Angel Broking Account Types

More on Demat Account

Do you want to open a Demat account with Angel Broking but don’t know which one? If yes, then you’ve reached the answer. Read along for a clear understanding of the various Angel Broking account types.

Angel Broking is a famous full-service broker that extends the facility to trade in the share market with the help of a Demat account and trading account. It is a SEBI registered company with membership from multiple exchanges.

The Angel Broking account types are as follows:

- Demat Account

- Trading Account

- 3 In 1 Account

- Corporate Account

- Joint Account

- Minor Account

1. Angel Broking Demat Account

A Demat account is what stores your securities (mutual funds, equity, commodity, currency, ETFs, etc.) in one place. When you keep your holdings in the digital form, they are known as dematerialized.

Angel Broking offers you 4 types of Demat accounts:

- Regular Demat Account – Used by traders residing in India.

- Repatriable Demat Account – It is useful for NRIs as it helps transfer money abroad. It has to be linked to an NRE bank account.

- Non-Repatriable Demat Account – This one is for NRIs too but here, the funds can’t be transferred abroad. Also, you have to link your NRO bank account with the trading account.

- Basic Services Demat Account (BSDA) – Special account for investors having a portfolio worth of less than ₹2,00,000.

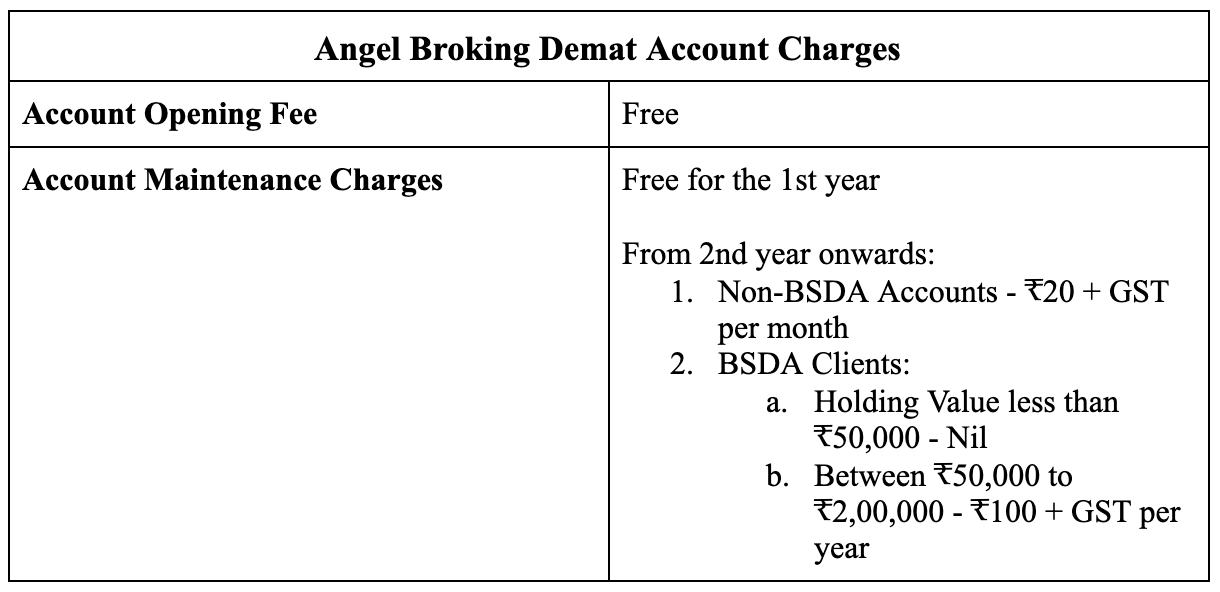

Angel Broking Demat Account Charges

You can open an account online or offline. There are various Demat account charges associated with it.

The account opening fee for the first one of the Angel Broking account types is Zero. This charge varies from broker to broker. The account maintenance charges are free for the first year and post that, you have to pay according to the account type.

