How to Sell Option in Zerodha

More on Derivatives

Options trading is gaining momentum with various changes that are making their way in the stock market. With the increasing craze, traders often wonder how to sell option in Zerodha.

Now, option selling might look very bizarre and difficult to understand as a concept but actually is very simple and straightforward. Let us first try to understand what option selling means.

Just like you buy and sell the shares, in a similar way, you buy and sell the option contracts as well.

Let us take an example.

Have you ever been a part of a debate? So, now when you are participating in a debate competition, there are two speakers, one who stands for the motion, and the other one who stands against the motion.

Now, the topic remains the same, but the opinions of the two speakers completely differ from each other.

But now you must be wondering, what is the relation of this with option selling? Just like debate, in options trading, two traders having different market sentiments enter the market. One pays the premium and the other one receives the premium.

The option seller is the one in the option contract who is receiving the premium, which means that the option seller does not have the right to exit the contract of his own will. The option seller is also known as the option writer.

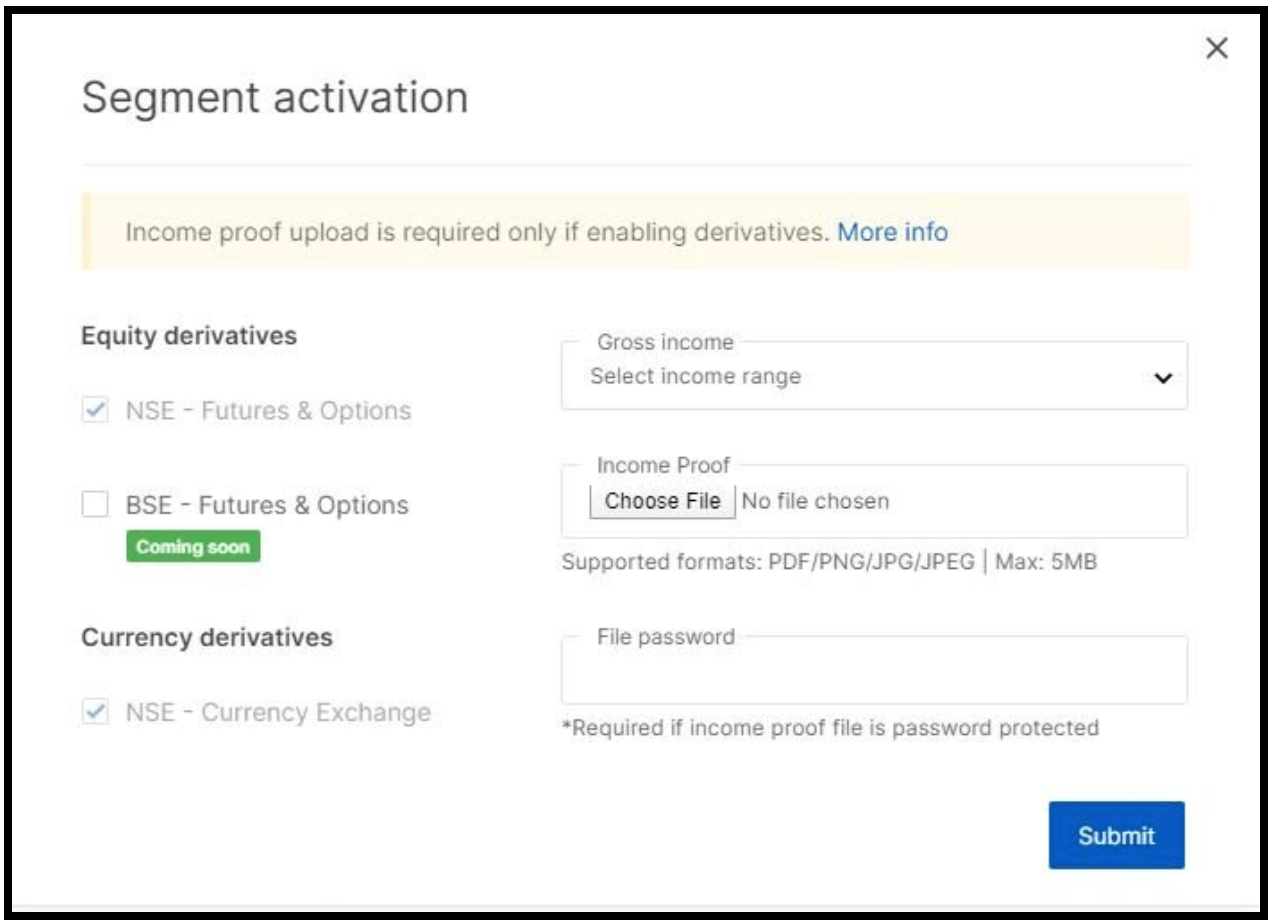

Before doing options trading, it is very important that you activate the segment. Let us now see how you can activate the options trading in Zerodha.

How to Activate Option Trading in Zerodha?

The activation of Options trading in Zerodha is a very simple process and can be carried out in just a few steps.

- Log in to Zerodha Console using your credentials.

- Go in ‘My profile’ and from the drop-down menu, select Activate segment and then the F&O segment.

- Upload the desired income proof.

- Click on submit and your segment will be activated.

How to do Option Trading in Zerodha?

Now that you have successfully activated the derivatives segment in Zerodha, you must be wondering how you can do options trading in Zerodha. For that, you can follow some simple steps.

- Log in to your demat account, using your login credentials.

- On logging in, you will see a dashboard and on the search option, you can search the scrip that you are willing to trade-in.

- You can now do an in-depth analysis by studying the option chain.

- Click, on the strike price that you are aiming for, and select the buy/sell option.

- A pop-up will appear on the screen. Enter the number of lots and other necessary details and click on place order.

Now here we are specifically talking about option selling, so let us now move on to how to do Zerodha option selling.

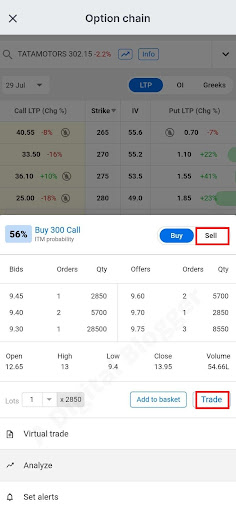

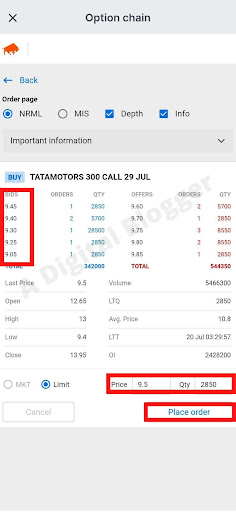

How to Sell Call Option in Zerodha?

Now, when we talk about how to sell option in Zerodha, call option is important for traders going bullish.

In the call option, the buyer is bullish regarding the market, thus pays a premium. If we think of the seller who is actually receiving the premium, what situations can benefit him?

- If the market stays at the same price, then the option seller will benefit as he will take the money out of the premium that he will be receiving.

- If the market goes bearish, then also the option seller will benefit in the case of the call option.

Here to get into the trade, the seller has to maintain a minimum margin and later maintain a non-upfront margin to avoid Zerodha penalty charges.

Let us now have a look, how you can sell call options in Zerodha.

- Log in using your login credentials.

- Now on the search bar, you can search the scrip you want to trade in.

- Now, open the option chain. Here you can see open interest in options, the implied volatility, last traded price, and much more.

- On the left-hand side, you will see the call option. Click on your desired strike price.

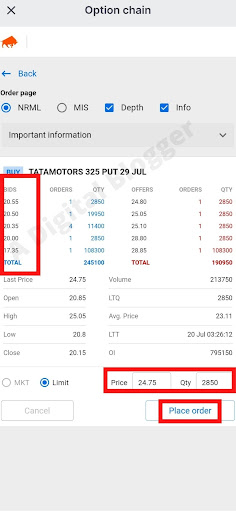

- A window will pop up. Click on the sell option.

- You will see another window. Enter the number of lots, price, and then click on place order.

Your order will be placed.

In case you want to trade in multiple options of the same underlying assets or are using specific strategies then you can trade using basket order in Zerodha.

This help you in executing multiple orders that sometimes reduce the overall margin in options. You can get details of the total used margin in Zerodha under the Funds category.

Here if Zerodha showing negative balance then this is because of T+1 settlement in F&O segment i.e. the amount earned on executing the trade displayed as negative on trading day.

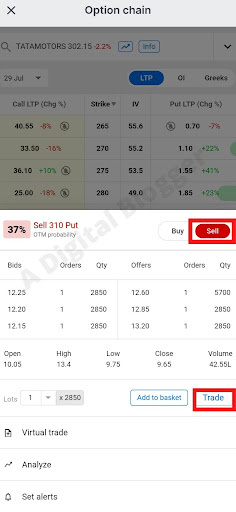

How to Sell Put Options in Zerodha?

Apart from the call, there is the put option and that also is crucial while we understand the concept of how to sell option in Zerodha.

To understand about put option selling in Zerodha, let us take an example:

Now, look at Ashlesha, she is sure that the handloom shop that she owns will soon see high competition as Rahul is also coming up with his shop. This will in the future decrease the demand for Ashlesha’s shop and decrease its prices.

Scared that the new shop might cause a lot of trouble for her, she is willing to sell her shop at the best price. But on the other hand, her friend believes that even though there is some new competition in the market, Ashlesha has the best quality products.

So, now Ashlesha enters into a contract with her friend, wherein she gives the upfront fees and asks her friend to purchase the shop from her for 15 lakhs, no matter where the price moves.

Now, in this case, Ashlesha’s friend is the option seller.

In the case of put option selling, the buyer takes on the role of an option seller as here the buyer is receiving the premium. In what cases the option seller, in this case, will benefit?

- If the market stays flat.

- If the market goes bullish.

Let us now see how you can sell the put option in Zerodha.

- Log in to your account using your Login credentials.

- Similar to the call option, search the scrip.

- Now on the right-hand side of the option chain, you will see the put option.

- Click on the desired strike price and then click on sell.

- You can now enter the price, lot, and click on place order.

In this way, you can easily place your order.

How to Carry Forward Options in Zerodha?

By creating a sell order you take a short position in Options, which only benefits you when the option expires out of the money. In another case, you need to settle the trade as you are obligated to do so.

But like future contracts, is there any way to carry forward options in Zerodha?

Well! the answer is NO.

But if you want to trade at the same strike price for the next expiry then you can exit your current position and acquire a new short position in Zerodha by following the steps mentioned above.

Zerodha Option Charges

Now, whenever you are trading, the first thing that comes to the mind of every trader is the amount of brokerage that will be charged. Let us now have a quick look at the Zerodha sell charges:

| Segment | Brokerage |

| Equity Options | ₹20 per order |

| Commodity Options | ₹20 or 0.03% (whichever is lower) per order |

| Currency Options | ₹20 or 0.03% (whichever is lower) per order |

Apart from this, there are other fees, taxes, and STT charges in Zeordha that differs across segments. To calculate this fee you can use the brokerage calculator Zerodha options.

Zerodha Option Selling Leverage

Apart from Zerodha Brokerage for option selling, people also wonder what is leverage they will be receiving on the option selling. So let us quickly have a look at that.

Every stockbroker gives leverage for options trading and so is the case with Zerodha. But how much leverage does Zerodha give on option selling?

Zerodha gives 2X leverage on exposure margin in option selling. Suppose you have ₹10,000 trading amount in your account, then on getting leverage this amount goes to ₹20,000.

So, now you can trade using ₹20,000 instead of ₹10,000.

Another question that lingers in every trader’s mind is that how much margin is required for option selling in Zerodha? Let us answer this question in the next segment of the article.

Zerodha Option Selling Margin

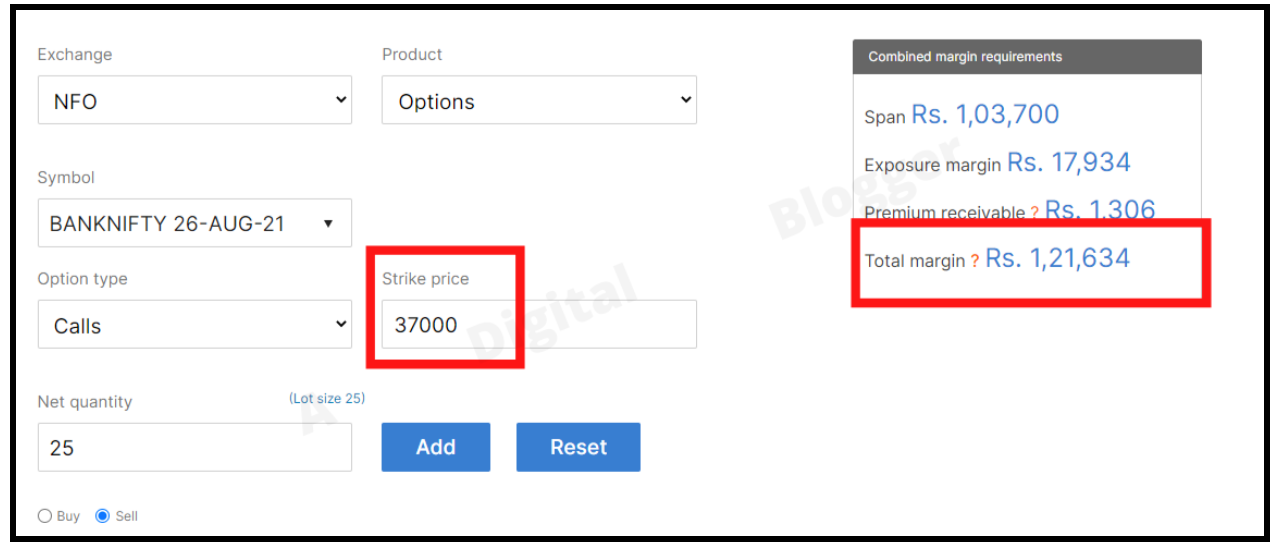

When you are selling an option, you have to maintain a certain amount in your account so that you can trade effectively. In Zerodha, you can have a look at this by using the Zerodha margin calculator.

There are some points that you should keep in mind when you are selling an option.

- The total margin is the margin including the premium that you will receive.

- The margin reduces when you move from the ATM to the OTM option as the premium decreases.

- When you hedge your options, then the margin reduces subsequently.

So, let’s take the example of Bank nifty.

If you are selling the call option of Bank Nifty of 28 October 2021, at a strike price of 36,100, then the total margin required on calculation comes out to be,₹ 1,86,891, which means that you will have to maintain this much amount in your account before buying a call option of bank nifty.

Conclusion

Options trading is the trend that is sooner or later going to gain a lot of popularity in the market. Option selling can be a tricky business but when done with the right mindset can also reap great benefits. So, if you are looking to sell option in Zerodha, we hope that your doubts are resolved by now!

Open your demat account today and start trading: