Trigger Price in Zerodha

More on Intraday Trading

Trigger Price in Zerodha can be executed through any of the trading platforms offered by Zerodha, a leading discount stockbroker in India.

But before we explain the complete process, let’s understand ‘Trigger Price’ as a concept.

Trigger price is the price mentioned by a trader at which the stock exchange (for instance BSE, NSE etc) makes an order for buy or sell active for execution. Trigger prices need to be set in stop-loss limit and stop-loss market orders.

As soon as the trigger price is reached, the order for buying or selling of shares is sent to the exchange to be executed at either the limit price mentioned in the stop-loss limit order or at the market price in case of stop-loss market orders.

In this article, we will discuss how the trigger price works in different types of orders and how we can set a trigger price in Zerodha.

Also Read: Zerodha GTT

Trigger Price in Zerodha Stop-loss Order

Let’s understand the concept with the help of a simple example!

Suppose Mr A wants to buy shares of L&T, the market price of which is ₹1286.5. But he wants to initiate a position only if the stock price touches ₹1290 as that would give him a confirmation of trend reversal.

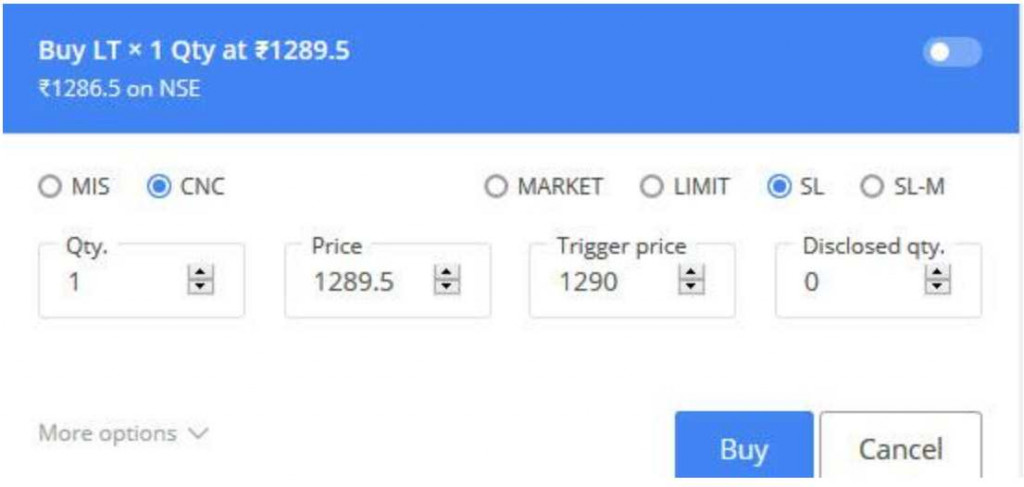

At ₹1290, he would feel bullish and would want to buy L&T shares. So, in this case, he can place a stop-loss order (SL Order) by mentioning the trigger price and price in the Zerodha buy window which looks like this:

The trigger price should be a little lower than the price at which one wants to initiate a buy order. As soon as the trigger price of ₹1290 is reached, an order for buying 1 share of L&T at ₹1289.5 is placed.

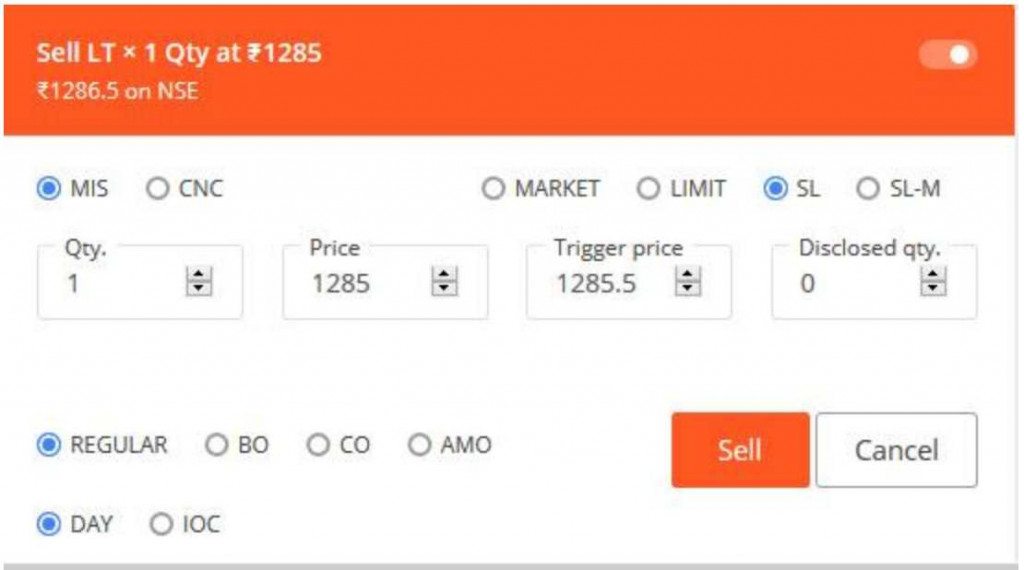

Now, suppose that the order is executed and Mr A holds that 1 share. If he wants to limit his loss, he can make use of the SL order to do that. Please look at the picture below to understand it.

He would have to select SL order type and fill a trigger price and price in it. This trigger price is higher than the price because when the stock price starts falling, it will touch the trigger price first, which is ₹1285.5.

As soon as that happens, the order for selling 1 share at ₹1285 will go to the exchange, thus limiting Mr A’s loss in this intraday trade. This concept is extremely helpful in intraday trading as far as limiting your loss is concerned.

This is how Trigger Price in Zerodha Kite works. Trigger price in Zerodha Kite Mobile is set up exactly in the same way.

Trigger Price in Zerodha Stop loss – Market Order

A stop-loss market order is similar to a stop-loss order and gets initiated at the trigger price. The only difference being that the buy or sell order gets executed at the market price of that instant and not the limit price as set in the stop-loss order.

Let us have a look at trigger price in Zerodha in SL – M order:

In this case, the trigger price set is ₹1286.5. As soon as it is reached, the buy order for 1 L&T share will be executed at the market price. Trigger price in Zerodha Kite and mobile app is set in the same ways.

If one wants to place an SL – M order after holding this 1 share, and one wants to limit his loss to only ₹1, one can do it by placing an SL – M order at a trigger price of ₹1285.5.

The loss will be booked at market price as soon as the trigger price of ₹1285.5 is reached:

Trigger Price in Zerodha Bracket Order

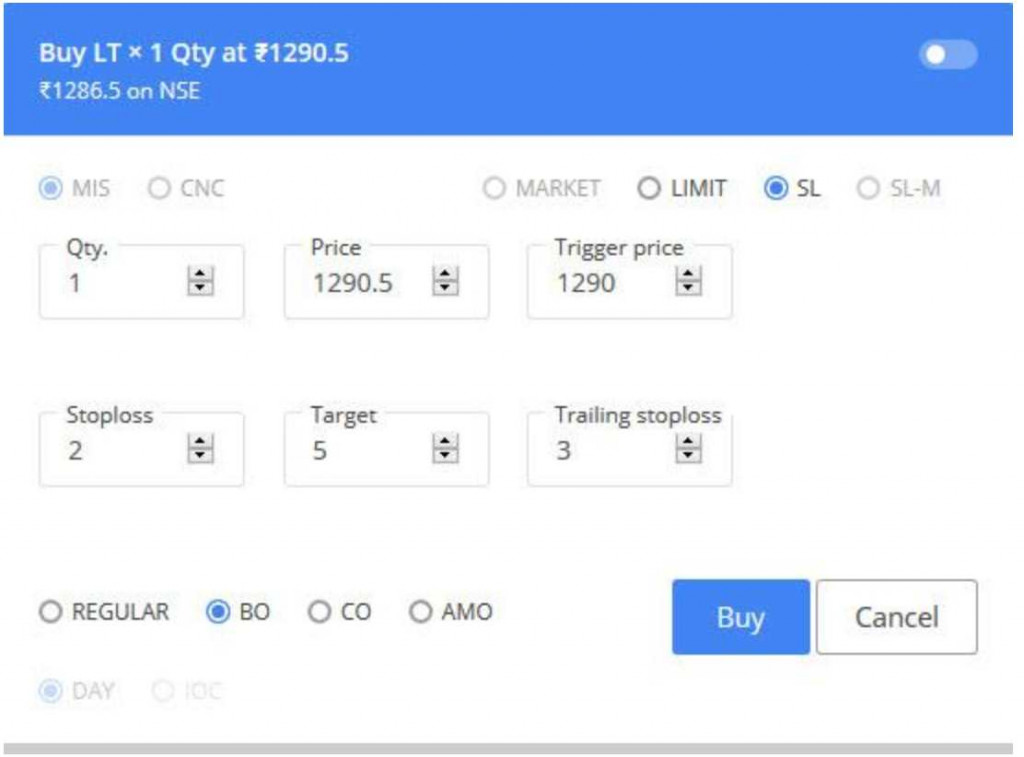

Bracket order can be placed only for intraday. Trigger price in Zerodha for bracket orders is set by going to the advanced option in buy or sell window and selecting SL or SL – M order type.

In this type of order, one needs to fill in details like the price at which the order needs to be executed, target, stop loss and trigger price which is above the current market price and a little below or equal to the price at which buying of shares is desired.

Stop loss and target is mentioned in terms of points.

For example, after buying 1 share of L&T at ₹1290.5, if I want to earn a profit at ₹1295.5 and keep a stop loss at ₹1288.5, then, I would have to fill 5 in the target field and ₹2 in the stop loss field.

Please refer to the picture below. An option to fill a trailing stop loss is also there:

Trigger Price in Zerodha Cover Order

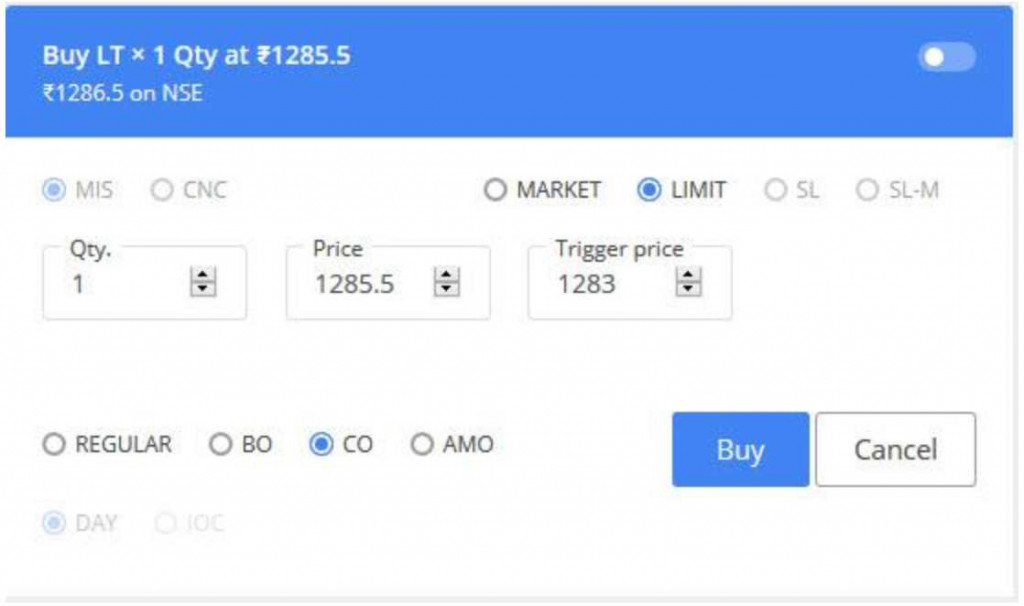

Cover order should be used when one is certain about the market trend.

Suppose I want to buy 1 L&T share through cover order, I will be required to fill quantity, the price at which I want to enter and a trigger price which is acting as a stop loss.

In this example, I want to buy 1 share of L&T at ₹1285.5 and the trigger price is ₹1283.

Conclusion

Trigger price in Zerodha can be set in case of stop-loss orders, stop-loss market orders, bracket and cover orders. One should be very careful while filling the details in different types of orders.

Stop-loss orders help in buying and selling stocks at a pre-defined price after the trigger price has been reached which acts as a confirmation of another trend in stock prices.

The stop-loss market order is placed to help buy and sell stocks at market price after a trigger price is reached.

Bracket orders can only be placed for intraday trading purposes. They are helpful in defining entry price, target price, stop loss and even trailing stop loss in one order only.

Cover orders can also be used for MIS trades only. They are helpful in defining the trigger price and the price at which one wants to make an entry in the market.

Trigger price in Zerodha platforms like Kite and Kite 3.0 mobile app is set in exactly the same ways. One should choose to place trigger price in Zerodha as per one’s preference of trading type and expectations from the stock market.

Stay educated, stay smart!

If you are looking to get started with stock market trading, let us assist you in taking the next steps forward. Just fill in a few basic details to get started:

More on Zerodha

In case you wish to learn more about this stockbroker, here are a few references for you: