How to Apply For RailTel IPO?

More on IPO

We are sure that you must have click on our link or have arrived at our respective article since you wish to know the process of “how to apply RailTel IPO” and certainly you are at the opportune spot.

Today, in this report we will cover two distinct approaches to apply for RailTel IPO in a method that will be simple to understand and speedy to use. But, let’s have a piece of quick information on RailTel company! Shall we?

Being a public sector understanding, RailTel Corporation of India is known to be the “Mini Ratna” firm of India. With the goal to improve the Telecom sector and services of India, the firm was incorporated in 2000.

Presently, the optic fiber network installed by RailTel covers as many as 5848 railway stations in India and worked dedicatedly to improve the standard conditions of railways, install VPN services, and implement appropriate safety measures of Indian Railways.

Now, prior to understanding the step-by-step process on how to apply for IPO, you should know its significant dates, for example, beginning and finishing so that you can subscribe or bid to the respective IPO on time.

As you are here, you might be aware of the fact that the RailTel IPO process is beginning on 16 February 2021 and will keep going for two days till 18 February 2021 with the objective to raise Rs. 819.24 crore.

In this IPO, the minimum bid lot is estimated to be 155 equity shares and the cost of each equity share is believed to range from Rs. 93 to Rs. 94.

Therefore, an investor or trader keen to bid on this IPO has to make an initial investment ranging from Rs. 14415 to Rs. 14570; which is an affordable and convenient amount for most of the bidders.

Apart from this, before investing or bidding in RailTel IPO and understanding How to apply RailTel IPO you must be well known about its details, objective, promoters, GMP, and also the company’s background.

Once you have got all the essential information, you can begin with the bidding process that is covered in the below sections.

How to Apply for RailTel through ASBA Process

The traditional way to apply for an IPO is ASBA that refers to Application Supported by Blocked Amount.

Quite possibly the most helpful and secure approaches to apply for an IPO is through the ASBA procedure through your registered bank. In this process, the bank pays the bid amount of the ideal IPO on your behalf and blocks the amount from your account.

Till the allotment date doesn’t arrive and the shares are not credited in your demat account, the amount stays blocked in your bank account.

Also Read: How to apply for Nureca Limited IPO?

Furthermore, when the shares are allotted to you or credited in your demat account, the amount in a split second gets deducted from your bank account.

However, on the off chance that the shares of the IPO are not designated to you, the sum will be unblocked from your registered bank account and you can utilize it according to your desires; which is definitely sad news for many!

Do you know that there are more than 65 SCSB (Self Certified Syndicate Banks) that can help you in applying for ASBA and a portion of these banks include State Bank of India (SBI), ICICI Bank, Canara Bank, Bank of India, Allahabad Bank, Punjab National Bank (PNB), HDFC Bank, Axis Bank, and many more?

A detailed list of these SCBC Banks is accessible on the SEBI official site and you can easily view your registered bank along with their addresses and contact information of the branch head.

Now, coming back to the ASBA process, there are two different ways to proceed with the ASBA process-

- Online technique

- Offline technique

How to Apply for RailTel through ASBA Online Technique

The online technique is totally not the same as the online one. Here you are not needed to actually visit the branch, rather you play out all the tricky work through the web. All you require is to visit your enrolled bank’s net banking site, either from your mobile or via desktop.

Follow the below step by step procedure to complete Online Technique-

- Log in to your bank net banking website.

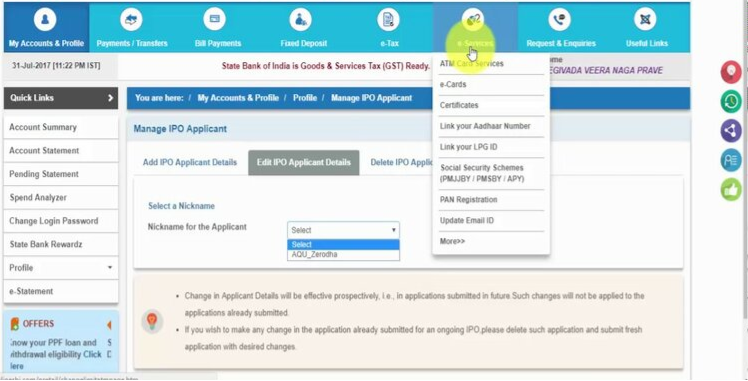

- Go to the e-services tab in the main menu. Here we are taking an example of the State Bank of India (SBI).

- Here, on the left side, you can view the ASBA or Demat button. Now, click on the same.

- Once you click on the tab, you need to tap on the “IPO equity link”. After clicking, approve the same.

- Now, a list of current IPO’s will be displayed. Select your ideal one and press the “GO” button.

- After pressing the button, a new window will appear. Here, enter the necessary share value, offer size, PAN number, and other significant information. Please note that no more than 3 subscriptions can be set at a time.

- Whenever you have entered the details, the sum will be blocked from your account.

This entire process is fast and straightforward however while bidding or proceeding with the same, ensure that you have a demat account.

In case, you don’t have a demat account, at that point basically fill the demat account opening box given beneath by entering your valid name and a working contact number.

In no time, our executives will help you in opening a FREE demat account!

Besides this, you should ensure that the fundamental conditions identified with the ASBA application measure are satisfied by you. These fundamental basic requirements are written as follows-

- Without having a legitimate demat account, no application against the IPO will be provided; henceforth application will be straightforwardly blown over.

- Any offer under the Reserved classifications, for example, Retail Individual Investor (RII), Non-Institutional Investor (NII), or Qualified Institutional Bidder (QIB) won’t be affirmed or put by the bank.

- The application cycle should be applied in the demat structure and the offers are obligatorily needed to be set in the Demat account.

- Base speculation of Rs. 2 lakh (roughly) is required to be made in a solitary IPO.

- At last, the bank must be SCSB, which means it should be enlisted with SEBI under the direct ASBA office. No applications will be entertained that has a registration with non-enlisted banks.

In this manner, in the event that you satisfy these imperative conditions, at that point, you can undoubtedly apply for RailLimited IPO through the ASBA cycle.

One of the reasons a plethora of investors choose the ASBA method is because they do not need to make an upfront payment in the IPO or even issue a cheque. Instead, they only pay when the shares of the respective IPO are allotted to them.

How to Apply for RailTel through ASBA Offline Technique

As the name says, the process is conducted in a non-digital format. Perhaps, it is the traditional method where an investor or a trader visits the nearest branch of the bank directly.

If you choose this technique to apply for RailTel Corporation of India IPO, at that point you will be needed to fill an ASBA form at the bank’s branch which will incorporate the accompanying details-

- Name of the IPO (In this case RailTel Corporation of India)

- The ideal offer size or bid size (minimum lot 155 equity shares)

- Demat account number

- PAN number

- Price of the bid (Rs. 93 to Rs. 94 per equity share)

- Enrolled Bank account number

Once you have filled in the details, don’t forget to cross-check them and after verification, duty signs the form and within one to two hours, the given sum amount will be right away blocked from your account.

Let’s understand the UPI gateway method too! Shall we?

How to Apply for RailTel through UPI Process?

UPI measure has made the IPO application very basic and advantageous and all credit goes to SEBI for understanding the requirements of financial investors or traders and establishing this program in 2019.

UPI strategy is normally used while applying for an IPO through a stockbroker.

A financial investor interested to bid in Initial Public Offering (IPO) or in some other can instantly apply with his UPI ID as an installment gateway on Indian Stock Exchanges- NSE (National Stock Exchange) and BSE (Bombay Stock Exchange).

In 4 basic steps, you can apply for RailTel IPO with your fingertips and these steps are recorded underneath:

- The first step and requirement is to have a Google Pay or Bhim Pay App. In the event that you don’t have a Google Pay application on your mobile, at that point download this App from your play store or the application store. Once you have successfully installed the app, you need to connect the same with your registered bank account.

- When you generate a UPI ID, then names like-xyz@okaxisbank or xyz@okhdfcbank will be created where your bank name will be consequently included at the end of the ID.

- Now, while applying for the IPO through your representative’s trading stage (mobile, web, or desktop), enter your UPI ID (like xyz@okaxisbank) in the IPO application e form and hit on the “Submit” button.

- In the following stage, you will get a prompt notification on your Google Pay application for blocking the amount from the account. Affirm the request so that sum can be blocked for the IPO.

Consequently, the sum stays blocked till the shares of the listed IPO are dispensed to you and get unblocked if the allocation cycle moves against you. This generally occurs after the expiry or the end date of the application.

Here, one of the reasons why investor or traders opt for UPI gateway is majorly preferred because-

- It’s simple, safe, and quick.

- Unlike the ASBA method, you are not required to make an initial minimum investment of around Rs. 2 lakh. You can even open the doors of IPO with an investment lower than Rs. 2 lakh by choosing the UPI gateway method.

Thus, that was about the cycles to apply for RailTel IPO and even you can follow this method to apply for any other IPO upcoming in the financial markets.

Perhaps, it’s time we should close the article with a couple of conclusive words.

Conclusive Thoughts

Henceforth, with this article, you don’t need to keep your eyes stuck on Google or other platforms for finding a safe, convenient, and reliable path on the most proficient method to apply RailTel IPO.

We believe that both the cycles ASBA (online and offline) and UPI methods above are helpful and clear.

Through these techniques, you can basically answer your question – How to apply for RailTech IPO yourself through your cell phones or even visit the nearby branch of your registered bank. We wager it isn’t so difficult! Right?

Other than this, prior to applying for this IPO or any other ensure that you have total data related to the same such as financial reports, balance sheets, networth data, etc. and you are very much aware of the organization’s development and profit.

Also, don’t forget to have an in-depth ratio analysis of the company such as the P/E ratio, Debt to Equity ratio, PEG ratio, and other important ratios.

What’s more, in particular, if in case that you are hoping to apply for this IPO without a demat account at that point it’s going to be unfruitful to you as a demat account is an unquestionable requirement while putting resources into stocks, IPO, assets, or some other securities available in the stock market.

Wishing you a fortunate turn of events with your subscription to RailTech IPO!

Want to apply for IPO in a seamless manner, open a demat account now. Fill the form below and the call back is arranged for you in no time.