7 Things To Know Before Buying Craftsman Automation IPO

More on IPO

It would be absolutely right if we said that March is an ‘IPO month.’ There is another IPO that is about to mark its presence in the stock exchanges on the 15 of March, the Craftsman Automation. What do you think about Craftsman Automation is it worth buying?

Well! you are not alone. There are many beginner investors like you who are confused about making their investment plan. We are therefore here with the 7 facts about this Initial Public Offering and company that helps you in making your plans and decision.

Being an established engineering company, Craftsman Automation IPO is considerably gaining some attention from the investors.

So let us begin!

Craftsman Automation IPO Detail

Before investing in IPO, it is very important to know the essential details. To make the work absolutely convenient for you, here are all the essential details summed up for you.

- The IPO is all set to make its appearance on NSE and BSE on March 15, 2021.

- March 17, 2021, is the closing date of Craftsman Automation IPO.

- It has an issue size of 5,528,187 equity shares of Rs.5, aggregating upto Rs. 823.70 crores.

- The face value of the IPO is Rs.5 per equity share.

- The Craftsman Automation IPO price band is set at ₹1,488-₹1,490 per share.

- The minimum order quantity is 10 shares, while the maximum being 130 shares.

Craftsman Automation IPO Objectives

Every company comes with an IPO with some objectives that make it easy for investors to make your investment plan. The objectives are listed below

Craftsman Automation Company Details

It is definite that you must be curious to know about the company details if you are thinking to apply to Craftsman Automation IPO. Craftsman Automation Limited is a leading engineering organization that was incorporated in the year 1986.

The company is responsible for designing, developing, and manufacturing a wide range of engineering products. It has also made its mark in the machining of the cylinder blocks, particularly in the tractor segment.

The company’s business majorly operates in three segments:

- Industrial and Engineering, Automotive-Aluminium Products, and Automotive-Powertrain, and others.

- Manufacturing material handling equipment, like crane kits, hoists, marine engines, storage solutions, and locomotive equipment.

The company also has a broad geographical reach, with 12 state-of-art manufacturing units spread across seven cities of the nation. It also has a very strong customer base, including Tata Motors, Mahindra & Mahindra, Ashok Leyland, Daimler India, and many more.

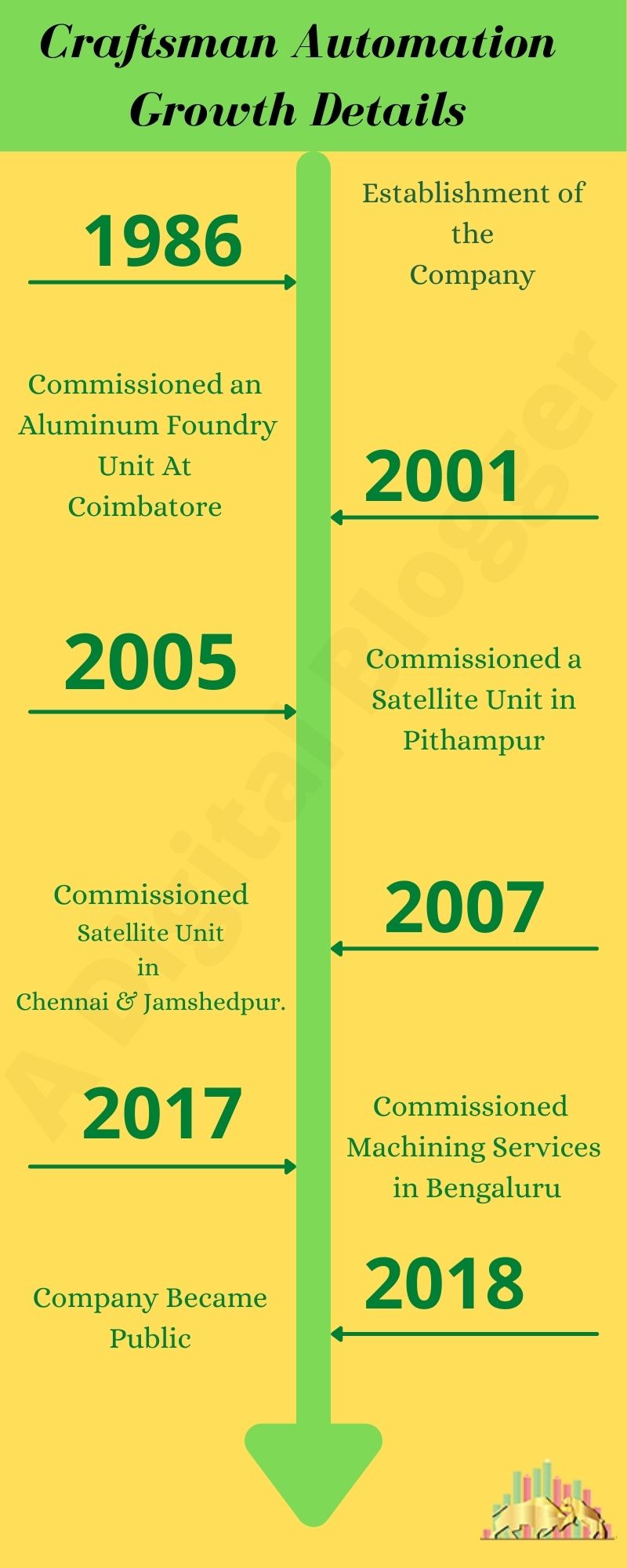

Growth of the Company

After the company was established in 1986, it has seen an immense in all aspects. The growth of the company has surged and reached great heights. The company was incorporated in 1986 as a private company.

In 2001, it also commissioned an aluminum foundry unit at Coimbatore. In the year 2005, the company commissioned a satellite unit in Pithampur. Later in 2007, it also commissioned a satellite unit in Chennai and Jamshedpur.

In the year 2017, Craftsman Automation commissioned machining services in Bengaluru.

After successfully setting up satellite units and other machining services, the company finally became public in 2018.

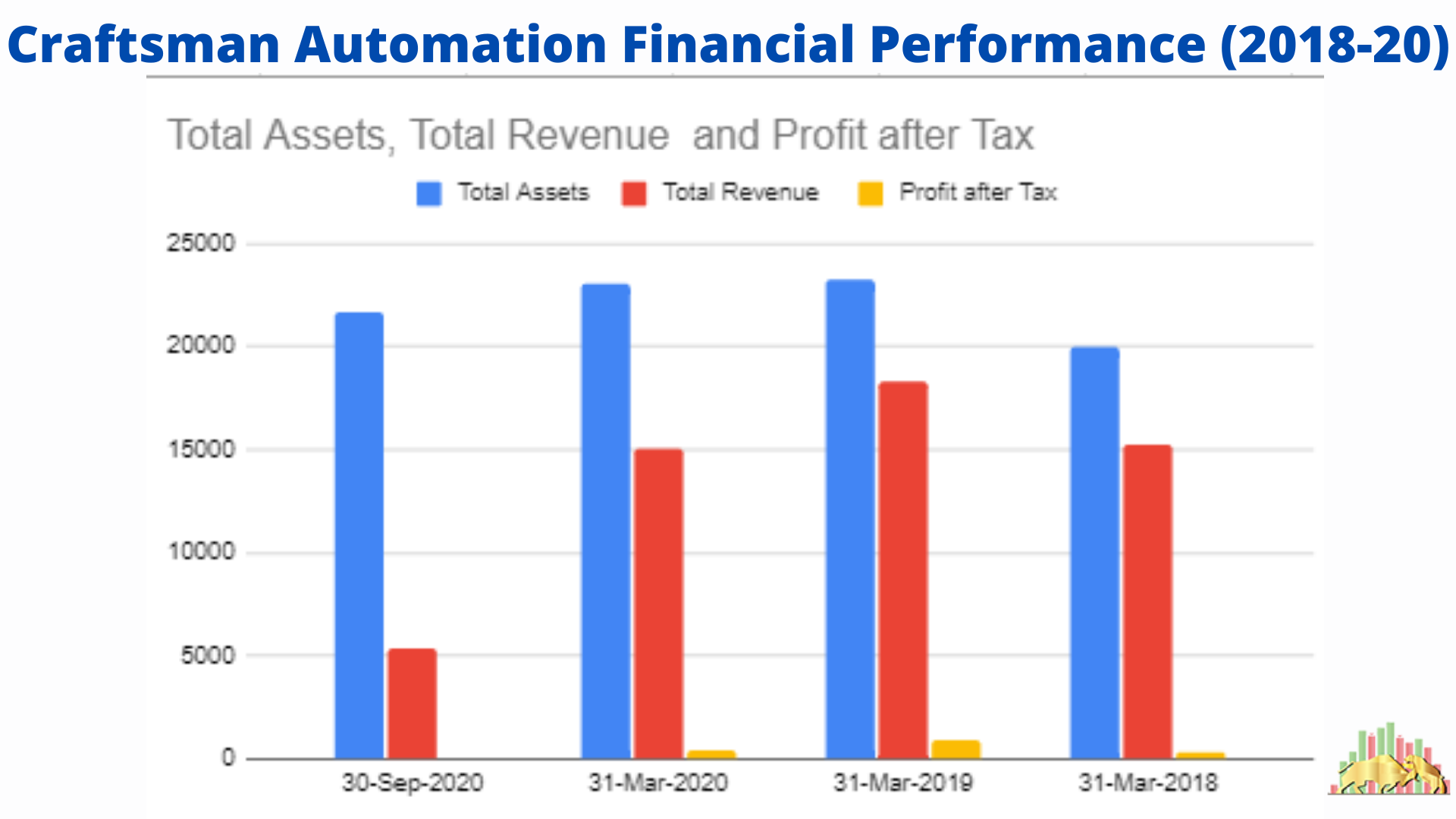

Financial Trajectory

Let’s understand the graph by reviewing the numbers in the table below:

Competitive Strengths

The company is coming with its IPO and truly wants it to be a success. To fulfill this, there have to be some strengths so that the investors are willing to invest in the IPO. Some of the strengths of the Craftsman Automated IPO are as follows.

- It is one of the leading players in the world of manufacturing of engineering products.

- The manufacturing units are widespread.

- They are leading players in the industry, and therefore their design capabilities are also par excellence.

- The company’s financial experience has surged upwards in the past years.

- The performance of the company has been consistent.

All these factors give the Craftsman Automation IPO an upper edge.

Weakness

One quality of a successful investor is that he/she weighs the choices on both levels. So now that we have discussed the strengths, let us move a bit to the weakness as well.

- During the Covid-19 pandemic and the whole lockdown situation, there was a significant reduction in the sales of the automobile industry. There is, therefore, a risk of the industry recovering completely post the pandemic.

- The growth of the company can be adversely affected in the future as well, because of the running Covid-19 situations.

- Since the objective of the company is the repayment of the borrowings or, in general, debt repayment. This can be a significant threat to the growth of the company.

- The fluctuations in the rate of interest are also an obligation.

Final Verdict

The popularity of IPO is increasing with every passing day, but the challenge of coming to a decision of whether to invest in it or not is constant. If you are planning to invest in the Craftsman Automation IPO, then there are some points that you should keep in mind.

- The performance of the company was adversely affected during the pandemic, and this can happen in the near future as well.

- The client base of the company is very strong with strategically planned manufacturing units.

- It is one of the leading players in its own industry.

We suggest you weigh the IPO from all angles and then make the most profitable decision.

Willing to invest in the Craftsman Automation IPO, open a demat account now. Fill the basic detail in the form below:

More on Upcoming IPO