NSDL Demat Account

More on Demat Account

Every Depository Participant has to get registered with the respective depositories to offer Demat account services. But opening Demat account with depository (CDSL or NSDL), is it possible? Let’s gain a complete understanding of the NSDL Demat account.

As already known that all your Demat accounts with the stockbrokers registered with NSDL are managed and maintained by NSDL.

The advanced technology and the dematerialization of shares make it easier for the depository to commit extra security and safety to your Demat account.

If you are wondering where to open a demat account or is there any way to open and operate the Demat account directly with the NSDL?

Not only you but many keen investors are looking forward to finding a way to have a secure or Government Demat account can choose to open an account with the DPs registered with depositories.

So without any further delay let’s learn about the NSDL Demat account.

NSDL Demat Account Details

NSDL or National Securities Depositories Ltd is one of the two major depositories of India. Currently, more than 278 DPs are registered with NSDL to offer advanced and secure Demat account services.

NSDL Demat Account simply means having a Demat account with the depository participants registered with NSDL.

This makes it important for you to be aware of the account opening process and charges to choose the right stockbroker for opening an account.

No doubt the account opening process is almost similar for all the stockbrokers also NSDL has a similar fee structure for all but stockbrokers are free to change those charges to gain or earn benefits.

NSDL Guidelines for Demat Account

Every firm comes up with specific guidelines to keep things in check and at the same time to make it easier for investors to avail of any of its services.

So, if you are willing to open a Demat account to start investing in the share market, then make sure you are aware of some of the specific guidelines mentioned below:

- For having a Demat Account one must be a citizen of India

- To open a full-operative Demat account, your age must be 18 years or more.

- In case your age is less than 18 years old, you can open a Demat account for minors.

- The minor can only trade in the equity segment.

- For KYC, there are some documents required for the Demat account, make sure you have all of them ready to avoid the hassle.

- Your Aadhar card must be linked with the mobile number.

- Apart from this, one must have a valid PAN Card.

So, if you fulfill all the above criteria, know how to open an account with NSDL.

NSDL Demat Account Opening

Now that we know that we cannot directly approach NSDL for opening a Demat account, instead have to find a reliable and registered stockbroker. The account opening process these days is completely online, however, you can have an account offline as well.

The basic requirement for both processes is similar to the documents requirement, charges, etc. However, the time taken in the online process is lesser than the offline process.

Let’s dive in to know the steps involved in opening a Demat account online and offline.

NSDL Demat Account Opening Online

These days technology has made it easier to get things done in no time. So, when it comes to opening a Demat account, most of the investors choose the online way of opening an account.

- Choose the stockbroker registered with the NSDL. The list is long and includes different full-service and discount brokers.

- On the basis of your trading style and requirements pick the one that suits your need.

- Click on the website and select the option “Open Demat Account“.

- Enter your name and mobile number and verify the details by entering the OTP received on your number.

- Next enter the PAN card details and upload the same for verification.

- Other than this upload the bank passbook to validate the bank details.

- Upload the photograph and proceed further.

- The last step is the NSDL e-sign where you need to enter the Aadhar card and OTP received on your registered number.

- Submit the details and complete the process of in-person verification by uploading the video or by recording a few-second video with the web or mobile camera.

- Once done you get the account opening confirmation email containing the User ID and Password to login to the respective trading app.

NSDL Demat Account Opening Form

As discussed above, that you can have a Demat account with the NSDL registered stockbrokers offline as well. For this, you can download the form from the DP website.

You can also avail of the form from the nearest branch.

- Once you get the form you need to fill in important details like name, mobile number, email id.

- Choose the trading segment in which you want to trade.

- Also, you can fill the nomination form to add a nominee.

- Other than this attach a copy of the self-attested documents required for the Demat account opening.

- Send the form via courier to the head office to submit it physically to the nearest branch.

Still, confused about choosing the right stockbroker? Get in touch with us and we will assist you in opening a Demat account online with the renowned stockbroker.

NSDL Demat Account Opening Documents

We discussed that there are some documents required for Demat account. Here is the checklist for the same:

- Proof of Identity

- PAN card

- Aadhar card

- Voter ID Card

- Driving License

- Address Proof

- Aadhar card

- Utility bills

- Ration card

- Rent agreement

- Bank Account Details

- Passbook

- Canceled Cheque

- Photographs

NSDL Demat Account Charges

Now when it comes to the fees charged by the depository to offer a Demat account service, it is generally the same for all the DP.

However, DPs can further offer the service at their own pricing. Also, these charges depend upon the type of stockbroker and further on the brokerage plan you choose to trade.

In general, most stockbroker offers a free Demat account opening facility and further charge the AMC that ranges from ₹0 to ₹900 per annum.

NSDL Demat Account Opening Charges

Here is the detail of Demat account opening charges charged by the stockbrokers registered with NSDL.

NSDL AMC for Demat Account

As discussed there are some account maintenance charges as well. These charges again vary according to the broker and the brokerage plan.

Let’s have a quick look at the Demat account annual charges charged by different NSDL registered stockbrokers.

NSDL Demat Account Broker

In the above segment, we discussed the services and benefits you can avail with the NSDL Demat account.

Also, it is mentioned that you cannot have a Demat account directly with the NSDL, in fact, you can open it with any of the registered stockbrokers.

For your convenience here we have enlisted the top stockbrokers offering Demat account services and related services to its investors.

So, let’s have a quick look at the benefit of opening an account with any one of them.

Zerodha Demat Account

Zerodha is the first and foremost stockbroker that introduces the discount brokerage plan to investors. This brings a big modification in the share market and eventually makes it possible for investors to trade at the minimum cost.

Let’s have a look at some of the features of having a Demat account with Zerodha:

- Zerodha sign up process is completely online.

- Zerodha demat account opening charges are ₹200 for equity account while ₹300 for commodity account.

- Other than this, AMC charges is ₹300 per annum or ₹75 per quarter.

- It offers a Zerodha Kite trading platform that makes it easier for traders to trade across different segments.

- Being a discount broker, it charges the flat brokerage of ₹20 per trade across segments.

Angel One Demat Account

Next comes the Angel One Demat Account. Although the broker is full-service, currently the broker started offering the discount brokerage, iTrade Angel One Plan.

To reap the benefit of hybrid stockbroking services, here are some of the features of the Angel Broking Demat account:

- It provides the provision for both online and offline account opening.

- The broker does not charge any account opening fees and further waive off the AMC charges for the first year.

- Also, from the second year onwards, the broker charges fees of ₹20 per month.

- It offers research reports and other tools for stock analysis for free.

- Angel Broking mobile app and the terminal platform provide seamless to traders to trade across different segments.

- Further, there is no brokerage to trade in the delivery segment. Other than this the broker imposes the fees of ₹20 per trade.

HDFC Demat Account

HDFC Securities is a bank-based stockbroker, offering full service broker services for years. Being bank-based, it is more reliable and assures better services.

Here are some of the features of the HDFC Demat Account:

- Offer services to trade in equity, IPO, and mutual funds.

- It does not charge any fees for opening an account.

- The AMC charges are ₹750 from the second year onwards.

- Other than this it offers different brokerage plans thus providing you an opportunity to trade at a minimal cost.

- HDFC Securities offer mobile, desktop, and trading terminal to offer a seamless trading experience to its users.

Kotak Demat Account

Similar to Angel One, Kotak Securities also offers Trade Free Plan under which it provides broking services at a discounted price.

To open a Kotak Securities Demat account here are the top features:

- Kotak Securities offer a 3-in-1 Demat account.

- It charges zero account opening charges and a minimal AMC of ₹50 per month.

- Other than this, under the Kotak Trade Free Plan, it offers relaxation to intraday traders by charging zero fees to trade in intraday.

- Next, the trading platform of Kotak Securities makes the life of traders and investors easy.

Demat Account ICICI

Here is another bank-based stockbroker, ICICI Securities. Being a reliable banking partner to many it offers the best Demat account services to its clients.

Here are some of the top features of the ICICI Demat Account:

- Provides 3-in-1 Demat account

- Open account at no cost.

- AMC fees vary from ₹0-₹799 depending upon the brokerage plan.

- Provides the NEO plan under which it does not charge any fees to trade in the Futures segment.

- For other segments, the ICICI Direct Neo charges the fee of ₹20 per trade.

NSDL Demat Account Login

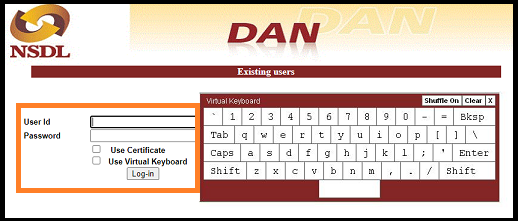

Once you have successfully opened a Demat account, you now need to know the process of logging in to the Demat account.

The NSDL Demat account login process is as follows.

- Open the NSDL website.

- Enter the client ID and Password.

- Click on Submit button.

You would be able to log in to your Demat account successfully. Other than this, you can use the web or trading app of your DP to log in to your Demat account.

There are cases when a user forgot the user id or password. What should you do in such a case? How will you log in? Fortunately, there is a solution for this as well. In a case where you forget the password, you can log in following the given steps.

- When you open the log-in screen of the trading app, click on the ‘Forgot Password’ option.

- Enter your DP ID, user ID, and client ID. Click on ‘Generate OTP’.

- You will receive a one-time password on your registered mobile number. Enter the OTP, and enter submit.

- After the submission of the OTP, a change password screen will appear.

- Enter your new password and submit.

- Once you have successfully changed the password, you can easily log in to your Demat account.

NSDL Demat Account Number

The Demat account number is the client id that makes your Demat account unique. In NSDL it is the 14 digit code preceded by two alphabets IN.

Now the first 6 digit is the Depository number or DP ID i.e. NSDL number that is the same for all the clients holding an account with the stockbroker registered with NSDL.

The rest 8 digits are the client ID that is the unique identification number provided by the depository to its client.

So, if the NSDL Demat account number provided to you is IN45674887676514 then here the IN456748 is the NSDL number while 87676514 is the unique client ID.

NSDL Demat Account Closure Form

In case you are not using the Demat account with NSDL then it is better to close the account. This is necessary to prevent you from the usual maintenance cost.

Here it is important to note that one can close the account with the depository participant only via offline mode.

So, if you are looking forward to closing the account with NSDL then here is the complete process.

- Download the account closure form and fill in all the required details.

- Sign the form at the required places.

- Submit all the unused DP slips.

- Make sure you sell/transfer all the holdings before processing the closing application.

- Along with the form, one must send the written application mentioning all the details like:

- Reason for closing the account.

- DP ID

- Duly signed instruction form.

- Once done send the form along with the application via post or submit it to the nearest branch.

It takes around 7-10 business days to close the Demat account.

NSDL Demat Account Transfer

Now if you want to close the Demat account with any of the stockbrokers registered with NSDL, you need to either sell off the shares or transfer them to another operative Demat account.

Here if another Demat account is registered with NSDL then you can do it simply using the Speed e-Facility of the NSDL. To transfer your shares online, click here.

To use this service, the user has either to be:

- Password user

- Clearing Member.

- Password users need to debit the shares in favour of any specified Pre-Notified Clearing Member account.

- The clearing member must be an e-Token user who can submit instructions in favour of any account.

Other than this, if you want to transfer shares from NSDL to the Demat account registered with CDSL then here you need to follow the inter-depository Demat account transfer process.

Before processing one must consider a few features of the inter-depository transfers:

- Only those Demat shares must be transferred that can be stored in dematerialized form in another depository, i.e. CDSL.

- To debit shares from the Demat account of NSDL one has to submit the ‘Inter-Depository Delivery Instruction‘ form to its respective stockbroker.

- One cannot transfer the Government securities in inter depository Demat account transfer.

For the successful transfer of the Demat account, one must remember the User ID, DP ID, and the password for registration and further for transferring shares.

NSDL Demat Account Benefits

There are many benefits of the NSDL Demat account and also various ways in which it can be put to use. Some of the services of an NSDL Demat account are as follows.

- The Demat account can be used to hold and purchase all kinds of securities, including shares.

- You can use it to apply for an IPO as well.

- You can get a loan against your shares stored in the Demat account.

- You will also get access to all the corporate benefits.

- If you have some physical shares or securities, you can convert them to electronic form and store them in your Demat account with the help of your DP.

- You can also hold your mutual funds in the same account.

NSDL Demat Account Disadvantages

Opening an NSDL Demat account gives you an opportunity to trade across segments. But at the same time, your choice of stockbroker defines a lot about what kind of services you can avail.

Here are some of the drawbacks:

- The technical issues in the NSDL can affect your trade.

- The AMC charges of most of the stockbrokers registered with NSDL are comparatively high.

- There are still many stockbrokers charging high fees for opening a Demat account.

- The trading app of most of the stockbrokers is not technologically sound thus making it difficult for beginners to trade.

Conclusion

When we open an NSDL Demat account, we open a Demat account with a Depository Participant registered with NSDL.

If you want to open a Demat account in NSDL, then you have to approach the DP of your choice and fill the registration form. Along with this, you will also submit proof of identity, proof of address, bank account details, and photographs.

The process is easy, and the benefits are many. When it comes to NSDL Demat account charges, then NSDL is not responsible for directly charging the amount but is done by the intermediary in between.

We hope that the concept of the Demat account with NSDL is now clear to you, and you will not face any problem in opening one now.

More on Demat Account