How to do Intraday Trading in Kotak Securities?

Check All Frequently Asked Questions

Intraday trading has been an area of immense interest for a lot of years now. So, if you are having a Kotak Demat account you can trade smartly by using the advanced trading platforms of the broker. In this article, we will look at how to do intraday trading in Kotak Securities App.

Let us have a look at the steps that you should take when you want to do intraday trading in Kotak Securities.

How to do Intraday Trading in Kotak Securities App?

For those traders who are wondering how to do intraday trading online, Kotak Securities comes up with advanced trading app like Stock Trader, Keat Prox, and Kotak Trade Smart that can make work easier for the traders.

Here are the steps you should follow to trade intraday across segments.

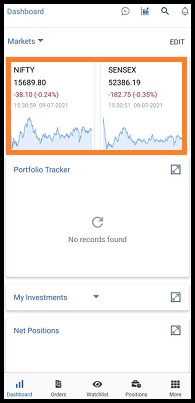

- Login to your Kotak Securities trading platform, using your login credentials.

- The dashboard opens where you can view the SENSEX and NIFTY to analyze the market condition.

- You can now analyze the stocks and see the market depth before investing in a stock.

- The best way to do intraday trading is to do an in-depth technical analysis of the stock.

- Once you have analyzed the stock, it is easier for you to buy/sell your stock.

- You can use the watchlist feature to enlist all the stocks in which you are willing to trade. This makes it easy for you to track their performance.

Let us now have a look at how you can buy or sell your shares in the intraday segment of Kotak Securities.

If you are thinking of buying shares in Kotak Securities, then you can follow the given steps for the same.

- You can analyze the stocks and add them to your wishlist so that you can easily keep an eye on them. You can search the scrip and simply add it to your watchlist.

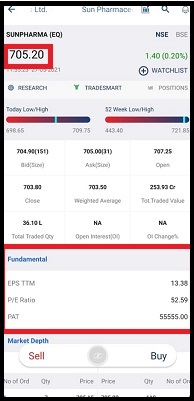

- You can then study the stock properly as the information is displayed in the app.

- So here let’s say you want to trade in Sun Pharma. Click on the scrip Then click on the ‘buy’ option.

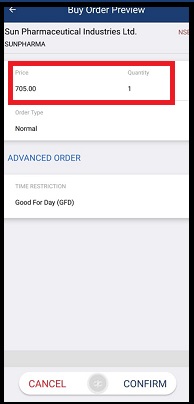

- When you click on the buy option, a new window will open. Fill in the price and quantity in this.

- You can opt for a market order to execute the order.

- Other than this you are provided with an option of an advanced order type that gives you multiple choices to trade intraday.

- Now you can easily choose your order type and can also place a stop-loss order. Once you have done this, click on confirm.

- You are doing intraday trading here so you have to choose the MIS option and click on confirm.

- You need to ensure that there are sufficient funds in your account to carry the trade.

- Your order will be placed as soon as the payment is done.

Similarly, you can also sell the shares in Kotak Securities very easily.

- Just like while buying, you can sell scrips either to do shorting or to square off your position.

- After the stock selection from the watchlist, click on the sell option.

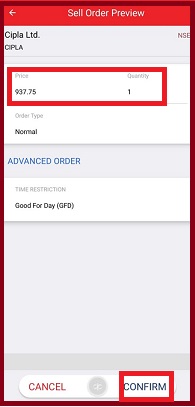

- After this, a selling window will open wherein you will be required to enter the price and the quantity that you wish to sell. You will also see an option for advanced orders.

- You can choose your order type and then click on confirm.

- Tick the MIS checkbox for the intraday segment. Also, you can opt for the buy stop-loss order in case you opt for shorting to avoid losses.

- You will now see a confirmation page. Review your order and click on confirm.

Following these simple steps, you can easily buy/sell using the Kotak Securities app.

How to Put Stop Loss in Kotak Securities?

Along with intraday comes the risk because of high volatility and therefore it becomes important for traders to put stop loss.

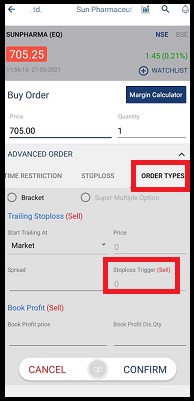

To put the stop loss, just click on advanced order types and enter the trigger price.

Now here, the stop loss value varies according to the type of trade you execute. For buy stop-loss, the trigger price should be more than the current market price while for the sell stop loss, the trigger price is less than the CMP.

To get a better understanding let’s assume the example of the screenshot shown above. Let’s say you buy Sunpharma shares of ₹705.25. You are bullish for the stock but to keep yourself on the safe side, you make use of the Stop-loss order.

Here as you are buying stock, thus you place the sell SL order at a value less than the buying price. So let’s suppose you can bear the loss of ₹5 per share thus you enter the stop loss value of ₹700.

If the stock price drops and reaches the SL value, then the order gets triggered and you would be able to exit the trade without facing much loss.

On the other hand, if you are shorting or selling the stock then you enter the buy stop-loss which is higher than the selling value.

So, in the sell order example of Cipla, if you sell the share at ₹937.80 using the stop loss order then the buy stop-loss order would be more than the selling value.

If here again, you can bear the loss of ₹5 then the stop loss would be at around ₹942.

In this way, you can make use of different order types to prevent yourself from much losses during the day trade.

Also, you are provided with the trailing stop loss option thus you can define the percentage of profit or loss you can incur. Here you can minimize the losses. So here if the stock price moves in your favor then the stop loss value changes by the value defined by you.

Suppose for the sell stop-loss order you added a trailing stop loss of 1% than with the rise or fall in the share price by ₹1 the stop loss changes by 1%.

So, in case the price moves in your favor, the stop loss trails accordingly thus preventing you from facing major losses.

Kotak Securities Intraday Charges

Kotak securities have introduced a Kotak Trade free plan, that charges zero brokerage for its intraday trades.

(Note- An amount of 1 paisa per scrip is charged just to maintain the regulatory measures).

The Kotak Securities intraday charges are as follows.

You can also use the Kotak Securities Brokerage calculator to easily calculate the brokerage easily.

Conclusion

The new Trade Free Plan of Kotak Securities opens the gateway for intraday traders to trade at zero cost. Along with this, the user-friendly interface has made it easy even for the newbies to trade effortlessly across the segments.

Apart from the app mentioned above, you can download the new and advanced beta trading platform Kotak Securities NEO. The different and highly advanced charts in the app help you in analyzing stocks and at the same time, placing orders in few taps makes it easy for you to do multiple trades during the day.

Follow the above-given guide to make the best use of the trading app to place intraday orders in Kotak Securities.

Not having a Demat account yet? Get it now. Just open the Demat account for FREE!

More on Kotak Securities