HDFC Demat Account

More on Demat Account

HDFC Bank provides its investments and trading services through HDFC Securities, which further offers the HDFC Demat Account.

HDFC demat account is chosen by many people since the firm- HDFC Securities, with its corporate office in Mumbai, has been one of the leading stock brokers in India since the year 2000.

It provides a one-stop solution for all investment-related needs like equity, commodity, currency, mutual funds, etc.

Not just this, by opening an HDFC Demat Account one can trade or invest in IPO, ETFs, Bonds, or even opt for PMS (Portfolio Management Services).

Learn how to use demat account HDFC and make efficient use of the same. One can avail of its services through phone, email, website, or even visit HDFC Securities branches.

There are more than 2.03 million HDFC Demat accounts spread across a network of more than 3500 demat centres across the length and breadth of the country.

In this article, let us try to learn various aspects related to HDFC demat account.

HDFC Demat Account Review

HDFC Securities is one of the best banks for demat accounts offering three different schemes under which a Demat account can be held by a person. In this HDFC Demat Account review section, we are going to discuss them one by one.

- 2-in-1 Account: This comprises of HDFC Demat account along with an HDFC Securities Trading account. The Demat account HDFC will be used for storing all the investments and trading accounts will be used for trading and making transactions.

- Demat Account Opening Charges = ₹0

- Annual Maintenance Charges for the First Year = ₹0

Besides, second-year onwards charges are based on transactions. The higher the transactions, the lower are the charges deducted from the HDFC Demat account.

- 3-in-1 Account: This comprises of HDFC bank savings account, HDFC Demat account along with HDFC Securities Trading account.

- Account Opening Charges Related to HDFC Demat Account = ₹0

- A waiver of ₹750 on Annual Maintenance Charges for the First Year. Charges of annual maintenance from the second year will also depend on the transactions. The higher the transactions, the lower are the charges.

- Demat account: This can be opened on a standalone basis without opening any other kind of account with HDFC. One can also visit a branch to open a demat account with HDFC.

HDFC Demat Account Features

Before you opt for an HDFC Demat account you must also be sure about the features that make it distinctive from others.

So, here is a quick look at some of the prominent features offered in the HDFC Demat Account to its clients:

- Imperia, Preferred and Classic are the kinds of HDFC Securities Brokerage plans that are offered to its customers having an HDFC Demat account and they differ on the basis of pricing.

- Corporate benefits like dividends, bonuses, rights, etc. get added directly to one’s account automatically.

- HDFC Free Demat Account services are available under certain schemes and plans.

- One does not need to pay stamp duty on the transfer of securities held in Demat form.

- HDFC Net banking shows a Demat tab that can be viewed to check one’s investments and statements.

- You can use the HDFC Securities Refer and Earn plan where you may refer your network to open an account with this stockbroker. In lieu of that, you will be provided with some cash and/or brokerage-related rewards.

There are a few more Demat Account features but we have tried to limit the most usable features here.

HDFC Demat Account Charges

Once you open a Demat account with HDFC, you will be required to pay a sum of a certain amount in the initial phase.

To trade with any Stockbroker or HDFC in this particular case, having a Demat and Trading account is a must. But is that facility free with the HDFC or how much do we have to pay for the same?

Let us find that the HDFC Demat account charges as below:

From the above charges for HDFC Demat account, we can precisely say that opening a Demat as well as a trading account is completely free of cost.

However, the account holder will be required to pay an annual maintenance charge (AMC) once you have successfully opened an account.

In some circumstances, the HDFC Securities AMC charges for the first year are not charged from the person. For the same, you can also talk to the Relationship Manager(RM).

Then there are HDFC DP Charges as well, applicable on the cash and carry trades only.

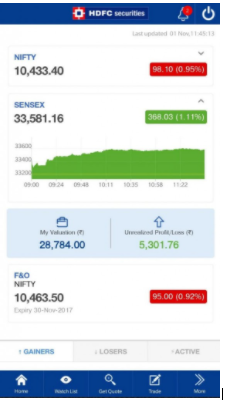

HDFC Demat Account App

Once you open an HDFC account, here comes the question of how to use Demat account?

Well! for this you are provided with the HDFC securities Mobile App that smoothens your trading journey with the stockbroker.

Some of the best features of this HDFC Demat account app have been discussed below

- Live streaming quotes and real-time news updates.

- Notifications feature which can alert a trader to use a trading opportunity.

- Interactive demos are available on this app which can help in increasing one’s knowledge about the financial markets.

- If you have an HDFC Demat account, you can also apply in initial public offers through this app.

- Another good feature of this app is that it provides trading calls on the basis of research (for more information, you can check HDFC Securities Research).

- Intraday real-time charting (make sure you understand the HDFC Securities Intraday brokerage charges while you use this format of trading).

This is how the app looks like

You can check out the latest stats of this mobile app from Google Play Store here:

In case you forget your login details, you can easily recover them by following a few simple steps. Here is the complete details of how to unlock HDFC Securities account.

HDFC Demat Account Customer Care

In case you are looking to get in touch with the HDFC Demat account customer care support related to your account, there are multiple ways to do that:

- Phone

- Chat

- Branches

As far as the HDFC Demat Account customer care number is concerned, you can place a call at 39019400 while prefixing the local code of the support centre you are calling.

You may also choose to use the HDFC Securities Call and Trade facility in order to place trades or get some of your basic queries resolved.

HDFC Demat Account Benefits

Here is a quick look at some of the benefits of using HDFC Demat Account for your trades and investments:

- The integration of bank account, Demat, and trading account under 3 – in – 1 account makes it quite convenient to use for its customers.

- By opting for a Bank Demat account HDFC, One can make investments in stocks, mutual funds, insurance, initial public offerings, bonds, post office savings schemes, etc. HDFC provides a one-stop solution for all investment-related needs.

- Trading platforms and apps provided by HDFC are user-friendly and easy to use.

- Corporate benefits like dividends, bonuses, etc. get credited to one’s HDFC demat account directly.

HDFC Demat Account Problems

Every coin has two sides. Therefore, there are some disadvantages to opening the HDFC Demat account too. These disadvantages have been discussed below

- The brokerage charged by HDFC Securities is very high in comparison to the brokerages charged by discount brokers in India.

One with HDFC Demat account can get an idea from the minimum brokerage amount that they charge for any transaction which is ₹25, which is very high as compared to brokerages of discount brokers.

This makes the costs of the traders high and in turn, less profitable.

- Commodity trading cannot be done through HDFC Securities Trading cannot be done on MCX and NCDEX.

- It is very expensive to trade in penny stocks through HDFC demat account because the brokerage charged on trading the scrips of value less than ₹10 is ₹0.05 per share.

- There are some technical glitches because of which users usually complain about HDFC Securities mobile app not working.

How To Open HDFC Demat Account?

One of the frequently asked questions by the traders and investors interested in HDFC is “How to open HDFC Demat Account”. The whole process to open a Demat account with HDFC is very simple and consists of a few basic steps.

It can be opened online as well as offline, depending on your requirements.

- Offline Method

To open an HDFC Demat account through the traditional way, one needs to download the HDFC Securities account opening form from their website and submit it along with the KYC (Know Your Customer) form and required documents for address proof, PAN card, identity proof like driving license, passport size photographs, etc.

One also needs to submit a cancelled cheque along with the other documents. After the verification process is completed in a maximum of 2 – 3 days, a demat account HDFC gets opened.

For more information on how to open an HDFC demat account or what proofs are essential, you can check out this detailed review of Documents required for Demat Account.

- Online Method

The online process of HDFC Securities Sign Up is a paperless and hassle-free experience.

One needs to fill in some basic details and submit all the scanned copies of the required documents online. An account opening form along with the KYC form can be filled to make the HDFC demat account process more convenient.

The whole process will take of opening the HDFC Demat account will take a few minutes to complete and an account will be opened as soon as the verification part is complete from HDFC Securities’ end.

One gets all the username and password-related details as soon as the account is opened.

How To Close HDFC Demat Account?

Many people have the question in their mind that How to close HDFC Demat account and the answer to this is quite simple.

So, If you ever wish to close your HDFC Demat account with the broking company, then you just need to fill up the account closure form and submit it to the support team of the broker.

The HDFC Demat Account closure form can be downloaded from here.

Once you fill the form, simply send the same to the nearest HDFC branch or courier the same to their Head Office.

Conclusion

HDFC Demat account services are used by lakhs of customers in India.

One can open a demat account with HDFC either under 2 in 1 account which comprises of trading and demat account or under 3 in 1 account which comprises of the services of savings account, demat, and trading accounts on the same platform.

HDFC demat account can be opened online as well as offline. One just needs to provide a few basic documents like a PAN card, driving license, passport-sized photographs, proof of address, etc.

The HDFC demat account opening and maintenance charges have been mentioned earlier in the article.

Whenever a transaction is done, there are many charges related to it like brokerages which depend on the broker through which the transaction has been made and other transaction costs like STT (learn more about HDFC Securities Transaction Charges), SEBI charges, GST, etc.

The details of all these costs including depository charges have been shared earlier in the article.

HDFC securities Mobile Trading App is available on Google Play Store from where it can be downloaded on any Android phone and used for a seamless trading experience.

One should carefully analyze different aspects related to this while making a decision to open an account with HDFC Securities.

Advantages of the HDFC Demat account include options to choose from 2 in 1 account and 3 in 1 account and the facility to invest in initial public offerings, mutual funds, post office schemes, bonds, equities, etc.

Disadvantages of the HDFC Demat account include higher brokerage costs as compared to discount brokers in India, non-availability of the facility of trading on MCX and NCDEX (commodity trading).

While deciding which service provider to choose for holding a Demat account or even if you have chosen the HDFC Demat account you must pay attention to some important factors like costs related to the account, brokerages charged across different segments, its benefits, disadvantages, etc.

One should also be clear about his / her requirements from a Demat and trading account. After keeping all these things in mind, one can easily make a wise choice. Stay aware, stay wise!

In case you are looking to get started with your stock market investments, let us assist you in taking the next steps ahead

More on HDFC Securities

If you wish to learn more about this stockbroker, here are a few references for you: