Kotak Trinity Account

More on Demat Account

Kotak Securities over the years have established a niche in the world of stockbroking. With their amazing plans and products, you can now simplify trade with Kotak Trinity Account.

Opening the 3 in 1 account with the broker is really a fascinating deal; it prevents traders from juggling between the multiplicity of three accounts.

Let’s dive in to know about the features of the account and the answer of which is the best bank for demat account?

Kotak Trinity Account Meaning

Kotak trinity account, also known as 3 in 1 account consists of a Kotak Demat Account, a trading account, and a Kotak Mahindra bank account all clubbed in one.

So it ends your hassle of juggling around different accounts. You can conveniently trade by linking your bank account, thus making it easy to transfer funds and later securing your holdings and securities in your demat account.

Wondering how you can activate the account and what are the features of the Kotak Securities trinity account.

Let’s dig a little deeper to extract all the details.

Kotak Trinity Account Features

Kotak Bank has always been a prominent mark in the nation. Kotak Securities following the niche has made its mark in the stockbroking world.

Let’s find some Kotak demat account benefits by looking at some of the major features:

- It gives you the benefit of a demat account, a trading account, and a bank account together.

- Along with the Kotak 3 in 1 account, you will also get a savings account with Kotak Mahindra bank and that too at your nearest branch.

- When you get access to the Kotak trinity account, the hustle of transferring funds to your trading account from your savings account is reduced. You can transfer the funds directly from the Kotak Securities website.

- ASBA facility is also available for IPO orders.

- You will get multiple trading platforms to choose from. These platforms include KEAT Pro X, Kotak Trade Smart, and a mobile application called Kotak Stock Trader.

- You can get the margin funding for your intraday trades at absolutely no cost.

- You also get AMO (after-market orders) facility so that you can trade even after the market hours.

- You get free access to research reports so that you never miss out on trading opportunities.

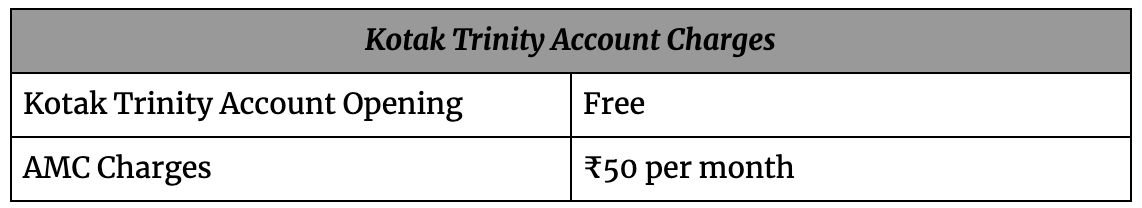

Kotak Trinity Account Charges

Kotak also charges some amount on its trinity account, like account opening charges and also Kotak account maintenance charges. Let us now have a look at the charges.

Thus, you can open the account for free. Apart from this, the broker charges the minimum account maintenance fees of ₹50 on the monthly basis.

Fascinated to open a Kotak trinity account? Let us now discuss the opening procedure.

How to Open Kotak 3 in 1 Account

The Kotak Securities account opening is a simple process.

For Kotak Securities registration you can either go for the online or offline mode but make sure you have all the documents required for demat account opening.

Some of them are:

- PAN Card

- Aadhar Card

- Single Cancelled cheque

- Signature on a paper

- Utility Bill

- ITR Acknowledgement Slip and Account statement (to trade in derivatives)

Follow the given steps if you are looking to open a 3 in 1 trading account in Kotak Securities.

You can open your account either online or offline.

- Fill out an application form by entering the basic details.

- Enter the Aadhar and PAN card details.

- Add the bank account details and link them with the trading account.

- Now upload your signature and photograph.

- The last step is e-sign where you need to enter the Aadhar number and the OTP received on the registered mobile number.

- After the successful verification, your account will be opened in no time.

You can also process offline by downloading and filling the account opening form.

Other than this, you can make the whole process hassle-free, by filling in the basic details in the form below.

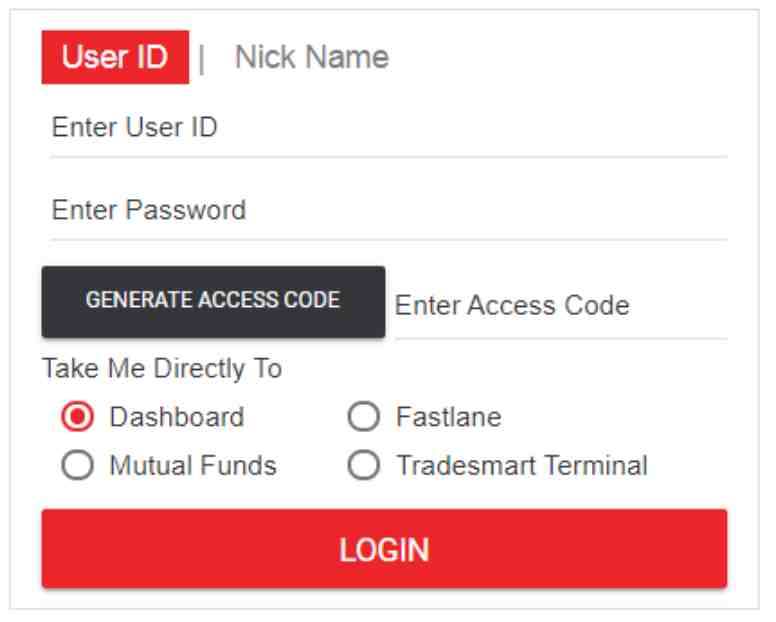

Kotak Trinity Account Login

Let us now have a look at how you can start using the Kotak trinity account. The Kotak Trinity account is activated after 10 working days of the successful application of your form.

Once you have an activated account, you will get your Login credentials. You can easily log in using your username and password.

The Login process of all the trading platforms is also very similar. You can go to the website of Kotak Securities and log in.

- You need to enter your user ID and password.

- Then you will be required to generate an access code.

- You also get an option to directly go to the trading terminal as well.

- Confirm and you will be logged in successfully.

Kotak Trinity Account Benefits

There are various benefits associated with the Kotak trinity account which are as follows:

- There are no upper case limits in the transfer of funds in your savings or trading account in a day.

- It is a seamless and hassle-free process.

- Wide range of platforms to choose from.

- SMS alerts and other timely alerts so that you do not miss out on any trading opportunities.

- You can reap the benefit of trading at zero brokerage for intraday with the Kotak Trade Free Plan.

Conclusion

Keeping a track of a single account rather than 3 different accounts is always better.

Kotak 3 in 1 account is like a package with the advantages of all three accounts.

If you want to start trading and enjoy benefits too, open your Kotak trinity account today by filling the basic details in the form below: