry month (This excludes Saturdays).

- Daily Settlement – It occurs as per T + 1

- Final Settlement – It occurs as per T + 2

This needs to be known that Cross Currency Trading is not allowed in India. Cross-currency pairs are those pair of currencies in which either of the currencies involved in not Indian Rupee (INR).

As mentioned above, trading in cross currency pairs is not allowed in our country and therefore Zerodha currency trading cannot be done in cross currency pairs.

Zerodha Currency Trading Account Opening

Currency trading feature is mostly enabled on the existing Zerodha users’ accounts.

This means that if one already has a demat account and trading account with Zerodha and currency trading is enabled with it, one can start forex trading with the broker.

If one does not have an account with Zerodha, on needs to open the combination of demat and trading account first. This would come with the facility of currency trading as well.

The account can be opened online as well as offline the details of which have been covered in another article.

How to Trade Currency in Zerodha?

Trading in currency can be done through futures and options contracts. Zerodha Kite offers a seamless way for traders to trade in different currency pairs in India. However, before you begin trading, check for the Zerodha strike price range for currency trading to avoid any issue later.

Here are the steps need to follow to trade currency:

- Open the Zerodha Kite app and log in using the User Id and Password.

- Now select the currency pair future or options contract.

- Add it to the watchlist and click on Buy or Sell button.

- Now enter the quantity, price, product type, and other advanced trading options available to minimize the loss and to save the cost of trading.

- Swipe to left and Confirm your order.

In case you want to take an early position in any currency trade, you can opt for AMO order in Zerodha that allows you to trade between 3:45 PM to 8:59 AM.

Now in futures currency contracts if the trade does not seems to be beneficial then you can rollover your position.

But when it comes to options where it is only obligated for a seller to settle the trade, the buyer already holds the right to exit without settlement, is there any provision to rollover the position.

Wondering how to carry forward options in Zerodha?

Well! you cannot rollover your option position. The only way is to exit the current position before expiry and take a new position at the same strike price for new expiry.

Zerodha Currency Trading Charges

Zerodha Currency Trading can be done in 2 segments only which are futures and options (calls and options). Different charges apply for both the segments have been discussed below :

Zerodha Currency Trading in Futures

Zerodha Brokerage Charges – The lower of these two: 0.01% or ₹20 for every executed order. For more information, you can check this Zerodha Brokerage calculator for your reference.

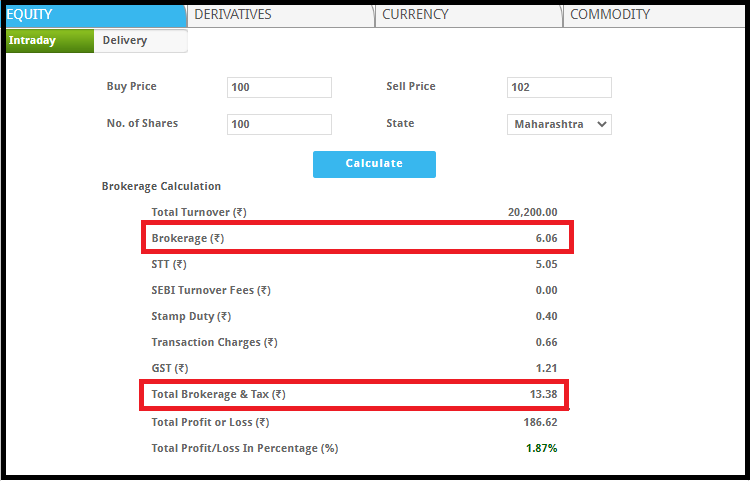

In fact, brokerages and all other charges for Zerodha Currency Trading can be calculated using the brokerage calculator which can be easily accessed at their website.

The details and break up of all the charges are quite transparent and there are no hidden charges involved.

Securities transaction tax (STT) / Commodity Transaction Tax (CTT) – No STT

Transaction Charges –

- Exchange transaction charge for trading currency futures on NSE – 0.0009%

- Exchange transaction charge for trading currency futures on BSE – 0.00022%

GST – 18% on the sum of brokerage and transaction charges

SEBI Charges – ₹10 per crore

Zerodha Currency Trading in Options

Brokerage – The lower of these two: 0.01% or ₹20 for every executed order

Securities transaction tax (STT) / Commodity Transaction Tax (CTT) – No STT

Transaction Charges:

- Exchange transaction charge for trading currency futures on NSE – 0.0007%

- Exchange transaction charge for trading currency futures on BSE – 0.001%

GST – 18% on the sum of brokerage and transaction charges

SEBI Charges – ₹10 per crore

Besides the above-mentioned charges, stamp charges for different states are applicable, the details of which can be seen on the website.

For more information, review Zerodha Options Charges in detail.

Zerodha Currency Trading Leverage

Currency derivatives span margin calculator is available which can give details of the contracts, expiry dates, prices, normal margin and MIS margin. Intraday trades using MIS (Margin Intraday Square Off) product type give additional leverage which is around 50% of NRML margin.

All intraday positions in currency trading must be squared off by 4:30 pm, failing which an auto square off will occur.

Let us take an example to understand how margins can be calculated.

Suppose I want to trade in USD – INR, I would need to type “USDINR” in the margin calculator and the details of margin requirements with respect to different expiry months will appear on the page.

Cover Orders (CO) – Intraday trading in currencies can be done using cover orders where one can place buy/sell market orders.

Cover orders include a compulsory stop loss which makes them a little less risky and therefore, provides higher leverage as compared to an MIS order. Margin requirements are variable on the basis of the stop loss specified.

Bracket Orders (BO) – Intraday trading in currencies can be done using bracket orders where one can place buy/sell limit orders with the specification of a target price and a compulsory stop loss.

There is an option to specify a trailing stop loss too.

Bracket orders also include a compulsory stop loss which makes them a little less risky and therefore, provides higher leverage as compared to an MIS order.

Margin requirements are variable on the basis of the stop loss specified.

All the intraday bracket and cover orders should be squared off before 4:30 pm each day

Zerodha Currency Calculator

Now comes the calculation of the overall brokerage and other fees imposed by the broker to trade in the currency segment.

As discussed above there are taxes and other fees associated with the trading which are a little difficult to evaluate. However, you can make it simpler by using the brokerage calculator.

We provide the calculator tool where the trader just needs to enter the buy and sell price along with the quantity. This helps you in knowing the total brokerage and profit you can make from the trade.

Conclusion

Currency trading is slowly picking up pace in India among retail investors as well. One should trade in currencies only through SEBI registered brokers and only those pairs which are allowed right now.

Cross currency trading is not allowed in India.

Zerodha allows currency trading in 4 pairs and existing demat and trading account holders need not open a separate account for trading in currencies. New customers can easily open a Zerodha demat account and trading account to trade in currencies.

Again, this needs to be understood that before placing an order, Zerodha brokerage calculator and span margin calculator must be checked in order to know about the margin requirements and details of charges going to be incurred on a trade.

One does not need to make an actual trade in order to find the margin requirements and brokerage and other charges. Stay educated, stay invested!

In case you are looking to get started with currency trading or stock market investments in general, let us assist you in taking the next steps ahead.

Just fill in a few basic details to get started:

premrajpk327@gmail.com