RankMF

Check All Investment Services

Looking for a fruitful mutual fund scheme that can give you high returns? If yes, then make the best choice with the RankMF.

Wondering what’s that? Let’s get started with the simple concept of mutual funds.

Mutual funds are the most popular products among potential investors when they want to step into the investment space.

But before investing in any of the schemes it is essential to know the one that can provide you with the best returns.

No wonder it is difficult as well as challenging at the same time but with the RankMF, life has become much simpler for the investors to pick the right mutual fund.

Wondering what RankMF is?

We are here with the complete information that helps you learn the objective and how to use this technology-driven platform to reap fruitful investment results.

So let’s get started!

India is a country with thousands of mutual funds and each of them varies in terms of their performance. Here it is important to note that investment in a single incorrect mutual fund can affect your return and of course, the overall portfolio.

But now, technology has come up with a better and more effective option – RankMF. It is a platform that helps not only in searching for the right mutual fund schemes but also offers you the seamless way to invest in them.

How to Choose and Invest in ‘Sahi’ Mutual Funds?

Disciplined and regular investing is an essential part of the investment world that helps to achieve one’s financial goals. However, many people don’t invest either because they think it’s risky or because they don’t understand it completely.

Mutual funds are the most popular investment option in India among potential investors when they want to step into the investment space.

But before investing in any of the schemes it is essential to know the one that can provide you with the best returns to help you to create wealth.

Generally, when an investor starts to look for funds to invest, they google around a bit to discover the basics but find themselves overwhelmed by the sheer amount of seemingly complex and even contradictory advice on the internet.

And if they have a financial advisor, they blindly trust them and invest in the funds which are told to them without understanding it completely.

Due to this, investors choose and invest in the wrong mutual fund scheme and get low or negative returns.

There are more than 3000 mutual fund schemes in India, no wonder it is a challenging task for an investor to understand what to buy and which funds are right for them to invest.

So, to solve this problem Rank MF created India’s first and only technology-driven proprietary research and rating platform to help investors choose & invest in the right mutual funds scheme to generate better returns on their investment.

What Is RankMF?

When it comes to investing in mutual funds, investors have to analyze various parameters like returns, risk tolerance, investment horizon, etc.

To ease the pain, Samco Group has come up with a dedicated platform by the name RankMF where investors can evaluate mutual funds across various segments.

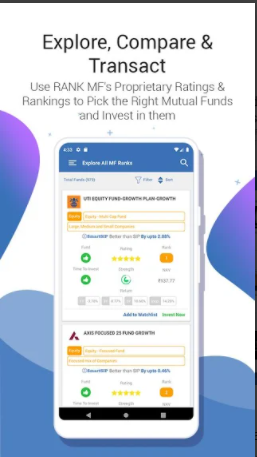

Investors can use RankMF to compare, choose, and invest in mutual funds to assist investors in making a better investment decision.

Depending on the analysis, the investor picks the right mutual fund scheme. But wait, not every scheme works in their favor either.

To avoid any losses or say to get better returns on investment, RankMF mutual fund is introduced where you can explore and compare different mutual fund schemes on the basis of their performance and returns.

To make the best use of the RankMF you have to open an account with a demat account with Samco or a RankMF investment account. They offer a free account where you can start investing in profitable schemes.

The selection of mutual funds with RankMF is very much different from the other mutual funds’ organizations in a lot of ways. Let’s discuss those ways :

- RankMF doesn’t offer you mutual funds on the basis of their performance over the past few years. They have more than 20 million data points such as standard deviation, expense ratios, market valuations and multiples, the cash ratio of a fund, size of the fund, etc.

- RankMF works on one easy principle that companies at a very good price give awesome returns and investments while poor companies give poor returns and investments. This principle stands for both the equity and debt devices of companies.

- Most of the Mutual Fund companies don’t rank the funds but the RankMF works in unbiased, objective ways and scans opportunities for their valuable investors. RankMF truly believes in honest evaluation for their customers.

How is RankMF Different from Other Platforms?

Many mutual fund investment platforms use third-party research which rates funds only based on their past performance.

Overcoming the drawback of other platforms, the technology-driven tool Rank MF is introduced that gives the best suggestion on the basis of a proprietary research method that evaluates more than 20 million fundamental and market data points on an everyday basis.

On the basis of research and analysis, it recommends the right funds based on its future returns giving potential.

- Many investors in the past had faced losses by investing in a mutual fund scheme at the wrong time & price. Hence, Rank MF research developed a Margin of Safety Index Indicator which tells you whether it is the right time to invest in a mutual fund scheme or not.

- Rank MF research has a strength indicator for every scheme. This indicator shows the quality of the underlying portfolio of the scheme and how resilient it is in times of high market volatility. So that your investments stay strong and generate steady returns.

- Rank MF not only recommends the right mutual funds schemes for you to invest in but also has unique investment tools to give you an opportunity to invest in them in a better way to generate superior returns.

Some of the investment tools provided by Rank MF are:

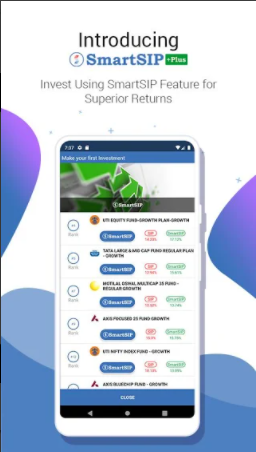

- SmartSIP is an order type that works completely like a SIP but intelligently buy, sell or hold your investments to generate better returns. You can invest in over 300+ schemes via SmartSIP and before investing you can check how much additional return a SmartSIP generates over SIP on the Rank MF platform.

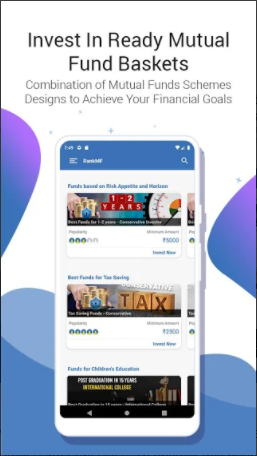

- Rank MF Baskets is a more new-age way of goal-based investing as these are expert-curated professionally built baskets of 5-10 quality mutual funds schemes based on various goals, time horizon and risk-taking ability of an investor. You can simply choose a basket of your preference and invest in them with a single click.

- SmartSwitch is a unique portfolio evaluation and upgradation tool. It helps you to check & review your existing mutual fund portfolio quality score based on which it allows you to eliminate poor-performing schemes. Thus, it helps you to pick the best performing schemes that not only improve the return on investment but also help you to improve the portfolio score by 30%.

Whether you are a new mutual fund investor or an existing mutual funds investor, Rank MF with its research method and unique investment tools makes it really easier for anyone to explore, compare, choose and invest in the right mutual funds to generate superior returns.

As per Mr. Omkeshwar Singh, Head, RankMF tool’s research recommendation has outperformed by a good margin compared to other platforms recommendations.

RankMF App

When investing in the mutual fund every investor comes up with one common question “Kaunsa Mutual Fund Sahi hai?”

For this very reason, Samco has developed this product of RankMF.

This product is based on the screening mechanism as the future growth of the mutual fund not only depends on past performance.

You can easily use it on your mobile phone by downloading the RankMF.

The app offers you many features and benefits like:

- You can track NAV and performance SIP easily.

- The app offers you easy access to tax-saving funds where you can directly invest in ELSS.

- The app contains a SIP calendar that further helps investors in managing their investment cycles and funds.

- As mentioned above, the unique feature of the app is the strength indicator that helps in identifying the robustness of fund

- Apart from this, you can check the quality of the portfolio by uploading the e-CAS.

- You can access the target-oriented fund basket containing financial targets and time frames.

Some of the mutual fund available on RankMF are:

- Axis Mutual Fund

- Baroda Pioneer Mutual Fund

- Aditya Birla Sun life Mutual Fund

- DSP BlackRock Mutual Fund

- Franklin Templeton Mutual Fund

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- JM Financial Mutual Fund

- Kotak Mahindra Mutual Fund

- L&T (Fidelity) Mutual Fund

- LIC Mutual Fund

- Reliance Mutual Fund

RankMF Login

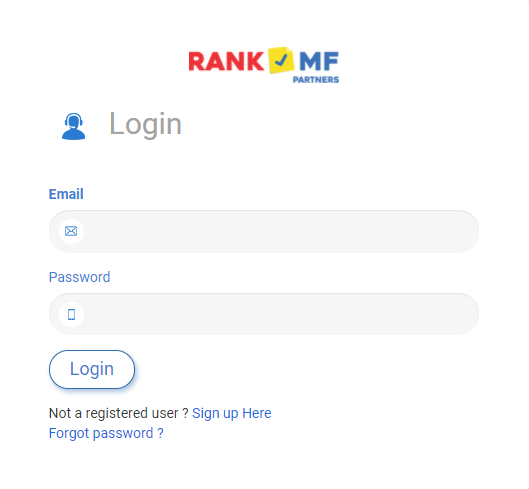

Once you open the Samco RankMF Account you will be provided with the login credentials (username and password).

On opening an account you can also access the RankMF platform from the browser. You just have to follow 4 simple steps to access the RankMF web :

- Go to the RankMF website.

- Then click on the Login tab.

- Enter your credentials.

- And click on the Login button and you are good to go.

Is RankMF Safe?

RankMF is a part of the Samco group previously known as Samruddhi Stock Brokers Limited established in 1993.

It has launched RankMF in the year 2018 with an intent to objectively and scientifically evaluate every mutual fund that helps investors to select & invest in the best mutual funds that generate superior returns.

Its technology-driven research method updates mutual funds schemes rating and rankings on a daily basis without any manual intervention.

A scheme is purely recommended based on the quality of the underlying portfolio and its future potential to generate returns.

Thus, the tool helps to sort and eliminate the poor performing mutual funds that eventually helps you to avoid losses.

Rank MF Customer Care

There is dedicated customer care for RankMF which provides a detailed understanding of the platform and guides investors on how to use the RankMF research to choose and invest in mutual funds.

For any mutual funds queries, you can call on 022-22227777. You can also create a RankMF support ticket for any of the related questions you have and an email will be sent to support them to get in touch with you.

Conclusion

At the end, we can summarize that RankMF has developed a very simple and easier way for an investor to choose and invest in good quality top-ranked mutual fund schemes.

It is India’s only mutual fund research & investment platform where all mutual fund schemes ratings & rankings are updated on a daily basis using technology-driven research methods without any manual intervention.

Only a platform which indicates the right time & price to buy a mutual fund scheme and how fundamentally strong & resilient it is to market volatility so that you continue to generate steady returns on your investments.

There are many unique investment tools that can help you generate better & improve your returns on investments like SmartSIP, SmartSwitch, and goal-based Baskets.

There are more than 3000 mutual funds schemes available in the market, you should know the right one to invest and RankMF is the one you can trust and secure your future.

You can simply visit the RankMF website or download the App from Google Play Store or Apple App store to open an account digitally and start investing within a few steps easily.

Wish to open a Demat Account? Please refer to the below form:

Know more about SAMCO