Value Investing Stocks

Check All Investment Services

Warren Buffett, a well-known name in the share market who follows the single strategy of value investing. But have you ever wondered what value investing stocks are?

If not, then here is the complete information and list of value investing stocks.

Value Investing Stocks in India

Value investing is simply an investment strategy involving the collection of shares that can be exchanged for less than their intrinsic value or book value.

So, when it comes to wealth creation, then value investment is something that works the best. But here, the investor needs to consider a few important parameters.

Generally, investors look for undervalued stocks when it comes to value investment.

According to definition, actual value investment is actually to invest in such stocks, but apart from the value, the value investor must consider a few important factors as well, like, true or Intrinsic value of the company, future prospects, and growth of the company.

The general principle of value investing is the same and the right direction and discipline of the investor can actually help him in creating wealth.

There are a lot of value investing books as well that you may want to consider reading. Totally worth it!

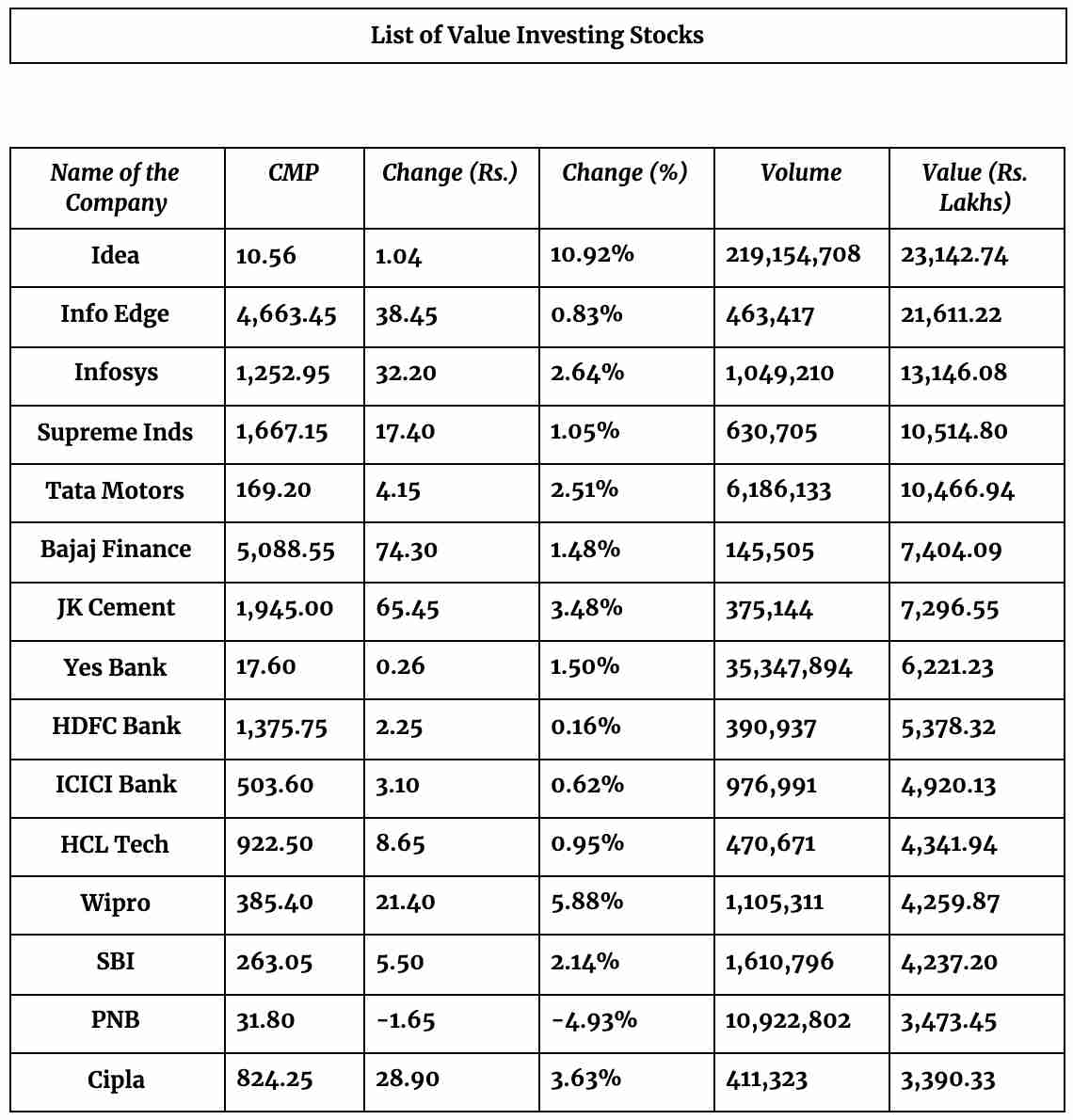

Best value investing stocks in India

As an investor, you might be eager to know the list of value investing stocks. Although, you can find the best one by doing a proper analysis, for your ease here is the list of the top value investing stocks that can give you a high return:

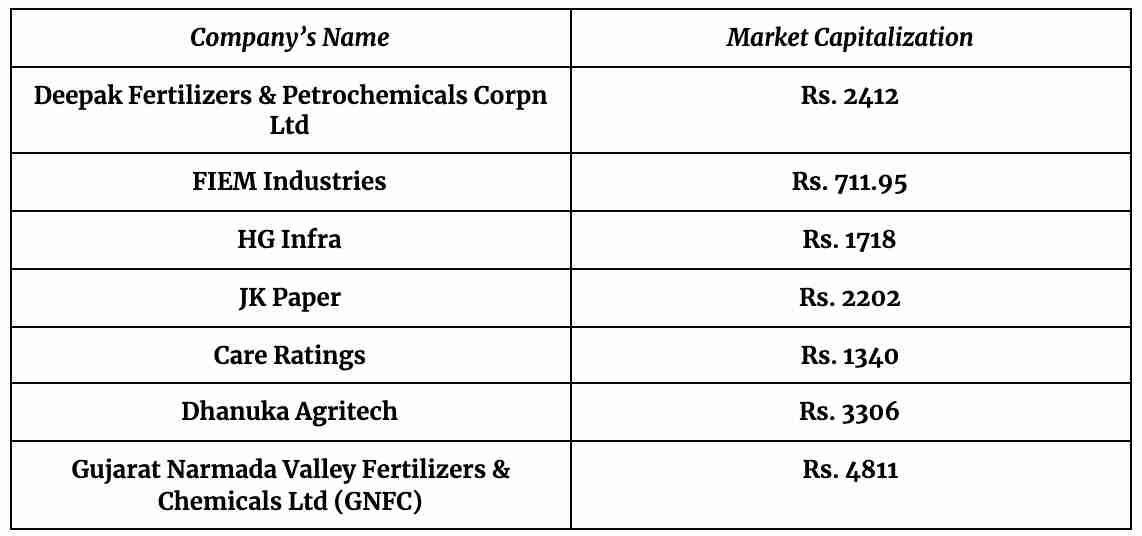

Value Investing Small-Cap Stocks

Small-cap companies are on the verge of growth bringing a lot of opportunities for investors as well to create wealth.

So, if you want to invest in the small caps and hence want to trade in the value investing stocks, then here is a complete list of small-cap value investing stocks that can provide higher returns.

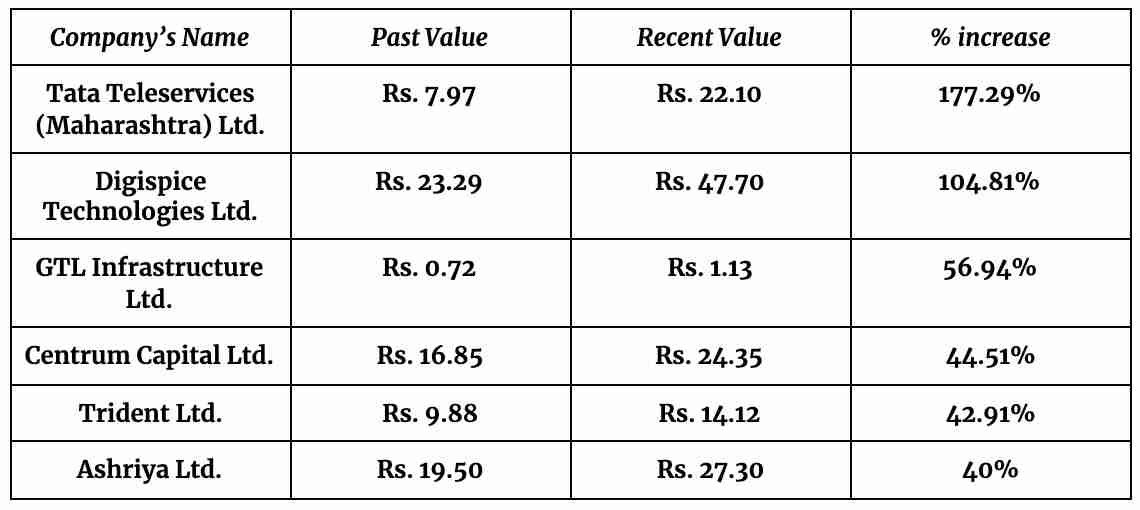

Value Investing Penny stocks

If you want to earn more returns with cheap but reliable stocks, then penny stocks are the best opinion for you. Refer to the following list of the penny stocks that will guide you about the penny stocks of 2021 with good returns.

How to Find Value Stocks?

Now the confusion may arise. How to find value investing stocks? Want to know more about it? Interpret the segment to understand more about it.

In general, to pick the right value investing stocks, it is necessary to do a proper fundamental analysis that further helps you in evaluating the ratios useful for shortlisting value stocks.

To learn how to find value investing stocks, refer to the following information:

To compare the valuations of the firms among the same industry, the price-to-earnings is a valuable tool.

P/E ratio= Market value of the share/Earning per share

2. PEG ratio

This is similar to the P/E ratio, but it enhances the field of play among businesses with growth rates that are somewhat different.

Dividing the P/E ratio of a business by an annualized rate of income growth can help you equate with other firms.

PEG Ratio=( P/E)/EPS Growth

3. Price to Book Ratio

If a business ceased operations and sold all its properties, think of the book value as what would potentially be left.

Price to book ratio= Market price per share/ Book value per share

The multi-book value estimation of a company’s share price will help recognize underrated opportunities, and many value investors are actively searching for opportunities to purchase stocks selling for less than their book value.

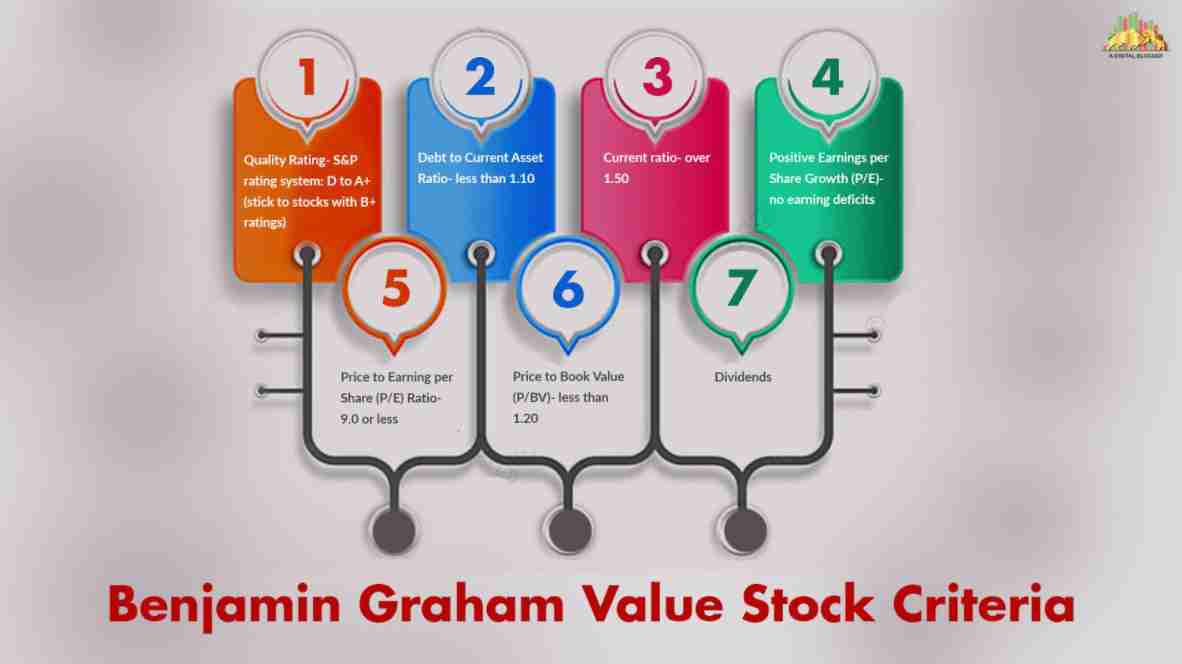

Apart from these factors, here are the Benjamin Graham Value Stock Criteria mentioned below.

Value Investing Stock Screener Criteria

Benjamin Graham, follow certain criteria to pick the value stocks.

This includes certain qualitative and quantitative aspects of the company like quality and rating of the company, apart from this certain ratio apart from those discussed above, current ratio, debt to current asset ratio, etc, that further helps in evaluating the company and stocks for investment.

1. Quality Rating

If we have to talk about the quality rating, then there is the S&P rating system that offers the rating from D to A+ in which an investor can choose the stocks with B+ ratings to get better profit.

2. Debt to Current Asset Ratio

In the debt to current asset ratio, an investor should check the company with a debt to the current ratio of less than 1.10.

3. Current ratio

The current ratio is also known as liquidity ratio is the measure of the company’s ability to pay the short-term obligations or due within a year.

In short, the number helps investors to determine how the company can work towards increasing the asset value on the balance sheet to satisfy the debt and other payables.

For value investment, make sure the company has a current ratio of over 1.50.

4. Dividends

Dividends help investors in generating passive income. So, when investing in value stocks, look at whether the company pays dividends or not. Invest in a company that is currently paying dividends and make sure you know how to invest in dividend stocks before you do that.

How to Invest in Value Stocks?

Well, to begin investing in any of the stocks, the foremost step is to open a demat account. For this, it is good to consider your need.

Since there are different stockbrokers offering services for years. Understand your need, like if you want to get assistance in picking the right stock, then you can go for the full-service stockbrokers like Angel Broking, Motilal Oswal etc.

On the other hand, the one who wants to trade at the minimum brokerage can opt for the discount brokers (Zerodha, 5paisa, Upstox etc).

After choosing a stockbroker the next step is to apply for a demat account opening. For this, you can either apply online or offline.

For a better experience, you can get in touch with us. Just fill the form below and we will help you in opening a demat account for free.

3. Download the Trading App

Every stockbroker provides a trading app that helps you to trade freely across segments. You can use the trading platform either on your mobile phone or on your desktop.

Log in using the username and password provided to you by the broker.

After logging in do your research and look for various technical and fundamental aspects of the company to evaluate the ratios discussed above.

List the top stocks you can invest in. You can also make use of the list given above and do in-depth research using the app.

Once done, invest the fund and wait for the right moment to grab the high return on your investment.

Conclusion

The technique of investing in value stocks is to keep the undervalued stocks of strong companies for a long time after buying them.

Before investing in value investing stocks it is good to spend time doing proper research to pick the best. Apart from this to build a strong portfolio, the investor should diversify their investment.

This helps them to multiply their return and in minimizing the risk of investment. So, invest smartly and create wealth by picking the right value investing stocks.

In case you would like to learn more about value investing or the related concepts, just fill in the form below and we will call you right away: