Barbeque Nation IPO Review

More on IPO

Barbeque Nation IPO

Barbeque Nation IPO gets a Sebi’s signal to be floated into the share market. Are you thinking of investing in this IPO? If yess!! Do not worry. Here we have come with all you need to know about the Barbeque Nation IPO through Barbeque Nation IPO review.

But before that, getting familiar a little with the company launching the IPO is essential, Right??

So let’s get started !!

A casual dining chain Barbeque Nation Hospitality Limited is one of the leading and trusted hospitality industries that owns and operates multiple Barbeque Nation Restaurants. It is headquartered in Bangalore, Karnataka.

This company had a single Barbeque Nation Restaurant in FY2008, that has now reached to 138 spread across 73 cities in India.

Besides, it has 7 international Barbeque Nation Restaurants in 3 cities (UAE, Oman, and Malaysia) outside as of 30 November 2019.

Barbeque Nation is all set to open its Initial Public Offering (IPO) for subscription on 24 March 2021.

The purpose of Barbeque Nation Hospitality Limited to launch the IPO worth ₹453 Cr is to utilize net proceeds from the fresh issue for the following objectives:

- For expansion and opening of new restaurants.

- To repay certain outstanding borrowings of ₹205 Cr in part or full.

- To repay the expenses related to general corporate purposes.

Barbeque Nation IPO Details 2021

Let us take a look at the below table for the Barbeque Nation IPO review:

| Barbeque Nation IPO Details | ||

| Barbeque Nation IPO Date | Opening Date: 24 March 2021 | |

| Closing Date: 26 March 2021 | ||

| Barbeque Nation Issue Size | [●] Equity Shares of ₹5 (aggregating up to ₹453 Cr | |

| Barbeque Nation Fresh Issue | [●] Equity Shares of ₹5 (aggregating up to ₹180 Cr | |

| Barbeque Nation Offer For Sale | 54,57,470 Equity Shares of ₹5 (aggregating up to ₹273 Cr approximately | |

| Barbeque Nation IPO Price Band (Per Share) | ₹498-₹500 | |

| Barbeque Nation Market Lot (Equity Shares) | Minimum Lot: 1 (30 Shares) | |

| Maximum Lot: 13 (390 Shares) | ||

Barbeque Nation IPO Date

Before applying for a Barbeque Nation Hospitality IPO, you should first take a look at the dates so that you would not miss any process starting right from Issuing of IPO shares to Allotment of shares.

Barbeque Nation’s shares sale via Initial Public Offering will open for subscription on 24 March 2021 (Wednesday) as per the market speculations.

The public offer of the company will remain open for the next 3 days, i.e. on 26 March 2021.

Other than this, other important dates of the IPO have been tabulated below:

| Barbeque Nation IPO Date | ||

| IPO Opening Date | 24 March 2021 | |

| IPO Closing Date | 26 March 2021 | |

| Finalization of Allotment of Shares | 1 April 2021 | |

| Initiation of Refunds | 5 April 2021 | |

| Credit to Demat Account | 6 April 2021 | |

| IPO Shares Listing Date | 7 April 2021 | |

Besides, equity shares are to be listed on the BSE and NSE on 7 April 2021. However, the date of the listing is not decided as yet.

Barbeque Nation IPO Price

Next in the Barbeque Nation IPO review, we will cover the Barbeque Nation IPO Price. Basically, IPO Price includes two main prices; the Issue price, and Listing price.

IPO issue price is a price at which any company offers its shares to the investors for the first time in the share market whereas, the listing price is a price at which shares get listed in the stock exchange.

The Barbeque Nation Hospitality Limited will open its IPO of [●]equity shares worth ₹453 Cr.

This IPO consists of a fresh issue of [●]equity shares worth ₹180 Cr and Offer for sale of up to 54,57,470 Equity shares worth ₹273 Cr.

by the present shareholders and promoters.

According to the data on stock exchanges, Barbeque Nation Hospitality has set the price band for its IPO at ₹498-₹500 per equity share.

Barbeque Nation market lot size (minimum order quantity) is 30 shares. A retail-individual investor can apply for up to 13 lots, especially 390 shares.

That means the investors can bid for a minimum number of shares by investing ₹14,940, whereas they will be required to make a maximum investment of up to ₹1,94,220.

| Barbeque Nation IPO Price | ||||||

| Application | Lots | Shares (Lot Size) | Amount | |||

| Minimum | 1 | 30 | ₹14,940 | |||

| Maximum | 13 | 390 | ₹1,94,220 | |||

Tip: You should try to bid at a higher band, as there are major allotment chances.

Barbeque Nation IPO GMP

Next in the Barbeque Nation IPO Review is Barbeque Nation IPO GMP. GMP is a premium amount at which IPO shares are bought and sold in the Grey Market. These shares are not listed on the stock exchange.

Besides, the GMP of an IPO changes every day as per the demand of IPO shares.

Barbeque Nation IPO GMP will come up soon.

Barbeque Nation IPO Promoters

The Barbeque Nation Hospitality company is promoted by:

- Sayaji Hotels Limited

- Sayaji Housekeeping Services Limited

- Kayam Dhanani

- Raoof Dhanani and Suchitra Dhanani

All of them have a total stake of 60.24% in Barbeque Nation IPO.

Besides the issue is managed by book running lead managers, namely IIFL Securities, Axis Capital, Ambit Capital, and SBI Capital Markets.

Barbeque Nation IPO Apply

To apply for any IPOs, you will first need to select a registered stockbroker and open a Demat account with them.

For this, you will need some documents listed below:

▶️ PAN Card

▶️ Adhar Card

▶️ Bank Account Number

Once the documents get verified and the account is opened. The broker will provide you an online platform where you can apply online for any IPO using UPI (Unified Payment Interface) and ASBA (Application Supported by Blocked Amount) effortlessly.

For this, you will have to go through the following steps:

🎇 Download the app.

🎇 Scroll down on the stocks tab.

🎇 Click on the IPO section.

🎇 Choose any active IPO name and select the bid quantity.

🎇 Select any of the payment methods; Net banking or UPI method.

Once you complete the process on the UPI app, your application form gets submitted and the amount will get blocked in your Bank Account.

In case you don’t have a Demat Account, refer to the form below and proper guidance will be given to you:

Barbeque Nation Hospitality Details

So, this is all about Barbeque Nation IPO Review. Now whether you should invest in it or not?

Confused?

Do not worry!

Here we have mentioned some details about the company fundamentals, strengths, and also the risks associated with this IPO that helps you in planning your investment accordingly.

So let’s have a quick glance at it.

Barbeque Nation Limited is famous for offering its best quality of food items, interior, and services to foodies and travelers. It currently runs two brands Toscano Restaurants and UBQ that takes care of the delivery segment.

Not only in India, but this hospitality industry also set its footprints in 3 countries outside India.

Besides Toscano and UBQ, it diversified its brands into another brand “Red Apple” which is located in Bengaluru and Chennai and operates 10 Italian restaurants.

After going through what this company actually does.

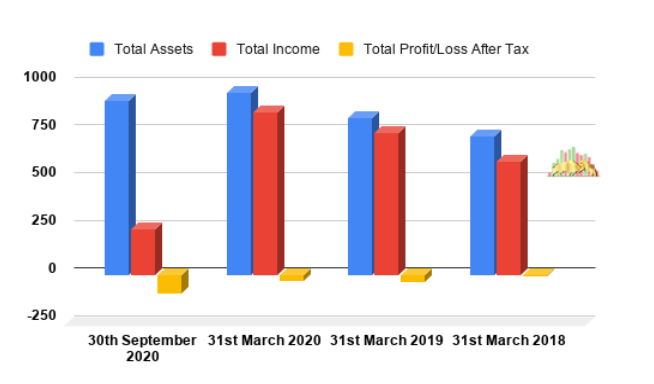

Now let us understand the past and present fundamentals of the company with the help of a table and infographic.

| Barbeque Nation Hospitality Financial Performance In Crores (FY18-FY20) | ||||||||

| 30 N0vember 2020 | 31 March 2020 | 31 March 2019 | 31 March 2018 | |||||

| Total Assets | 908.585 | 955.458 | 819.085 | 723.160 | ||||

| Total Income | 236.608 | 850.794 | 742.541 | 590.448 | ||||

| Total Profit After Tax | -100.648 | -32.928 | -38.386 | -5.8 | ||||

Barbeque Nation Hospitality IPO Should I Buy

Well you might be thinking, the business model of Barbeque is great and this sector is doing quite well in markets, so it would be okay to go with its IPO.

But, stop !! What appears is not always true.

Before investing your hard-earned money, make sure you analyze the company’s IPO objectives and financial performance first and related details.

Firstly, the company’s main objective of making the public offer is to use the funds for repayment and payment of loans of the company which can be considered one of its downsides.

However, apart from this, it also intends to complete general corporate purposes through this IPO.

Secondly, Barbeque Nation Hospitality is backed by CX Partners and Rakesh Jhunjhunwala, both are renowned private equity and stock market investors with a shareholding of 33.79% and 2.05 % respectively.

Thirdly, the financial performance of this company is not that great throughout FY18 to FY20.

The net loss of the company has increased by 94% in the last 3 financial years from 2018 to 2020. It can be said that the loss incurred in 2020 may be due to Covid-19 Pandemic as their restaurants were closed due to country-wide lockdown.

But apart from FY20, this company has faced losses in other last years too which indicates that this IPO may not provide higher gains to the long-term investors.

Besides, From FY17 to FY19, the revenue of the company has increased by 22% which is a good aspect. On the other hand, its sales have increased by 5%.

Now if we talk about IPO allocation, then 50% of IPO shares are reserved for the qualified buyers (QIB), 35% for retail investors, and 15% for NII.

Similarly, Burger King from the same industry has already come in December 2019. It has given high listing gains to the investors but considered not okay for long-term investors.

As some of you might know that this company could not launch the IPO earlier in 2017 due to some regulatory hurdles. This is their second attempt to float the IPO.

We have compiled all the above data and provided you with our insight but never invest in the IPO without doing an in-depth financial analysis.

We believe your query regarding Barbeque Nation IPO Review has been resolved. Now let’s discuss the competitive strengths and risks of the company.

Strengths Of Barbeque Nation Hospitality Limited

While going through the Barbeque Nation IPO Review, make sure to check the competitive strengths of Barbeque Nation IPO listed in an Infographic:-

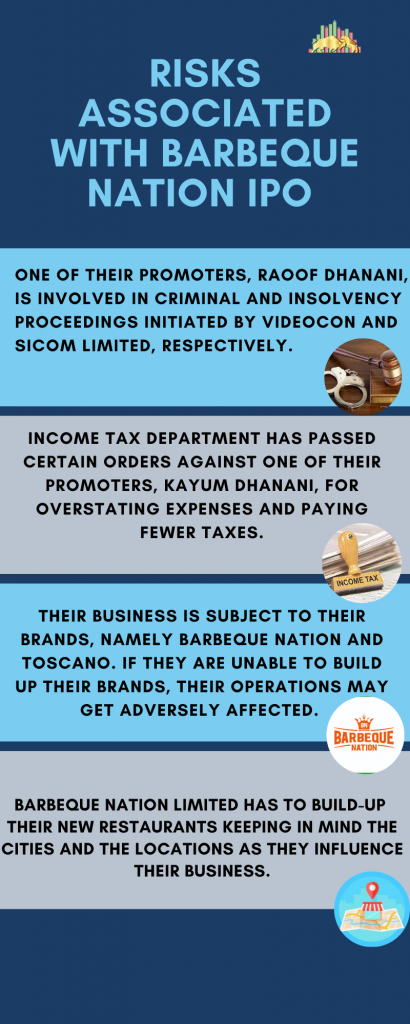

Risks Associated With Barbeque Nation IPO

Barbeque Nation Hospitality Limited has shown good financial growth over the financial years. However, there are also several risks related to this investment too and they are:

After going through the Barbeque Nation IPO Review, you might think of investing in this IPO? Refer to the form below and open a demat account.