ICICI Demat Account Opening

More on Demat Account

ICICI Direct commonly known as ICICI Securities is one of the leading financial services companies in India and the best bank for demat account. It is a bank-based stockbroker offering full-service brokerage services for years. So, if you want to gain a better trading experience with one of the leading stockbrokers in India, then here is the complete information of the ICICI Demat Account opening.

Being the second-largest stockbroking company in India after Zerodha, It serves more than 20 lakh clients across India and abroad. Opening an account with the firm opens a gateway for you to trade in different segments including Equity, currency, derivatives, mutual funds, etc.

How to Open ICICI Demat Account?

With the advancement of technology, opening a demat account is no more hassle. You can apply via multiple ways including both online and offline methods.

By opening an account you can reap the benefit of the ICICI 3-in-1 account. Thus, you can directly get into a trade without worrying about linking your demat, trading, or bank account.

ICICI Demat Account Opening Online

The online process of opening ICICI demat account is simple and thus you can process the activation step from your desktop or mobile phone seamlessly. Here are the steps below:

- Visit the ICICI Direct website and process for account opening by entering your mobile number.

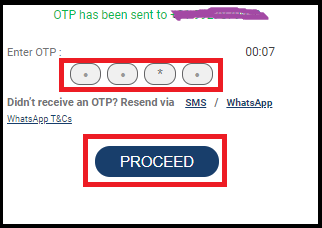

- Enter the OTP to validate your mobile number and proceed further.

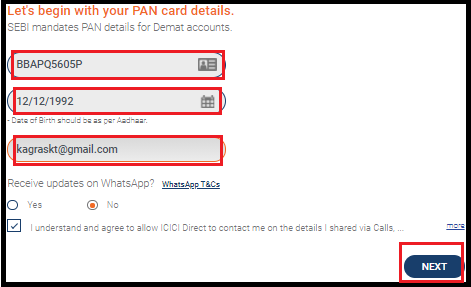

- Now enter the PAN card details and other basic information like DOB and click on NEXT button.

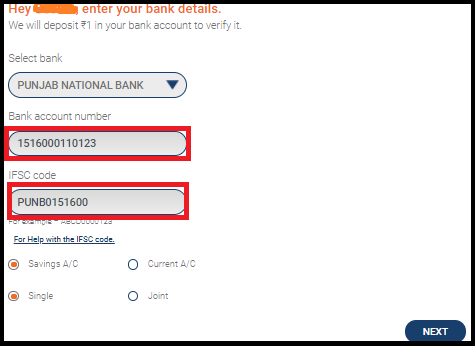

- Select the bank, if already having an account with the ICICI then enter detail or link other bank account number for seamless transactions.

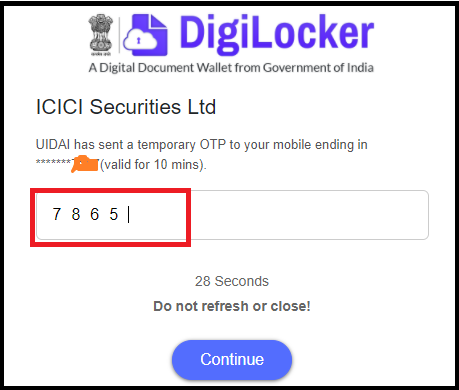

- Now validate your documents via digilocker. Enter the Aadhar card number.

- You will receive an OTP in the mobile number linked with your Aadhaar. Enter OTP and click on Continue. Here click on Allow button to give permission to ICICI Securities to access your Digi locker app.

- Upload the scanned image of your signature.

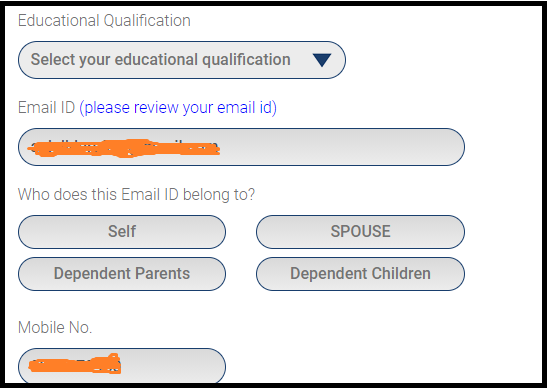

- Now to activate the demat account you need to enter some more basic information like your Father’s name, educational qualification, occupation, annual income, etc.

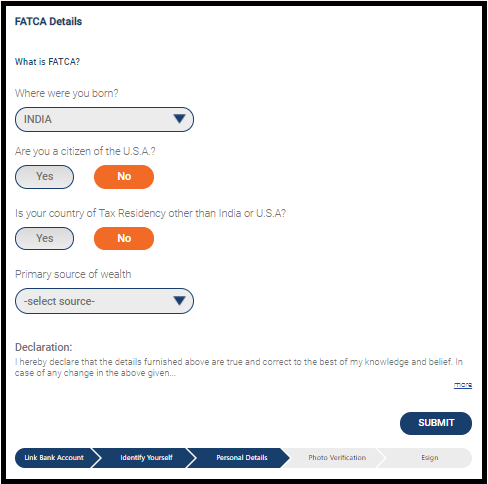

- Now enter the FATCA details that include your country name, the primary source of income, etc.

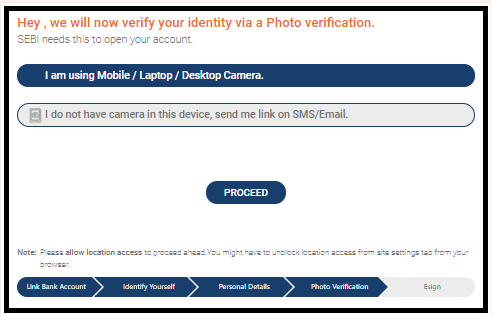

- The next is the photo verification step. For this turn on your device location and allow the webcam or mobile camera to take photos.

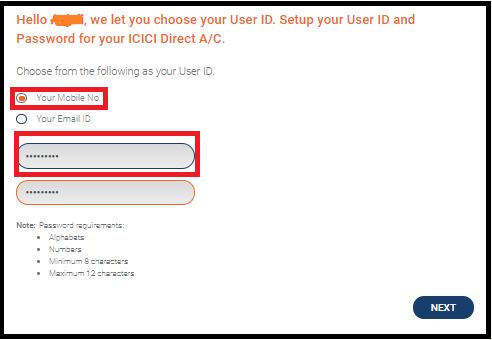

- On successful verification, you will be redirected to the page where you can select the USER ID (Mobile phone or email id) and set the password. Make sure you choose a strong password to keep your account safe and secure.

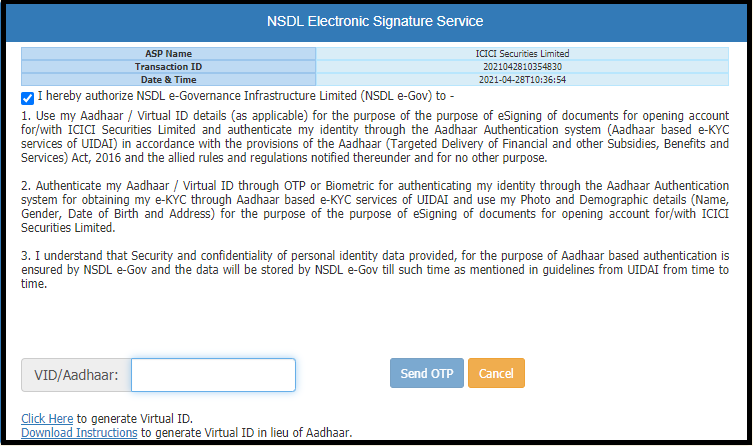

- Post this click on eSign. For this enter the Aadhar number and enter the OTP sent to the linked mobile number.

- Next is the email verification step where the OTP will be sent to the registered email address.

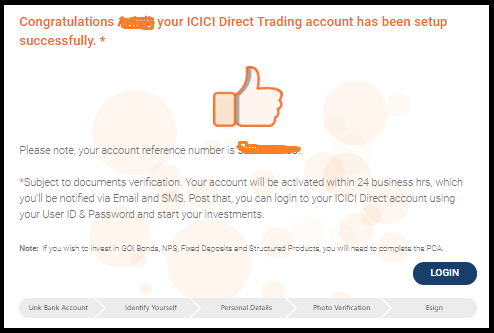

- On successful validation, your account opens and you can log in to get into a trade without delay.

ICICI Demat Account Opening Form

Apart from the online method, you can also apply for the account opening via offline mode. Here you just need to download the form from the links given in the table below:

Once you download the form, follow the steps below:

- Fill in the basic details including name, mobile number (linked with your Aadhar card), email id.

- Along with general information now add information like Aadhar card and PAN card number.

- Sign the form wherever necessary

- Attest the passport size photograph

- Attach the self-attested photocopies of your documents to validate the information.

- Send the form to the nearby branch via courier or submit it physically.

- On the verification of information, your account gets activated within few business days.

To make the overall process easy, fill the demat account opening form below and get your account activated in no time.

ICICI Demat Account Opening Documents

As already mentioned you need to submit or upload few important documents for ICICI demat account opening. Here is the list, make sure you keep the documents handy to avoid any last-minute hassle.

ICICI Demat Account Opening Charges

Being a full-service stockbroker there are ICICI demat account charges imposed by the broker to open a demat account. In general, the overall opening fees vary and depend upon the brokerage plan you opt for.

So basically the demat account opening charges of ICICI range from ₹0-₹975. However, the client opting for ICICI NEO plan can reap the benefit of Demat account for free with ICICI

Other than this, there are certain other charges like Annual Maintenance fees, DP charges, etc.

The annual maintenance fees vary too. The customers opting for the NEO brokerage plan, need to pay the AMC of ₹300 from the first year onwards while for others the AMC charges are ₹700 (waived off for the first year).

DP charges on the other hand are to be paid on every transaction you do from your demat account. These charges are imposed by depositories (CDSL & NSDL). For ICICI Demat Account, both the depositories charge ₹20+18% GST per scrip.

Here are the complete details of the ICICI demat account charges.

In case, you want to open ICICI Demat account for FREE, then fill in the basic details in the form below:

ICICI Demat Account Opening Time

Well, the time taken to open the demat account depends upon the method you opt for. So, here of course the online process takes lesser time than the offline process.

Once you are done with the online application process your ICICI demat account activates in 10 minutes and you can start trading within 30 minutes.

On the other hand, the offline process takes a bit longer time but still, you can avail of your account details within 3-4 business days.

ICICI Demat Account Opening Status

Want to know the account opening status? In general, it takes 2 working days to update the status of your 3-in-1 demat account. To check its status, you can visit here and enter a few basic information; Date of Birth and Form Number.

On submitting the details, you would be able to know your account opening status.

ICICI Demat Account Customer Care Number

Once the customer opens an account with the firm, they come across certain challenges. But to resolve them, the stockbroker offers instant help via customer support services.

For an account opening query, you can reach out to the customer care executive at 1860 123 1122 between 8:30 AM to 6 PM and get information on the account opening status, user ID and password details, etc.

Apart from this, you can visit us at A Digital Blogger to avail the instant response to ICICI demat account opening queries or doubts.

How to Use Demat Account ICICI?

After opening an account with ICICI Direct, the next challenge is how to use Demat account.

If you too are wondering the same, then here is the way to make use of the ICICI Demat account efficiently.

Download the ICICI mobile trading app.

Login using the credentials provided to you on opening an account.

Access the features like:

- Trading in different segments

- Investing in IPO

- Adding a nominee

- Allocation of Funds

- Managing a Portfolio

With these multiple features, you can reap the benefit of trading with ICICI Direct.

Is ICICI Demat Account Good?

ICICI is a bank-based stockbroker that opens a gateway for investors to get a 3-in-1 account.

So, if you are willing to trade using the advanced trading platforms and by following the profitable trading tips and guide then follow the process above and open your account with the best stockbroker now.

Also, it offers multiple plans thus offering you the relaxation from paying the hefty brokerage fees. So, get into a trade with this renowned bank-based stockbroker now and trade smartly.

Other than this, once you open a Demat account with the broker, you can refer its services to your friends and gain additional benefits in form of a referral amount. Under ICICI Direct refer and earn program you can earn the benefit and an opportunity to earn up to ₹750 for each referral you provide.

To get into the trade, open your demat account for free. Just fill in the basic details in the form below:

More on ICICI Direct