Smallcase Investment

Check All Investment Services

Smallcase investment has given a new introduction to the stock market world.

Now, you might be thinking what are we talking about today? And might have questions in your mind like what is smallcase investment, is smallcase investment good and what role does it play in the trading and investment sector.

Well, all the answers to your questions lie just below. So, let’s quickly begin the journey, shall we?

Smallcase Investment Review

Smallcase is a container of stocks chosen by an algorithm based on a model, theme, area or smart beta.

Doing investment into a crate of stocks is a key highlight that nowadays numerous stockbrokers have in their trading platforms.

Indeed, smallcase investment is the first case in quite a while where a different party is offering such stock crates that different stockbrokers can access.

Surprisingly, this investment style was made popular by one of the leading discount brokers of India namely Zerodha.

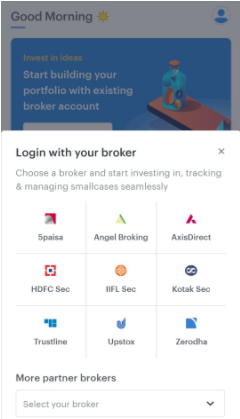

Now, apart from Zerodha, traders and investors having demat accounts in IIFL Securities or India Infoline, Angel Broking, Motilal Oswal, Stoxkart, and 5paisa can have access to the Smallcase investment.

Also Read: How Smallcase Zerodha works?

To have access to a basket full of stocks and to track them from time to time, access to a stockbroker’s platforms is essentially required.

✌ But do you know that smallcase is an innovative idea and work of a Bengaluru-based firm known as Smallcase Technologies?

It offers clients a bushel of stocks that are based around a specific theme or idea.

It is completely different from mutual funds as unlike MF, it doesn’t hold any stocks for an investor rather the stocks are kept in the demat account of the account holder or investor.

In addition to this, the dividend pay also comes directly to the registered bank account of the investor.

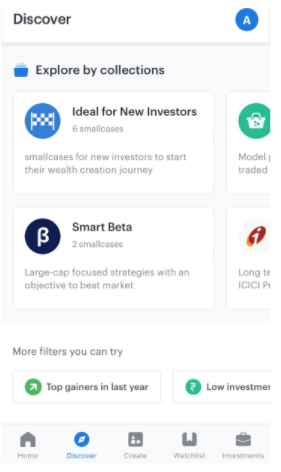

Smallcase to Invest In

There is a diverse range of portfolios offered for an investor who opts for smallcase investment and more than 50 unique themes and stock baskets contribute to achieving the same.

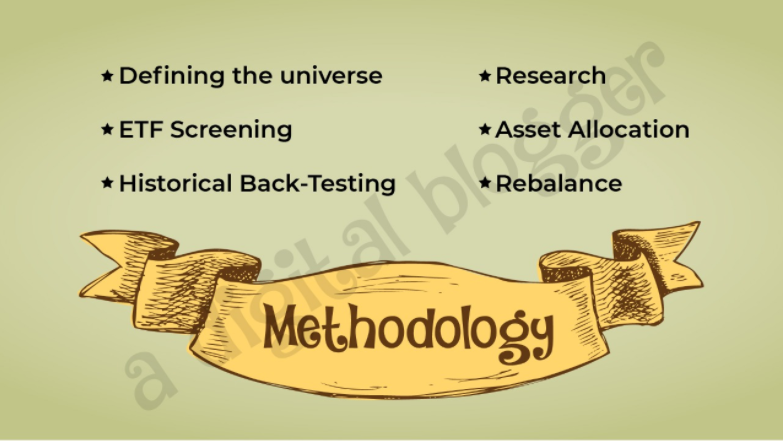

Each of the portfolios is built through an innovative methodology.

Hence, making your investment process easy by offering a wide variety of smallcase to invest in. Underneath are some of the prominent smallcase in which you can invest and make huge profits-

- All-Weather Investing

- Smart Beta

- ETF smallcases

- ICICI Prudential ETF smallcases

- Long Term

- Dividend & Income

- Sector Trackers

- Growth Investing

Let us discuss each of them in a detailed way!

All-Weather Investing

The smallcase investment is best suited for new investors. Learn what this basket brings up for you and invest smartly.

- This smallcase portfolio has diversified stocks for the new investors who wish to begin their wealth creation journey in the stock market with low risk.

- This popular strategy ensures that your investment performs well in each weather throughout the year. This clearly means that it tends to help you in availing profits in good as well as in bad times too.

- However, if you wish to get returns in a day or two then its possible with this portfolio. You will be required to wait for at least a year to build wealth.

- This smallcase investment section covers three distinctive segments such as

- Equity

- Gold

- Debt

- After some time, the portfolio is rebalanced to build relatively possible higher returns by predicting the minimum possible risks.

- Undoubtedly, this type of smallcase investment is perfect for several types of stock market conditions.

- What an investor gets here is a stable ride to assist you in meeting your long-term investment goals.

- This smallcase investment portfolio ensures that neither your portfolio will sink, nor it will soar high in the sky.

- It includes top 100 stocks, dividend aristocrats, brand value, quality-smart beta, and low risk – smart beta. By the way, make sure you know how to invest in dividend stocks while you kick off your investment journey.

Smart Beta

Another in the list is the Smart Beta, which is considered best for passive long term investment. Learn about this smallcase below:

- This Smallcase is an assortment of the best low risk for inactive long term investing and high-quality organizations for passive long term investment. These are generally large-cap organizations.

- Low Risk utilizes ABB India Ltd, Alkem Laboratories Ltd, Pfizer Ltd, Asian Paints, Dabur India Ltd, Hindustan Unilever Ltd, etc. to build this container.

- Although higher risks tend to yield huge returns, as various studies have shown, however low-risk stocks have consistently outperformed high-risk stocks and have shown great results.

- This effect, known as “Low-Risk Anomaly” is the bedrock of low volatility investing and has questioned the fundamental notion of risk-return trade-off.

- It works with an object to beat the market and is considered a “safe stock”.

- This smallcase investment section only picks liquid stocks from the top 150 market cap stocks which are listed on NSE or National Stock Exchange.

- This portfolio or strategy for smallcase investment provides a much better risk and reward ratio as compared to Nifty ETFs or Nifty Index.

Also, Know about Nifty and Sensex that are the two indexes of stock market.

ETF Smallcases

Having a low-risk appetite, then here is a smart investment option for you, ETF smallcase. Given below are some of its top features.

- This smallcase investment portfolio is an assortment of ETFs or Exchange Traded Funds.

- It contains stocks having low to moderate risk combined with all-weather investing, top 100 stocks, and equity and gold.

- Wealth is allocated in different segments such as gold, shares, and in large-cap companies using ETFs.

- Adding such stocks to the portfolio increases the firmness of the investor’s portfolio as the stock prices listed in this section are not very fluctuating.

- Some of the stocks listed in the ETFs smallcase are Nippon India Junior Bees ETF, Nippon India Nifty 500 Bees ETF, Nippon India Liquid Bees ETF, and many more!

- It is known to be among the most invested smallcases in India.

ICICI Prudential ETF Smallcases

Now build your long-term ETFs portfolio with ICICI Prudential ETF smallcases. Here are the details of the product.

- A ton has been said and written on ICICI Prudential ETFs smallcases. This Smallcase investment has made a bin with itself and has offered many long terms ETF smallcases such as ICICI Prudential Diversified, ICICI Prudential Leaders, and ICICI Prudential Smart.

- This smallcase offers exposure to gold, small-cap focused ETFs, mutual funds for long term investing, and smart ETFs in various companies by evaluating their value and fluctuations.

- The minimum investment to be made in this portfolio is Rs. 2852.

- A rebalance of the portfolio is done on an annual basis and looking at the volume and robust business techniques, the prices of the stocks are known to be less volatile and quite high in liquidity.

- This smallcase investment strategy can offer investors attain reasonable stress free trading strategy.

Long Term

Get huge returns in long term by investing in the following:

- This basket is composed of organizations that are encountering profit development and have major future impacts.

- These companies are well-researched by experts and are presented since they are expected to increase in demand and will show a significant performance in terms of finance.

- This investment portfolio is based on broader macro and sectoral trends of various companies such as transportation, banking or finance, consumer companies, popular brands, and also the companies rising in its rural demand, chemicals, etc.

- Some of the companies in this portfolio can be Adani Ports, Dunkin Donuts, Pizza Hut, Kotak Bank, Axis Direct, gold, HUL, etc.

- Under the Banking sector, you can invest in potential NBFCs and private banks that have low NPA’s. They have a better condition than government banks, which have suffered from huge amounts of debts or loans.

- Under the Rising Rural Development sector, comprises the companies that are working to supply goods to meet the demand of rural area people.

- Brand value is not less than others, it has a basket full of companies that have the potential to arise in the near future and have outstanding financial track performance.

- As the profits are expected to be higher, therefore the minimum investment required in such cases is higher.

In case you are looking for a long-term investment, you can subscribe to IIFL NCD before it closes the doors. Hurry up and open the doors of profits in your life of the stock market.

Dividend and Income

Want to get high returns in long term? Here are a few points that you can consider:-

- It comprises income techniques that are based on fundamentals and dividends.

- Three kinds of stocks are illustrated in this category namely Straight flush, dividend stars, dividend aristocrats.

- The stocks showing consistent earnings growth, stocks of a company having high dividend yield without a previous record of any cutting dividends, and lastly, the companies having consistently rising dividends over the last few years.

- Some of the firms included in this portfolio are Apollo Tyres, Affle India, BoB, Axis Bank, Infosys, UltraTech cement, L&T, Gold, reliance Industries, and many more!

- The minimum investment in such large-cap companies is usually higher, in lakhs.

- This smallcase investment is a leading strategy for the investors who prefer to do long term investment on a passive basis and they also tend to take exposure with quality smallcap stocks.

- The returns under this category are differentiated into two parts- dividend return and income return, which is why they are named as dividend and income.

- Before selling the stock or shares or any other underlying security, an investor can surely earn a major portion of the investment that he had made while buying it.

Now you must be thinking the stock and shares are similar. No, they are not. To know the difference in detail. Read Stock vs Shares

Sector Trackers

The following investment is suitable for long term passive investment!

- Sector trackers comprise smallcase investments that can be made in several sectors of the stock market.

- They give sector-specific exposure and some of the prominent sectors are listed below-

- Auto Tracker – It includes spare parts, tyres, batteries, and automobiles.

- Banking Tracker-

- FMCG Tracker

- Energy Tracker

- Infra Tracker

- IT Tracker

- Pharma Tracker

- Metal Tracker

- Insurance Tracker

- Realty Tracker, and many more!

✌ Do you know how many sectors there are in the stock market?

- These sectors’ demand has grown dramatically over the period of time and middle-class requirements have made these industries more demanding.

- These industries are tracked or analyzed based on current and future share market predictions and growth development.

- Smallcase has made a packet full of firms, divided into various sectors, that are putting money in their specific niche and are assumed to profit from the development in their industry mobility.

- Organizations that are relied upon to assume a significant part in satisfying the public authority’s central goal of setting up a hundred savvy urban communities across India are the focal point of this Smallcase investment.

Smallcase Investment India

The following Investment is suitable for higher returns with moderate risk!

✌ Do you really know how the concept Of a Small Case works?

- Smallcase takes help from its in-house research analysts and algorithms to develop portfolios around different topics.

- They study the large-scale monetary variables found in the nation, research firms, study business plans of action and discover organizations that will profit from the predominant conditions. In addition to this, stocks are also screened utilizing algorithms.

- The stock portfolios set up to do smallcase investments are then occasionally pivoted and rebalanced as the economic circumstance changes or evolves.

- The Smallcase investment portfolios will list the assets such as stocks or shares of organizations alongside each stock’s weight.

- Consequently, if a stock market investor recognizes a specific pattern and accepts that the pattern will keep going long enough to have a critical effect as far as capital increases, at that point he or she can put assets or security into such themes by using Small case’s customized portfolios.

✌ Do you know that putting resources into a diversified portfolio is consistently a preferable thought over putting down all bets on a single company’s stock or shares?

- The loss diversification and a completely explored basket of stocks are what the idea of Smallcase investment offers.

- In India, on the off chance, an investor wishes to modify or alter his or her smallcase portfolios, then it can be quickly done too. Stocks can be added and eliminated.

- This makes Smallcase a flexible investment model solution for active and passive investors.

- Smallcase is such a center ground between direct equity investment and investing in mutual funds or MFs.

- On one hand, mutual funds give a well-informed arrangement of diversified stocks. On the other hand, direct equity investing requires the investor or traders to accomplish all the work in choosing extraordinary stocks.

- Smallcase limits the stocks according to a chosen subject. The work of the stock market investor is to think about subjects and comprehend the fundamental drivers of such topics. Typically, it is a semi-dynamic type of investing in the stock market.

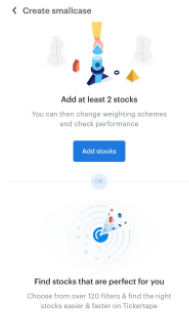

How to Do Smallcase Investment?

If you wish to invest in the smallcase then you must know the right direction of using them. You must remember that to choose a smallcase investment you must be registered with a stockbroker, either full service broker or discount brokers, and have opened a demat account with them.

If you do not have a demat account yet, then simply fill the form below and our executives will guide you through the FREE opening process with the lowest AMC or Annual Maintenance charges.

There are certain steps that you need to follow while doing so and these are listed below:

1.Since smallcase is a third-party integration, hence you will be required to download their application from Play Store or Google Play.

2. Once you have downloaded the application, select your stockbroker- with whom you are having a demat account.

Please Note: If you are registered with any other broker, then unfortunately you will not have access to this portal.

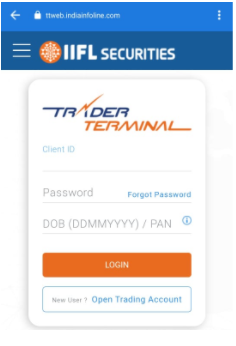

3. Now, enter the username and password against your chosen stockbroker.

4. Once you have added the information, a new screen will appear on your mobile where you view over a variety of themes or portfolios such as all-weather investing, top 100 stocks, smart beta, sector trackers, and many others.

5. You can view the stocks that structure the portfolio. Further, you can also add or eliminate stocks while doing smallcase investment.

While a few stockbrokers permit you to make your customized smallcase, others offer curated smallcases.

6. Once your smallcase investment selection is completed, you will be taken to a new page, which will be of payment gateway.

The cost and weight of individual stocks will state the initial amount you will be required to pay for the smallcase investment.

7. Once you have made the payment, your desired broker’s mobile platform will submit purchase requests for all stocks, which will be executed quickly relying upon liquidity.

However, in the event that illiquidity prompts non-transaction of a couple of requests, the investor will have the option to return and ‘fix’ their request. So, at that point or later, a new request will be put.

Hence, in this simple way you can place a smallcase order instantly!

Smallcase Investment Charges

Smallcase doesn’t charge any expense independently for its portfolio. The expense is charged by stockbrokers who provide smallcase investment services to their customers.

Its partners such as Zerodha,5paisa, HDFC Securities, Edelweiss, and Axis Direct charge Rs.100 as the expense for the transaction on a specific Smallcase portfolio.

In addition to this, IIFl or India Infoline and Alice Blue charge a flat fee of Rs. 100 including brokerage and taxes as the one-time payment fee at the time of buying stocks through smallcase.

Apart from this, Trustline do not charge any amount except brokerage and taxes from its customers opting for smallcase investment

Let’s make it more clear and understandable with the help of a table; given as below-

| Smallcase Investment | |

| Stockbroker | Payment or Fee |

| Zerodha | Rs. 100 + GST + Brokerage |

| HDFC Securities | Rs. 100 + GST + Brokerage |

| Edelweiss | Rs. 100 + GST + Brokerage |

| Trustline | Free (only charge brokerage and tax) |

| Alice Blue | Rs. 100 + GST + Brokerage |

| India Infoline Ltd | Rs. 100 + GST + Brokerage |

| Axis Direct | Rs. 100 + GST + Brokerage |

| 5paisa | Rs. 100 + GST + Brokerage |

When the investor has paid the Rs. 100 charge after choosing a specific Smallcase portfolio, at that point no extra payment is charged for buying stocks in that specific portfolio. Sounds, great! Right?

✌ Did you know that only one time Rs. 100 will be charged to invest in the same portfolio section of smallcase?

For instance, let us assume that an investor named Anjali Dora begins her smallcase investment by an initial cost of Rs. 10,000 “Long Term” portfolio.

During this first Rs. 10,000 investment, a charge of Rs.100 will be levied by her broker namely Zerodha. Please note that this Rs. 100 is irrespective of the total investment sum made in this portfolio.

The total investment in the smallcase can range from Rs.10,000 or Rs.50,000 or maybe more however, the fee will remain Rs.100 for that first investment.

Now, if Anjali Dora contributes another Rs. 1 lakh, at that point there will be no smallcase charge from Zerodha. Just taxes and different charges, as charged by the Zerodha, will be applied.

However, if Anjali Dora plans to invest in other sections such as “Top 100 stocks” or “Smart Beta” or any other, then again Rs. 100 will be charged for buying the stocks in this portfolio.

Charges for All Weather Investing and Smart Beta smallcases is Rs 50 + GST

For any other remaining smallcases (theme or sector or model-based, equity and gold smallcase) is Rs 100 + GST

| Smallcase Investment | |

| Portfolio | Payment or Fee |

| All Weather Investing | Rs. 50 + GST (Brokerage if applicable ; varies from broker to broker) |

| Smart Beta | Rs. 50 + GST (Brokerage if applicable ; varies from broker to broker) |

| Other Smallcase investment Portfolios | Rs. 100 + GST + Brokerage (varies from broker to broker) |

Fortunately, these are only one-time expenses for one portfolio of smallcase. For additional orders in the equivalent smallcase, no additional charges will be relevant.

So, these are only charges added in the smallcase investment. The brokerage will be charged as per the stockbroker rates.

Is Smallcase Investment Good?

Now a major question that might arise in your mind will be “Is smallcase investment good or not”?

Well, let’s find the answer to the same by going through the below section.

- If you opt for the equity segment, then its fee ratio pulls in different fees such as fund management, broker’s fee, and different other costs. This cost ratio is deducted every year from your investment in this segment and generally close to around 1 to 1.5 percent (1 – 1.5%) of the total investment.

However, if you opt for smallcases, after making an initial cost of around Rs. 100, you will be only required to pay the brokerage fee without any other additional charge.

Smallcase investment is cheaper than equity investment!

While putting your money in Mutual Funds or MF gets you fund units, smallcase, on other hand, put shares in your demat account.

✌ Do you know that if shares are directly added to the demat account then investors get tax-exempt dividends straightforwardly in their respective bank accounts?

- Smallcase empowers you to put money and time into ideas instead of in stocks that are based on market capitalization.

It ought to be noticed that the smallcase investment may not be perfect for a new or beginner level investor, as the person in question may not be sufficiently qualified to comprehend the risks related to the various sectors or portfolios.

For instance, one can opt for smallcase investment in firms that are pursuing reasonable housing projects if the main point of the government is to give moderate housing facilities to all. There are no equity funds that can give such widespread exposure.

- Redemption demand with an equity MF or Mutual Fund requires three working days to get handled. On the other side, if you opt for a small case investment, then you can monitor your investments progressively during market hours.

- Satisfactory liquidity is the key parameter in smallcase that is used to select stocks as the request for recoveries happens at the real market time. This, thus, encourages rapid redemptions.

If you are a new level investor then it is prudent to take the right direction from a financial guide prior to investing through this platform.

Pros and Cons of Smallcase Investment

Smallcase offers a sensibly balanced and inventive investment solution for any individual who is keen on developing their wealth without doing broad exploration on individual stocks.

While there are a lot of advantages connected to Smallcase’s investments, there are some disadvantages too.

Let’s talk about each one of them in a detailed way!

Pros

- You own the stocks, which is altogether different from claiming units of a mutual fund (MF).

- You get to bask-in the tax-exempt dividends, which can range to up to Rs. 10 lakhs according to new tax rules of share market.

- Smallcase utilizes innovation and algorithms alongside in-depth analysis to construct and rebalance its portfolios. You don’t have to play out any examination work by yourself on which stocks to select.

- The rebalancing feature is a key player in overcoming probably the greatest decision of each investor, which is when to sell.

- In addition to the above, additionally, investors realize when to set foot in stock with Smallcase.

Cons

- Although a small case fee is paid during the first order execution, however, one needs to pay extra fees such as tax and brokerage charges during each rebalance.

- Contrary to an MF investor, you won’t be needed to cover expenses (or brokerage) when the rebalancing of the trade or portfolio is performed by the fund manager of the broking house or small case research team.

- The graphs which show past execution are just a backtest of the specific arrangement of stocks. They do exclude any kind of related fees or costs. Hence, they are not an exact portrayal of profits.

- If you think that investing in smallcase portfolios is a passive investment strategy then unfortunately you are wrong. As you will be required to routinely stir the portfolios and watch out for any potential risks and warnings. It always requires an active investment component.

Hence, these were some of the pros and cons related to smallcase investment. If you wish to trade in their portfolios, then you will be required to have a comprehensive understanding of their advantages and disadvantages.

To Sum Up

From the aforementioned information, it is clear as crystal that smallcase offers a quite unique value proposition. One can essentially invest in a readymade portfolio without doing a broad examination of hundreds and thousands of stocks available in the market.

When the portfolio is constructed, it is essential to strictly follow the rebalancing occasionally.

While charges and taxes during each rebalancing exchange will minimize the portion of profits, however, they can be very fulfilling if the idea is constantly followed.

With smallcase portfolios, you don’t pay cost proportions to anybody, as in a mutual fund segment.

Best of all, with Smallcase, you really own the stocks in your own Demat account. That way, you will get profits directly to your financial account. There is no expense on those dividends by the same token.

And in case you opt for mutual funds, then remember that your dividends are dependent upon the dividend distribution charge.

On the off chance that you like to be a semi-dynamic investor and can discover sufficient opportunity to follow your interests in a basic manner, at that point Smallcase is a creative and important help to have.

Smallcase bodes well for investors who know the different financial portfolios and their particular drivers. Individuals who monitor such portfolios will discover smallcase investment very profitable.

Smallcase investment is incredible as it flourishes and based on ideas. But, it will work only if the stock market investor or trader follows it perfectly.

For this, they may need to agitate the portfolio altogether too much and pay charges. However, for some, it can neither be alluring nor satisfactory.

So, this means when you are ready and wish to give this a shot, be ready for the agitation and related expenses. Try not to begin right away. Watch the adjustment in the portfolio for a couple of quarters and afterward choose.

And if you have a bit of openness related to stock analysis, it won’t help your portfolio to an extreme.

An option is to follow a container of stocks or a brilliant beta index and start with a couple of stocks from the best 10 and hold until they drop out of the file (30 or so stocks).

Since the record will be rebalanced just double a year and it might take some time for the top stocks to leave the list, the agitation would be fundamentally lower. In any case, the order included would be the equivalent.

Wish to start Investment? You will need to have a Demat Account. For that refer to the form below