Intraday Trading In Options

More on Intraday Trading

Many traders wish to commence Intraday Trading in Options but are sceptical about it due to the lack of information. So, we thought of bringing all the necessary information in this article.

Before that, let’s break the phrase into terms and understand them individually.

Let’s begin the concept with the understanding of intraday trading?

Intraday Trading is a trading style that requires the trader to buy and sell particular security in the same trading session i.e. buying and selling (or vice versa) are happening the same day. The trader might own it for a few seconds, minutes, or hours, but not overnight.

Next is Options that are a financial segment traded on various stock exchanges. It comprises a contract that gives the buyer or seller the right, but not an obligation, to sell an asset.

The contract has an expiration date and is signed for a future date.

The price is mentioned according to the negotiation between the buyer and seller. The party that pays the premium for the contract is the one that has the right to cancel the contract when it expires.

Thus, giving one party the option to cancel. Hence, the name – Option.

So, when you trade in the options segment while squaring off the trades the same day, it is called Intraday Trading in options.

As the phrase has been understood in-depth, we should move ahead to learn what to keep in mind while day trading with options.

Day Trading With Options

The process of intraday trading in options is the same as that of normal intraday trading (which also has its own set of intraday trading rules too). However, in normal circumstances, there are quite a few differences between Option Trading Vs Stock Trading.

There are two significant aspects to look for – Trade Volume and Price Fluctuations.

Let’s discuss them in detail.

1. Trade Volume

Volume refers to the total number of traders who are buying and selling any particular asset over a given duration of time, which in this case is a day. A higher volume translates to the asset being more active in the share market.

When you have data that denotes the volume of an asset on your trading screen, it means that it is readily available for trade. Almost every website dedicated to financial information equips its users with the volume of assets.

So, as you are selecting an asset to trade, make sure to check its volume so that you have the freedom to sell it off whenever you want quickly and do intraday trading in options with utter ease.

2. Fluctuation in Stock Prices

Expecting huge fluctuations in the share price during a day is like wishing for the bright sun in winters. It means that it is improbable but not impossible.

But, there are financial securities that have such wavering prices that, if you choose to invest in them at the correct time, they will help you in making huge profits in one day.

The majority of retail traders trade in the stock options on an intraday basis. It is an undeniable fact that options are volatile. So, when you sense an opportunity to make an intraday trade, you take it and make the best out of it.

Short term traders and, more precisely, intraday traders look for price shifts in intraday shares and several other technical charts to find out the best time for entering and exiting the trade.

When this analysis is concluded, trading strategies are implemented accordingly and then exploit the price of the asset in the short term. The strategy for intraday trading in options is similar to the ones used for day trading.

Since the prices of options don’t move as fast as that of underlying stocks, the traders keep an eye on stock price fluctuations and play on this thin line.

These fluctuations help them figure out the time gaps where the price is not in sync with the current price of the asset.

It is at this moment when they make a move and earn huge profits.

Now that we have a brief understanding of the two important aspects of day trading in options let’s move to the discussion of the two types of Options Trading – The call Option and Put Option.

Day Trading Call Options

Before we understand day trading in Call options, let’s know what Call option is?

The definition of Call Option is that the seller feels bullish about a particular asset and thus enters an options contract with a buyer that is bearish about the same. The seller pays the nonrefundable premium in this transaction.

As the seller pays the premium, he has the right, not the obligation, to execute the trade at the end. The contract will be executed at the seller’s will, and the buyer gets no say in this.

If a trader buys and sells the options contract on the same day, it is said to be intraday trading in options.

Intraday Trading Put Options

Understanding the basic concept of Put Options is necessary to carry out intraday trading in Put options. So, let’s go!

Put options are a type of options contract where the seller of a particular asset feels bearish about it and thus enters an options contract with a buyer who feels bullish about the same.

Here, the buyer pays a non-refundable premium to the seller to finalize the deal.

As the buyer is paying the premium, it is his right and not an obligation to execute the contract on the expiration date. The contract is executed at the will of the buyer and not the seller. The seller gets no say in this regard.

This trade is known as intraday trading in options.

Day Trading Options Strategies

Day trading options strategies are extremely important as they help you stay calm during times of market volatility. Moreover, to row past an unforeseen price fluctuation, you must stick to your trading strategy and not let emotions take the best of you.

Thus, below are some commonly used strategies in intraday trading in options that will guide you while trading in the share market. Let’s go!

1. Long Call

This strategy is suitable for traders who are confident or bullish about a particular financial asset, ETF, or share market index and wish to limit risk. The potential loss in this strategy is limited to that of the premium.

Further, the potential profit is unlimited as there is no limit to how high the prices may rise.

2. Long Put

Long Put is an amazing strategy for traders who feel bearish about a particular index, ETF, or stock. This strategy exposes you to lesser risk than that in the short-selling strategy that can lead you to have stress free trading.

A trader uses this strategy when they want to take advantage of the falling prices by utilizing margin.

The potential profit is capped at the underlying price as the price can not drop below zero, and the potential loss is limited to the premium paid for the options.

3. Covered Call

This trading position is favorable for traders who expect a slight increase or no change in the price of the underlying asset. Further, they are willing to limit upside potential in exchange for downside protection.

Short call options can be used in the case when the share price increases above the strike price before the expiration. In addition to exchanging this risk, the strategy provides limited downside protection as a premium when you sell a call option.

4. Protective Put

Protective Put is very close to the Long Put strategy discussed above. But it varies in only one aspect, which is the goal. The goal here is downside protection.

When a trader owns a financial asset that they are bullish about, they wish to protect it against a decline.

If the price of the underlying asset remains the same or rises, the loss is limited to the premium paid. However, if the prices drop, the loss will be limited to the difference between the initial price and strike price plus the premium paid.

These trading strategies are preferred and used by many traders according to their financial goals and plans. Now, let’s learn about some of the day trading options rules that may become your goal based investing strategy.

Day Trading Options Rules

Some of the important day trading options rules are listed below:

- Manage your risk cautiously – Don’t hold a position that might cause you a massive loss in the worst-case scenario.

- Use Option Greeks to analyze and manage risk in options trading.

- Options are a financial instrument that reduces risk and should be used like one. Don’t use it for gambling, as it might turn the tables against you.

- Never let an unprecedented event wipe out your trading account. Stay alert and keep your emotions aside.

- Be alert about the number of contracts you enter as it is very easy to overtrade in the case of inexpensive contracts.

- A market is a place that works on strategies, and ‘Hope’ is the worst strategy. If you see a risk in a position, reconsider holding it. Analyze it deeply to avoid any losses in the long run.

- The market does not work on miracles. Don’t buy options just because they are inexpensive. The chances are negligible, not zero but negligible.

- You must try to limit your losses. It can be achieved by buying one option for every option that you are selling. It means that selling spreads rather than naked options.

- Selling your naked option position is less risky than buying a stock but just like every financial instrument has a downside risk, naked options are no exception.

Having learned about the various strategies and rules of share market, let’s learn how to do intraday trading in options.

How To Do Intraday Trading In Options

Suppose you are a day trader and want to commence day trading options or an options trader and willing to switch towards intraday but are scared of how to do it.

Well, we are here to rescue you from the fears and guide you through the complete process.

Let’s understand the complete process of intraday trading in options with an example of a mobile trading platform Kite from Zerodha.

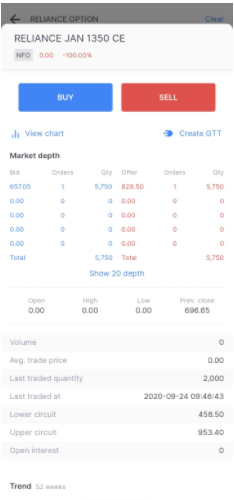

Once you log in to your account, search for the options you wish to trade. Suppose you want to trade the Call Option of Reliance Industries. When you click on it, a pop up opens with all the relevant information about the trade.

A snapshot of this is attached below:

The next step to analyze the trade is to check the Option Chain Ladder. This ladder guides you with multiple aspects of the trades available. You can check the strike price, Open Interest, Call LTP, and much more. Of course, you would need to know whether the open interest calculated is correct or not.

Here, you choose the most suitable trade according to the expiry date and price. Once you select the strike price at which you wish to trade, you pay a premium amount.

The premium amount is dependent on the date of expiry of the options contract.

