Alice Blue Demat Account

More on Demat Account

With so many stockbrokers offering trading and investment services to its customers, Alice Blue is no more the hidden name. Many investors are willing to trade with the broker. So, if you are one among them then here is the complete review of the Alice Blue Demat Account.

But before anything else, it is essential to jot down that Alice Blue is a discount stockbroker and was incorporated in 2006.

After the demat account is opened once, the trader can use the best trading platform in India as Alice Blue app is not restricted to one platform. One can trade smartly using its mobile, web and desktop application mentioned below:

- Ant Web (web portal)

- Ant Mobile (Mobile trading app)

- Ant Desk (desktop app)

- Ant Meta (for analyzing stocks, commodity, and currency)

Isn’t it amazing to get too many options of trade in one of the best trading apps in India?

Why wait for more? Let’s check out the demat account review of Alice Blue in the following segments.

Alice Blue Demat Account Review

The broker offers the 2-in-1 account to the customers and also allows trading in various stock exchanges, including NSE, BSE, MCX, and MSEI. Like all other stockbrokers in India, Alice Blue is also monitored and controlled by SEBI. The broker is a depository participant of CDSL.

When it comes to reaping the benefit of Alice Blue trading, one needs to start from scratch by opening an Alice Blue demat account. The broker again gained much fame by offering a smooth and completely online process to open an account.

In all with Alice Blue offer the following demat account features:

- 2-in-1 account opening facility.

- It offers paperless account opening to clients.

- Easy step-by-step process to activate the account.

- Opening account in less than 15 minutes.

Alice Blue Demat Account Opening

So here we grab the information on Alice Blue demat account and now is the time of how to activate the services, i.e. Alice Blue Demat account opening process.

As a beginner, many investors have no idea of how to open a demat account. Well! if you are facing the same challenge then here we are to smoothen the whole process.

Just fill in the form below and open a demat account for FREE!

In all you can simply apply online, to open an account. Just make sure you keep all the documents handy to avoid the last-minute hassle.

So to get started, let’s shed light on the Alice Blue demat account opening through the online procedure in the following segment.

Alice Blue Online Demat Account Opening

To open a demat account with Alice Blue, one can go directly to the official website of the broker and then can apply from there. For that, refer to the following steps.

- Go to the official website of the broker, i.e., Alice Blue.

- Click on ‘Open an Account,’ and the following window will appear on the screen.

- Fill in the information’s like ‘Full Name,’ ‘email id,’ ‘Mobile number,’ and ‘State,’ and at last, click on ‘Open an Account.’

- Complete the further page by filling in the PAN Card details and date of birth as per the PAN Card.

- Select the segments in which you want to trade-in along with the permanent address.

- The most important step is to link the bank account to the trading account.

- Enter the financial information and then upload the documents required for demat account.

- It is time to upload the PAN Card for In-Person Verification (IPV) process by showing the PAN Card and face together in the camera.

- By verifying the Aadhar Card and Mobile number, ensign the documents.

- After the process is done, the account will be opened or gets activated in 24 hours.

Alice Blue Account Opening Form

After checking the online procedure, if you are not comfortable in opening an account, then there is no need to worry about it, as there is another option for you as Alice Blue demat account can be opened offline too.

To know how the account can be opened with the offline procedure, then let’s dive into the following steps.

- At first, download the KYC form from Alice Blue’s official website and take a printout of the same.

- Fill in the form by putting in the details.

- Attach the documents that are required for opening a demat account.

- Send the hard copy of the form to the corporate office address of Alice Blue after signing the KYC form.

It is important to note that the online procedure for opening an account is easier as compared to the offline mode as it is less time-consuming.

After all the procedure is completed, the account will get activated within 24-72 hours. The TAT, i.e., Turn Around Time, is:

- For NSE or BSE cash, it will take 72 hours.

- For NSE F&O and Currency, it will take 24 hours.

- Opening an account with MCX, will take 24 hours.

After the KYC verification is successful, at that time, the timings mentioned above are adequate.

To smoothen the offline opening of the demat account for FREE, fill in the basic details in the form below

Documents Required for Alice Blue Account Opening

For taking admission to the college, a student is needed to submit the documents of class 10th and 12th, like that only; for only an account, the brokers ask for the documents that help in the verification of an individual.

As mentioned in the above segment, there are some documents required for demat account that are to be submitted for opening a demat account. Those documents are as follows:

| Alice Blue Demat Account Documents | |

| Address Proof | Voter ID |

| Passport | |

| Valid Driving License | |

| Banker’s Certificate on letterhead of the Bank | |

| Electricity Bill | |

| Bank Statement/ Passbook | |

| Unique Identification Number | |

| Identity Proof | Aadhar Card |

| PAN Card | |

| Passport | |

| Voter Card | |

| Scanned photograph | |

| Income Proof | ITR Acknowledgement Slip |

| Account Statement (last 6 months) | |

| Demat Account Holding Statement |

Note: It is important to submit these documents in both the procedures, be it online or offline.

Alice Blue Demat Account Charges

After looking at the account opening procedure and documents required for Alice Blue demat account, it is time to check the account charges.

But before that, it is also important to pen down that the trading account is usually get opened with the demat account. Therefore, an applicant is not required to revisit the broker for the activation of the trading account.

But at the same time, it is also important to note that the charges include two different types of fees that have to be kept in mind before connecting to a stockbroker. Therefore, let’s shed light on the charges included in the account opening procedure. Those are listed below:

- Account Opening Charges

- Account Maintenance Charges (AMC)

Hence, let’s start with the charges in detail with the following segments.

Alice Blue Account Opening Charges

As we have discussed the charges above, then why not start with the Alice Blue demat account opening charges first. Being a discount broker it offers a benefit to its customer right from the beginning by providing them demat account for free.

| Alice Blue Demat Account Opening Charges | |

| Account Opening Fees | Nil |

From the table mentioned above, it is easier to derive that Alice Blue opens the free demat account to the applicants. If the demat and trading account is taken into consideration, at that time, it can be seen that the broker does not charge a penny for the same.

Alice Blue AMC Charges

Apart from the account opening charges, another type of fee that is to be checked is the Account Maintenance Charges. The AMC is a type of fee that is to be paid by the trader or investor every year for maintaining the account.

To know more about the AMC in detail, check the following table for reference.

| Alice Blue Demat Account AMC Charges | |

| AMC Charges | ₹400 |

Furthermore, the additional charges of Alice Blue are listed in the following table.From the above table, it can be checked that the demat account AMC is ₹400 in which the broker charges ₹33.30 per month as an AMC. Whereas, for the trading account, the broker does not charge any AMC.

Alice Blue Demat Account Login

After opening a demat account with a broker, if you are ready to start trading, it is essential to login into Alice Blue’s trading platform.

For that, the broker will send the login credentials like client id and password on email. Just use the credentials to login into the platforms.

After visiting the platform, a trader can easily change the password. The same credentials can be used in the app, software, and on the website too.

After login into the app, go for the technical as well as fundamental analysis of the stocks. Now, start trading efficiently with Alice Blue.

Alice Blue Demat Account Number

The demat account number is also known as the BO ID or Client ID. Basically, the demat account number carries a unique 16 digit account number.

Here, the first 8 digits present the demat account number of the client and also known as the DP Id, whereas the last 8 digits are dais to be a unique customer Id.

Apart from this, the demat account number in CDSL varies from the NSDL. in case the broker is registered with CDSL, the demat account number represents 16 numeric digits.

If the broker is registered with NSDL, the demat account number will carry 2 alphabetical characters, i.e., IN at the beginning, and the rest 14 will be the numeric digits.

As Alice Blue is registered with the CDSL, so the demat account number will be in 16 numeric digits.

So here if the Demat account number is 1234567809876543, then here the first 8 digit i.e. 12345678 is the DP ID while the last 8 digit; 09876543 is the BO ID or client id.

You can easily find this number in your trading app once your account is opened with the firm.

