Angel One KYC Update Online

More on Demat Account

Are you thinking of starting your investment or trading journey with Angel One? If so, you need to open Angel One demat account. And for this, it is mandatory for you to complete Angel One KYC update online for your demat account.

Are you clueless about it? Don’t worry! We have got your covered. Here, we have mentioned the validation requirements for this stockbroker to ensure the authenticity of customers.

How to Complete KYC Process for Demat Account on Angel One?

Now to complete the KYC process for demat account you need to collect some of the important documents listed below:

- PAN Card

- Aadhaar Card

- Bank Account Statement

You need to upload these documents in your Digilocker account. Later, it will allow you to fetch these from there when required. Now, let’s discuss the step-by-step procedure!

The prerequisite for Angel One KYC update online process is linking of Aadhaar Card, Mobile Number and PAN Card. If you have already done it, you are good to go!

Follow this step-by-step process to complete the online KYC process for demat account on Angel One:

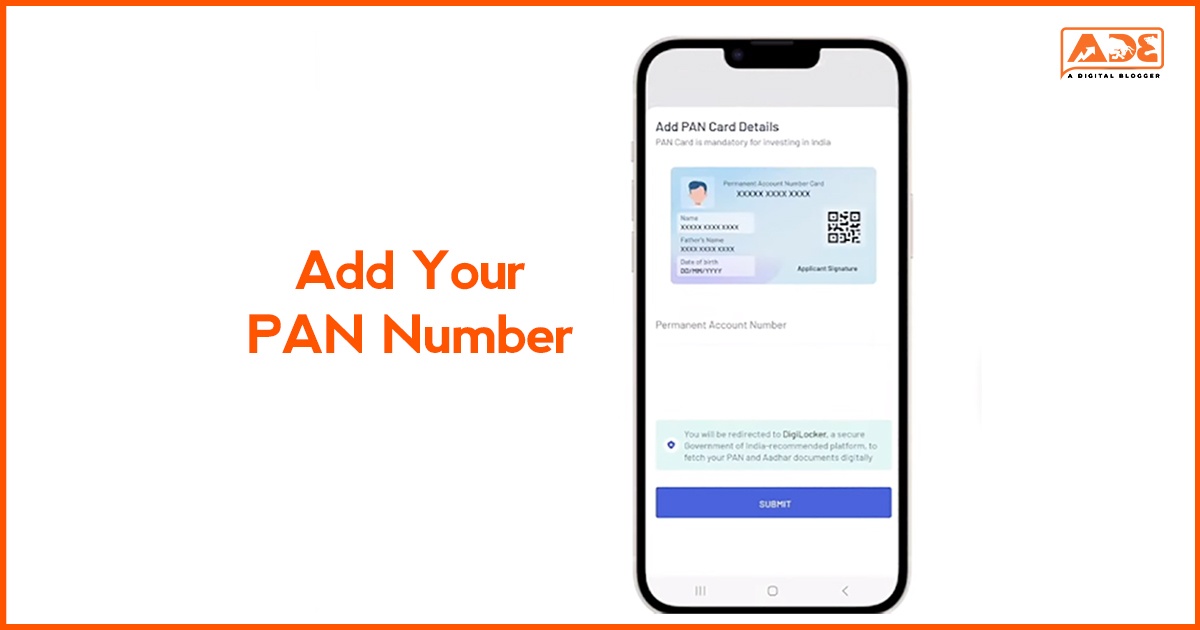

Step – 1: Enter Your PAN Number for Verification

PAN is mandatory for updating KYC online on Angel One. And you can either choose to upload your PAN Card or enter the PAN manually in the window that appears on your screen.

Once you have entered your PAN, give authorization to Angel One for fetching your KYC details.

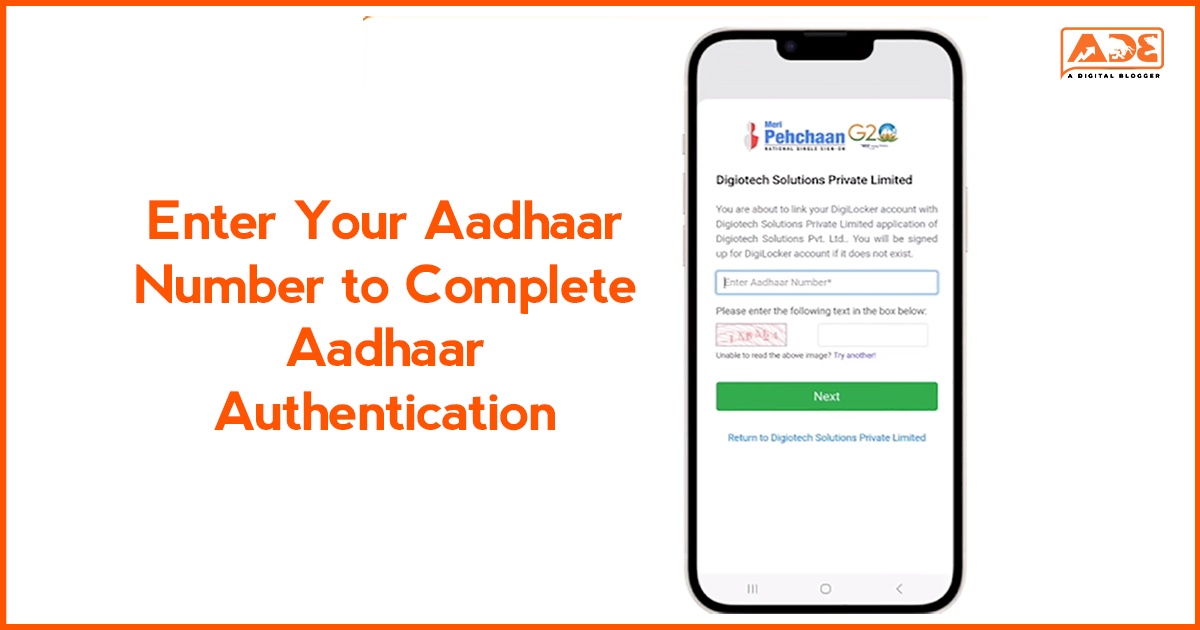

Step 2: Complete Aadhaar Authentication

Similar to PAN, you are required to authenticate your Aadhaar Card. For this, you need to enter your Aadhaar Number and enter the Captcha on your mobile screen.

Once you are done with step 2, you will receive an OTP on your registered mobile Number linked with Aadhaar. And you need to fill this in the OTP field appearing on your mobile phone.

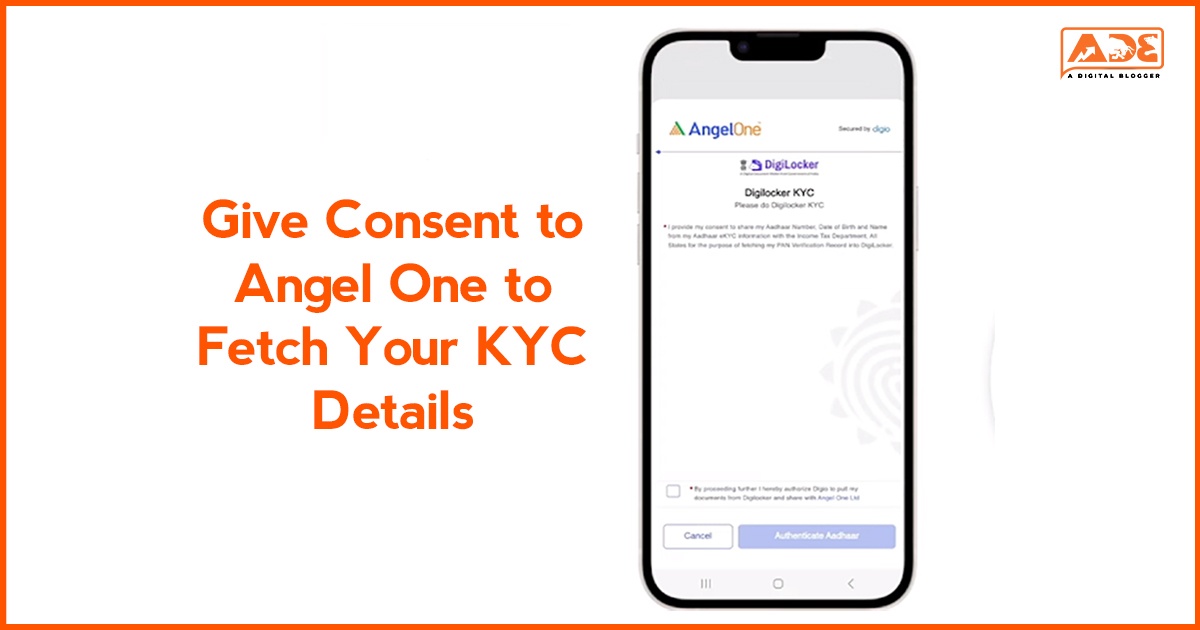

Step 3: Give Consent to Fetch Documents from Digilocker

The next step in the Angel One KYC update online process is entering the 6-digit Digilocker pin.

What it will do is help in fetching documents from your Digilocker account to get your details.

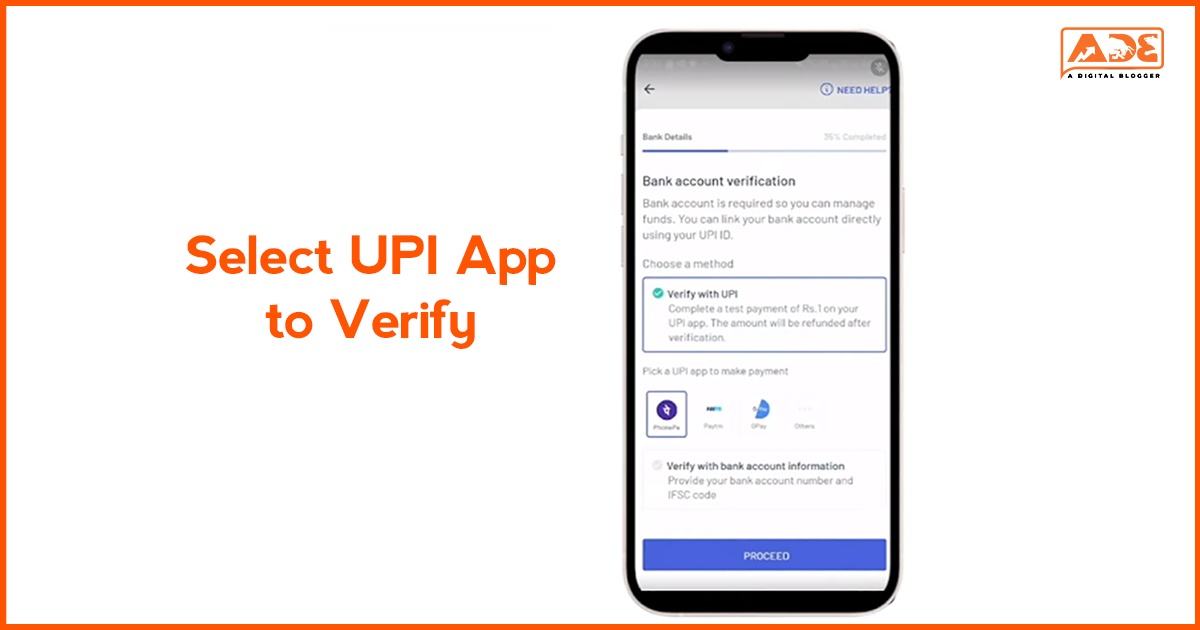

Step 4: Bank Account Verification

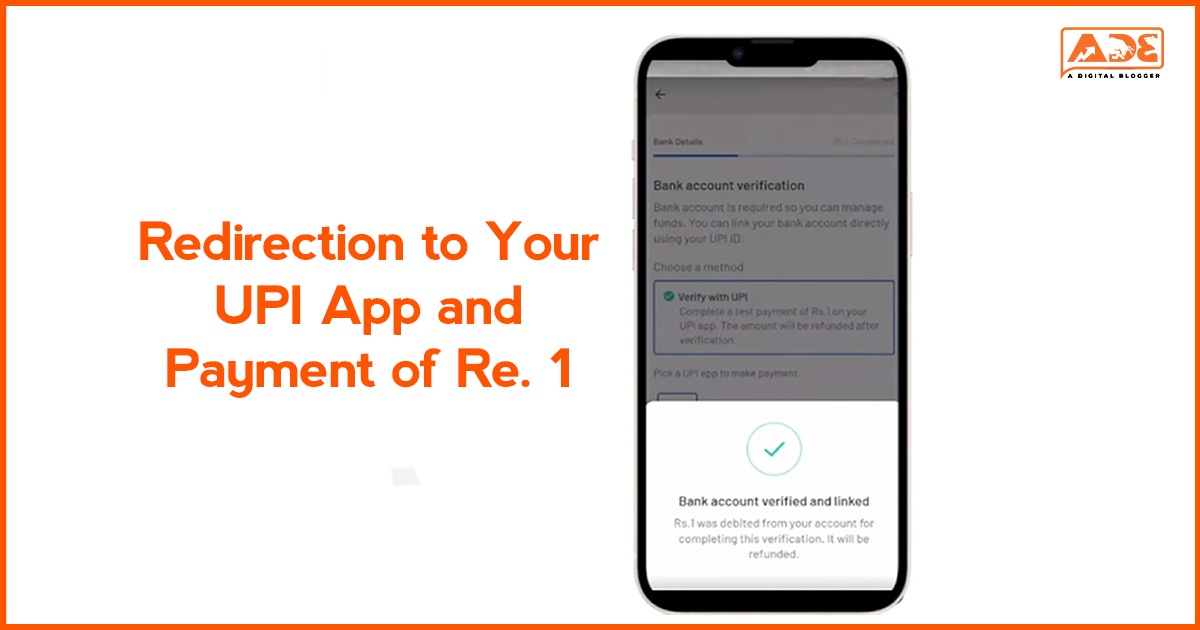

Now, you need to share your bank account details with the Angel One platform. You can do this either via UPI or your bank account details.

UPI Method:

Suppose, you have chosen the UPI option, now you need to choose your UPI app among all the options given on your mobile screen.

Once you have done it, you will be redirected to the UPI app you chose. A minimal charge of Re. 1 will be debited from your bank account during this process.

However, note that you will get back this Re. 1 in your bank account within just 2 business days.

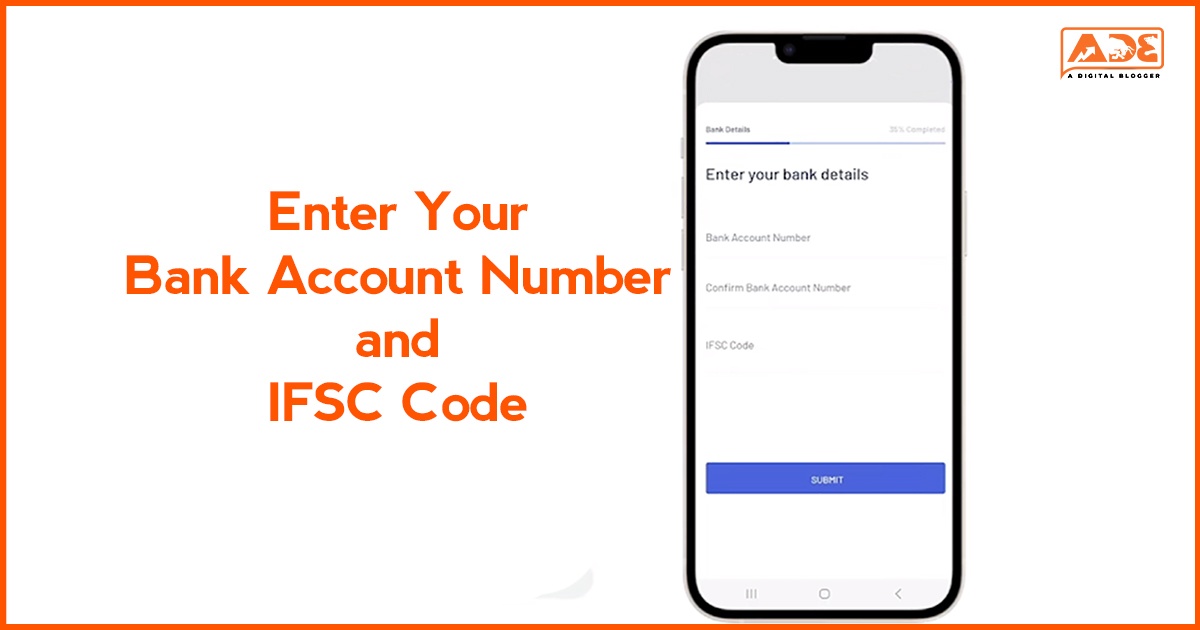

Bank Account Method:

In case, you opted for the bank account option, then you need to fill in your bank account number.

Subsequently, you need to confirm your bank account and enter your IFSC number in the fields appearing on your Angel One mobile app.

So, you can choose either of the two ways to do so. Both are really simple to execute.

Step 5: Upload Your Live Selfie

Among all steps in the process of Angel One KYC update online for demat account is uploading a selfie. Keep in mind that you need to submit a live selfie with a clear background.

For this step, you need to give camera permissions to Angel One app, if you haven’t done so. How do I execute this step? Follow along!

You just need to place your face within the circle you see on your mobile screen. Once your face is clearly visible, just click the camera icon on your mobile to capture a selfie. Simple as that!

During this process, your face shouldn’t be covered with a mask or any cloth. A clear and visible face is mandatory to complete this step.

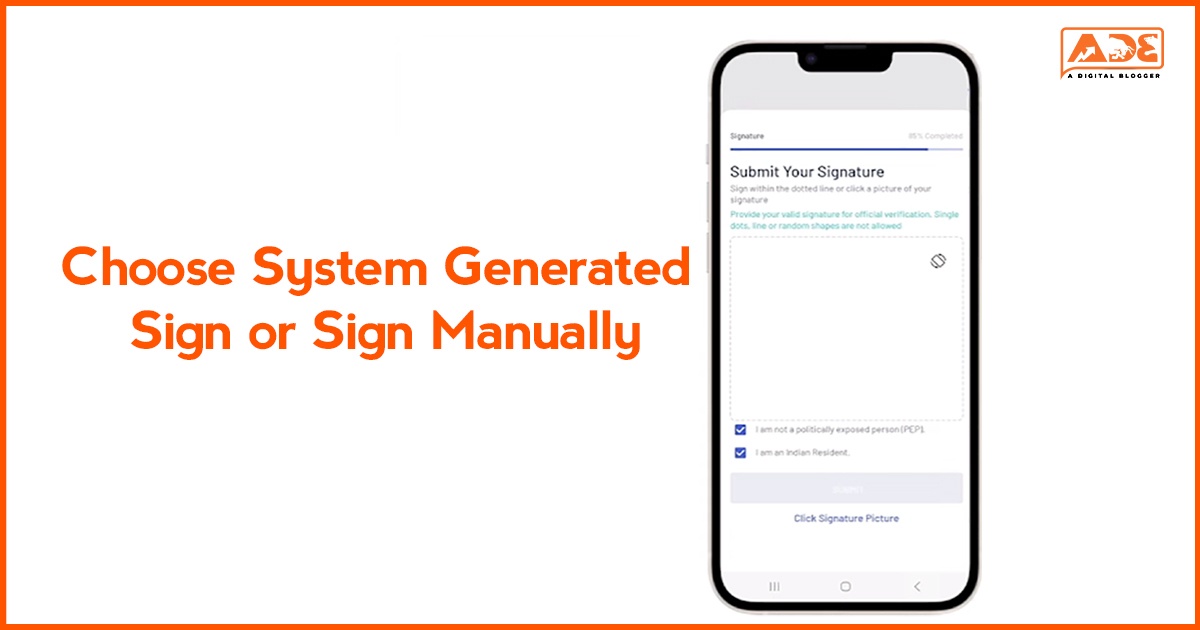

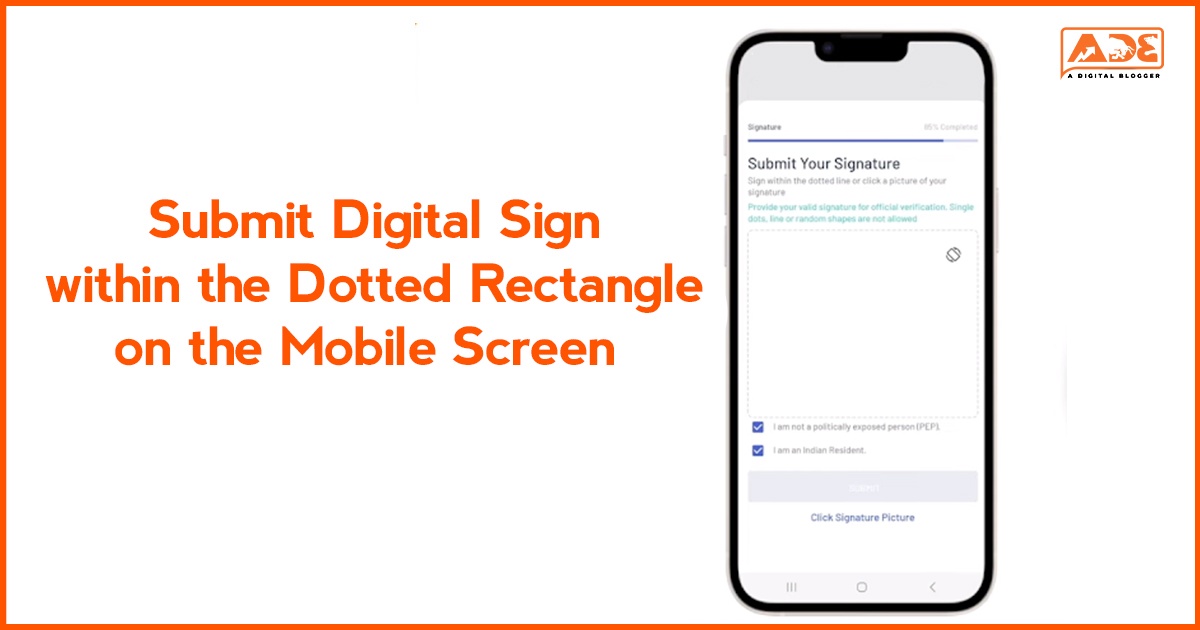

Step 6: Submit Your Signatures Digitally

It is a vital step in verifying your identity. While submitting your signature, you will get to choose out of System Generate Signature or Sign Manually options.

If you opt to sign manually, you need to sign digitally within the dotted rectangle visible on your mobile screen.

While doing so, it is necessary to sign properly. If you sign with a dot or line (basically improperly), then it will not get counted. And you won’t be able to complete your Angel One KYC update online process.

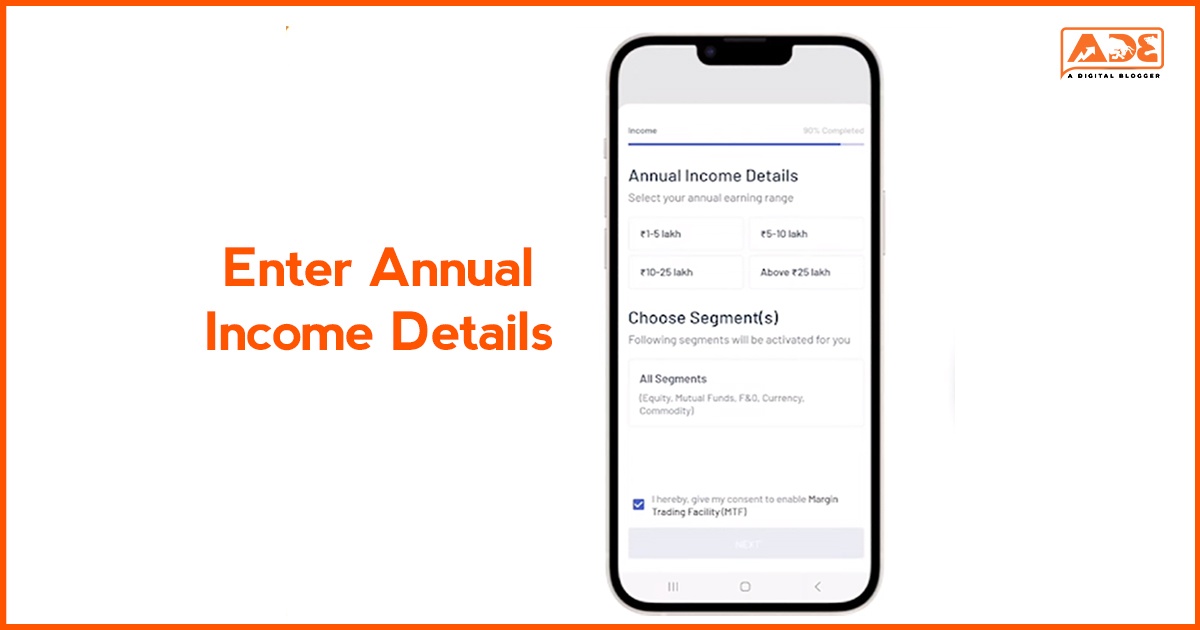

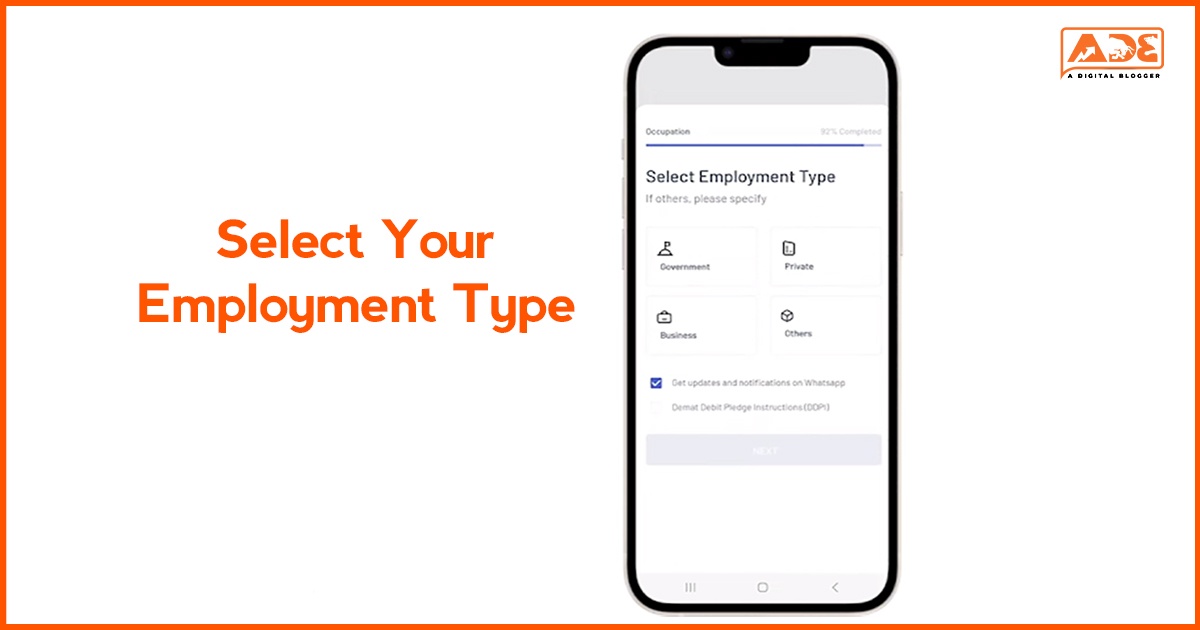

Step 7: Enter Annual Income Details

Under this step, you need to share your annual income details.

On your phone screen, choose your income category, employment type and select MTF (if needed) to complete it.

You can also opt to receive Whatsapp notifications.

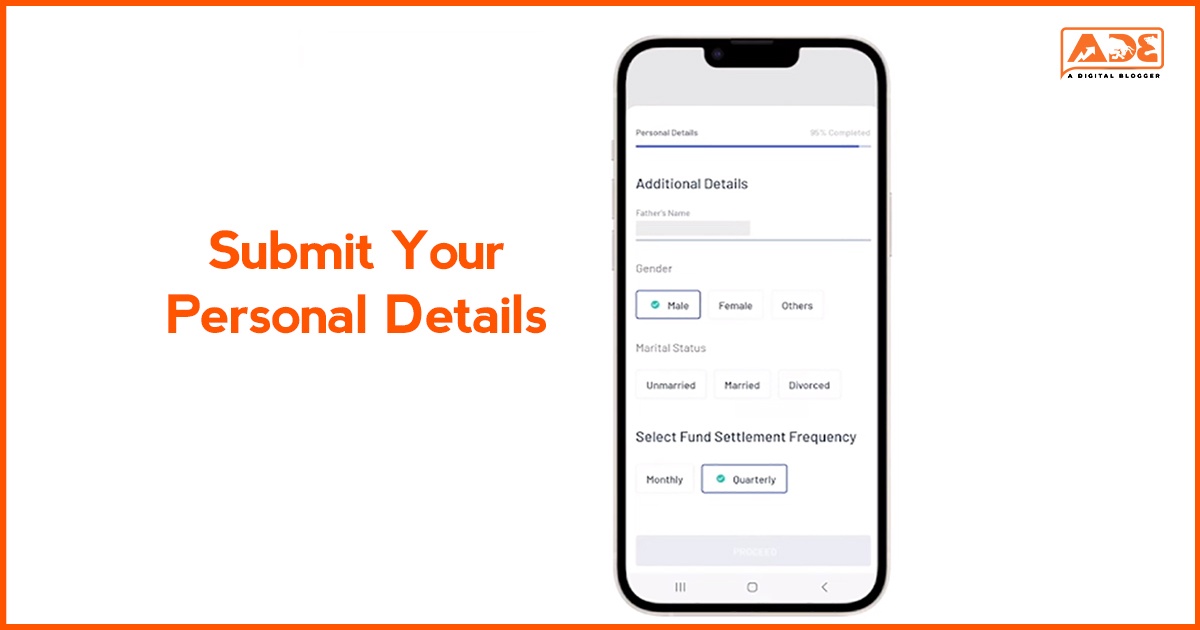

Step 8: Submit Your Personal Details

Apart from your income details, you also need to enter your personal details as a part of the Angel One KYC Update online process for demat account.

Fill in details like father’s name, marital status, and also choose your security settlement preference.

Note: Though it automatically gets pre-filled by fetching data from your PAN card details, you can still fill these details manually to make any edits in them.

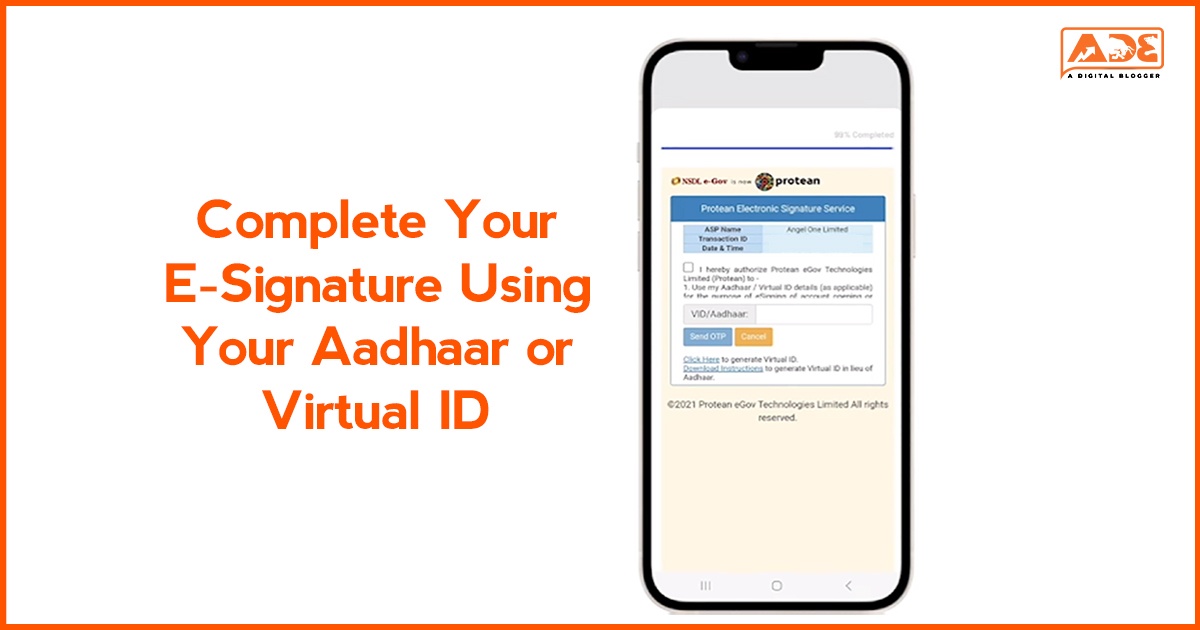

Step 9: Complete Your E-Signature Using Aadhaar or Virtual ID

After submitting your personal details, you will be automatically redirected to execute the E-Signature step with the help of Aadhaar / Virtual ID.

At the end of this process, you have submitted the mandatory documents for completing the procedure for Angel One KYC update online for demat account.

And the activation of your demat account will just take 3 business days.(Hurrah!) And you can take part in online trading in Angel Broking (now Angel One) to earn a hefty sum of money.

Angel One Demat Account Charges

Opening an Angel One demat account is free and there are no account maintenance charges for the first year. However, there are some fees and taxes that traders or investors need to pay to the Angel One platform. Here are these:

| Type of Angel One Charges | Charges, Fees and Taxes |

| Account Opening Charges | ₹0 |

| Brokerage Charges on Delivery Trade | ₹0 |

| Account Maintenance Charges | 0 for First Year ₹20/ month from second year onwards |

Conclusion

So, now you know everything about the Angel One KYC update online process for demat account. It is high time you execute these steps and get done with it.

One major factor that makes this stockbroker quite popular among traders and investors is amazing Angel One features.

It provides excellent features to its clients due to which its client base reached 9.64 million in 2022.

Earlier, it changed its name from Angel Broking to Angel One and it has improved its functionality to fulfill its clients’ financial needs in a better way.

We must tell you that SEBI has made it compulsory for all investors and traders to complete the KYC process for opening a demat account with Angel One or other stockbrokers.

We hope you get useful information here and it will help in your KYC journey for this stockbroker.

If you are new to the stock market and have no clue about how to enter it, you can fill in the form given below. Our team will reach out to you immediately and assist you in opening your demat account.