Astron Paper and Board Mill IPO Review

Check All IPO Reviews

About Astron Paper and Board Mill Limited

| IPO Name | Astron Paper and Board Mill | Astron Paper and Board Mill |

| Opening Date | 15th December, 2017 | |

| Shares Issue Size | 14,000,000 | 14,000,000 |

| Estimated IPO Size | ₹63 Crore to ₹70 Crore | ₹ |

| Day# | No. of Shares Subscribed | Shares Subscription %age |

| Day 1 | 1,31,69,520 | 94% |

| Day 2 | 7,15,88,440 | 511% |

| Day 3 | 17,34,31,720 | 1239% |

Day 1 Performance

Astron Paper & Board Mill IPO was subscribed 94% of its open shares on Day 1 (15th December, 2017) and it seems by Day 3, this percentage is going to reach a very high number. The company is looking to raise a meagre ₹70 Crore and there is a limited chance that many subscribers are going to get these shares in the kitty.

The IPO received bids for 1,31,69,520 shares against the total issue size of 1,40,00,000 shares.

If you are interested enough, you still have a couple of days to take the decision and put your bid.

Astron Paper & Board Mill Ltd. was founded in the year 2010. It is an Ahmedabad based company engaged in manufacturing of Kraft paper, which is also called as paperboard or cardboard. The paper so produced by the company is primarily used in the packaging industry for making crenellated boxes, corrugated satchels, and composite vessels.

Astron Paper has its manufacturing unit in a city called Halvad in Gujarat. The company utilizes discarded paper as raw material for production. The Company has a Triple Wire Machine with a per diem capacity of 350 MT along with pulp mill capacity of 400 MT per day.

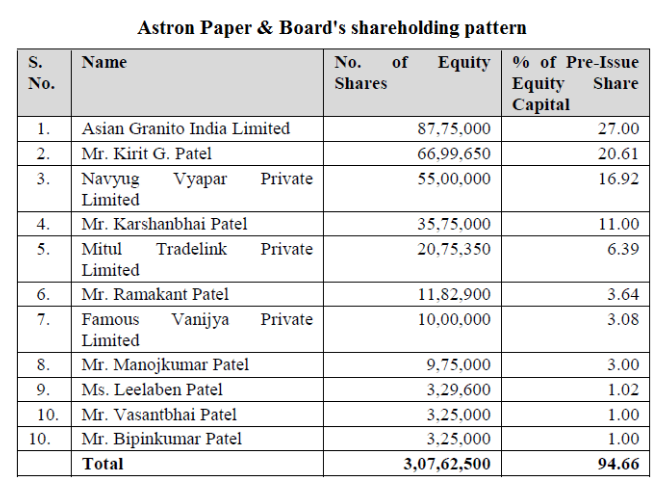

Promoters of Astron Paper and Board Mill Limited:

The Company’s promoters are Mr Kirti G. Patel, Mr Ramakant Patel, and Mr Karshanbhai Patel. The corporate promoter of the company is M/s Asian Granito India Ltd. The equity shares of Asian Granito have been listed in the BSE and NSE since 2007.

Astron Paper and Board Mill Limited Financials:

The below-mentioned table represents the restated financials of the company:

| Particulars | For the year/period ended (in ₹ Million) | ||

| 31st March 2015 | 31st March 2016 | 31st March 2017 | |

| Total Assets | 1372.42 | 1584.46 | 1727.51 |

| Total Revenue | 1521.37 | 1578.53 | 1845.89 |

| Profit After Tax (PAT) | 41.29 | 60.85 | 99.59 |

Accreditations:

- The company’s manufacturing, engineering, dispatch method has been certified with ISO 9001: 2015, ISO 14001: 2015 by SGS United Kingdom Ltd. Systems & Services Certification due to its exceptional standards.

- Due to the fact that manufacturing Kraft paper takes places by recycling waste paper the company is supporting the Go Green Campaign by the Govt. of India. The company produces FSC certified Kraft paper in an eco-friendly way. Due to their environmentally cognizant products, they have been certified with the FSC Standards since the year 2014 by SGS South Africa (Pvt) Ltd.

Astron Paper and Board Mill’s Focus:

The company mainly focuses on the 4 Ps – Product, Pricing, Presence, and Promotion. The company strives to develop new products per customer’s requirements and give them the best quality.

They do so by using 100% of the imported waste paper. Right from procurement of raw material to the finished goods, product quality is kept in mind.

Astron puts great efforts to provide the best quality material at competitive prices. Due to innovation in the manufacturing process, they minimize the production cost. With the broad range of products and competitive pricing, they have secured a countrywide presence.

They also have planned to become a global player by entering the Middle East, Iran, Bangladesh, a part of Africa and South East Asia.

As a part of their long-term vision for 2020, the company is planning to add new and innovative products to its manufacturing line.

Astron Paper and Board Mill IPO Synopsis:

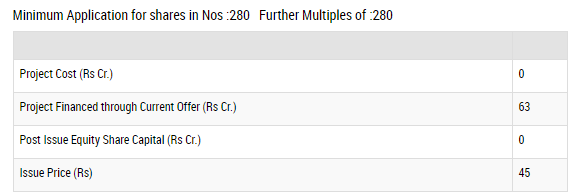

The company has launched an Initial Public Offering (IPO) of up to 1,40,00,000 equity shares of face value of ₹10 each of Astron Paper & Board Mill Limited.

The company has also announced a discount of ₹2.50 per equity share on the issue price to be offered to the Eligible Employees. This can be treated as Employee Discount.

The Price band is stated to be ₹45 to ₹50 per share of face value of ₹10 per share.

| Event | Date |

| IPO Open Date | 15th December, 2017 |

| IPO Close Date | 20th December, 2017 |

| Allotment Date | 22nd December, 2017 |

| Initiation of Refund | 26th December, 2017 |

| Listing on Exchange | 28th December, 2017 |

Objectives of the Astron Paper and Board Mill IPO:

Astron Paper aims at utilizing the net earnings from Astron Paper and Board Mill IPO for the following objectives:

- For setting up an additional manufacturing unit with a lesser GSM and B.F Kraft Paper: ₹23 Crore

- Part-payment of unsecured borrowings: ₹8.1 Crore

- Supporting the working capital needs: ₹23.9 Crore

- Other general purposes are pertaining to the corporate: ₹15 Crore

Astron Paper and Board Mill IPO Review:

Astron has decided to keep the price band of ₹45 – ₹50 per share of its equity shares and contemplates organizing around ₹63 to ₹70 crore through the IPO, keeping in mind the lower and the upper price margins. The Initial Public Issue will be open for public subscription on 15th December 2017 and will close on 20th December 2017.

After the allotment of shares, they are going to be listed on the exchanges like BSE and NSE. The minimum quantity of application is has been fixed for 280 shares and in the multiples after that. The IPO constitutes nearly 30% of the post-issuance paid-up capital of Astron.

Astron Paper has kept back 7,00,000 equity shares and is offering a discount of ₹2.50 per share to all its eligible employees. The Issue is single headedly managed by Pantomath Capital Advisors Pvt. Ltd. Link In time India Pvt. Ltd. is the registrar for the IPO issuance.

The average budget of procurement of shares by the promoters is ranging between ₹2.77 to ₹9.10 per share. It has issued the equity shares at par at the commencement of the company and during a period between March 2013 and March 2015.

It has also raised more equity at the cost of ₹30 per share during the period between May 2011 and March 2012. The company has also issued some bonus shares in the ratio of 2 is to 1 during March 2013. After the issue, the current paid up capital of the company amounting to ₹32.50 Crore is expected to stand heightened to a high mark of ₹46.50 Crore.

Talking about the performance of the company, Astron Paper has posted a net profit by turnover of

- ₹106.20 crore / ₹– (3.02) crore in the Financial Year ending 2014

- ₹152.14 crore. / ₹4.13 crore; For the Financial Year ending in 2015)

- ₹157.85 cr. / ₹6.09 crore for the Financial Year ending in 2016

- ₹184.59 cr. / ₹9.96 crore for the current Financial Year so far.

For the first half of the current Financial Year, the company has recorded a net profit of ₹9.46 crore on the turnover of ₹110.96 crore. Consequently, the company’s top and bottom lines have displayed a commendable growth pattern.

The issue has been priced at a P/BV of 3.01 based on its NAV of ₹16.62 as on the 30th of September 2017. For the previous three, Financial Years the company has displayed an average EPS of ₹2.38 and average RoNW of 19.07 on the equity base of ₹32.50 crore.

If you look from a retail banker’s point of view, this is the very first main IPO from and has no past track record on this front. However, the company has picked up more than 50 IPOs on the SME listings during the last three Financial Years.

Our Recommendations & Views:

Our View on Astron Paper and Board Mill IPO:

Kraft paper is the primary raw material for use in the manufacturing of corrugated boxes. The demand for corrugated boxes for packaging has seen an increasing trend steadily.

The company is aiming at starting an additional manufacturing unit for these boxes. You can see that the growth rate for these products is at a slow rate, and also the company’s business is a bit less varied.

Also, we also feel that the company’s issue is quite small in size; hence getting higher allotment might not be as easy as expected or projected.

We feel that the investment is a little risky, hence the investors have to think twice before investing.

Contact Details of the Company:

Registered Office:

D 702 7th Floor Ganesh Meridian

Opp. High Court SG Highway

Ahmedabad – 380060, Gujarat, India.

Phone: 91-79-40081221 Fax: 91-79-40081220

Email: cs@astronpaper.com

Interested to open a Trading account for upcoming IPO investments?

Enter Your details here and we will arrange a FREE Call back.