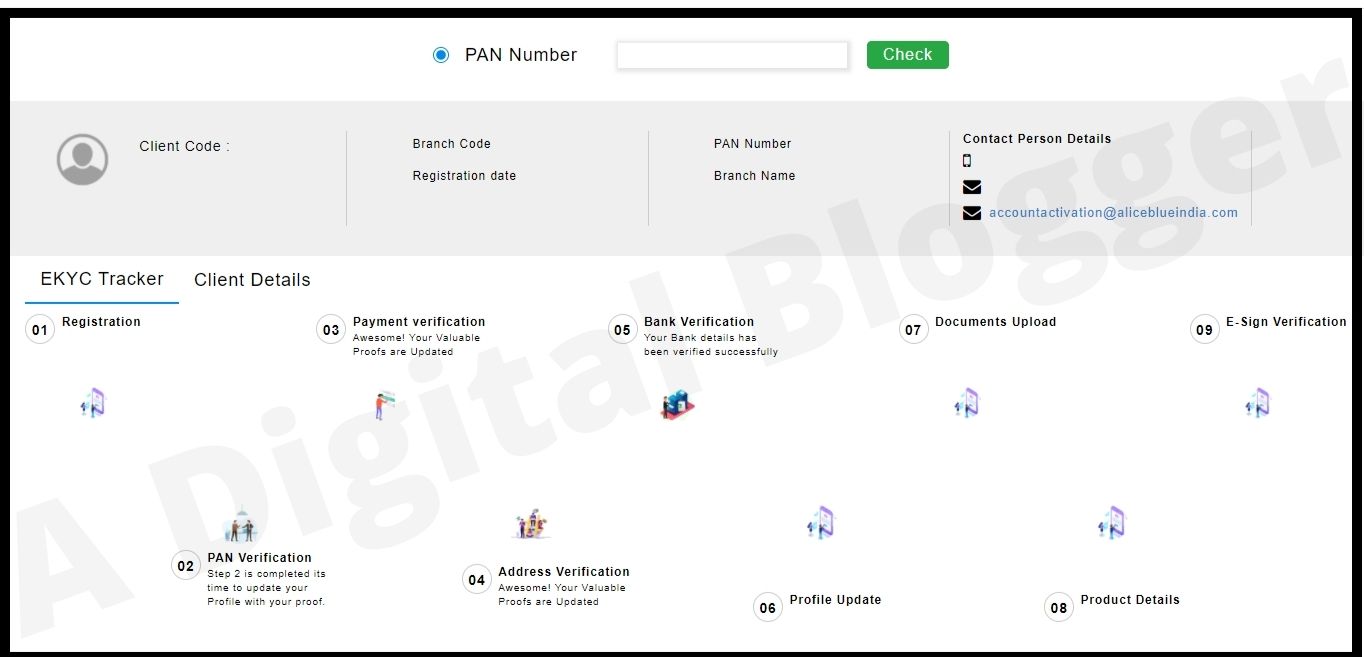

Alice Blue Demat Account Status

After receiving the application for opening the demat account and once the process is done by the applicant, the demat account gets opened within 2 hours.

Still, if the account is opened in the timeframe, at that time, the applicant can check the status of the demat account.

To check whether the account is opened or not, or to know the status of the account opening, at that point, an applicant can quickly check it to get acknowledged.

Therefore, to get the Alice Blue demat account status, you can click here.

To check the status update all you have to do is to enter the PAN Card number and verify by entering the OTP sent to the mobile number. The status will be displayed on the screen.

Alice Blue Demat Account Refer and Earn

Alice Blue offers a two-sided referral program where the referrer and the referee both get the benefits.

For referring each friend or acquaintance to open an account with Alice Blue, you will get ₹500 plus 10% cashback on the brokerage for 30 days.

To understand in a more precise way, check the following situations:

- If the referrer refers one friend, he will get ₹500 plus 30 days 10% brokerage cashback.

- If the referrer refers two friends, he will get ₹1000 plus 60 days 10% brokerage cashback.

- If the referrer refers three friends, he will get ₹1500 plus 90 days 10% brokerage cashback.

Apart from this, a referrer also gets a 10% lifelong commission on the brokerage from the referee. Furthermore, it is essential to note down the terms and conditions of referring and earn program of Alice Blue.

Want to get an instant award on refer and earn demat account, here we are with the instant cashback offer. Just fill in the details of the referral in the form below and get cashback directly in your bank account on account opening.

Alice Blue Demat Account Benefits

After covering all the details, let’s now check some of the advantages of beginning your trade with the broker.

- Provides a fluent trading platform to invest or trade.

- Offers guidance over the issues related to the trade.

- Providing services in pan India and multilingual support is also available.

- Alice Blue brokerage is the least among other discount brokers.

- The broker offers the Alice Blue Brokerage Plans with the name FREEDOM 15 that help traders to maximize the profit per trade.

- Other than this, Alice Blue DP charges are also minimal.

- Availability of the single margin account for all the segments in both NSE and MCX.

- Offers the cover, bracket, and AMO orders on trading platforms.

- There are no Alice Blue algo trading charges.

- The customer support team is available till 11:55 pm.

- Offers personalized service and supports.

- A trader can pledge the equity shares and also can trade in commodities.

- Offers the algo trading in both mobile and desktop platforms.

- Least brokerage of ₹15 per trade.

Alice Blue Demat Account Disadvantages

Every coin has two sides and here along with the advantages there comes the disadvantages of Alice Blue. to know more about the cons of same, refer to the following information.

- For 6 months, if no activity is found, the broker will automatically shutdowns the account of the client.

- The mobile app is not upgraded on a daily basis which is why it causes problems while trading.

- Since the broker is not in much fame and thus when it comes to reliability one need to think twice before utilizing its services.

Final Clinching

If you want to connect with a discount broker like Akshay, then Alice Blue can be a perfect option because of the services offered by it.

You can refer a friend to open a demat account with the broker and can get exciting rewards. If the charges have to be taken into consideration, then also it is essential to note that the broker does not charge a penny for opening an account, whereas the AMC is ₹400 to maintain the account.

Plan your investment with the renowned stockbroker. Open a demat account now for FREE and reap benefit of trading.

More on Alice Blue

Video Review

Video Review