How to Apply for Lodha Developers IPO

More on IPO

Another IPO is set to make its public appearance on April 7, 2021, the Lodha Developers IPO. With the onset of hustle, one common query is how to apply for Lodha Developers IPO.

If you are aware of Lodha Developers IPO Review and want to know about the process, then fret not because we have got you covered.

Macrotech Developers, a real estate firm, is coming with its third IPO. Aiming to raise upto ₹2,500.00 Crores, the IPO has a face value of ₹10.

You can easily apply for the IPO either through an online or offline mode, depending on your preference. Let us now have a detailed look at both methods of application.

How to Apply for Lodha Developers IPO Online

With the world moving to a more digitized zone rapidly, the demand for online applications for IPO has already increased. Now you can apply for the Lodha Developers IPO online as well.

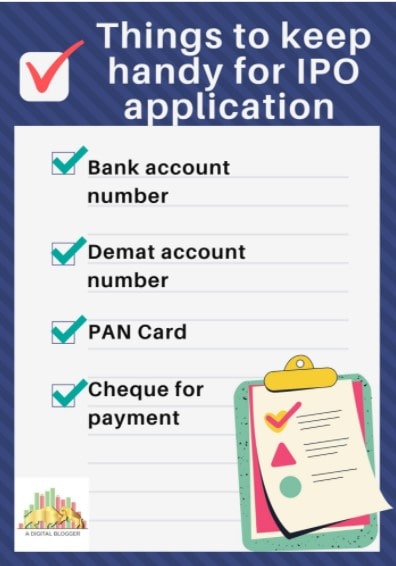

The first requirement that you should fulfill before applying for an IPO online is the presence of a demat account with a stockbroker or a depository participant of your choice.

In case you don’t have a demat account, refer to the form below and proper guidance will be given to you:

Once you have a demat account, you can easily apply for Lodha Developers IPO through two methods:

▶️ ASBA

▶️ UPI

Let us now discuss these methods in detail.

How to Apply for Lodha Developers IPO using ASBA

ASBA or Application Supported by Blocked Account is a widespread method of applying for an IPO.

In this method, the amount of your respective bid is blocked in your bank account till the time the allotment is completed. Once the process concludes, the amount is unblocked or debited in your bank account.

There are a lot of SEBI approved banks that can carry the application process through ASBA. If you are willing to apply for the Lodha Developers IPO using ASBA, you should follow the given steps.

- Open the net banking portal of your respective bank.

- Log in using the credentials. (Login ID and password)

- In the dashboard menu option, find the ‘request’ button and click on it.

- A page carrying the list of all the IPOs will appear on the screen.

- Choose ‘Lodha Developers IPO’ from the list.

- Now fill in the required details and submit the application.

Once you complete this process, the respective amount will be blocked in your bank account.

How to Apply for Lodha Developers IPO using UPI?

Another method that has gained immense popularity is the UPI method. It was considered by SEBI in 2019 and has become a popular option ever since.

The steps to apply for Lodha Developers IPOusing UPI are given below:

- First, you need to download any UPI payment app on your smartphone.

- Link your registered bank and then create a UPI ID and password.

- Now open the trading platform of your broker and log in using the credentials.

- From here, you will see an IPO tab. On this click on the ‘Lodha Developers IPO.’

- Fill in all the necessary details in the form.

- Now on the payment option, click on the UPI method.

- You will now receive a request to block the amount in your UPI platform.

- On approving the request, the bidding amount will be blocked in your bank account till the whole allocation process is not completed.

How to Apply for Lodha Developers IPO Offline?

There are still people in this digitalized world who lay their trust on only the offline process. The process for applying for Lodha Developers IPO offline is easy and can be completed in the following steps.

- Visit your nearest bank. Remember that it should be approved by SEBI.

- Choose the IPO that you are applying for.

- Here, fill in all the necessary details in the application form.

- Submit the desired documents.

- After the completion of the process, the amount will be blocked in your bank account.

Note- The amount is only unblocked or debited into your bank account after the process of allocation of shares is completed.

Lodha Developers IPO Date

It is very essential to keep an eye on the various IPO dates so that you don’t miss out on any opportunity to make a profitable decision.

The Lodha Developers IPO date is tabulated below:

Lodha Developers IPO Price

The different prices of an IPO are essential in deciding whether the subscription of the IPO is suitable for you or not. The list of various Lodha Developers IPO Price is given below:

Should you Invest in Lodha Developers IPO?

Investors with a keen interest in real estate will be eyeing the Lodha Developers IPO. Although, there are various other factors that one should analyze before investing in an IPO.

A lot depends on the Lodha Developers IPO GMP as well. A positive trend shows that the IPO will bag great success in the stock market.

The finances, strengths, risks, and various other factors should also be analyzed before making a sturdy decision to invest in Lodha Developers IPO.

Analyze and seal for yourself a sweet deal!

Want to invest in IPO and still not having a Demat Account? Do Not Fret! Fill the form below and open a demat account for free without delay.