2. Angel Broking Trading Account

A trading account is like the bank account of the share market. It has all the funds for trading and investing. Further, the various charges levied on the trades are deducted from your trading account. It is one of the many on the list of Angel Broking account types.

Angel Broking is one of those brokers that offer a 2 in 1 account to its clients, by default. When you fill the form for opening a Demat account, you get a trading account opened too.

Although for intraday traders, a Demat account is not necessary, and thus they have the option to open only a trading account with the depository participant.

With the Angel Broking trading account, you must ideally know how to do option trading with Angel Broking as well, so that you can trade across different segments, if and when required.

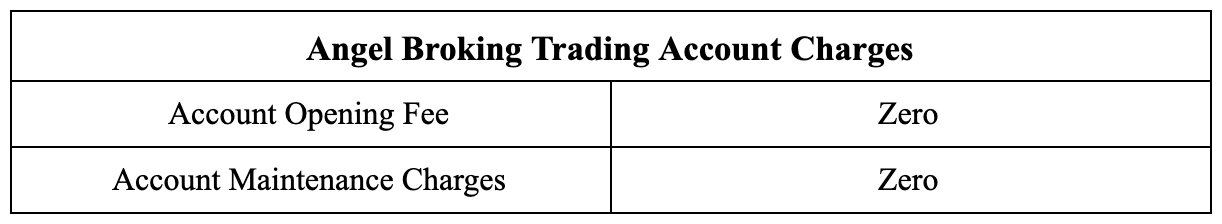

In the situation when you open the 2 in 1 account, you pay no extra charges but in the case of opening only a Demat account, the charges are as follows:

3. Angel Broking 3 In 1 Account

This full-service broker doesn’t extend the facility of a 3 in 1 account. Generally, the broker ties up with a bank to offer a fully inclusive and integrated account package – a Demat account, a trading account, and a bank account.

The user experience in the case of this 3 in 1 account is a little enhanced as the bank account is actively linked to your trading account.

Angel Broking, however, does not offer a 3 in 1 account opening facility but you can link your existing saving account with your trading account while opening an account with the broker online

4. Angel Broking Joint Account

An individual chooses to open a joint account only in two scenarios:

- They have a joint account with another broker and want to transfer it to Angel Broking.

- The individual wants to own securities jointly with a family member or a closed one.

In these situations, you follow the same process of filling the form with the details of all the joint holders. Since the online method does not support this, we have to carry it out by the offline method.

So, print the form, fill it, attach all the KYC (Know Your Client) documents and submit it at the nearest Angel Broking branch or you can visit the branch and open the account under their guidance.

5. Angel Broking Minor Demat Account

The next one on the list of Angel Broking account types is the minor account.

There are times when the natural or legal guardians want to open a Demat account for their minor child, i.e., an individual below the age of 18 years.

The account opening process and charges are the same, all that is required to submit some additional documents required for a minor demat account.

This is generally used for the off-market transfer of shares as this account is not eligible for trading. You can only send shares into this account and the trading is permitted after the minor turns major.

Here, the KYC process is completed for both the minor account holder and the guardian (legal or court-appointed). Once the child is an adult, the KYC is to be completed again and the account holder has to confirm his holdings.

The account opening and maintenance charges are just the same for this account as well. So, these were all the Angel Broking account types.

Conclusion

Angel Broking is a popular broker in the stockbroking industry. It offers you to open an account that will facilitate trading in the stock market. There are various types of accounts that can be opened with a broker.

They vary according to the age of the account holder, if it is for an individual or a corporate entity, for multiple people, etc.

The most basic ones are trading and Demat accounts. Their features may vary according to the type of account you open. They have been discussed briefly above.

The charges for opening or maintaining the account are the same for this broker through the categories.

We hope that all your queries regarding the topic – Angel Broking Account Types have been resolved. In case of any other queries, feel free to reach out to us!