A snapshot of the Option Chain Ladder is shown below:

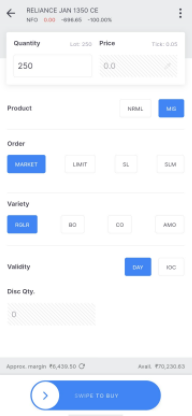

Now, you choose if you want to buy or sell the contract. Here, we have selected the option to buy. So, today trade, you have to select the MIS product type.

Before you place the trade, make sure to click on the right order type, validity, and variety. Also, crosscheck the quantity of the order. A screenshot of the buying screen is displayed below:

Since now it is well understood that intraday trading in options is meant for the risk-taker in the market.

But in order to look for room for more profit with lesser risk than opt for positional trading.

For the beginner traders like you, here is the complete detail of the intraday vs positional trading that helps you in understanding the difference between the two and eventually in picking the right trading type depending upon your risk profile.

With the process of day trading clear, let’s now understand what happens when we trade with and without margin in day trading of options.

Day Trading Options Margin

When you day trade options with margin, there is a good and a bad perspective of the same. In this section, we will discuss them in detail. Let’s first talk about the positives.

Margin helps you trade in enhanced profit-making as you trade more than your financial capability. The increased trading capacity is dependent on the margin percentage provided by your broker.

Coming to the negative aspect of trading with margin, if by chance, you fail to make profits from the trade and the price movement doesn’t happen the way you predicted, the trade is loss-making.

A loss-making trade with margin is a double shock to the trader as they have to bear the loss on the capital they invested, payback the margin availed by him to the broker, and lastly, pay interest on the margin amount.

Moving forward, we should talk about a trading practice without availing the margin facility.

Day Trading Options Without Margin

A trader makes a choice of day trading options without margin according to the capital available with him. Generally, he avoids this facility when there is enough capital to trade with ease.

This choice makes him susceptible to both positive and negative aspects of margin trading. Let’s discuss them in detail.

Day trading without margin saves you from the stress of having to repay a larger amount than your financial capability. You trade with no obligations or restrictions and can take decisions with the least psychological pressure.

On the other hand, if you don’t avail of the margin facility, you might miss out on the opportunity to make bigger profits due to the enhanced capital availability.

With every aspect of intraday trading in options covered, let’s understand the whole concept with the help of an example.

Day Trading Options Example

Understanding day trading options with an example would help you clear the concept in an easier way. So, without any delay, Let’s get going!

Let’s suppose that Rahul has a villa worth ₹1 Crore, and he is not so confident about a price rise and is bearish. Thus, he puts the villa on sale to find a willing buyer.

After a few days, Dev approaches him with an offer to buy the property six months from now. Rahul finds the offer viable, and thus they enter a contract that will expire six months from now.

Dev is keen on buying the property as he knows that the villa is around the area proposed for a National Highway. This development will lead to the prices skyrocketing.

When they finally sign the contract, Dev pays Rahul a premium of ₹10 Lakhs. The premium paid here is non-refundable. After five months, the National Highway is almost ready, and the prices have started to rise.

Rahul is regretting his decision to put the villa on sale as the increase is significant. Here, Rahul has no say in the execution of the contract because the one who pays the premium calls the shots in a contract.

He has no option but to execute the contract at the agreed date and amount as he has received a premium from Dev at the time of signing the contract.

On the other hand, for a moment, let’s suppose that the plan of the National Highway is postponed or canceled. The prices of the villa decrease and reach ₹80 Lakhs. Since Dev paid the premium, he calls off the contract with Rahul.

Buying this villa in the current scenario would have been a direct loss of ₹25 Lakhs to Dev.

Draw a parallel between Rahul and Dev as the seller and buyer of a financial asset and the Villa as the financial instrument. When that happens, you enter an options contract and trade them while reducing your risk exposure.

You can gain a better understanding of these skills and strategies by referring some of the best intraday trading books for option trades.

Conclusion

An intraday trader when trades in the options segments while following the intraday trading style; it is known as intraday trading in options.

So, he opts for the same strategy as in general intraday trading and plans his entry and exit wisely.

But, they look for volume and fluctuations in the options segment to avoid any undesired results at the end of the trade.

A proper analysis of the stock market and the particular asset can certainly help you navigate through the tough terrains of intraday trading in options.

Wish to start Intraday Trading in Options? For that, you need to get a Demat Account opened. Refer to the form below