BSDA

More on Demat Account

In order to trade in the stock market, you need to have your own Demat account, as well as, a trading account. All the Depository Participants or DPs have been asked by SEBI or Security Exchange Board of India to make BSDA available for all the retail investors.

This move taken by SEBI was mainly aimed at encouraging Demat account holders, achieving a wider financial inclusion, and to help lower the cost of maintaining Demat accounts for individual retail investors.

Also, know about the IIFL BSDA Account.

BSDA Account Full Form

BSDA abbreviation stands for “Basic Services Demat Account”.

Now, with that understanding, you’d get an idea about what this type of account actually does. Obviously, it is limited, or let’s say a mini-format of a full-fledge Demat account.

But at the same time, it works well for a specific set of investors who are not looking for all the frills involved. They want an account that helps that to invest in the stock market and that’s pretty much it.

No offline assistance, no research, no quick customer support BUT simple straight-forward investments.

Let’s know more in this rest of the detailed review about how it actually works and what is expected out of you to open one.

BSDA Rules

The BSDA is designed to provide you with all the basic services at a reduced cost. This account is easily available for any individual who either has one existing Demat account or wishes to open one under their name as the sole first holder.

However, it is also important to note that the total value of all the securities should not exceed ₹2 Lakhs at any time. It is also crucial for you to remember that each person is allowed to open just one BSDA across all Depository Participants.

That may sound like a limitation to a few aspirant traders but honestly, it works fine for smaller investors, at least initially.

Also, if you still have doubts read Demat Account Rules.

BSDA Charges

When it comes to the charges of maintaining a BSDA, the AMC or Annual Maintenance Charges will be in accordance with the predetermined slabs. For example, if the total value of your holdings does not exceed ₹50000, there will not be any charges.

However, once the total value of your holdings falls between ₹50001 and ₹2 Lakhs, your AMC will be ₹100.

Who All Decide the Value?

As far as the calculation of the value of the holdings is concerned, it is done based on the closing prices of the securities bought by the Demat account holder, and based on that the corresponding charges are levied.

SEBI has given the responsibility of determining the value of the holdings to all the DPs. This is done based on the Net Asset Value or the daily closing price of all the units of Mutual Funds or securities.

As a retail investor it is very important for you to remember that once the value of your holdings exceeds the maximum slab of ₹2 Lakhs, your DP has the authority to bring your AMC at par with any regular Demat account charges.

Will I Get Periodic Statements?

Just like any other service, BSDA providers will also provide you with electronic statements, which will be free of charge. However, if you opt for physical statements, any DP will provide 2 such statements without any charges in a billing cycle.

If you require more than 2 statements, you will have to pay a certain fee which will be up to a maximum limit of ₹25. Even if there has been a minimum of a single transaction in a quarter, you will be given a transaction statement each quarter.

On the other hand, for those accounts where there have been transactions, you will be given an annual statement of total holdings, which will either be physical or electronic as per your choice.

What Will Be The Scenario If I Have An Existing Demat Account?

If you are eligible for a BSDA and also have an existing Demat account with a DP, you can certainly ask them to convert your existing one to a basic Demat from the date of the next billing cycle.

However, this is subject to the value of the total holdings under your name in the account as on the last date of the previous billing cycle.

Who does a Basic Demat Account suit the best?

It suits perfectly for smaller investors who either do not want to invest regularly or they cannot do so.

In fact, this was the whole reason behind introducing the concept of a basic Demat account in the first place i.e. offer a product to those investors who want to have a limited number and/or amount of investments in the stock market.

Can I convert my Demat account into a BSDA?

Well, it is generally by default by most of the stockbrokers depending upon the value of your holdings, the account is automatically converted into a BSDA or a Demat Account. With most of the stockbrokers, you don’t really need to perform any formalities.

However, it is better to check with your broker.

What are the brokerage charges on a BSDA?

The brokerage charges levied stay the same in a BSDA as they are levied in a regular Demat account. There is no difference when it comes to brokerage charges.

How do I avail of the facility of a BSDA?

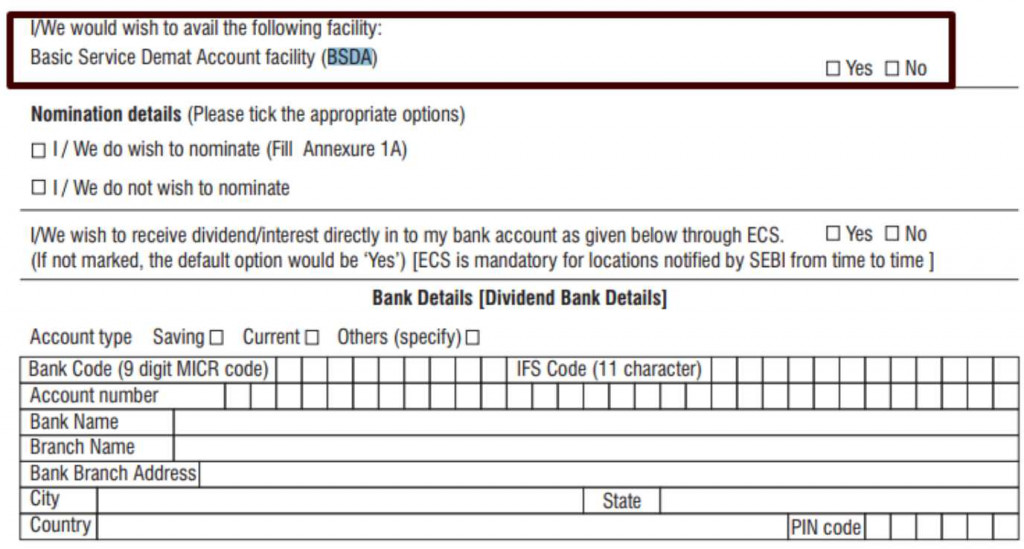

It’s pretty straight-forward. While filing up the account opening form, you need to select the BSDA facility for your account. Your Demat account will be opened accordingly as shown:

BSDA Vs Demat Account

Well, there are a few differences between these two types of accounts:

- Demat Account is for regular investors and traders whereas BSDA suits low-frequency traders.

- Demat Account is for mid to large portfolios while a BSDA is for a smaller portfolio.

- You may have multiple Demat accounts but just one BSDA at any given point in time

- The AMC is relatively high in a Demat account but as explained in the charges section above, in the case of BSDA it is pretty low.

If you are looking to get started with a BSDA or open a Demat account, just fill in your details in the form below.

A callback will be arranged for you:

More on Share Market Education:

If you are looking to learn more about the Demat account or Share Market investments in general, let us assist you in taking the next steps forward.

You can also refer to this detailed declaration by SEBI on this subject.