Barbeque Nation IPO Should I Buy

More on IPO

Barbeque Nation IPO

The month of March, or should we say the ‘IPO month’ is still in full bloom. Another IPO is all set to join the list on the 24th of March, the Barbeque Nation IPO. Being an absolute favorite food chain of the nation, the IPO is awaited by a lot of investors. Barbeque nation IPO should I buy, if that’s your concern, you will get all the answers here.

Barbeque Nation IPO Details

When we talk about the Barbeque Nation IPO review, then it becomes extremely important to know all the details. About to be listed in both the stock exchanges, BSE and NSE, here are all the necessary details that you need to know about the IPO.

- The Barbeque Nation IPO launch date is on the 24th of March 2021 and will remain open till the 26th of March 2021.

- The issue size of the IPO is Rs. 452.87 Crores.

- The Barbeque Nation IPO price band is Rs. 498- Rs. 500.

- The market lot size of the Barbeque nation IPO is 30 shares, with the minimum order quantity at 30 shares.

- The face value of each share is Rs. 5.

Barbeque Nation Company Details

When it comes to the question of Barbeque Nation IPO should I buy, you must be aware of the details of the company in which you are about to invest your money.

Started in 2006 by Barbeque Nation- Hospitality Limited, Barbeque Nation is one of the leading and most loved dining chains in the country.

It has over the year, left no stone unturned in providing the customers with great food, ambiance, and services.

Apart from being an absolute favorite in the country, it is also a popular option in 3 other countries. They also operate Toscano restaurants and UBQ, which majorly look at the delivery segment.

It has over the years managed to establish hundreds of chains in India, as well as abroad. They also host food festivals and events occasionally so that their customers don’t miss out on the fun.

Growth of the Company

Barbeque nation, just like any other company also started its journey from the scratch. With its first restaurant set up in 2002, it soon acquired five restaurants by 2012, owned by SHL.

The company has seen the journey of just one restaurant in 2008, to almost 147 restaurants in 2020 including all the operating, under construction, and temporarily closed outlets.

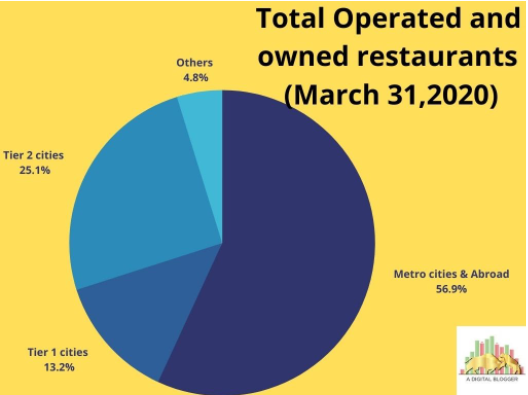

They have their outlet across 77 cities in India, along with six international restaurant chains in three countries. The city-wise data of the barbeque nation restaurants till 2020, is depicted below.

Want o invest in the company for that, you need to have a demat account. In case you don’t have one. Refer to the form below:

Promoters

The IPO is backed up by Rakesh Jhunjhunwala and has the following promoters:

➡️ Sayaji Hotels Limited

➡️ Sayaji Housekeeping Services Limited

➡️ Kayum Dhanani

➡️ Raoof Dhanani

➡️ Suchitra Dhanani

Objectives

You will be clear about barbeque nation IPO should I buy, when you know the objectives of the IPO. Every company that comes with its IPO has specific objectives in mind. The objectives of Barbeque Nation IPO are listed below.

▶️ The company is coming with the IPO so that it can make the payment and repayment of its loans that were taken on a consolidated basis.

▶️ The other objective of the Barbeque Nation IPO is to fulfill corporate purposes.

Finances of the Company

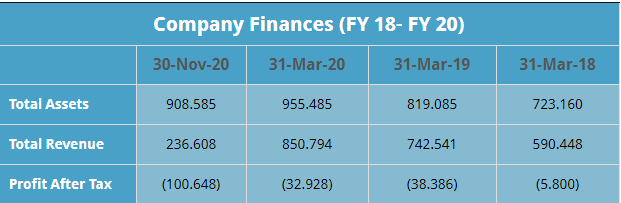

Before arriving at a conclusion to the question, Barbeque Nation IPO should I buy, it is important to take a closer look at the financial growth of the company.

The financial growth of the company tells a lot about the company’s performance and whether it will be beneficial to invest in its IPO or not.

All the values are in crores

Competitive Strengths

Below given are the strengths of the company to make your decision of Barbeque Nation IPO should I invest an easy one.

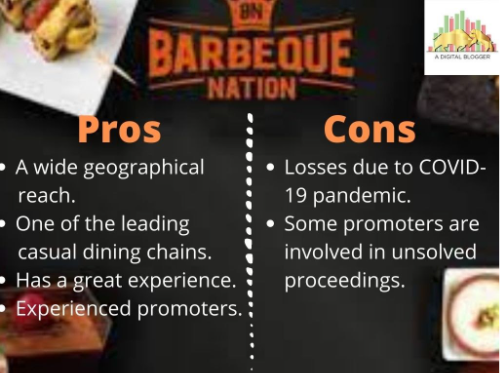

🎇 It is one of the most popular and also one of the fastest-growing casual dining chains in India.

🎇 It caters equally to both vegetarian and non-vegetarian customers.

🎇 Their financial track record has shown immense growth over the years.

🎇 Barbeque nation IPO is backed up by experienced promoters and has a very professional and well-organized management team.

Risks

Just like the competitive strengths, there are some risks associated with the IPO as well.

- The ongoing pandemic had a subsequent effect on the finances and growth of the company.

- The growth of the company can be largely impacted by the wrong selection of geographical regions for its new branches.

- If they fail to deliver what their brand name specifies, they may face a downfall.

- If they encounter any deterioration in the services that involve a third party, the growth of the company will be adversely affected.

Final Verdict

The decision of Barbeque Nation IPO should I buy is totally your choice. Although there are some key pointers that you should keep in mind before making the final decision.

- They have prolonged experience in the industry.

- Some of the promoters are involved in unresolved proceedings.

- It has seen growth over the years but also a drop because of the pandemic.

There are always risks and strengths both associated with an IPO, it is always better that you analyze and then secure a sweet deal for yourself.

Want to invest in Barbeque Nation IPO? Refer to the form below