HDFC Securities Sign Up

More Demat Registrations

For a smooth trading journey in the share market, it is important to open a demat account with the best stockbroker in India after which execution of the order becomes smoother. HDFC Securities came to the forefront for the customer for a reliable trading experience. For that, it is essential to understand the HDFC Securities sign up process.

If you are confused, there is no need to fret out as in this informative piece, and we will discuss the HDFC Securities Sign up in a detailed version.

What to wait for now? Let’s dive into the following segments to gather the gist of:

- HDFC Securities Sign Up Process

- HDFC Securities Sign Up Documents

- HDFC Securities Sign Up Fee

- HDFC Securities Sign Up Bonus

- HDFC Securities Sign Up Problem

- HDFC Securities Sign Up Advantages and Disadvantages

Now, let’s delve inside the following segments to discuss the same.

HDFC Securities Sign Up Process

To start with the HDFC Securities Sign Up process, the broker allows the applicant to proceed with either of the procedure, i.e., online and offline.

As we know, the online method is taking the eyes of every individual, thus making every service easier.

Therefore, why not let’s start with the online process.

- Visit the website of HDFC Securities to register with the stockbroker or open an account.

- Now, click on ‘Open Trading Account’ for opening a demat and trading account with the broker.

- A new window will appear on the screen. Simply enter the mobile number to proceed further.

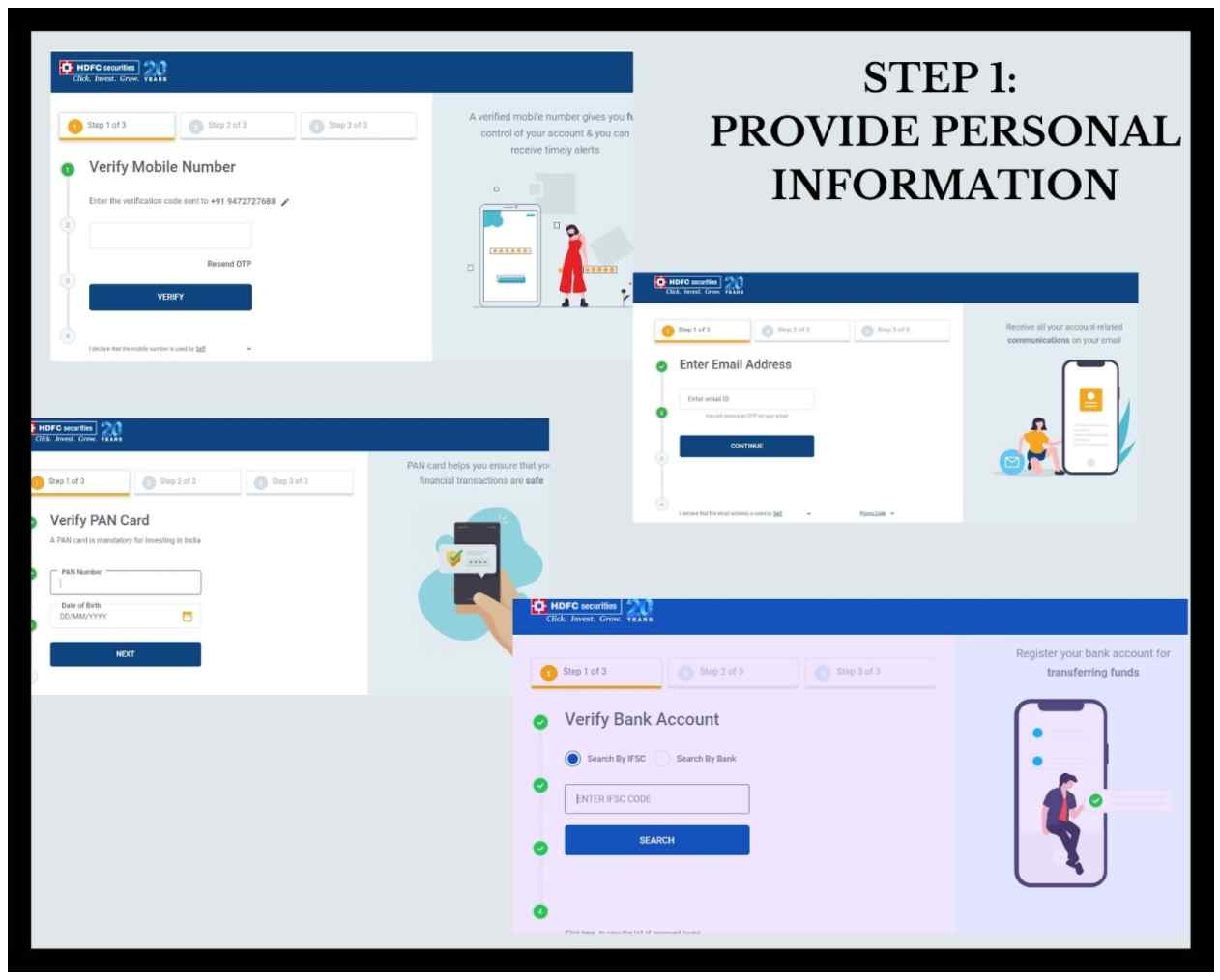

- Start with the procedure by filling in the mobile number, and email id. Further, verify the PAN Card and Bank Account.

- Keep the documents required for opening an account handy.

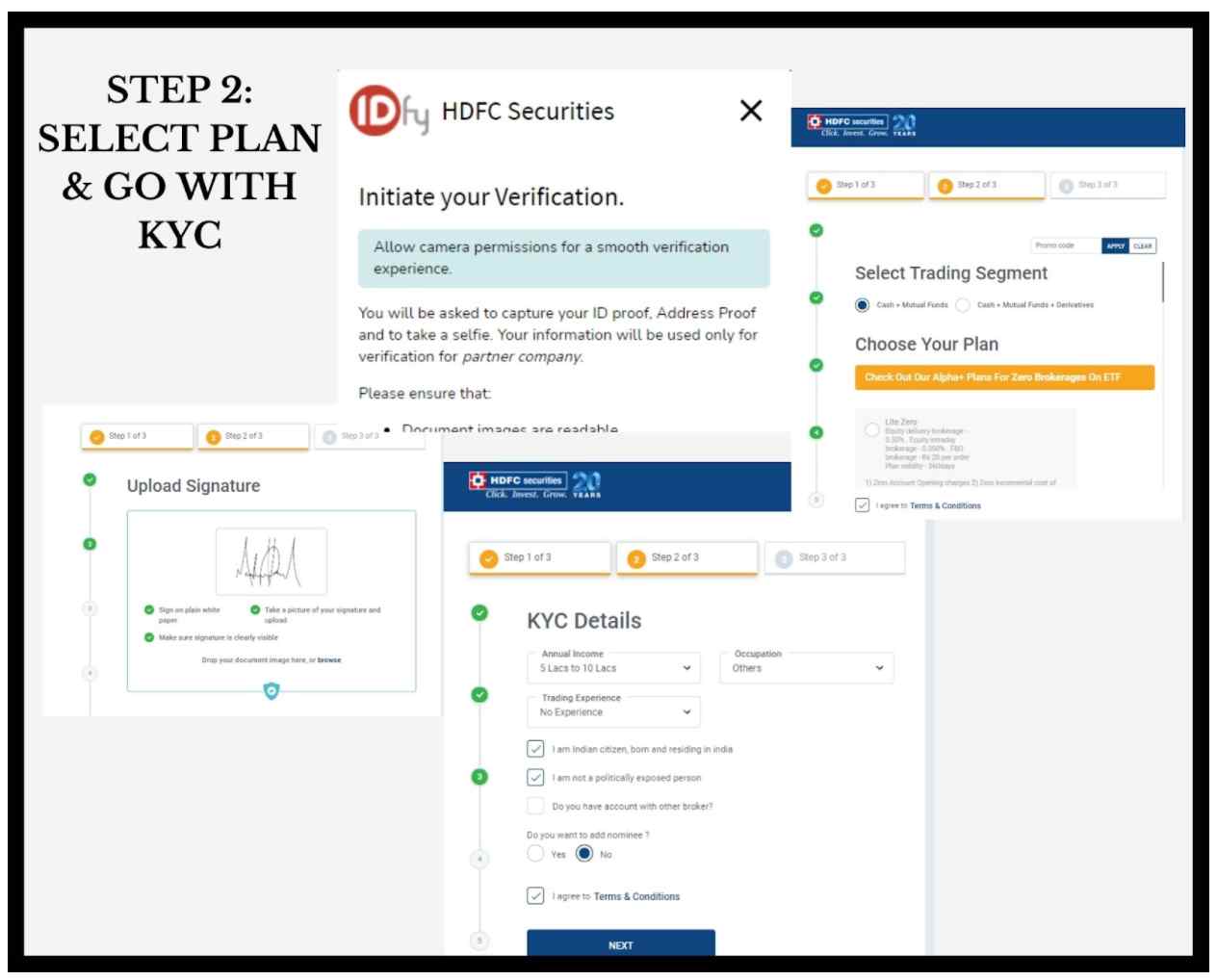

- It is important to upload the scanned copy of the PAN Card during the process. Upload the selfie for KYC Verification along with the procedure of selecting the plan.

