TATA Quant Fund

Check All Investment Services

You must be investing in funds for long? Isn’t it? How do you select funds? Are you able to select an unbiased fund? Tata Quant Fund is one of those funds that is around the block these days.

Is it good enough?

Curious to find out!

Investing in funds is useful but not every time the selection of funds proves to be fruitful.

Till now, many of the investments are managed by the Fund Managers. By proper research, they analyze diverse and voluminous information and thus the whole investment decision is based on human judgments.

The manual process of selecting the securities works but at the same time it is not easy and even the smart investors can end up making a wrong investment decision.

Adopting new technology and investing in Tata Quant Fund can help you in reducing human errors and in building portfolios.

Wait, what exactly is a Quant fund in the first place?

Quant Fund is an algorithm that is used to drive the investment strategy. This new scheme utilizes the capabilities of advanced quantitative analysis to make an efficient selection of securities.

In all, the managers make the efficient use of tech-savvy software programs to build customized models that is useful to determine investments for the fund. Quant fund utilizes the state of art technology to create data thus assist in building investment strategies.

| Tata Quant Fund | |

| Subscription Opens | January 3, 2020 |

| Subscription Closes | January 17, 2020 |

| Subscription Reopens | Not later than 5 business days from the allotment. |

| Benchmark Index | BSE200 TRI |

| Turnover Ratio | 58% |

| Available for | Lumpsum and SIP investment |

| Minimum Investment | For Lumpsum: ₹5000 |

| For SIP: ₹500/month | |

| NAV | 10 during initial subscription |

| Entry Load | Nil |

| Exit Load | 1% if redeem within 365 days |

| Objective | To generate the medium to long term capital appreciation with Quant Model |

| Eligibility | Resident Individual |

| Minors | |

| Partnership firm | |

| Proprietorship | |

| Companies, Banks |

TATA Quant Fund Review

Tata Quant Fund would open up its subscription on January 3rd, 2020 and will close on January 17, 2020. It is an open-ended mutual fund scheme that is completely based on the technology and algorithm-based investment theme.

Since it is an open-ended scheme the subscription will open again not later than 5 business days from the allotment.

Tata Quant Fund is the rule-based investment strategy that enables the passive selection of securities. On the basis of the machine learning algorithm, the Tata Quant Fund model creates the portfolio according to the emerging market scenarios.

The model act on changes that occur in:

- Broad and persistent factors driven by equity returns

- Historic portfolio momentum

- Pre-decided economic and market parameters.

This advanced technology tool and machine learning would make use of historical correlations and patterns for assessing the impact of new economic and market conditions on portfolio returns.

Tata Quant Fund has a multi-factor investment model created using the advanced AI modules. On the basis of the market conditions, these modules change factor strategies dynamically every month.

What makes the Tata quant fund model different from other managed funds is the efficient use of the machine learning algorithm for driving the best investment strategies.

The Tata Quant Fund would use the proven factor strategies like value, quality, momentum, and market-cap for rule-based stock selection and portfolio allocation. Also, the fund would invest in a portfolio of stocks selected from the BSE 200 and Equity Derivative List.

Since the Tata Quant Funds modules are designed using the AI technology and Machine Learning, the machines are equipped to take the market calls as well.

The Tata quant fund strategy aims at outperforming market returns over the medium to long term with the least probability of any loss.

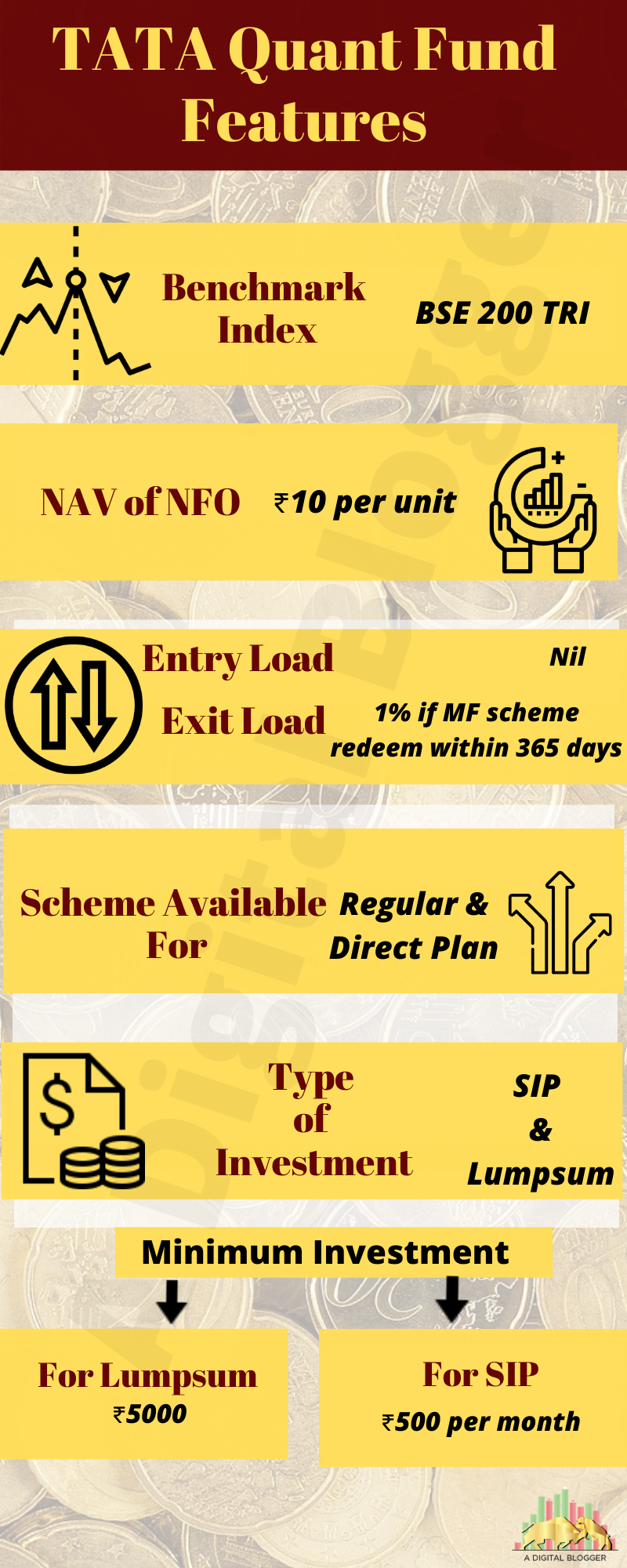

TATA Quant Fund Features

Here are the key features of the Tata Quant fund. Make the efficient use of the service and start investing in a smarter way.

- The benchmark index for Tata Quant Fund is BSE 200 TRI.

- The scheme is available for both regular and direct plans.

- It offers both a growth option and dividend option.

- The Tata quant fund option is available for both lump sum and SIP investment.

- The minimum investment for lump sum investments is ₹ 5,000/- with the multiple of ₹1.

- For the SIP the minimum investment is ₹500 per month for a period of 6 months.

- The NAV of the NFO is ₹10 per unit during the initial subscription.

- There is no entry load for investing in this upcoming mutual fund scheme.

- The exit load is 1% if the mutual fund units redeem within 365 days.

Tata Quant Fund Objectives

Tata Quant Fund is initiated with an objective to generate the medium to long-term capital appreciation by availing options for investing in an equity-related instrument that is selected on the basis of the quantitative (Quant) model.

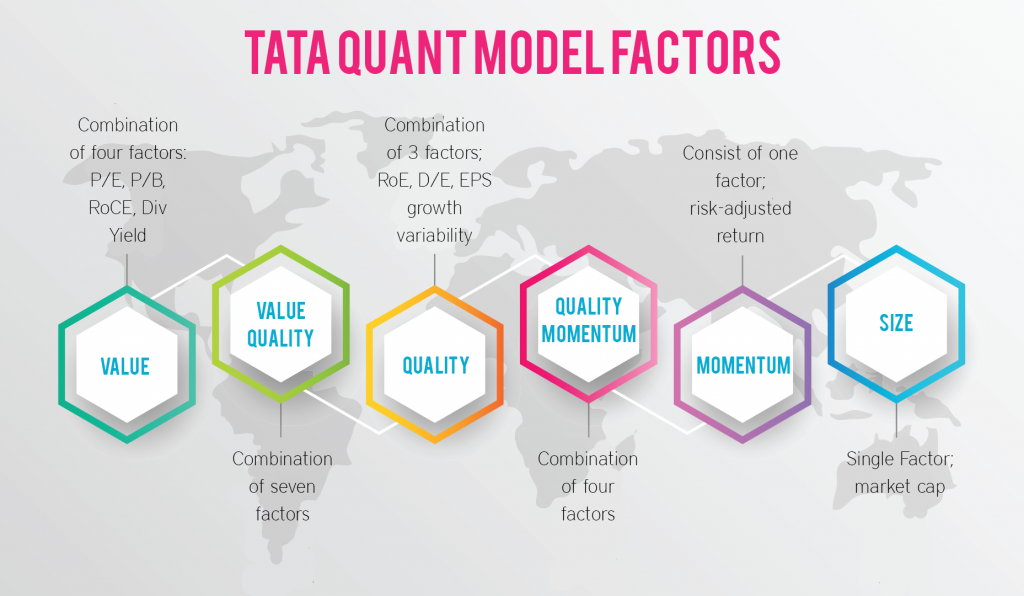

Factors For Creating Tata Quant Model

Here are the various factors on the basis of which the Tata Quant Model is created.

| TATA Quant Fund: Factor Strategies | |

| TATA Quant Model | Factors |

| Value | Combination of four factors: P/E, P/B, RoCE, Div Yield |

| Value Quality | Combination of seven factors |

| Quality | Combination of 3 factors; RoE, D/E, EPS growth variability |

| Quality Momentum | Combination of four factors |

| Momentum | Consist of one factor; risk-adjusted return |

| Size | Single Factor; market cap. |

Ways to Select Factors for Tata Quant Funds

However, there is no defined way to build models with combining factors but there are simple ways and machine learning that are helpful in selecting factors for Tata Quant Funds.

1. By evaluating the historical performance of multiple combinations of factor strategies

2. By identifying the set of factor combinations performing better than others.

TATA Quant Fund Theme & Category

SEBI categorizes the Tata Quant Fund into a Thematic Category.

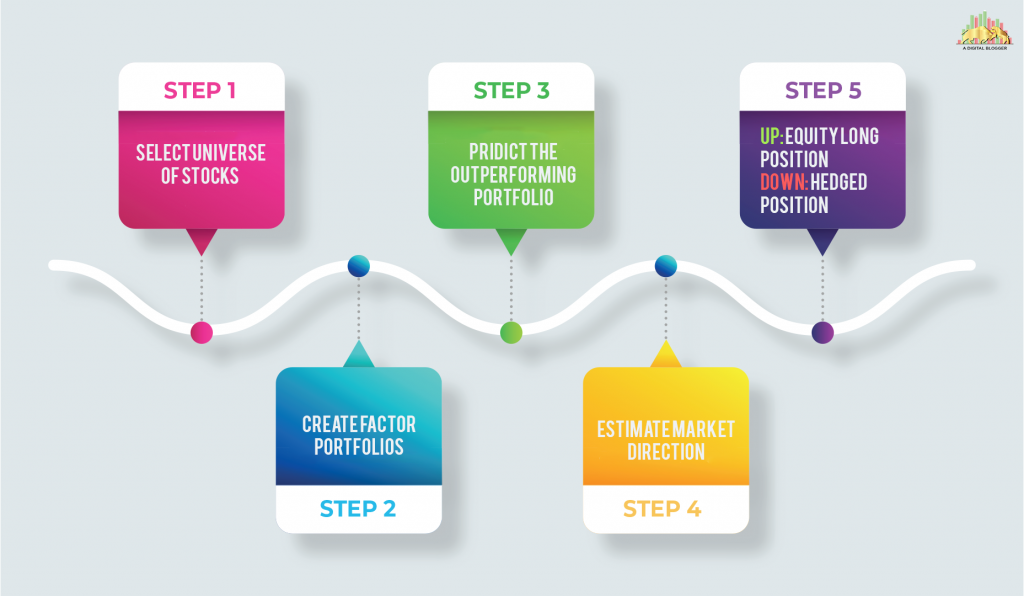

TATA Quant Fund Process

The Tata Quant Fund is the mutual fund scheme that is used to construct a diversified portfolio across market capitalization and sectors. It includes the benefits of both active and rule-based systematic investments thus minimizing the influence of human emotions in taking an investment decision.

Here is the complete Tata Quant Fund Process explained in detail:

- Predicts the Optimal Strategy of Forthcoming Month & Profile Creation

- Every month for the past 20+ years each stock of BSE 200 is scored and selected on the basis of various factor models like value, quality, value+quality, momentum, value+momentum, and market cap.

- The score is used to know the 1-year data of the individual stocks under the defined variables.

- The top-scoring stocks are created for each factor to create a portfolio.

- For the above set portfolios, the machine is provided with the 20 plus year of macroeconomic, key market-related data and the data of monthly returns.

- The machine learning algorithms analyze the hidden correlation and patterns of the historic data to identify portfolios with the highest returns.

- Each month the ML embedded investment strategy framework takes in:

- The latest available macroeconomic and key market-related data.

- Historic momentum values of each factor model portfolios

- On the basis of machine learning, it decides the factor strategy that will perform the best in the forthcoming month.

- On identification and creation of the optimal factor strategy, the next process is to predict the direction of return for the next 30 days.

- Market Direction Prediction

- The second algorithm is to predict the direction in either direction of portfolio returns.

- The technology and AI-based predictive engine predict the 30 days direction of portfolio returns based on similar variables as defined in the previous model.

- Strategy Execution for Forthcoming Month

- On turning of predictions to bearish, the model recommends taking the market position that further reduces the net long equity position to zero. All this is done using derivative to hedge the portfolio that is held for long.

- When the prediction turns bullish, the portfolio created is used to rebalance or create a cash long position in identified stocks

Tata Quant Fund Eligibility

To invest in the Tata Quant fund, here are the general eligibility criteria:

- Resident Individuals, either single or jointly.

- Minors through parents or legal guardians

- Hindu undivided family through its Karta.

- A partnership firm.

- Proprietorship with the name of a sole proprietor.

- Companies, societies, body corporate, a body of individual, clubs and public sector undertaking registered in India

- Banks

Tata Quant Funds Benefits

Tata Quant Fund gives many reasons to investors for choosing it. Here are a few benefits associated with this new mutual fund scheme.

- The introduction of the machine learning model in designing investment strategies is the elimination of various behavioral biases like confirmation bias, loss aversion, recency bias.

- Adding the Tata Quant fund strategy to the portfolio, the investor is benefitted a lot. With the Tata Quant fund, the investor can invest a part of their portfolio thus diversifying the risk and hence portfolio.

- Tata Quant Fund is a more rule-based investment strategy with no flexibility in selecting the optimal portfolio strategy.

- Also, the model does not learn from the current economic and market conditions to calibrate its future decisions.

Tata Quant Fund Predictions

Investing in the Tata Quant Fund is something that can help you in getting a clear view and thus in knowing the securities in which to invest. But not all the time the stock market prediction is true. Here is the accuracy of the model used in the Tata Quant Fund.

Since the machine learning models are useful to make the consistent predictions for the minimum 10 years data and therefore the predictive model backtested for testing performance from 2011 onwards.

As per the backtesting result of the January 2011,

- Around 17% of the time, predictions done by the model are in the line with the benchmark

- Around 62% of the predictions, the predictions made are correct and generated alpha over the benchmark performance.

Tata Quant Fund Risks

Tata Quant Funds directs the investment strategies on the basis of algorithms created on the basis of historical relations of the multiple factors related to the stock market movements.

Although the model makes the efficient use of AI technology and works towards creating unbiased investment strategies, there are certain risks associated with the Tata Quant Fund.

- The first risk associated with the Tata quant-based model is the time taken by the algorithm to adapt to new development and influence of factors.

- The model is suitable for both lump sum and systematic investment.

- The next risk associated with the Tata quant fund model is the inability to enter the market at the right time that might hamper the market growth and performance of the fund.

Tata Quant Fund Returns

Currently, the data under this scheme is not available, we will update it soon on our website.

Tata Quant Fund Allocation Pattern

The allocation pattern of the Tata Quant fund is defined in the table below.

| TATA Quant Fund Allocation Pattern | ||

| Investment | Platform | Risk |

| 80-100% | Equity & Equity Related Platform | Medium to High |

| 0%-20% | Debt & Money Market Instruments | Low to Medium |

| 0%-10% | REITs & InvITs | Medium to High |

Conclusion

The basic objective of the Tata Quant Fund scheme is to increase the chance of earning profit. This scheme will give a chance to invest in the active portfolio of stocks with a greater probability of earning profit.

Get the subscription plan for the Tata Quant Fund.

For more information, feel free to contact us.