Should You Invest in Easy Trip Planners IPO?

More on IPO

It is just the beginning of March, and the long list of upcoming IPO has already begun unfolding. And to justify this, there is another company coming up with a fresh issue, Easy Trip Planners. So what do you think? Should you invest in Easy Trip Planners IPO?

Facts About Easy Trip Planners IPO

No wonder! To invest in an IPO or not is just like walking on a tightrope. But, fret not because to make your decision a lot easier, here are 7 things you should know before you apply for Easy Trip Planners IPO.

1. Easy Trip Planners IPO Details

The Easy trip Planners IPO is set to make its public appearance on the 8th of March. Here are some details related to the IPO.

- The issue size is Rs.2 per equity shares that sums up to Rs.510 crores.

- The face value of the IPO is Rs.2 per equity share.

- Easy trip planners have set the price band of the IPO at Rs.186 to Rs.187 per equity share.

- The market lot is 80 shares.

- Mr. Nishant Pitti, Mr. Rikant Pittie, and Mr. Prashant Pitti are the three promoters of the Easy Trip Planners IPO.

2. Easy Trip Planners Company Details

Easy Trip Planners Limited is a major online travel agency in India. It was founded in 2008 and offers a wide range of facilities which includes air tickets booking, hotel bookings, train tickets, bus tickets, and a lot more.

It made significant progress as within a time span of nine months (upto December 2020), it was ranked second with respect to the total booking volume. It also bagged the third rank in terms of gross booking revenues in the entire country.

It made significant progress as within a time span of nine months (upto December 2020), it was ranked second with respect to the total booking volume. It also bagged the third rank in terms of gross booking revenues in the entire country.

Easy Trip Planners have made it to their clients’ hearts by providing a user-friendly and very client-centric experience.

They have easy-to-access websites and apps that have helped in increasing the reach of their company. They have great marketing strategies and a dedicated team that continuously develops a safe and secure platform for its users.

3. Growth of the Company

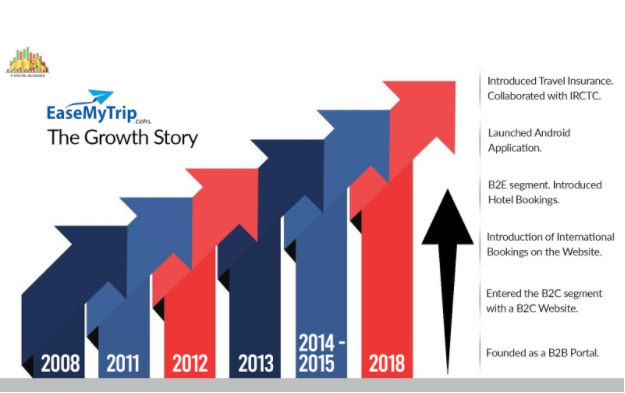

The foundation of Easy Trip Planners Limited was laid in 2008 by Mr. Nishant Pitti and Mr. Rikant Pitti. It was developed as a B2B portal and started seeing considerable growth since its establishment.

They initially provided the travel agents access to their website to book domestic airline tickets to manage India’s offline travel market.

Later on, when the traveling requirements to middle-class families also enhanced, they made sure that there was a way to cater to that as well. So in 2011, they entered the B2C segment.

In the year 2012, they expanded a little and introduced online booking for international flights also.

In 2013, they ventured into the B2E segment and gave its customers access to online hotel bookings and holiday packages.

In 2014, the company launched an android application as the revenues reached a whopping amount of USD 150 million.

In 2018, they started with insurance and successful collaboration with IRCTC for railway tickets.

4. Objectives

The company is looking to obtain the benefits that a company gains by listing its equity shares in the stock exchanges. These benefits include:

- Enhancing the visibility and popularity of the brand.

- Giving liquidity to the present shareholders.

5. Financial Details

Over the years, the company has progressed, and it has affected their financial fluctuations as well.

Over the years, the company has progressed, and it has affected their financial fluctuations as well.

Given here is a glance at the financial progress of the company, over the last 3 years.

All the amounts given in the above table are in crores.

6. Competitive Strengths

Let us look at the strengths of Easy Trip Planners Limited:

- The company is determined to provide the best online traveling services to its customers. It has an excellent user interface and even an option of a no-convenience fee.

- The growth trajectory of the company is excellent, be it in financial terms and overall as well.

- The apps and websites are customer-centric. They even have a very dedicated team who is consistent in making it a safe, secure, and technologically advanced platform.

- They have a wide distribution channel, including B2C, B2E, and B2B2C.

- It also has a very experienced management team.

7. Weakness

Like the two sides of the coin, there are some downfalls of Easy Trip Planners Limited. Let us take a look at them.

- When the pandemic started, the travel sector was affected the most. Since the company is completely involved in providing travel services, these situations can have a long-term effect.

- The company is dependent on limited airlines for ticket selling for most of its revenue. If the airline finds another way of selling its tickets, the company can fall at potential risk.

- The company functions in many areas but has significantly less experience in some of the segments.

Final Verdict

Investing in an IPO can be nerve-racking, and there is no denying that fact. If you are still doubtful regarding the Easy Trip Planners IPO, then there are some essential points that you should keep in mind.

- It is the leading player in the online travel business and can have significant gains.

- The bulk revenue is generated through airline tickets. Any adverse situation like this covid pandemic can have negative effects on the business.

Now that you know the ins and outs, you can balance the opinions and choose one for maximum gains. Till then, keep an eye on the Easy Trip Planners IPO dates.!

Want to invest in the IPO? Refer to the form below

Know more about the Upcoming IPO 2021 List