Zerodha Options Charges

More on Online Share Trading

Zerodha is known for zero delivery trading charges, but when it comes to trade in other trading products like options, then what brokerage is charged by the broker. Let’s get into the detail to check Zerodha options charges.

Zerodha Options Trading Charges

Options trading can be done in equity, commodity, and currency segments. Here the trader buys and sells in lots. Few brokers charge brokerage on the basis of lot size while some are on the basis of trades executed.

So, in which category does Zerodha fall?

Here, being a discount broker, Zerodha brokerage for options trade is charged on the number of trades.

Also, the maximum brokerage is equal to ₹20 per trade.

Here is the detail of Zerodha options charges for trading find different segments.

| Zerodha Option Trading Charges | ||

| Equity Options | Flat Rs. 20 per executed order 0.05% on sell side (on premium) | |

| Currency Options | 0.03% or Rs. 20/executed order whichever is lower | |

| Commodity Options | 0.03% or Rs. 20/executed order whichever is lower | |

Zerodha Brokerage Charges for Nifty Options

Nifty options come under the equity segment. To trade in equity options or indexes, you have to activate options trading in Zerodha

Zerodha charges a fee of flat ₹20 on every executed order. Thus, whatever the lot size or trade value is, you just have to pay the brokerage of ₹20 per lot.

But there are a few taxes and other charges, the detail of which is given below.

| Zerodha Equity Option Charges | ||

| Brokerage charges | Flat Rs. 20 per executed order | |

| STT/CTT | 0.05% on sell side (on premium) | |

| Transaction charges | NSE: 0.053%(on premium) | |

| GST | 18% on (brokerage + transaction charges) | |

| SEBI Charges | Rs. 5/Crore | |

| Stamp Charges | 0.003% or Rs. 300 / Crore on buy-side | |

Similar charges are imposed for buying and selling Bank Nifty options in Zerodha.

Here if you place an options trade using basket order in Zerodha, then brokerage will be calculated on the basis of per trade.

Zerodha Option Brokerage Charges for Commodities

Next to equity, comes the commodity in which you buy or sell the call or put option. Here for each trade you execute, you will be charged 0.03% or ₹20/executed order whichever is lower.

For instance, You buy 100 lots the trade value of which is ₹10,00,000.

Here calculating the brokerage:

Commodity Option Brokerage= 0.03%*10,00,000

=₹300.

However, Zerodha maximum brokerage is ₹20, hence you have to pay ₹20 on trade execution.

| Zerodha Commodity Option Charges | ||

| Brokerage charges | 0.03% or Rs. 20/executed order whichever is lower | |

| STT/CTT | 0.05% on sell-side | |

| Transaction charges | Exchange Taxation charge: 0 | |

| GST | 18% on (brokerage + transaction charges) | |

| SEBI Charges | Rs. 5/Crore | |

| Stamp Charges | 0.003% or Rs. 30/Crore on buy-side | |

Zerodha Option Brokerage Charges for Currency

Zerodha charges a similar fee as it charges for options commodities i.e. 0.03% or ₹20/- executed order whichever is lower.

For example, if you buy 50 lots of 50,000 in options currency. You calculate 0.03% of 50,000 we will get ₹15. You will need to have to pay only ₹15 as it is lower.

Other than this, the taxes detail is given in the table below:

| Zerodha Option Trading Charges | ||

| Brokerage charges | 0.03% or Rs. 20/executed order whichever is lower | |

| STT/CTT | No STT | |

| Transaction charges | NSE: Exchange Taxation charge: BSE: 0.001% | |

| GST | 18% on (brokerage + transaction charges) | |

| SEBI Charges | Rs. 5/Crore | |

| Stamp Charges | 0.0001% or Rs. 10/Crore on buy-side | |

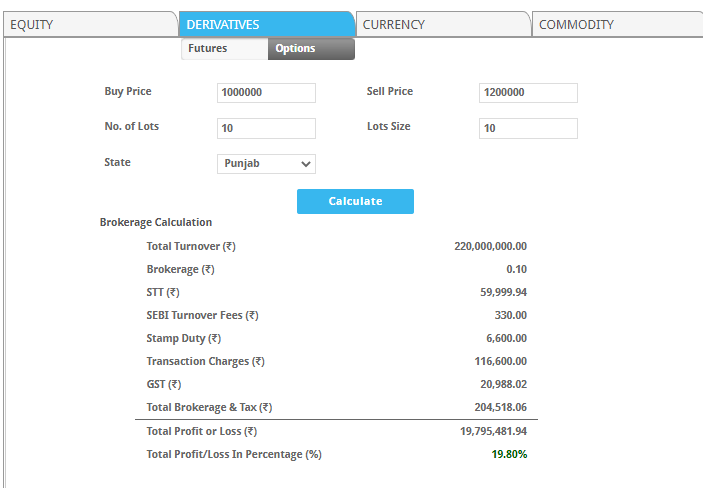

Brokerage Calculator Zerodha Options

Zerodha options brokerage charges calculator is here for you to resolve your query as to how to calculate actual Zerodha Option Trading Charges. It calculates the options brokerage charges for all trades in options, like equity options, currency options, and commodities options.

If you wish to evaluate the Zerodha Trading Charges (brokerage charges) for options, you need to select your trade (options) to calculate its brokerage charges.

This will show you the computed Government tax results, SEBI charges, clearing account, Exchange Taxation charges, turnover, and all that you have to pay on options.

Suppose you want to trade options contracts, you have to put some details, like buy price, sell price, number of lots, lot size, etc. These inputs will show you the total brokerage that is charged upon you for that particular asset.

Conclusion

So, here is the complete information of the brokerage charged by Zerodha to trade-in options. Being a discount broker, Zerodha charged minimum fees of ₹20 and allows you to trade in different segments including commodities and currency in options.

But for better choice, it is always better to do your own research and comparison for the same. For example, check out the detail of Zerodha vs Groww stocks charges and make a decision accordingly.

This is the time to get started and earn maximum profit with the minimum Option trading risk.

Wish to get the Demat Account Open? Refer to the form below

Know more about Zerodha