Groww Intraday Charges

Check All Brokerage Reviews

The other day Kunal was very worried about the high brokerage that he has to pay sometimes when he is doing intraday trading. Someone suggested to him that he should have a quick look at Groww Intraday Charges.

If just like Kunal, you are also worried about the Groww intraday charges, then in this article, the majority of your doubts will get resolved. Groww is a discount broker and comes with great brokerage charges when it comes to its competition in the market.

Once you are done with the Groww Account Opening process, these charges and offers will be applicable to your trades.

Let us have a look at the Groww charges so that just like Kunal, you can also resolve your doubts.

Groww Brokerage Charges for Intraday

There is only one plan in Groww and the intraday brokerage charges for the same are as follows:

| Groww Intraday Charges | |

| Intraday Charges | 0.05% of trade or ₹20 (whichever is lower) |

Let us understand this with the help of an example. Suppose Kunal placed a trade of ₹20,000. So, for the brokerage, he will pay either 0.05% of ₹20,000 or ₹20 flat.

0.05% of ₹20,000= ₹10 which is lower than the flat ₹20 fees, so in this case he will pay ₹10.

Now, let us assume that he placed a trade of ₹50,000. In this case, 0.05% of 50,000= ₹25 which is higher than the flat ₹20, so in this case, he will pay ₹20.

Apart from the brokerage charges, there are other charges as well, which form part of the intraday trading journey in Groww. Let us discuss them one by one.

STT Charges in Groww

STT charges or the securities transaction taxes are charged on the buy and sell-side of the Groww intraday charges. The details for the same are as follows:

Groww STT Charges STT Charges 0.1% (buy and sell-side)

If you bought 100 shares of ₹200 each and then sold the same for ₹250 each. In this case, you can calculate the STT as:

100 ×200 ×0.1% + 100 ×250 ×0.1% = 20+25

The STT charges on this trade will be= ₹45

Groww Transaction Charges

Apart from the brokerage charges that a broker levies, there are certain transaction charges that users need to pay as well. However, users need not worry about Grow BTST charges as there are none.

The transaction charges levied on intraday trades in Groww are as follows:

| Groww Transaction Charges | |

| Transaction Charges | NSE- 0.00345% (Both buy and sell) BSE- 0.00345% (Both buy and sell) |

DP Charges in Groww for Intraday

Intraday trading is where you just trade for a day. Now as per the exchange rule, the shares are credited or debited from your demat account in T+1 or T+2 days. Hence in intraday there is no actual debit or credit of shares.

Since DP charges are debit transaction fees hence no such fees is imposed for doing intraday trading in Groww.

Groww Intraday Margin Charges

The intraday traders always look for a good margin. It is usually an important aspect for them. There have been a lot of changes in the margin after the SEBI circular.

So, if you want to make use of the margin facility while trading, then let us have a look at the Groww intraday margin charges.

| Groww Intraday Margin | Groww Intraday margin Charges |

| Intraday Margin | upto 5X (based on stock) |

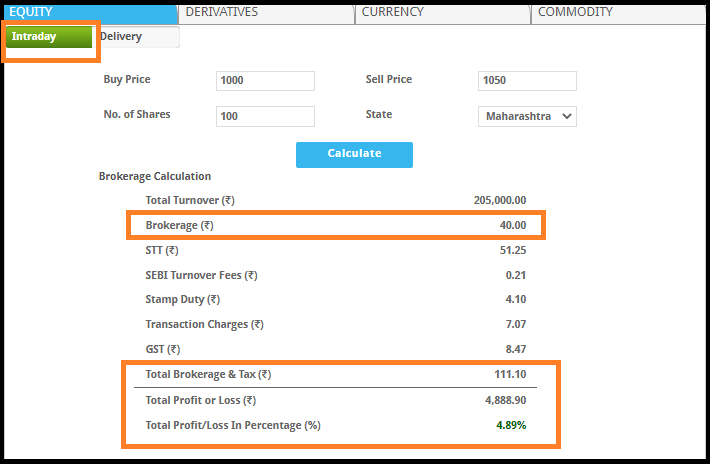

Groww Intraday Calculator

There are certain times when you can face difficulties in calculating the exact brokerage that will be levied on your trade. In such cases, you can use the Groww intraday charges calculator, to find the apt charges for your intraday trade.

Conclusion

Most likely Kunal has his doubts cleared now, we hope that yours are too.

So, if you are looking forward to how to do intraday trading in Groww app then availing the information on its charges is equally important.

Being a discount broker, it makes it easier and profitable for traders to trade more at a minimal cost.

So, if you think that the charges serve your purpose and requirements, open a Demat account with a relevant stockbroker and reap the benefits.

Here is an account opening form for your reference: