How To Do Intraday Trading?

More on Intraday Trading

When it comes to day trading, most of the traders fail to make a profit. Do you know why? Well! this is all because of the lack of understanding and knowledge. To simplify this, here is the information on how to do intraday trading.

To succeed in this, all you have to do is to know what is intraday trading, be patient, and avoid greediness.

So take risks but only when you are ready financially and mentally.

Let’s get started.

How to do Intraday Trading Online?

“Focus, patience, wise discernment, non-attachment – the skills you acquire in meditation and the skills you need to thrive in trading are one and the same.”

-Yvan Byeajee

It is true that intraday trading is risky but at the same time, it is interesting though. As the above quote exhibits, to get profits from your trade, it is important to be focused, patient, keep emotions aside, and then be vigilant for your stock.

Nothing is perfect when it comes to day trade, but when doing intraday trading success, it is up to the traders’ analysis and understanding.

Nowadays, intraday trading has become much easier with advanced charts features and technical indicators available online and in the trading platform provided by the stockbrokers.

The platforms showcase the charts, different patterns, included more than 100 best intraday trading indicators that help the traders to know more about the trend and eventually helps them to make the trade decision.

Let’s consider the following information on the same with the help of Trading View.

- In the Trading View, let’s take the example of Tata Steel.

- Since we need to do analysis for one day, so we open a 1-day chart. You can also set the time limit, minimum up to 1 min to get a better idea.

- For the best analysis click on the indicators option on the top bar.

- The most common and popular indicator among analysts and traders is MACD, Moving Averages Convergence Divergence.

- The ‘Blue Line’ indicates MACD whereas the ‘Red Line’ is a Signal Line.

- Here the crossover of the MACD and signal line gives an idea of the trend, as when the MACD line (blue line) crosses the signal line (red line) from below, it depicts a bullish signal and vice versa.

- For better use know the best MACD setting for intraday.

- To get accuracy over the analysis, it is better to choose a few more indicators to come to the point. So let’s say you picked the moving average of 9days.

- The simple moving average of 9 days if crosses above the opening price signal the bullish trend, while if it crosses below the opening price gives the signal of a downtrend.

- There seems to be a bearish crossover on MACD, and the Moving Average is above the opening price of the stock, it is the right time to sell the stock.

- The right time to buy stock in between when there is a bullish crossover on MACD and when the Moving Average is passing from above the closing price

- Thus, using both the indicators and comparing their signals gives you a better idea of entry and exit points, hence helping you in making a profitable trade.

Once you gain an idea of the process of doing intraday trading, now comes the question of what options are available to do intraday trading online in India.

Other than MACD there is another indicator, ADX that tells the trader about the strength of the trend. Learn how to use ADX indicator for intraday trading and make the best use of tend and charts to gain more profit.

How to do Intraday Trading in India?

When it comes to intraday trading in India, there are many stockbrokers offering the services by opening a trading and Demat account for FREE.

Here it becomes important to choose the stockbroker offering the best trading platforms and other services at the minimum brokerage.

Well! When it comes to intraday trading charges, many traders prefer to pick discount brokers. No doubt! There are many like Zerodha offering one of the best intraday trading apps like Zerodha Kite that makes it simpler for the trader to analyze the stock and to do trading seamlessly.

But at the same time, since it is a discount broker it does not offer technical reports and other advisory services that could help you in getting an idea of which stock to trade in.

So, if you are a beginner it is better to choose a full-service stockbroker.

Now every stockbroker has a different user interface of the mobile or desktop app and hence here we are with a brief demonstration of how you can make use of the different trading apps to do intraday trading.

To get into the trade, open a Demat Account for Free!

How to do Intraday Trading in Zerodha?

Being a discount broker, Zerodha allows trading in various segments. Incorporated in the year 2010, the broker is registered with CDSL and provides trading in NSE, BSE, and MCX.

In day trading, the trader can execute the orders with different trading platforms, including Zerodha Kite as a mobile app and desktop app.

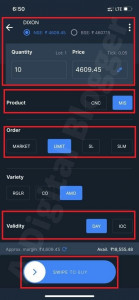

Now, if you want to know how to do intraday trading in Zerodha, then it is time to check the following steps.

- Choose a scrip you want to trade-in. Do proper analysis as discussed above.

- Fill in the necessary options like ‘Quantity’ (number of shares to buy), ‘Price’ (if selected the limit order) ‘Product Type’ (MIS), ‘Order Type’ (Limit, Market, SL, or SLM), and ‘Validity’ (Day, IOC, i.e., Immediate or Cancel).

- At last, Swipe to Buy, and the order will get executed.

- Similarly, you can place the sell order in the Zerodha intraday trading.

If you feel the stocks prices have fallen down, it is the right time to put Zerodha stop loss to reduce the risk and losses in intraday trade.

How to do Intraday Trading in 5paisa?

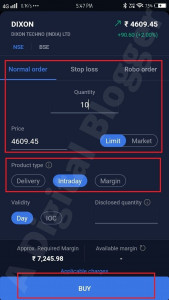

Like Zerodha, there is another discount broker 5paisa offering a highly advanced and easy-to-use trading app.

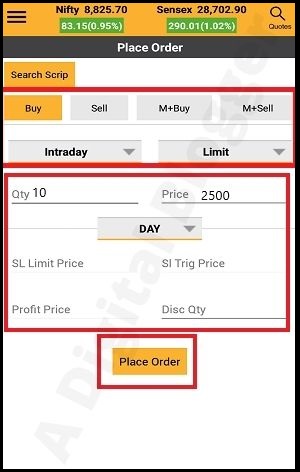

So now, if you are thinking of how to do intraday trading in 5paisa, then it is the correct time for referring to the following steps.

- Enter the 5paisa app, and select a stock you want to trade-in.

- Select ‘Intraday’ and fill in the ‘Quantity’, i.e. the number of shares you want to buy of a particular scrip, along with the ‘Price’ (if the limit order is selected).

- Choose the suitable ‘Order type’ and at last click on ‘Buy’ to execute the trade with 5paisa.

How to do Intraday Trading in Upstox?

Likewise, Upstox being a discount broker, also allows intraday trade in various segments, be it equity and derivatives. Furthermore, if talking about the background, then it can be seen that the broker entered the game in 2012 and allows trading with various stock exchanges like NSE, BSE, MCX.

With its trading platform, Upstox offers traders the opportunity to trade efficiently by using the features and gain efficacious profits.

For that, let’s proceed to know how to do intraday trading in Upstox with its mobile trading app. So now, let’s dive more into the following steps.

- After selecting a scrip, like all other apps, Upstox Pro will also ask for various desired pieces of information like Product Type (Delivery/Intraday), Quantity (No. of stocks), and Order Type (Market/Limit).

- And now, click on ‘Review Order’ to buy a stock.

To minimize the losses in intraday trading, there are many advanced order types options like Stop loss, cover order, bracket order that minimizes the losses during the day trade.

To make the best use of these order types learn how to set stop loss in intraday trading?

With the right strategy, you can make the best use of the opportunity in intraday trading.

How to do Intraday Trading in ICICI Direct?

Here comes the full-service bank-based stockbroker ICICI Direct that allows the trading facility in every single segment. Basically, being a part of ICICI Securities, ICICI Direct is registered with the exchanges like NSE, BSE, MCX, and MSEI.

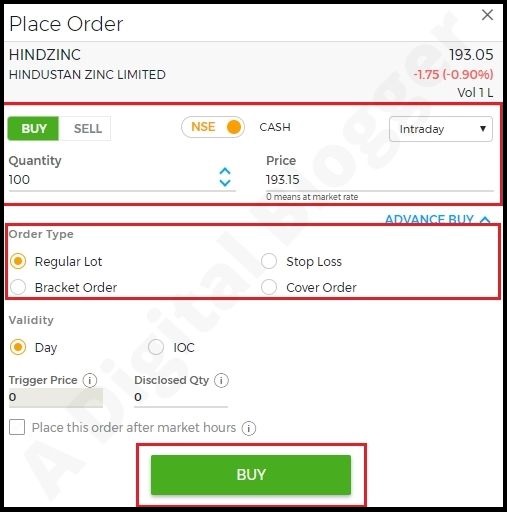

Now, if we have to check the procedure of how to do intraday trading in ICICI Direct, then it is time to review the procedure to execute the trade.

For that, let’s check the following steps to execute intraday trading eloquently.

- Open the trading platform of your choice, be it a mobile app, desktop app, and web terminal, to execute the order.

- Enter the ‘Product Type’ as ‘Intraday,’ ‘Name of the Exchange (BSE/NSE),’ ‘Name of the Stock.’

- Furthermore, fill the ‘Quantity,’ select the ‘Order Validity,’ ‘Order Time,’ and ‘Stop-Loss’ (if you want to exit at a specific price to lessen the losses).

- And at the end, ‘Buy the Order.’

Becoming a part of a famous bank automatically raises the expectations of the traders and investors for trading with ICICI Direct. Henceforth, the broker presents the services likewise.

How to do Intraday Trading in Angel Broking?

Angel Broking is now on the list of hybrid brokers as it offers full-service brokerage services at a discounted price.

Furthermore, Angel Broking allows the trading in various segments under intraday trading by offering different trading appls like

If taken Angel Broking mobile trading app into consideration, then the trader can execute the order with the following steps.

- Select the scrip and enter the ‘Quantity’ of the stock that is to be purchased.

- Enter the ‘Order Type’ and enter the ‘Price’ if the ‘Market Order Type’ is selected.

- Select ‘Intraday as a ‘Product Type.’And then click on ‘Buy.’

In case you automatically want to exit the order, in that case, let’s put a stop-loss order. For that, refer to the following information.

Mention the ‘Trigger Price’ on which you want to exit the order; as for the reference, the given trigger price is set at ₹4599.

This means the order will automatically get to exit once the share price touches the mentioned trigger price to reduce or maintain the losses.

The trading becomes fluent and easier with the facilities offered by the broker in its trading platform.

How to do Intraday Trading in HDFC Securities?

HDFC Securities is a renowned name as it is connected to India’s best banking service, HDFC, and was incorporated in April 2000. As mentioned about intraday trading earlier, the bank-based full-service stockbroker also comes to the forefront to provide the services in Intraday Trading.

Now, if you want to know how to do intraday trading in HDFC Securities, then it could be an excellent time to start the discussion by referring to the following steps.

- Choose the stock in which you want to trade-in. Make sure that you have learned about how to choose stocks for intraday before doing that.

- Select the transaction (Buy/Sell) and exchange type (BSE/NSE).

- Now, select the stock and add it to the ‘Symbol’ segment.

- Fill in the Quantity and Order Type.

- Click on ‘Pave Order’ to execute the order.

The app is handy and offers various facilities to its customers so that trading became easier and fruitful in providing profits to the traders.

How to do Intraday Trading in Kotak Securities App?

Being active in providing services to the people, Kotak Securities is providing benefits to the customers and hence allows trading in various segments in intraday and delivery and was established in the year 1994. By connecting to the broker, one can easily trade with major stock exchanges of India, i.e., NSE and BSE.

So now, if you are thinking of trading intraday and at the same time want to open a Demat account with Kotak Securities, then let’s shed some light on how to do intraday trading in Kotak Securities.

For that, let’s refer to the following steps to proceed:

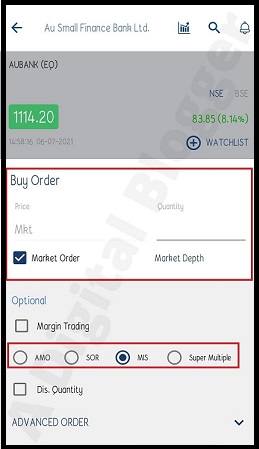

- Select the scrip you want to trade in. after that, it is important to fill in the necessary information according to the preferences like Price, Quantity, Product type (MIS).

- After filling in the information, click on ‘Confirm’ and the order will get executed.

How to do Intraday Trading in Motilal Oswal?

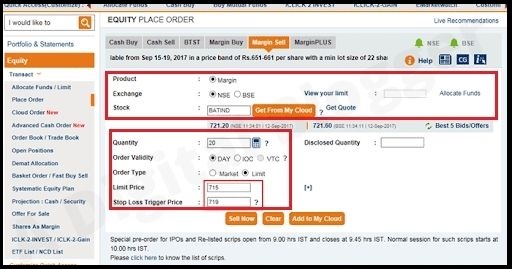

Motilal Oswal comes into the game in the year 1987 under the full-service stockbrokers and is a depository participant of both NSDL and CDSL, and it allows the traders to execute the orders in intraday trading.

To offer a seamless trade experience, MOSL offers two different apps created explicitly for traders and investors as MO Trader and MO Investor, respectively.

Additionally, the broker offers other Motilal Oswal trading platforms to the customers, like Motilal Oswal Orion Lite (desktop) Motilal Oswal Trade (web).

Now, if the curiosity is hitting you hard to know about how to do intraday trading in Motilal Oswal, then it becomes more important to check the following steps to learn more about it in detail.

- At first, select the scrip in which you want to trade in.

- Afterward, it is the time to select and fill in the necessary information like Product Type (Normal/Delivery/Value Plus/Margin Plus), Motilal Oswal Order Type (Limit/Market/Stop loss), Quantity (number of stock to buy).

- Lastly, click on ‘Place Order’ to execute the order.

How to do Intraday Trading in Groww?

Being a newcomer in the industry, Groww is proving its virtue by providing a simple app with limited features that only allow the newbies to begin the experience in the share market.

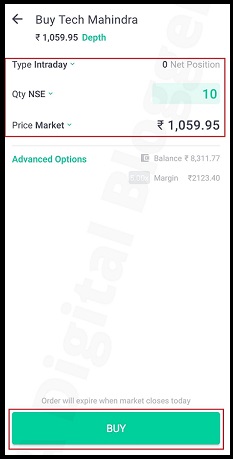

In case, you are thinking of how to do intraday trading in Groww; then it is the right time to break the snoopiness by referring to the following steps of using the Groww app for executing the intraday trade.

- After selecting the scrip, click on Intraday trading.

- Afterward, set the ‘Price’ depending on the order type selected as here ‘Market Order’ is selected, and the stock will be purchased at the current market price of the stock.

- At last, click on ‘Buy’ to execute the order.

The drawback that can be seen in the app of Groww is the unavailability of various features like stop loss and very limited peculiarities.

Hence, it is clearly stated that Groww can be a suitable option for beginners to learn intraday trading and other formats from basics, whereas, in the case of experienced or experts, it would be a challenging app to use for efficient returns and meticulous analysis of stocks.

How to do Intraday Trading in IIFL?

IIFL Securities is a full-service broker that entered the stock market in 1995 and offered to trade with NSE and BSE. At the same time, the broker also allows trading intraday and at the same time helps in maintaining the portfolio in a precise way with different IIFL App.

To know how to do intraday trading in IIFL, refer to the following steps.

- Select the scrip and Intraday as ‘Product Type’ and then move to the Advanced section, where you will find additional information that is to be filled.

- It is easier to select the Limit, Market, Cover, Bracket, Stop-loss order from the given options.

- Here comes the time to fill in the Quantity, Stop Loss Price.

- And at last, click on the ‘Buy’ option to execute the order.

How to Avoid Losses in Intraday Trading?

Intraday trading is risky and therefore one needs to gain expertise in the day trade.

Well, when it comes to becoming an expert it takes time and of course practice, which again comes with lots of failures.

One should not get disappointed if not able to make enough profit in the beginning but at the same time, it is good to look for different options that can minimize the loss in intraday trading.

To avoid losses in intraday trading, you can use the right intraday trading strategy like RSI strategy for intraday trading and can further execute the order using the advanced order types options like:

- Stop loss

- Cover order

- Bracket order

Let’s dive into a little detail to understand what these order types are and how you can use them to minimize your losses.

Stop Loss

As the name goes, this order type stops or limits the losses in the trading.

Stop-loss order is thus defined as the price value set by the trade below or above the buy or sell price respectively when the market trends go against your analysis.

Since one can go both long and short while doing intraday trading hence there are two different types of SL order:

- Sell Stop Loss: Here the stop loss value is less than the entry price of the stock.

- Buy Stop Loss: The stop loss value is more than the entry price of the stock.

When it comes to intraday trading you have to be very choosy in picking and setting the stop loss at the right value.

How to Calculate Stop Loss?

Although stop-loss helps you in minimizing the losses during the trade but setting it at the right value is even more important as:

- Setting the selling/buying stop loss too low/high can lead to huge losses in case the trend reverses.

- Also, if the stop loss is set near to the entry price then one would exit the trade at the earliest thus preventing them from making a possible profit.

Now comes the question, how to calculate the stop loss?

There are again different methods:

- Percentage Methods

Where you can set the stop loss by evaluating the percentage of loss that you can bear. For let’s say, buying the stock at ₹100 and choosing the stop loss to be set at 5% i.e. 95. Thus, here you can bear the maximum loss of ₹5 per share.

- Support and Resistance Level

Now percentage method is quite manual as it is generally done on the basis of your potential of minimizing the losses. For a better way, you can calculate the stop loss by using the support and resistance level.

For this just check the last support or resistance level to set the stop loss.

For example, for setting sell stop loss look for the support level, let’s say it is ₹93, ₹90, and ₹94.5 thus on the basis of analysis you can set the stop loss a little below the support level i.e. around 92.

- Moving Averages Method

Last comes another method, moving averages, where using the short-term moving average helps you in calculating and setting the stop loss value.

For setting a sell stop loss, enter the price slightly below the moving average value while for the buy stop loss, it should be a little higher than the moving average.

So, do your analysis and pick the right method to enter the right stop loss value to minimize the losses.

Bracket Order

Along with the stop-loss order, there is another order type, bracket order.

Bracket order, simply means, enclosing your complete order by specifying the entry price (limit or market order), target price, and stop-loss price.

So considering the above situation where you enter into the trade by buying the stock at ₹100 and setting the stop loss at ₹5, here one can play safe trade by booking the profit by defining the target price.

To define the right target price, one should set it 1.5 times the stop loss i.e. 1.5 times of ₹5 (₹7.5).

Thus, the target price for that particular trade would be ₹107.50.

Cover Order

Last, but not least, the cover order is the advanced order type that covers your losses by allowing you to make the entry at the specified price (limit order) along with the stop-loss price.

Thus here you just need to define two price values depending upon your analysis and the risk appetite.

It reduces the risk of the trade and also gives traders an option to enter the trade only when their specified price point is reached.

How Much Money is Required for Intraday Trading?

So, in all, we discussed what intraday trading is, how to do intraday trade using different stockbrokers’ trading platforms.

Also, we talked about how to reduce losses in the day trade.

But what we forget to discuss is what is the minimum amount you need to trade in intraday?

Of course, you might have thought about it. Didn’t you?

So yes, when it comes to the minimum amount to invest in stock market in India, there is no specific norm or protocol for the same in the share market.

In fact, you can start with as small as ₹1.

Of course, you will trade with a little more amount but again it depends upon your trading decision, the stock you pick, the quantity of trades, number of trades and the loss you can bear in case the trend reverse.

So, think strategically and start trading intraday right away.

Don’t forget to check your pockets before beginning.

Conclusion

Thus, doing intraday trading involves lots of knowledge and experience. Start with a small amount to get a better understanding of the market trend and different indicators.

This will help you in gaining knowledge and at the same time in keeping your losses under your control.

For the best experience, you can choose the stockbroker offering the advanced trading platform with minimal intraday trading charges.

Compare the services of the brokers and open a Demat account now.

Looking for assistance, now open a Demat account for FREE!

More on Share Market