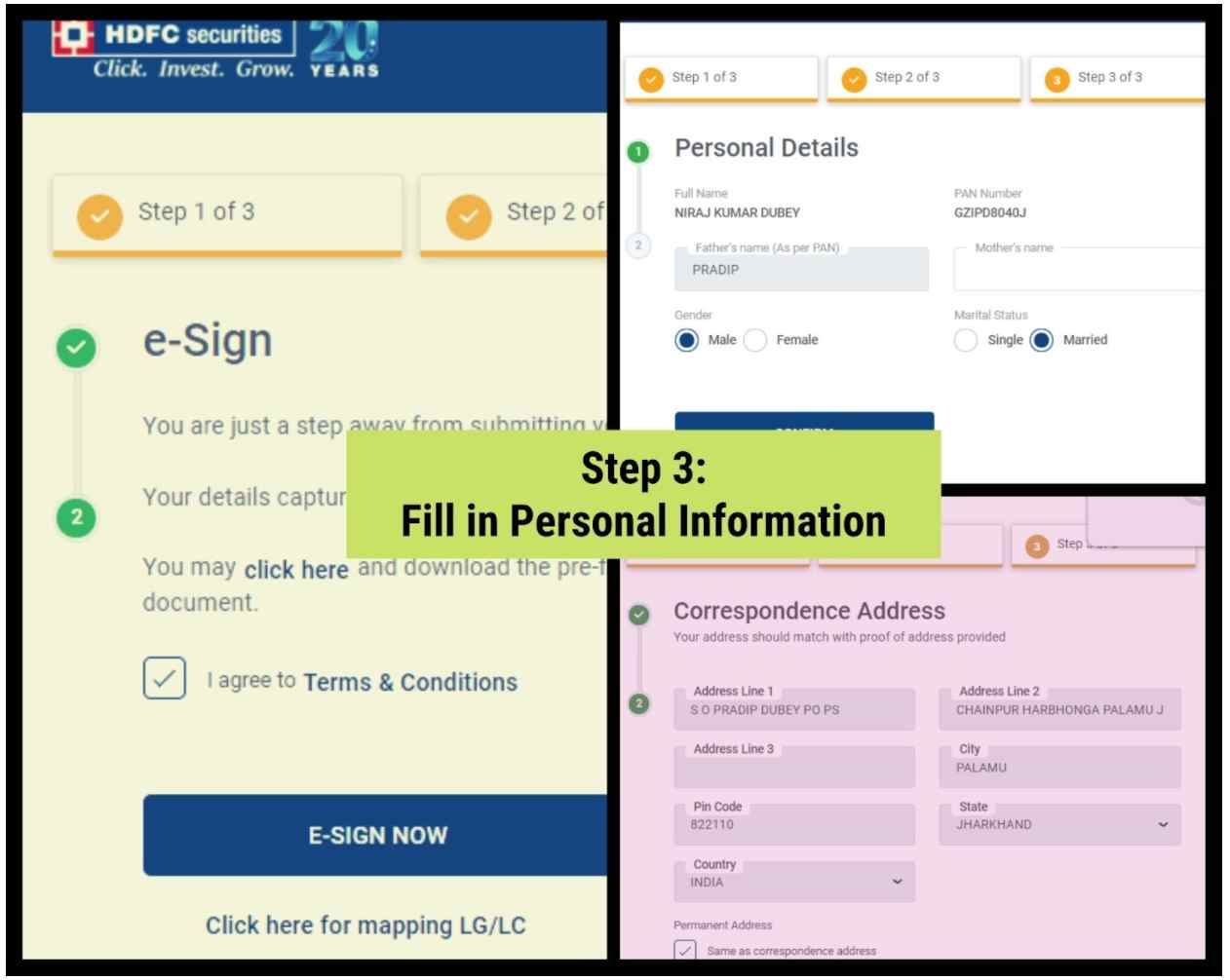

- It is important to mention the personal data in the next step including the address, e-sign verification.

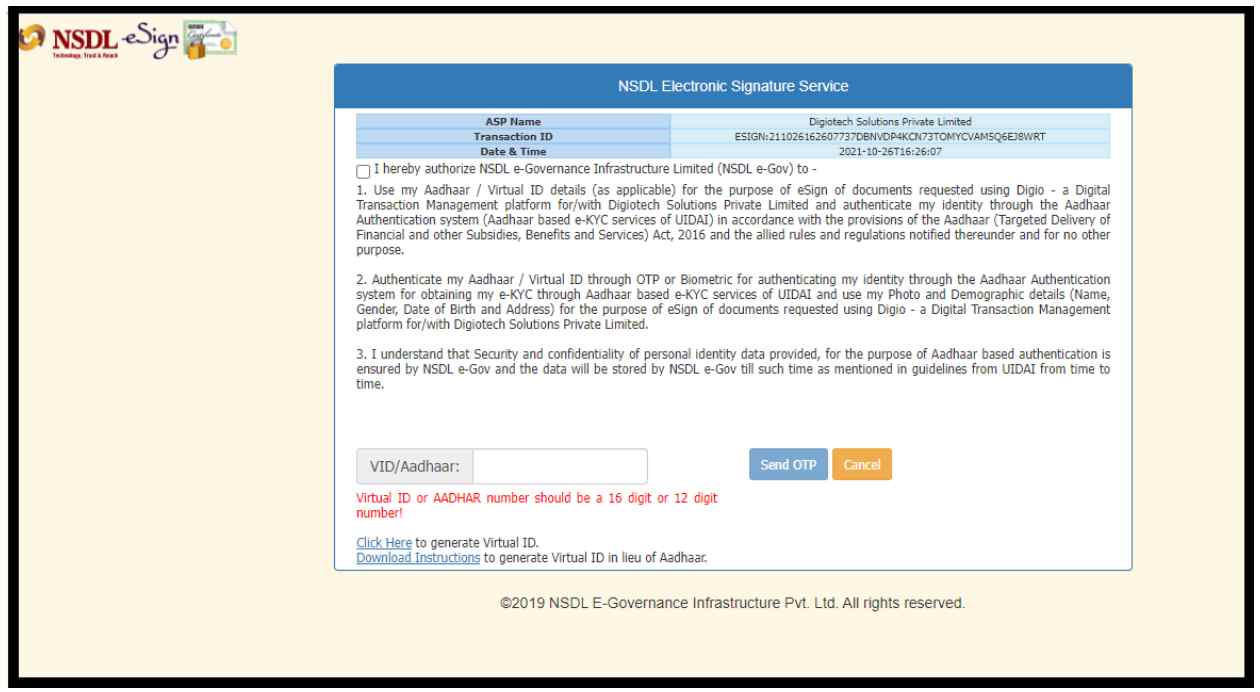

- Mention the Aadhar Card number for NSDL Verification.

- Once the registration is completed by you, the broker will take some more time to verify the documents.

- Once the process is completed, you will receive the registration toolkit, including the username and password.

After the online procedure, let’s shed some light on the offline procedure too. But before that, it is essential to note that the offline procedure is time-consuming. Now let’s check the steps for the offline process.

- By downloading the account opening and KYC form, the applicant is required to fill in the information and attach photocopies of the documents.

- After this, submit the form at the nearest or local office, and likewise, the account will get opened.

Note: The Aadhar Card is important to be linked with the existing mobile number for e-sign verification.

HDFC Securities Sign Up Documents

If the HDFC Securities Sign Up is taken into consideration, then it is also essential to keep an eye on the various documents required for the demat account.

But here, it depends on the different types of customers, including:

- Existing KYC Verified Customers.

- Non-KYC Verified Customers

To know the same in detail, let’s dive into the following segment that discusses the various documents.

Documents Require for Existing KYC Verified Customers

- Bank Proof

- Pass Book photo

- Cancelled Cheque

- Income Proof (Optional)

- Copy of ITR Acknowledgement

- Salary Slip

- Copy of demat account holding

- Copy of annual accounts

- Copy of form 16

- Networth Certificate

- Bank Statement

- Customer’s Signature and

- Photograph

Documents required for Non-KYC Verified Customers

- Address proof (any one of the following documents)

- Passport

- Voter ID

- Driving License

- Bank Proof

- Bank statement first page

- Cancelled cheque

- Income proof (optional/to trade in derivatives)

- Copy of ITR Acknowledgement

- Salary Slip

- Copy of annual accounts

- Copy of demat account holding

- Copy of form 16

- Networth Certificate

- Bank Statement

- Identity Proof

- Adhar Card

- PAN Card

Moreover, it is essential to note that the income proof is required to be submitted if you want to trade in the derivatives segment.

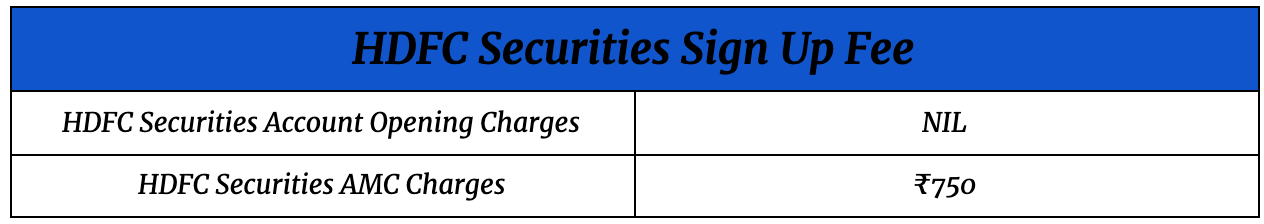

HDFC Securities Sign Up Fee

The most important parameter to check under the HDFC Securities Sign Up is the charges or fees of the same. Therefore, let’s review the following table to grab the information over the HDFC Securities account opening charges and AMC of the HDFC Securities.

For opening an account with the stockbroker, the applicant does not need to pay any fee. Whereas for maintaining the account, it is required to pay ₹750 every year as demat account annual charges.

HDFC Securities Sign Up Bonus

Now, you might be thinking of the route through which you can earn an extra bonus amount with the refer and earn demat account program of the stockbroker.

By referring a friend, the referrer will get a gift voucher of ₹500. The more the referees get included in the list, the more the referrer will earn.

To understand how HDFC Securities refer and earn works, let’s take an example.

Bunty refers his friend, Rishab, to open an HDFC Securities demat account. Whenever Rishab opens the account with the broker, Bunty will get the gift voucher of ₹500.

Along with Rishab, Bunty also referred the broker to Lavi, Mahi, Vishal, and Nikki. So whenever the referees open the account with HDFC Securities, Bunty will get a gift voucher of ₹2500.

Likewise, after being a customer of HDFC Securities, Bunty earned more like a bonus.

HDFC Securities Sign Up Problem

The most confusing and irritating problem arises when the applicant is unable to open the demat account. It can be because the Aadhar Card is not linked with the mobile number.

Hence the main question that arises here is Can I Open demat account without Aadhar card? The answer is Yes, you can.

The procedure is a bit longer than the usual procedure, and it is required to show the ID Proofs in front of the camera to get the verification done.

Other than this condition, other scenarios occur that includes:

- The OTP was not received on the mobile number.

- The name or spellings of the applicant is different on different documents.

- To activate the segments, sometimes the absence of the applicant’s bank statement can be another reason for the HDFC Securities sign-up problem.

HDFC Securities Sign Up Advantages

So what is the next confusion? Why connect with the broker? What are the benefits of opening a demat account with HDFC Securities? Then, why not let’s shed away all the queries by discussing the HDFC Securities sign-up advantages?

If you too want to know about the same, then let’s dive into the following pros of HDFC Securities sign up.

- With the HDFC Securities trading platform, the trader can execute unlimited orders or can trade efficiently.

- The account opening is free and AMC can be lessened down with the subscription plan selected.

- The most advantageous factor of HDFC Securities sign-up is that an applicant can easily open the demat account while being on the phone call.

- Moreover, it offers a 3-in-1 account facility to the customers.

HDFC Securities Sign Up Disadvantages

Apart from the advantages, there are several disadvantages too that need to be checked before selecting the stockbroker for opening an account.

Therefore, here are some cons of HDFC Securities signing up.

- The trading platforms sometimes show glitches and bugs.

- The login issue is the main factor that affects the credibility of the broker.

Conclusion

The trader of HDFC Securities remains curious to know about the HDFC Securities Sign up. If you too want to grab more about it, then let’s grab more about it by going through the various parameters as mentioned above.

Therefore, let’s grab more, by learning more!

And at the same time, if in case, you would like to kick-off your stock market trading journey, here is an easy form for you to fill it up: