Paytm Money Demat Account

More on Demat Account

Paytm Money is new in the stock market industry but offering many trading benefits at a minimal cost to traders and investors. For the beginners looking for such a platform, here is the complete review of the Paytm Money demat account.

Paytm Money, a discount broker is the subsidiary of On97 Communications registered with both NSE and BSE thus allowing traders to trade in equity, currency, derivatives, mutual funds, and IPO.

Paytm solely started with a motive to grow more and more and skyrocket their business in a very short time span. And thus has achieved this motive by having good customer base in the shortest time possible. Thus, giving you all a reason to invest with this broker.

To experience trade with Paytm Money here is the complete information of how to open a demat account, and the charges levied to reap their account services.

So, let’s get started.

Paytm Money Demat Account Review

Now to understand the demat account, let’s take an example of the bank. Generally, when you open an account with any of the banks you get eligible to use its different services like investing in FDs, applying for loans, and reap the benefit of smooth financial transactions.

Right?

Similarly, when you open a demat account with the stockbroker, you can trade in different segments, keep your shares securely in the dematerialized form, and can apply in IPO using its trading platforms.

Talking about Paytm Money demat account, the broker offers a 2-in-1 account facility i.e. you can have online trading and demat account.

Along with this, the broker provides a trading app that helps you to trade across segments seamlessly.

Without any further delay let’s know how to open an account with Paytm Money.

Paytm Money Demat Account Opening

In this digital environment where everything is going digital, so as opening a Demat Account is. But before certain formalities are needed to be fulfilled.

- Your name, email id, and mobile number.

- Investors must have PAN Card details, Proof of Address, and Bank Details.

- You need to submit an e-signature for the first time.

- To register with net banking or UPI you must have your bank account details (IFSC and Bank Account Number).

Note: before trading with Paytm Money you need to have a KYC verified Paytm Account.

Eligibility Criteria To Open Paytm Money Demat Account

Here are some of the eligibility criteria to open a Demat account with Paytm Money:

- Residential and non-residential Indians can open a Demat account with the help of a Depository Participant.

- Children below the age of 18 can also open a demat account but with their parent’s consent.

- Joint account opening is another type of facility provided by Paytm Money but the only condition applied is that only 3 account holders can be there.

Paytm Money Demat Account Opening Online

Being a discount broker, the broker offers completely online services to open an account. So, follow the steps given below and start reaping the benefit of trade with the broker immediately.

Visit the Paytm Money website and click on Start Investing.

- Click on Sign-up and then enter your mobile number and email id.

- Once done now create a password. Here it is recommended to create a strong password using at least one capital letter, numerals, and a special character.

- Next enter the Name and Gender.

- Verify your mobile number by entering the OTP send to your mobile number.

- Now upload all the essential documents like PAN card, Aadhaar card etc.

- Enter your bank details to link them with your trading account.

- Now upload your signature and photograph and proceed further toward e-sign.

- Here you need to enter your Aadhaar card number and validate it by entering the OTP send to your registered mobile number.

On verification of all the details, you can access the trading app and start investing without any delay.

Grab the offer of opening a FREE demat account online. Just fill in the basic details in the form below:

Paytm Money Account Opening Documents

As already discussed above, to activate the demat services with Paytm Money you need to upload few documents.

Check out the list below to keep all the details and documents handy thus avoiding last-minute hassle.

Generally, the documents required for a demat account includes:

- Address Proof

- Voter ID Card

- Aadhaar Card

- Ration Card

- e-Utility Bill

- Identification Proof

- Aadhaar Card

- Voter ID Card

- Passport Size Photograph

- Income Proof

- Last 6 Months Salary Slip or Account Statment

- Bank Passbook

- ITR Acknowledgement Slip

All these documents are very important and need your self-testing in order to have a problem-free account opening.

Paytm Money Demat Account Charges

Every service charge some fees and so does the demat account.

Basically, there are two different types of charges associated with the demat account; i.e. Demat account opening charges and AMC charges.

Paytm Money introduces itself as the broker charging the lowest fees and provides an offer of fee relaxation right from the beginning by providing a demat account for free.

Thus, there are no account opening fees.

| Paytm Money Demat Account Charges | |

| Account Opening Charges | Nil |

| AMC | Nil |

| Stamp Paper Charges | Nil |

| Custody Charges | Nil |

| Transaction Charges (Buy) | Nil |

| Off-Market Transactions | Rs 12.5 per ISIN per day |

| Pledge Creation/Closure/Invocation | Rs 32 per ISIN |

| Dematerialization Charges | Rs 250/100 shares + Depository charges |

| Rematerialization Charges | Rs 250/100 shares + Depository charges |

| Modification in CML | Rs 25 per request |

| Physical Statement Courier | Rs 300 per request + Rs 300 courier charges |

Paytm Money AMC Charges

As already discussed Paytm Money offers Zero Annual Maintenance Charges for its investors but the broker charged an annual fee of ₹300 as Annual Platform Fees.

Thus, although there is no AMC you need to pay charges for using its trading platform and other features but still, there are certain fees you end up paying for availing the services.

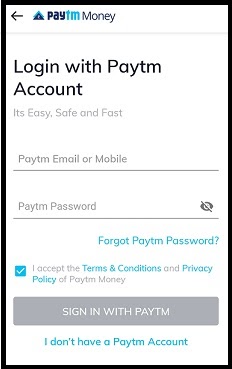

Paytm Money Demat Account Login

Once your account is opened successfully, you can move ahead to use its trading services right away.

To reap the benefit of trade with Paytm Money, the login credentials (user name and password) would be provided to you along with the confirmation email.

You can use the credential to log in to the trading platform and reset the password to make it more strong and secure.

Paytm Money Demat Account Number

Paytm Money Demat account number is a 16-digit number. It is a fusion of Paytm Money CDSL Depository Participant ID and your Client ID. The CDSL DP ID and your client ID are both 8 digits each.

Let us suppose, your Paytm Money CDSL DP ID is 11077700 and your client ID is 77777777. Then your Demat Account Number will be 1107770077777777.

In case you forgot your ID, you can contact Customer Care Services via email, chat, or phone call.

Also, you can easily get the information of your BO ID or client ID also called demat account number in your Paytm Money app.

Paytm Money Demat Account Customer Care

To access and to complain regarding any issue you have to visit the Paytm Money website where you are free to ask any of the queries in written form in the Contact Us section, also, FAQ’s are also present on their website to resolve your issues regarding mutual funds, trading charges and many more.

Paytm Money currently does not have a dedicated customer care number so you can drop an email at exg.support@Paytmmoney.com

If a customer issue is not resolved within 15 days or not satisfied with the services of level 1 then you write to the Compliance Officer.

| Paytm Money Demat Account Charges | |

| Customer care help desk | https://www.Paytmmoney.com/care |

| Compliance Officer | complianceofficer@Paytmmoney.com |

| Email Support | exg.support@Paytmmoney.com |

Paytm Money Demat Account Closure Form

Paytm Money always tries its best to provide the best of its services to its customers but as it is still on the way of making itself sometimes fails to please its customers.

Closing of Paytm Money Demat Account provides the simple and easy steps to do the same.

But before closing, you must check for any remaining balance with Paytm Money. If yes, then you can:

- Use the balance on any Paytm Service.

- Shift funds to another bank account

- Transfer to any other registered Paytm phone number.

To raise an account closure request you need to follow the following steps:

Step1: Visit the official site or download the account closure form here.

Step2: Fill in the details with the client ID, name.

Step3: Also, you will be asked to fill in the reason for closing the account.

Step4: Fill the downloaded form and with your signature and submit it to the head office address.

Also, you can close the account online using its trading app by following the steps below:

Step1: Login to the app.

Step2: Click on the Menu button in the top left corner.

Step3: Now click on ‘Help and Support’, then on ‘My Profile.

Step4: Select the option ‘I need to close/delete my account.

Step5: Proceed further and your account closing request would be generated.

So, if you are unsatisfied with the services then close the account by either of the method mentioned above. This will prevent you from paying the Annual charges for using the platform.

Benefits of Paytm Money Demat Account

Paytm Money provides transparency in all aspects whether its advantage or disadvantages or regarding charges. It’s very important to know all positive or negative facts about any broker.

Investors who are doing trading with Paytm Money can avail several benefits. Here are some of them:

- Paytm Money Demat Account reduces the risk of damage, forgery, or theft of funds.

- The electronic system is very simple to use and less time-consuming in terms of transactions.

- Demat account and bank account can be easily merged for facilitating the fund transfer.

- Loan facility benefit can be availed against the security of the shares kept in your Demat Account.

- You can easily avail benefits associated with the shares including refunds, interest, stock split, rights issue, bonus shares, etc. which gets automatically updated in your Demat account.

- Paytm Money Demat Account offers minimum brokerage charges. This low brokerage attracts more newbies as they won’t lose much of their hard-earned money.

Disadvantages of Paytm Money Demat Account

Paytm Money Demat Account has few drawbacks also. Let’s discuss them before facing any type of loss in the trading sector.

- Paytm Money Demat Account doesn’t offer users, traders, and investors to trade in futures and options. It might be available in the coming future.

- The mobile application, which is currently available on the Play Store, comprises many glitches. The reviews published on the Play store can give you a brief idea.

- The portfolio updating feature isn’t available. You will have to update the portfolios manually.

- Paytm Money Demat Account Does not provide facilities to do commodity and currency trading.

- Above all, facilities provided by Paytm are not available on Paytm Money.

Conclusion

Thus the Paytm Money offers a seamless way to open a demat account and allows you to trade at the minimum cost across segments.

Consider the charges and other required details to avoid any last-minute hassle and start trading smoothly in equity and derivatives.

Start trading now by opening a demat account with the renowned stockbroker online.

More on Paytm Money