5paisa Intraday Charges

More on Intraday Trading

Are you planning to opt for 5paisa day trading due to its world-class trading platforms? But, don’t you have complete information on 5paisa Intraday charges?

Well, that’s not going to be a problem as today we are going to talk about its fees in a simple way!

5paisa Intraday Charges List

It’s time that we must look at the complete 5paisa Intraday charges list to know the different kinds of fees that will be levied while trading.

Certain as a 5paisa Brokerage charges will be applicable on each segment including equity, commodity, currency, derivatives, etc.

Besides this 5paisa transaction charges will be imposed while buying and sharing shares from trading to demat account.

Underneath is a complete list of Intraday charges of 5paisa:

- Brokerage charges

- Transaction charges

- Square off charges

- 5paisa STT charges

- Goods and Services Tax (GST), and much more!

Intraday Trading Charges in 5paisa

Once you have opened a trading account and are ready to buy or sell stocks, shares, or any other underlying assets, you will be required to pay some Intraday trading charges in 5paisa.

Under their basic plan, the following 5paisa Intraday charges are applicable to a trader:

Apart from this, the broker provides you the option to trade at the lowest charges by introducing 5paisa brokerage plans. This include 5Paisa Power Investor Pack and Ultra Trader Pack 5Paisa that further reduces the fees to ₹10 per trade.

Also, the plans come up with other features and benefits that make it easier for you to make a profitable trade.

Let’s understand it from the below table-

Along with this low-cost brokerage, certain other services and tools are also offered to Intraday trading such as robust trading platforms, portfolio analysis, advisory calls, and a lot more!

Besides these charges, some other charges are also imposed on intraday traders such as:

Hence, the broking house is believed to offer affordable fees while making traders under intraday trading. These intraday charges are applicable for all the segments including the 5paisa f&o brokerage.

That means if you did intraday trading in futures and options then you need to pay the charges applicable for day trade.

Now, let’s discuss the leverage part!

5paisa Intraday Margin Charges

A majority of the Intraday traders are dependent on the margin. In layman’s terms, the margin is a borrowed money from the respective stockbroker to buy stocks, shares, or any other underlying asset at a higher value available in your trading account.

In return, a trader has to pay interest or a fraction of the total borrowed value.

Let’s have a look at 5paisa Intraday Margin Charges:

5paisa Margin trading is a loan-like feature backed by collateral. Here, in the stock market, the collateral is the stock, shares, and any other underlying security that is brought up to avail margin funds.

Further, 5paisa intraday margin charges are inclusive of the GST @ 18% per annum. The interest gets higher as the final day of the payment is gone. Therefore, the more you delay, the higher interest you have to pay.

5paisa Auto Square Off Charges

5paisa intraday square off charges are Rs. 20 per executed order and such orders are commonly known as MIS orders (Margin Intraday Square-up).

Perhaps, all open orders under the Intraday category are auto squared off by the end of each day with the facility of extra leverage offered by the broker.

Let’s proceed ahead with the calculator part!

5paisa Intraday Charges Calculator

Do you know that you can calculate the charges even before executing the order?

Well, yes! It’s definitely possible!

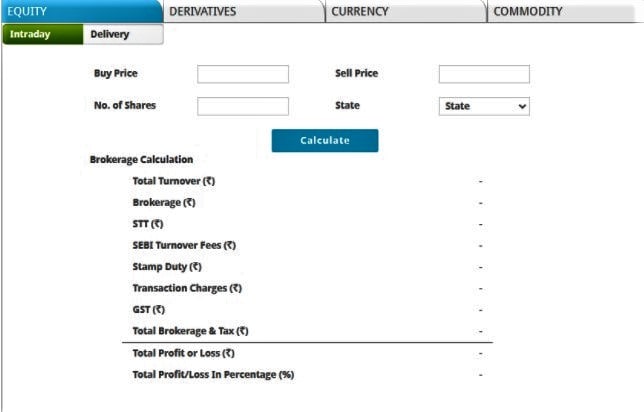

5paisa Intraday charges calculator allows a day trader to calculate brokerage and other charges that will be levied on a particular type of order and stock.

5paisa Brokerage Calculator will give you a clear picture of the charges that are not typically explicitly mentioned. The screen of the same will appear like the below one:

Once you enter all these details, complete information will appear before your eyes on the screen.

Now, let’s quickly sum up all that we have covered!

Closing Thoughts

5paisa is known to be a pretty convenient and affordable online discount broker that has received a number of awards and recognitions for its trading platforms.

When it comes to day trade, the broker proves to be beneficial as it imposes minimal charges as a brokerage charge, which are Rs. 20 per order execution.

These charges are similar across various segments and are levied to the day trader whenever he buys or sells securities.

5paisa Intraday charges also include transaction charges, brokerage charges, GST, STT, margin charges, Call and Trade charges, and a lot more!

Being an Intraday trader, the margin is a key element as most of the trading depends on it. The higher the margin offered by a broker, the higher is the success rate in trading. 5paisa provides 20 times the amount available in your trading account.

Let’s understand it with a quick example– Let’s assume that Mr. X has a 10,000 amount in his 5paisa trading account, and he wants to avail one lakh money to buy shares of a Tata Steel company.

Since 5paisa offers up to 20 times of margin, to buy those shares he can avail margin of 10 times, which can be calculated as:

Amount in Trading account = Rs. 10,000

Margin required= 10x

Margin availed= Rs. 10,000 x 10 = Rs. 1,00,000/-

Before starting your trading journey with any broker, make sure you understand the different charges levied by brokers and make a clear comparison among several other brokers to make a wise decision.

For the same, you can also use 5paisa Intraday charges calculator to depict the rates levied on each trade.

Hope the above information clears your queries around 5paisa brokerage charges. Start trading now by opening a trading account with the firm.

Wish to open a Demat Account? Refer to the form below

Know more on 5paisa