Axis Demat Account

More on Demat Account

Axis Bank is the third-largest privately-owned bank and is a well-known name in India’s financial market. Axis bank offers investments and trading related services through its subsidiary, Axis Direct (or Axis Securities), which further provides Axis Demat Account.

If you open a Demat account with Axis Bank, you can easily invest in various trading and investment segments such as equity, derivatives, mutual funds, systematic investment plans (or SIPs), etc. through Axis Securities.

In this article, we shall be discussing various aspects related to Axis demat account.

Axis Demat Account Review

If you want to open a Demat account with Axis Bank, you must know what it is offering and what its features are. So, let us begin with a quick look at the major features of the Axis demat account.

1. Ease of Dematerialisation – One just needs to submit physical securities along with a request form for the dematerialization of securities.

2. Ease of Rematerialisation – One also has the facility of converting e securities into physical form.

3. Corporate Benefits – With the Axis demat account, one has the facility of receiving corporate benefits like dividends, interest, etc. directly in one’s account.

4. Pledging – One can pledge of shares in Axis demat account in order to obtain a kind of loan on one’s securities.

5. Facility of freezing account – One can freeze his / her Axis demat account for a certain specified amount of time period during which there can not be any debits from the account.

6. Call and Know – One has the facility to call and know all the details regarding one’s holdings in a demat account with Axis Bank simply through a phone.

7. Online Availability of Holdings and Statements of transactions – If you have a demat account with axis bank, you can quickly view your online account statement details at any time and from anywhere. One can get all the details through email as well.

8. Ease of Transfer of Shares and Money – There is a seamless flow of transfer of funds as well as shares in one’s Axis demat account.

9. Speed – e – Facility – Axis demat accounts offer this facility to its customers with the help of which they can give delivery instructions using the internet.

After understanding its major features, understand how to use a demat account.

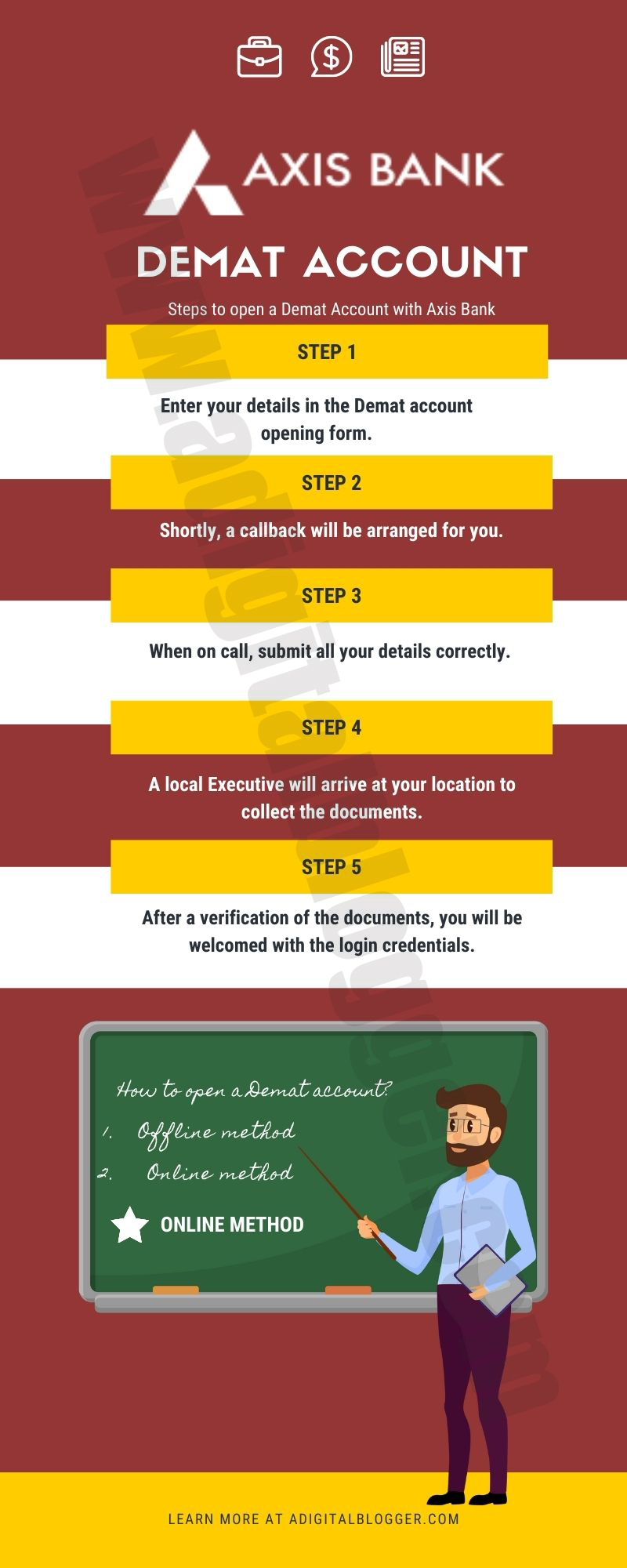

Axis Demat Account Opening

The online process of opening an Axis demat account is extremely simple and easy to do.

You just need to fill in some basic details like name, email id, city of residence, and phone number to get a one–time password to continue the process of opening a demat account.

To open a demat account with Axis Bank, you can also use the offline process of the demat account opening.

You will be required to submit the account opening form with copies of all the required documents for the process.

These can be submitted at any branch of AxisDirect, and the account will be open and ready to use in a few days.

However, to quickly open your demat account with one of the top stockbrokers in the country, just fill in the form below and without any charges, we will assist you in the next steps ahead

If you are human, leave this field blank.

Enter basic details here, and a Callback will be arranged for You!

Axis Bank Demat Account Documents

One needs to submit the scanned copies of the mandatory documents while opening the demat account with Axis Bank. Some of the Axis Bank Demat Account Documents required are as follows-

- PAN card

- Aadhar card/voter id/driving license, etc., as proof of address

- A canceled cheque

- Passport size photographs of the client

For more information, you can check this detailed review of the documents required for the demat account.

Demat Account In Axis Bank Charges

Here is a quick look at the different types of Axis Demat Account charges levied by the stockbroker at the account level:

- Opening charges = ₹0

- Closing charges = ₹0

So from above, we can precisely see the demat account in axis bank charges are nil, which is a good sign of a Stockbroker.

However, there are some other changes too that are levied by the stockbroker to its customers, such as transaction charges, Annual Maintenance charges (AMC), pledge charges, STT, GST, etc.

Along with this, to open a demat account with Axis Bank, one can choose from two different types of Axis Demat accounts. These accounts are as below-

- Regular account and

- BSDA (Basic Services Demat Account)

For the existing customers of Axis bank, AMC for the regular account is ₹750 from the second year onwards as the AMC for the first year of axis demat account opening is ₹0.

For those retail customers who are not existing customers of Axis bank, AMC is ₹2500 per year from the beginning year for opening the Axis Demat account.

That is definitely expensive!

For Trading in options

For Intraday Trading and Futures Trading

Here are the details on intraday as well as futures trading:

Brokerages charged by Axis Demat account for trading in penny stocks are 3 paise for every share. This brokerage will be subject to a minimum amount of ₹25 for every order that has been executed on the stock exchange.

Whenever there is a transaction occurring on the stock exchange, there are many kinds of charges that the trader has to incur.

One of the types of charges are brokerages that are paid to the stockbroker through which the transaction has been done.

There are some other charges as well which will be discussed below-

Transaction Charges of National Stock Exchange:

They are 0.00325 for trades done in the equity segment on NSE. Here is a quick look at other charges levied once you have an Axis Demat account:

- Transaction charges are 0.0019 for trading done in equity derivatives.

- SEBI Charges – These are ₹15 for every crore.

- Stamp Duty – These charges are variable depending on the state where the account holder resides.

- GST Charges – These charges are calculated by doing 18% of the sum of brokerages charged and transaction charges levied on a trade.

- Depository Participant Charges – DP charges are levied on every transaction that involves the sale of shares from the demat account. They are around ₹22 per scrip.

Securities Transaction Tax (STT):

STT is different for all the segments.

- For delivery based trades – 0.1% on both the buy and sell sides

- For intraday trades – 0.025% on sell-side only.

- For futures (equity) – 0.01% on sell-side only

- For options (equity) – 0.017% calculated on sell-side premium + 0.125% on settlement value in case of exercise of options

- For futures (currency) – 0.0009% for orders executed on the National Stock Exchange, 0.00022% for orders executed on the Bombay Stock Exchange

- For Options (currency) – 0.04% for orders executed on the National Stock Exchange

- 0.001% for orders executed on the Bombay Stock Exchange

- Commodities transaction tax for trading in commodity futures – 0.01% on sell-side in non – agricultural segment

- Commodities transaction tax for trading in commodity options – 0.05% on sell-side

All the details about different charges and brokerages can be calculated by brokerage calculators available on websites of different brokers.

Before entering any transaction, the brokerage calculator and margin calculator must be checked in order to know the exact brokerages and other charges as well as the margin requirements of any trade occurring in the Axis Demat account.

Axis Demat Account For NRI

If you reside outside India and hold an Indian PAN Card and are looking to invest or trade in the stock market – there is an option for you under Axis demat account for the NRI category.

You can choose to open a 3 in 1 Axis Demat Account, which comes with multiple benefits such as:

- Access to multiple investment products such as Equity, IPO, Mutual funds, etc.

- Multiple trading platforms offered, including the AxisDirect Trade, AxisDirect app

- Provision to place AMO or After M3rket Orders

- Call and Trade facility available.

AXIS DEMAT ACCOUNT CUSTOMER CARE NUMBER

In case you are in a doubtful position regarding your trade, Axis Demat Account customer care number comes with quick customer support with a reasonable level of client satisfaction on the response quality front.

You can get in touch with the broker through the following channels:

- Phone

- Toll-Free Number

- Offline branches

- NRI Customer Support

Axis Bank Demat account customer care number for the NRI’s is 022-61480809, and the Indian Residents can make a call at 022-40508080 or 022-61480808.

The broker can be trusted, from a competitive perspective, on the quality of its customer support.

AXIS BANK DEMAT ACCOUNT APP

Axis customers have the option of accessing their trading and demat account holdings through an Axis bank demat account app, basically, a mobile phone app called AxisDirect Mobile.

To know whether this app is profitable or not, it is important to consider its features and services. So, let us look at the prominent characteristics of this app-

- Live streaming price quotes of securities

- Access to demat account online

- Tracking live market through intraday charts

- The facility of placing off-market orders

- Access to available limits and margins on one’s account

Here is a quick look at the stats of this mobile trading app from the Google Play Store:

Axis Bank Demat Account Benefits

Here is a quick look at some of the top benefits you can avail if you choose to go ahead with the Axis Demat Account:

- Axis Demat account can be opened with a savings bank and trading account, which makes coordination among the three accounts very easy.

- One can invest in initial public offerings, mutual funds, etc. also through one Axis platform.

- You can avail of corporate benefits like dividends, rights, etc. which can be credited directly to your account.

- Trade@20 plan offers one of the lowest brokerages in Indian markets. That is ₹20 for every executed trade.

- Free research reports are provided to its customers.

- The facility of educating beginners with stock market basics through sessions, online tutorials, etc. is also available on the demat account with Axis Bank.

Axis Bank Demat Account Disadvantages

Like every other financial thing, there are some disadvantages of the Axis demat account too. Let us have a look at them one by one-

- The trade@20 brokerage plan cannot be availed for free for non-existing Axis customers, and the other plans offer quit high brokerages as compared to discount brokers in India.

- Currency trading and commodity trading cannot be done with the trade@20 brokerage plan.

- If the existing customers of the trade@20 brokerage plan fail to manage a quarterly minimum required balance of ₹75,000, the brokerage plan automatically gets converted into a high brokerage plan.

Axis Bank Demat Account Closure Form

If in case your experience with the broker has not been amazing and you are looking to close your Axis Demat Account, then you can get all the information from this section.

The right answer to “How to close Axis Demat account” is to quickly follow the below steps-

Download the “Axis Bank Demat account closure form” and print it out. Now carefully fill the details asked in the form.

Post filling the information, you are required to submit this form to the closest branch you may have around your area. These forms can be submitted in the Axis Bank branches as well.

Before filling the Axis Bank Demat account closure form, it is recommendable to make sure that all the dues are cleared as well.

Once all these formalities are completed, the broker will be validating and processing the documents.

It takes 4-5 business days for these proceedings to complete and to get your demat account closed.

For more information, you can check this detailed review on how to close a demat account.

Conclusion

Axis demat account can be opened easily with AxisDirect, which has some good features like easy demat and remat of securities, 3 – in – 1 account, which allows a seamless flow of transactions among the three accounts – bank account, trading, and demat accounts.

Other features include pledging of securities for obtaining extra margins in the trading account, the facility of freezing one’s account for a stipulated amount of time, etc.

The account opening process is quite simple and just needs some basic documents of a person.

The online process of a demat account with Axis bank will take just a few minutes to complete the formalities at one’s end.

The details of account opening and maintenance charges can be seen in this article.

One should know about one’s trading requirements and choose a brokerage plan offered by Axis Direct accordingly.

Trade@20 brokerage plan is an attractive plan offered by Axis, but not everyone cannot be eligible to be a part of it.

An average minimum balance of Rs. 75000 should be maintained on a quarterly basis for existing Axis customers. Non-Axis customers need to pay special charges for being able to trade under this plan.

The other brokerage plans have also been discussed in detail and are more expensive as compared to brokerage plans offered by discount brokers.

AxisDirect mobile app can also be used in order to trade and view holdings of the axis demat account.

Advantages of Axis demat account include ease in remat and demat of securities, facility of calling and knowing the balance of holdings in one’s Axis demat account, easy transfer of securities, and funds among the Axis demat account and bank savings and trading account.

Disadvantages of having a demat account with Axis Bank include higher brokerages except for the trade@20 plan and non-availability of this plan for currency and commodity trading.

One should look at various aspects of the Axis demat account before deciding to open it.

Charges, features, brokerage plans, advantages, and disadvantages are the things one should be aware of while thinking of considering a demat account with Axis Bank.

In case you are looking to get started with stock market investments, let us help you take the next steps ahead.

Axis Demat account can be opened quickly with us without paying any fees. Just click on the link, fill the form, and easily start your trading with Axis Bank.

Just fill in the form below to get started:

More on Axis Direct

If you wish to learn more about this stockbroker, here are a few references for you: